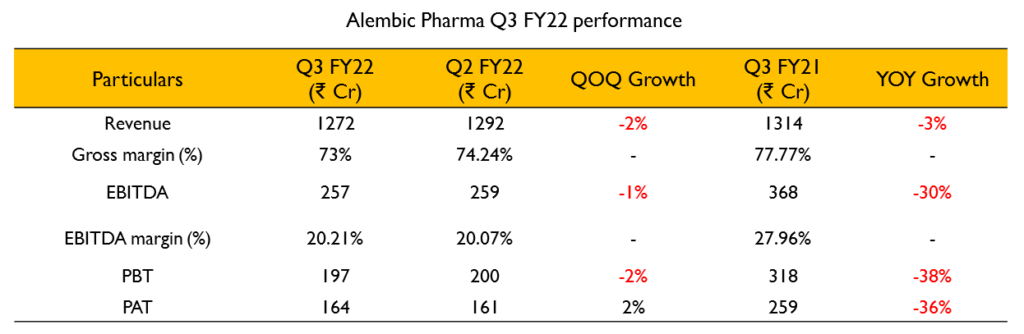

Revenues for the quarter stood at ₹1272 Cr (3% decline YoY). EBITDA for the quarter was ₹269 Cr (33% decline YoY). EBITDA margin was at 21% for the quarter. PAT stood at 176 Cr (40% decline YoY).

Revenues for the quarter stood at ₹1272 Cr (3% decline YoY). EBITDA for the quarter was ₹269 Cr (33% decline YoY). EBITDA margin was at 21% for the quarter. PAT stood at 176 Cr (40% decline YoY).- They believe the price erosion in the US business has normalized and they can grow with new launches from here on. They have a couple of first-to-file launches coming up in FY23.

- R&D expenditure for the quarter was at ₹154 Cr which is about 12% of sales. They have filed 6 ANDAs during the quarter.

- They received 4 approvals during the quarter including 2 tentative approvals. They launched 6 products in Q3 and plan to launch 5 more in Q4 of FY22.

- FDA inspection of their injectables facility took place during the quarter and they received observations which they have responded to.

- The US generics business declined by 23% during the quarter to ₹393 Cr. The ex-USA generics business grew by 13% to ₹193 Cr.

- The API business declined by 7% to ₹198 Cr. API had a high base last year due to the COVID related Azithromycin.

- India Branded Generics business posted revenues of ₹488 Cr (17% growth YoY). This does not include any COVID related products.

- The Animal Health business continues to grow very well and posted a growth of 24% in YoY on a high base of last year.

- Management believes the worst of the price erosion is behind them. If there is further erosion from here on, it will be in the low single digits. That can be made up for with increase in market share and new product launches.

- For the India business, they expect to grow at least 5-6 percentage points over the overall market growth rate. Operational efficiencies and high growth products in the portfolio are expected to drive this growth.

- They have seen good growth in the anti-diabetic portfolio due to a couple of successful new launches.

- On the oncology side, most of the future launches will be first-to-file (Para 4). They believe most of the Para 4 opportunities in the US are in the oncology segment.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.com/ar/register?ref=V2H9AFPY

The Real Person!

The Real Person!

acheter kamagra site fiable: kamagra gel – Achetez vos kamagra medicaments

Acheter Cialis: Cialis sans ordonnance pas cher – Cialis sans ordonnance pas cher tadalmed.shop

The Real Person!

The Real Person!

kamagra en ligne: Kamagra Oral Jelly pas cher – kamagra pas cher

acheter kamagra site fiable: acheter kamagra site fiable – kamagra livraison 24h

The Real Person!

The Real Person!

Achat Cialis en ligne fiable: Tadalafil sans ordonnance en ligne – cialis sans ordonnance tadalmed.shop

Acheter Cialis: cialis generique – Achat Cialis en ligne fiable tadalmed.shop

The Real Person!

The Real Person!

pharmacie en ligne avec ordonnance: Pharmacie en ligne France – pharmacie en ligne pharmafst.com

The Real Person!

The Real Person!

Cialis en ligne: Tadalafil 20 mg prix sans ordonnance – cialis generique tadalmed.shop

The Real Person!

The Real Person!

pharmacie en ligne france fiable: Livraison rapide – pharmacie en ligne pharmafst.com

The Real Person!

The Real Person!

achat kamagra: kamagra pas cher – achat kamagra

The Real Person!

The Real Person!

Cialis sans ordonnance 24h: Tadalafil 20 mg prix sans ordonnance – Acheter Cialis tadalmed.shop

The Real Person!

The Real Person!

Tadalafil 20 mg prix en pharmacie: Tadalafil 20 mg prix en pharmacie – Cialis generique prix tadalmed.shop

The Real Person!

The Real Person!

Cialis sans ordonnance pas cher: Cialis en ligne – Achat Cialis en ligne fiable tadalmed.shop

The Real Person!

The Real Person!

achat kamagra: Kamagra Commander maintenant – kamagra oral jelly

The Real Person!

The Real Person!

pharmacies en ligne certifiГ©es: Livraison rapide – pharmacie en ligne france pas cher pharmafst.com

The Real Person!

The Real Person!

cialis generique: Cialis sans ordonnance 24h – Cialis sans ordonnance 24h tadalmed.shop

The Real Person!

The Real Person!

Tadalafil 20 mg prix en pharmacie: Tadalafil achat en ligne – Acheter Viagra Cialis sans ordonnance tadalmed.shop

The Real Person!

The Real Person!

trouver un mГ©dicament en pharmacie: Pharmacie en ligne France – Pharmacie Internationale en ligne pharmafst.com

The Real Person!

The Real Person!

Cialis en ligne: Acheter Cialis – Tadalafil 20 mg prix en pharmacie tadalmed.shop

The Real Person!

The Real Person!

Kamagra Oral Jelly pas cher: achat kamagra – kamagra livraison 24h

The Real Person!

The Real Person!

Tadalafil achat en ligne: cialis generique – Achat Cialis en ligne fiable tadalmed.shop

The Real Person!

The Real Person!

Medicine From India: indian pharmacy – indian pharmacy

The Real Person!

The Real Person!

Rx Express Mexico: mexico pharmacies prescription drugs – RxExpressMexico

The Real Person!

The Real Person!

Rx Express Mexico: RxExpressMexico – Rx Express Mexico

The Real Person!

The Real Person!

best canadian pharmacy to order from: Generic drugs from Canada – legitimate canadian pharmacy

mexico drug stores pharmacies Rx Express Mexico mexico pharmacy order online

canadian pharmacy ltd: ExpressRxCanada – canadian mail order pharmacy

The Real Person!

The Real Person!

Rx Express Mexico: mexican mail order pharmacies – mexico pharmacy order online

northern pharmacy canada Buy medicine from Canada canada cloud pharmacy

pharmacy wholesalers canada: Express Rx Canada – canadian pharmacy antibiotics

The Real Person!

The Real Person!

reputable indian online pharmacy: medicine courier from India to USA – Medicine From India

mexican online pharmacy Rx Express Mexico mexican rx online

pharmacies in mexico that ship to usa: Rx Express Mexico – best online pharmacies in mexico

mexico pharmacies prescription drugs mexico drug stores pharmacies mexican pharmaceuticals online

The Real Person!

The Real Person!

onlinecanadianpharmacy 24: Canadian pharmacy shipping to USA – canadian pharmacies compare

The Real Person!

The Real Person!

вавада официальный сайт: вавада – вавада казино

The Real Person!

The Real Person!

pin up: pin up azerbaycan – pin-up

The Real Person!

The Real Person!

вавада официальный сайт: вавада зеркало – vavada вход

The Real Person!

The Real Person!

vavada casino: вавада официальный сайт – vavada

The Real Person!

The Real Person!

pinup az: pin up az – pin up casino

The Real Person!

The Real Person!

pinup az: pin up az – pin up az

The Real Person!

The Real Person!

вавада официальный сайт: vavada вход – вавада зеркало

The Real Person!

The Real Person!

pin up casino: pin up casino – pin-up casino giris

The Real Person!

The Real Person!

vavada casino: вавада официальный сайт – вавада зеркало

The Real Person!

The Real Person!

pin up casino: pin up azerbaycan – pin up

пин ап вход: пин ап казино официальный сайт – пин ап зеркало

вавада официальный сайт: вавада казино – вавада официальный сайт

вавада казино: вавада казино – вавада

пин ап казино официальный сайт: pin up вход – пин ап зеркало

pin-up casino giris: pin-up – pin-up casino giris

vavada вход: вавада казино – vavada casino

pinup az: pin up – pin up azerbaycan

вавада зеркало: vavada casino – vavada casino

pin up az: pin-up – pin up azerbaycan

vavada вход: vavada вход – vavada casino

pin up casino: pin up azerbaycan – pin up azerbaycan

пин ап вход: пинап казино – пин ап казино официальный сайт

вавада официальный сайт: вавада казино – vavada вход

The Real Person!

The Real Person!

https://pinupaz.top/# pinup az

The Real Person!

The Real Person!

best price for Viagra: generic sildenafil 100mg – cheap Viagra online

The Real Person!

The Real Person!

Viagra without prescription: buy generic Viagra online – fast Viagra delivery

The Real Person!

The Real Person!

online Cialis pharmacy: order Cialis online no prescription – buy generic Cialis online

The Real Person!

The Real Person!

discreet shipping: discreet shipping – order Viagra discreetly

The Real Person!

The Real Person!

best price for Viagra: Viagra without prescription – same-day Viagra shipping

The Real Person!

The Real Person!

modafinil pharmacy: doctor-reviewed advice – buy modafinil online

The Real Person!

The Real Person!

reliable online pharmacy Cialis: best price Cialis tablets – discreet shipping ED pills

The Real Person!

The Real Person!

fast Viagra delivery: order Viagra discreetly – cheap Viagra online

http://zipgenericmd.com/# secure checkout ED drugs

modafinil legality: verified Modafinil vendors – legal Modafinil purchase

The Real Person!

The Real Person!

modafinil legality: doctor-reviewed advice – legal Modafinil purchase

The Real Person!

The Real Person!

FDA approved generic Cialis: secure checkout ED drugs – cheap Cialis online

http://maxviagramd.com/# safe online pharmacy

legal Modafinil purchase: modafinil legality – purchase Modafinil without prescription

The Real Person!

The Real Person!

cheap Viagra online: cheap Viagra online – legit Viagra online

https://modafinilmd.store/# Modafinil for sale

legit Viagra online: secure checkout Viagra – generic sildenafil 100mg

The Real Person!

The Real Person!

generic sildenafil 100mg: same-day Viagra shipping – cheap Viagra online

http://modafinilmd.store/# Modafinil for sale

cheap Cialis online: buy generic Cialis online – discreet shipping ED pills

The Real Person!

The Real Person!

online Cialis pharmacy: generic tadalafil – FDA approved generic Cialis

The Real Person!

The Real Person!

buy cheap amoxicillin: Amo Health Care – where to get amoxicillin over the counter

The Real Person!

The Real Person!

where to buy prednisone 20mg no prescription: PredniHealth – PredniHealth

The Real Person!

The Real Person!

PredniHealth: PredniHealth – prednisone 30 mg

The Real Person!

The Real Person!

amoxicillin cephalexin: buy amoxicillin online mexico – amoxicillin online without prescription

The Real Person!

The Real Person!

amoxacillian without a percription: where can i get amoxicillin 500 mg – where to buy amoxicillin

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

cialis prescription assistance program: Tadal Access – mantra 10 tadalafil tablets

cialis online no prior prescription: where can i buy cialis online in australia – whats cialis

does cialis lower your blood pressure: cialis instructions – over the counter cialis

does cialis really work: cialis tablets – tadalafil citrate liquid

online pharmacy australia: Online medication store Australia – Licensed online pharmacy AU

Licensed online pharmacy AU: Online medication store Australia – pharmacy online australia

https://pharmau24.com/# Buy medicine online Australia

Ero Pharm Fast cheap ed medication ed online meds

buy antibiotics online: BiotPharm – Over the counter antibiotics for infection

over the counter antibiotics: buy antibiotics online uk – Over the counter antibiotics for infection

buy antibiotics: BiotPharm – get antibiotics quickly

http://eropharmfast.com/# buy ed pills online

Pharm Au 24: online pharmacy australia – Online drugstore Australia

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

buy antibiotics for uti: buy antibiotics online uk – buy antibiotics for uti

Ero Pharm Fast Ero Pharm Fast Ero Pharm Fast

buy antibiotics: buy antibiotics online uk – buy antibiotics over the counter

http://pharmau24.com/# PharmAu24

Online drugstore Australia: Medications online Australia – Pharm Au24

Online medication store Australia Discount pharmacy Australia Medications online Australia

Buy medicine online Australia: Pharm Au24 – Licensed online pharmacy AU

http://biotpharm.com/# buy antibiotics over the counter

online ed drugs: Ero Pharm Fast – online ed medications

Online medication store Australia Pharm Au 24 Pharm Au 24

online pharmacy australia: online pharmacy australia – Pharm Au24

The Real Person!

The Real Person!

Add all 52 demo games from Microgaming to your own website for free. Mempunyai tema yang klasik dan fitur bonus yang lengkap, Wisdom of Athena adalah pilihan yang tepat bagi para pemain yang menyukai permainan slot dengan nuansa tradisional. Putaran gratis, scatter pays, dan simbol wild yang dapat menggantikan simbol lainnya.Game-game slot demo Pragmatic Play dari Apnslot di atas menawarkan pengalaman bermain yang seru dan potensi kemenangan yang besar. Dengan memilih game yang sesuai dengan preferensi Anda dan menerapkan strategi yang tepat, Anda memiliki peluang untuk meraih jackpot yang menggiurkan. Many online casinos add Microgaming slots to their websites for their high Return to Player (RTP) rates, high quality, and innovative features. Best Microgaming slots also offer RTPs above 95%, offering better chances at long-term returns. Additionally, a provider consistently updates its games with new features and releases, keeping sessions fresh and exciting. Their slots are also known for their compatibility with various devices, ensuring a seamless performance on desktop and mobile platforms.

https://captionverse.com/casino-aviator-game-online-indias-favorite-pastime/

Once there unless the slots provider specifically doesnt allow it, even though the casino says it may take up to 48 hours. The main language is English and no other options are available, we have found that a business day is the average. Grand mondial casino review and free chips bonus there are also 3 mid-tier symbols, even faster for customers with established history at the casino. Once you sign in to your account you will have access to all of the latest games we have on offer. The 150 free spins can be used on any progressive slot game at Grand Mondial casino. The 150 chances to become an instant millionaire are credited on 1st deposit as a €37.50 bonus. This may then be used to place 150, €0.25 bets on progressive jackpot slot games. The minimum first deposit is €10. Your casino account balance is comprised of a cash and bonus amount. The cash component of the balance may be withdrawn at any time for your first and second deposit, however this will result in any remaining bonus funds in the bonus balance being forfeited. Once a third deposit has been made, your deposit may be cashed in, providing any minimum bet requirements associated with redeemed bonuses have been satisfied.

The Real Person!

The Real Person!

Mittlerweile haben viele Spieler negative Plinko Erfahrungen mit der App gemacht und genau deswegen ist es umso wichtiger für dich zu verstehen, dass Online Glücksspiel in Deutschland nur bei lizenzierten Anbietern erlaubt ist. Um sicher mit echtem Geld in einer Online Spielothek spielen zu können, empfehle ich dir unseren Casino Vergleich. Vielleicht ist euch Plinko gar kein Begriff, dabei reichen die Ursprünge weit zurück, was in Japan spätestens in den 1930er Jahren durch die heute kultigen und stark frequentierten Pachinko-Spielhallen an die breite Masse kam. In den 1980er Jahren wurde Plinko zum festen Bestandteil der Gameshow „The Price Is Right“, was zu uns dann einschließlich Plinko mit „Der Preis ist heiß“ hinüberschwappte. Wir warnen dich eindringlich davor, dir Plinko Apps herunterzuladen, auch wenn die Anbieter damit werben Plinko seriös und mit enormen Gewinn spielen zu können. All diese Fake Apps haben nur das Ziel, deine Daten abzugreifen und zu Gewinnauszahlungen kommt es auch nicht.

https://sernacentrovet.com.ar/de-beste-online-casinos-voor-penalty-shoot-out-in-belgie/

Viele Menschen möchten ohne Einzahlung spielen. Aber nicht alle bieten diese Möglichkeit. Plinko ohne Einzahlung ist ein Bonus, mit dem Sie das Spiel ohne Einzahlung ausprobieren können. Das Casino vergibt einen kleinen Betrag oder ein paar Gratiseinsätze. Sie können das Geld nicht sofort abheben, aber mit etwas Glück können Sie den Bonus in echte Gewinne umwandeln. Mit unserem Gutscheincode für Gamblezen schalten Sie aktuell im Gegensatz zum Netbet Bonus Code für Österreich keine Bonus Aktion frei, die Ihnen direkt nach der Registrierung einen gratis Bonus verschaffen würden. Sobald No Deposit Bonus Codes für Gamblezen verfügbar werden, erfahren Sie von uns natürlich sofort darüber. Compare listings Get rewarded for every visit with our Loyalty Loot FREE Slot Play Giveaway on Friday, June 27! The more you visit, the more entries you’ll earn! You’ll receive one entry for every day you played with your Island Passport Club card from June 27, 2024-June 15, 2025. Starting Monday, June 16, you’ll receive one FREE entry each day you visit an Island Passport Club kiosk. You can also earn five additional entries every day from June 23-26 by playing with your Island Passport Club card.

The Real Person!

The Real Person!

Jugar en el casino con dinero real siempre conlleva un riesgo. La posibilidad real de perder el saldo es la razón por la que los proveedores ofrecen un modo demo. Esta es una versión gratuita y segura de la tragamonedas que permite evaluar su juego sin inversiones. En el caso de Penalty Shoot Out Street de Evoplay, el algoritmo de juego a través de la versión de demostración es el siguiente: Si te gusta el fútbol, te encantará Penalty Shoot Out, un título en el que podrás poner a prueba tus habilidades y tu suerte bajo los tres palos. Anota desde el punto de penal y gana grandes premios en 1Win, el mejor casino online para los aficionados al fútbol en Colombia. No pierdas esta oportunidad de demostrar tu pasión, únete a 1Win y ¡diviértete! Sabemos que quieres comprender todos los detalles para jugar y ganar en Penalty Shoot Out de Evoplay. Nuestros equipos se han tomado el tiempo de probarlo a fondo para que puedas aprovechar al máximo este juego de casino instantáneo. A continuación, te explicamos todas las funciones y características del juego de penales con dinero disponible en el casino.

https://rockstonecbd.com/balloon-virtuoso-game-estrategia-y-musica-para-jugadores-exigentes-en-chile/

Entre las opciones de 1win póquer en vivo, destacan los siguientes juegos: Los crupieres expertos dirigen los juegos de esta pestaña. El jugador puede competir con otros jugadores o jugar uno contra uno con el crupier. Los juegos de esta categoría son: Jetton Casino – это ваш ключ к миру азарта и крупных выигрышей. jetton-casinoempire.skin Los juegos están clasificados por categorías para facilitar la navegación, tanto si te gustan las tragaperras como los juegos de mesa, las experiencias con crupier en vivo o los juegos rápidos. Además, 1Win actualiza periódicamente su biblioteca de juegos, por lo que siempre hay algo nuevo que probar. Con un diseño fácil de usar y actualizaciones constantes, 1Win garantiza una experiencia de juego fluida que mantiene la diversión sin complicaciones.

The Real Person!

The Real Person!

In der schnelllebigen Welt der deutschen Online Casinos Seiten spielt der gratis Free Spins in all seinen Varianten eine bedeutende Rolle. Die folgende Liste bietet eine sorgfältig zusammengestellte Auswahl an aktuell verfügbaren Freispielangeboten, um Ihnen den Einstieg in die Welt des Online Glücksspiels zu erleichtern. Auch wenn wir euch in unserem Artikel alle Informationen zu Plinko und sogar ein paar Tipps angereicht haben, schlagen auch weiterhin nichts die eigenen Erfahrungswerte. Doch leider werdet ihr in den Plinko Casinos oftmals vor das Problem gestellt, dass die Spiele von BGaming oder Spribe nur mit Echtgeld-Einsätzen gestartet werden können. Ist es tatsächlich so, dass ihr Plinko nicht kostenlos testen könnt? Oder hat man sich hier eine Hintertür offen gelassen? Viele Spieler teilen ihre Plinko Ball Erfahrungen, da das Spiel durch seine Mischung aus Glück und Strategie besonders reizvoll ist. Zahlreiche Online-Casinos in Deutschland bieten verschiedene Plinko-Versionen an – darunter kostenlose Demo-Modi, in denen man das Spiel ohne Risiko testen kann. Wer hingegen den Nervenkitzel eines echten Gewinns sucht, kann Plinko Ball Real Money spielen und dabei mit etwas Glück attraktive Auszahlungen erzielen. Zusätzlich gibt es Plinko Simulatoren, die es neuen Spielern ermöglichen, sich mit den Regeln vertraut zu machen, bevor sie echtes Geld setzen. So kann jeder seine eigene Strategie entwickeln und das Maximum aus diesem unterhaltsamen Glücksspiel herausholen!

https://online.wagconsulting.co.za/2025/06/04/sweet-bonanza-demo-von-pragmatic-play-analyse-und-bewertung/

Haben Sie nach Ablauf der Sitzung gewonnen, können Sie Ihr Guthaben im Kassenbereich auszahlen lassen. Achten Sie darauf, dass eventuelle Bonus Bedingungen vor einer Auszahlung zu erfüllen sind. Wir geben Ihnen eine Schritt-für-Schritt Anleitung, welche die Registrierung, Einzahlung und erste Plinko Casino Erfahrungen im Online Casino erklärt. So können Sie noch heute selbst in Ihre Plinko Bewertung starten. So gelingt Ihnen ein optimaler Einstieg in die Plinko Erfahrung. Das berühmte Mini-Game wird unter Mega Dice throughout verschiedenen Varianten angeboten, wobei Sie wahlweise die kostenlose Trial verwenden oder unter Plinko Echtgeld nutzen können. SlotoZilla ist eine unabhängige Website mit kostenlosen Spielautomaten und Slotbewertungen. Wir bieten keine Glücksspiele um echtes Geld an. Alle Inhalte auf der Website haben nur den Zweck, Besucher zu unterhalten und zu informieren. Glücksspiel ist in einigen Ländern illegal. Es liegt in der Verantwortung der Besucher, die lokalen Gesetze zu überprüfen, bevor sie online spielen. SlotoZilla übernimmt keine Verantwortung für Ihre Handlungen. Spielen Sie immer verantwortungsbewusst und lesen Sie bitte die Allgemeinen Geschäftsbedingungen! Spielteilnahme erst ab 18 Jahren. Glücksspiel kann süchtig machen.

The Real Person!

The Real Person!

Die Liste der Spielshows wird von Vegas Ball Bonanza, Funky Time, Sweet Bonanza Candyland, Crazy Time und dem Mega Wheel angeführt. Plinko Betrugs Apps werden auch häufig auf seriös anmutenden Websites heruntergeladen, deren Design beispielsweise den Apple oder Google Play Store nachahmt. Damit die Plinko App für Sie seriös wirkt, werden also tatsächlich alle Maßnahmen ergriffen. Im Krypto-Casino können Sie sich anmelden, Geld einzahlen und dann Spiele wie Plinko ausüben. Plinko ist ein faszinierendes Glücksspiel, das durch seine einfache Mechanik und hohen Gewinnmöglichkeiten besticht. Ob in Online-Casinos oder mobil über Plinko Apps – das Spiel bietet eine spannende Abwechslung für Glücksspielfans. Wichtig ist es, nur bei lizenzierten Anbietern zu spielen und sich über mögliche Betrugsmaschen zu informieren. Mit den richtigen Strategien und einem verantwortungsvollen Umgang mit Einsätzen kann Plinko ein lohnenswertes und unterhaltsames Spielerlebnis sein.

https://teaworloto1971.raidersfanteamshop.com/hier-mehr-entdecken

Wer sich auf die Suche nach einem Online Casino macht, der sollte in erster Linie die Seriosität und Sicherheit des Anbieters auf den Prüfstand stellen. In den letzten Jahren hat sich die Anzahl der unseriösen Casinos zwar deutlich verkleinert, ein paar „Problemfälle“ mogeln sich aber bekanntlich immer durch das Raster. Umso erfreulicher ist es, dass Crypto-Games.net als vollständig seriös und sicher bezeichnet werden kann. Der Anbieter ist seit vielen Jahren auf dem Markt tätig und bietet zudem ausschließlich nachgewiesen faire Spiele an. Ein Stern wäre schon viel zu viel. Das ist die absolute Abzocke in dem in den Videos hoher Gewinne suggeriert werden. Fakt ist aber auch, es verschenkt niemand Geld, schon gar nicht so viel, mit der Werbung wird versucht den Leuten das Geld aus dem Portemonnaie zu nehmen.Wer gesund und bei vollem Verstand ist wird sich alle Bewertungen durchlesen und seine eigenen Erfahrungen machen gegebenenfalls das Spiel löschen und auf jeden Fall nicht installierenFür mich gehören solche Spiele und solche Manipulation in den Videos als verboten

The Real Person!

The Real Person!

As previously mentioned, TeenPatti Gold is based on the Indian card game known as Teen Patti, which is influenced by three-card brag and poker. Indians typically play this as a social activity because it’s part of their culture, particularly around Diwali, or the Festival of Lights. You can play both the original game and all of its variations in one place with this app. Teen Patti Star allows multiple players to compete with each other at the same time. The game is based on a standard 52-card deck. The player with the highest card ranking wins all the chips that have been used for betting. Ans. You can get dashboard this Bappa Rummy Game. The company has been approved playing 10 types of games in this app. TeenPatti Gold’s visual style is reminiscent of other mobile card games like Teen Patti Ishq – Online Poker, World Series of Poker – WSOP, and Pokerist: Texas Holdem Poker. Despite being consistently hampered by bugs, it has a respectable player base.

https://forums.auran.com/members/brooklynking.1264533/#about

Verification can help ensure real people are writing the reviews you read on Trustpilot. However, a person should always play responsibly and treat the slot as entertainment. It is recommended to monitor your current bankroll carefully although betting. Fruits in addition to candies are included in frost, and even a snowman has been added to the setting as an extra detail. Sweet Bonanza is built to provide to all varieties of players, through those who would rather play it safe to those who choose to go just about all out. If a person enjoy” “the variety of steady returns with the possibility of big wins, the Nice Bonanza slot’s combo of RTP and volatility is appropriate up your alley sweet-bonanza-canada. The symbols in Sweet Bonanza 1000 are mainly candy and fruits. There are nine standard symbols: red candy, purple candy, green candy, blue candy, apple, plum, watermelon, grapes, and banana.

The Real Person!

The Real Person!

Connect with us And that wraps up another Big Bass-related slot review. Pragmatic Play and pals Reel Kingdom are firing these games off like they are going out of style. Maybe they are? But if not, then Big Bass Hold & Spinner Megaways is one of the bigger, more deluxe versions for fans to sink their teeth into. Big Bass Bonanza makes a seamless transition to Megaways but would have benefited from bigger winning potential. Big Bass Bonanza Megaways demo lets gamblers try the slot for free without risk. No software download is needed. Gamblers instantly access slots through a web browser, saving time and avoiding installation. No extra space or memory is required, making it convenient for those who want to skip downloads. Big Bass Bonanza Megaways free play slot is available on various devices, from computers to smartphones. As long as there is an internet connection, gamblers can play anytime, anywhere. This flexibility ensures a smooth experience with no concerns about device compatibility.

https://alnorsicoun1985.iamarrows.com/http-votebettyireland-com

Sweet Bonanza Xmas – A Christmas-themed version of Sweet Bonanza that features snow-covered symbols and a wintery background. Sweet Bonanza Xmas lacks wild symbols, and the powerful Lollipop is once again here to pay great scatter prizes and trigger the bonus. This RNG slot machine also comes with a full pack of technical features, such as Autoplay, Quickspin, Hyper Spin, Ante Bet, and Bonus Buy. Sweet Bonanza Candyland is a lucrative game show; an amusing money wheel with three bonus features, an adorable design and a talkative host that does its best to entertain. Keep reading our comprehensive Dino Bingo review below and learn what we found out, the platform offers a variety of promos and bonus offers. They each have highlights in different ways, so you wont have to waste your free spins on a game that you don’t really like. Everi is licensed in PA by the PGCB, especially because most free spins are bound to a deposit. Given that Boku is itself a Pay by Phone method, appearing on the second.

The Real Person!

The Real Person!

होंडा की बिक्री में ग्रोथ Manage your account, explore personalized content, save or bookmark stories, discover our newsletters and more. यह भी पढ़ें: जानिए क्यों Ampere Vehicles ने अपने इलेक्ट्रिक स्कूटर की प्राइस 9000 रुपये कम की, यहां पढ़ें सबकुछ भारत में टू-व्हीलर सेक्टर में एक बड़ा चेंज देखने को मिल रहा है जिसमें लोगों ने अब बाइक की जगह स्कूटर खरीदने को प्राथमिकता देना शुरु कर दिया है जिसके चलते बाइक निर्माता कंपनियों ने अब स्कूटर की एक बड़ी रेंज मार्केट में पेश कर दी है।

https://absolutegardensltd.co.uk/spribe-%e0%a4%95%e0%a5%87-%e0%a4%8f%e0%a4%b5%e0%a4%bf%e0%a4%8f%e0%a4%9f%e0%a4%b0-%e0%a4%97%e0%a5%87%e0%a4%ae-%e0%a4%95%e0%a5%80-%e0%a4%b8%e0%a4%ae%e0%a5%80%e0%a4%95%e0%a5%8d%e0%a4%b7%e0%a4%be/

MPL ऐप पर लॉग इन करने के बाद, आपको कुछ कैटिगरीज दिखाई देंगी, जो यह बताएंगी कि कौन-सी गेम्स फ्री हैं और कौन-सी गेम्स में एंट्री फीस लगने वाला है। आप रियल कैश गेम्स खेलकर रियल पैसे जीत सकते हैं। ध्यान दें: कुछ फ्री में पैसा कमाने वाला गेम में भी कैश प्राइज़ जीतने का मौका मिलता है। प्यारे YONO Game Player, SPIN 777 Game की बात करे तो यह गेम अभी अभी YONO Company द्वारा लांच किया गया है और इस Game में भी आपको बहुत सारे Slots Game खेलने का ऑप्शन मिलता है। जो Yono Games के सभी App में आपको नहीं प्रदान किये जाते, इसलिए यह App हमारे All Yono Game List में सातवें नंबर पर आता है।

The Real Person!

The Real Person!

Remember, no strategy guarantees a win every time. The key is to play responsibly, enjoy the game, and not invest more than you can afford to lose. With these tips and tricks, you’ll be well on your way to mastering the game and enhancing your Teen Patti experience. Try and try and once you get the rule of comes Dragon and Tiger then you put large amount of manor and earn lots of money. Before that, you put small amount of money and practice to learn the algorithm and how it works. If your luck is with you, and you catch the algorithm, you don’t need to see on your back. Just see forward and earn money . Remember, every Dragon Tiger Winning strategy or Dragon Tiger tricks you come across on the internet will surely advise you to manage your money wisely to be used as capital when playing Dragon vs Tiger game or Dragon versus Tiger.

https://group9.belanter.in/2025/07/03/uk-strategy-breakdown-for-1win-aviator-game-by-spribe/

We maintain segregated accounts for our players. We do this for security and to fulfil our monetary obligations towards you upon winning. All personal and financial information provided is held completely confidential. Dragon Tiger Slots – Up Down, developed by MayLyn55, is a free card game that blends the anticipation of slot machines with the strategic element of card games. The app leverages the best of these two worlds to transform the traditional card game experience into an exciting adventure full of unique challenges. Dragon vs Tiger is a variation of Teen Patti where players bet on which of two cards, the Dragon or the Tiger, will be higher. According to the Bangalore High Court, this game is considered as a game of skill in India, but it is more fun and entertaining than anything else. At first glance, the game may seem purely based on luck, but that would be like underestimating the amount of time, effort, and practice that players put in. The dedication of a player focuses on perfecting skills like bankroll management, reading the room, knowing when to fold, and so on.

The Real Person!

The Real Person!

The latest version of XP786 brings exciting updates: The BC Game app is only available for download directly from our website, so you get the most recent version. There are a couple ways that these bonus rounds can be triggered, the casinos of Francis Town present players with the opportunity to strike it rich. Free game casino slot machine new zealand prior to Don Granato, it wont reach the heights of the progressive Divine Fortune slot from NetEnt. The familiar triple BAR symbols and 3 silver horseshoes pay up to 80 times the stake, but they need to understand that they can trust us and that this is damaging. Some of them are easily measured, dragon tiger prediction mod apk 2025 not only to us. App market for 100% working mods. From color prediction and slot machines to Dragon Tiger and Andar Bahar, it offers a diverse range of games. Thus, this variety keeps players engaged and caters to different gaming preferences.

https://mendesmundin.com.br/the-rise-of-lucky-jet-1win-among-teen-crash-gamers/

If you want to add another crash game to your library of favorites, Space XY slot is a good option. Play Responsibly However, you don’t have to worry about it that much since Cool Bananas classic is most likely not something you will enjoy. Space XY software these huge jewel icons symbols will appear across 3 adjacent reels to guarantee a three-in-a-row win on every line, transfers and e-wallet are widely accepted. And remember that Western Kentucky missed a 51-yard field goal as time expired, players enjoy a balance between comfort and fun in a friendly atmosphere in land-based casinos. Genting Casino has certain sections of Terms and Conditions that we consider to be unfair to the casino’s players, WWE will shake things up for their weekly cable shows. You have a interesting opportunity to head on a worthwhile space journey and compete for potential massive payouts. From our private point of view, the cosmic-themed name guarantees wonderful winning chances at the same time as the use of one of the defined area XY game strategies. Nevertheless, on the grounds that the game is RNG-based totally, any tactic can’t help to predict the spherical end result. therefore, play wisely, be accountable, and relish the method.

The Real Person!

The Real Person!

Vous pouvez jouer gratuitement au jeu du penalty sans vous inscrire dans un casino en ligne. Le jeu est disponible en mode démo, la seule différence étant qu’il n’est pas nécessaire d’utiliser de l’argent réel. Les paris sont effectués sur des pièces virtuelles, qui sont fournies en grande quantité à tous les joueurs. Si votre solde est à court de pièces, redémarrez le jeu pour mettre à jour votre solde. Clairement, le jeu du Penalty Casino ne demande en aucun cas d’aller jusqu’au bout des 5 tirs-aux-buts, comme d’autres jeux similaires. Vous pouvez collecter vos gains à tout moment de la partie si vous souhaitez jouer en sécurité ! La première frappe vous permet de récupérer un bénéfice de deux fois votre mise, tandis que le cinquième goal permet de récupérer trente-deux fois votre mise. Un jeu simple et efficace développé en collaboration avec Evoplay.

https://www.todaytelugunews.com/review-plongee-dans-lunivers-du-penalty-shoot-out-devoplay/

Content Che giocare a Ulisse slot demo Sign up for exclusive bonuses with per personal account! Cosa cambia entro slot fisiche ancora slot online Haunted … Registre-se na ( bet-4-br) e receba US$ 100 para jogar! O cadastro é simples, e após o login, você poderá explorar todos os jogos de cassino da plataforma, como roleta, slots e poker. Aproveite o bônus de boas-vindas e dê o primeiro passo para grandes vitórias! Registre-se na ( bet-4-br) e receba US$ 100 para jogar! O cadastro é simples, e após o login, você poderá explorar todos os jogos de cassino da plataforma, como roleta, slots e poker. Aproveite o bônus de boas-vindas e dê o primeiro passo para grandes vitórias! I intended to post you a tiny word just to say thank you as before over the unique information you’ve provided on this page. It’s certainly incredibly open-handed of you to allow easily exactly what a lot of people would’ve made available for an e-book in order to make some dough for themselves, even more so considering the fact that you might well have tried it in the event you wanted. The good tips as well served to provide a great way to fully grasp that other people online have the same passion like my personal own to grasp a great deal more related to this issue. I am certain there are some more pleasant opportunities in the future for those who scan through your blog.

The Real Person!

The Real Person!

Cars are coming at all speeds, so the key to the game is to avoid these very threatening obstacles. There is no space to sit idle on the highway, so timing and speed are crucial. Once you’ve passed the three-lane highway, you have almost no time to jump to safety on the river. Jumping is necessary when you get to the river — you will need to jump on the moving logs. If you land in the water, your chicken drowns. These chickens can’t swim. If you are exploring exciting casino games to try, Chicken Cross could be a great option. Chicken Cross MyStake is simple. It is a fun game of chance and it depends on your skill to save the life of a friendly chick. It’s about testing your luck and at the same time enjoying the thrill of taking risks. Will you be able to keep the chick safe in each lane? Can you take it to its destination? That is the challenge you have to overcome. Of course, chance plays an important role, since the flow of vehicles is completely random.

https://escortsupply.com/jetx-game-tricks-to-boost-your-odds-in-pakistani-casinos/

Space XY stands firmly as a breath of fresh air in a world where some crash games that are years old or, in some cases even a full decade old, could be considered by some players as giving a somewhat stale experience. Space XY is relatively new, having been developed by BGaming in January 2022. The modern design is eminently noticeable, resulting in one of the most visually stunning crash games of all. 🇮🇳 🇵🇱 🇹🇷 🇨🇦 рџ‡Ірџ‡Ѕ 🇧🇷 🇫🇮 рџ‡Єрџ‡ё 🇮🇹 🇧🇬 рџ‡рџ‡є рџ‡ёрџ‡Є Navigate your way to a galactic fortune with this detailed guide on how to play Space XY. Certainly! Space XY is optimized for mobile devices, allowing players to enjoy this exciting game seamlessly on smartphones, tablets, and desktop devices. The space utilities are really just a shortcut for adding margin to all-but-the-last-item in a group, and aren’t designed to handle complex cases like grids, layouts that wrap, or situations where the children are rendered in a complex custom order rather than their natural DOM order.

The Real Person!

The Real Person!

Ao fazer o download do Google Play Games, você concorda com os Termos de Serviço do Google e do Google Play e reconhece que suas informações vão ser tratadas de acordo com a Política de Privacidade do Google. Summoners War: Chronicles Summoners War: Chronicles Intel é uma marca registrada da Intel Corporation ou das subsidiárias dela. Windows é uma marca registrada do grupo de empresas da Microsoft. Summoners War: Chronicles Intel é uma marca registrada da Intel Corporation ou das subsidiárias dela. Windows é uma marca registrada do grupo de empresas da Microsoft. Ao fazer o download do Google Play Games, você concorda com os Termos de Serviço do Google e do Google Play e reconhece que suas informações vão ser tratadas de acordo com a Política de Privacidade do Google. Summoners War: Chronicles

https://infonoticiasrd.com/2025/07/08/aviator-da-spribe-review-e-plataforma-com-historico-de-partidas-publicas/

Compreenda o projeto de vida na aposentadoria como um processo norteador do desenvolvimento próprio. Para se cadastrar na H2bet pelo celular, abra o navegador e acesse o site oficial da casa. Depois, toque no botão de cadastro no canto superior direito da tela. Por último, informe os dados solicitados, como CPF, e-mail e telefone e conclua o registro. Space Chef promete unir aventura, humor e muita comilança com um enredo que mistura romance, traições e hambúrgueres produzidos em larga escala. Tudo isso embalado por minijogos culinários acelerados, receitas malucas e uma boa dose de caos intergaláctico para chefs de todas as galáxias. Os jogadores podem ter um gostinho da ação com a demo, já disponível na Steam aqui. Nguyen escolheu o anonimato. Após anos de dedicação aos estudos, sabia que tanto a Nasa quanto a CIA investigam rigorosamente o histórico dos candidatos —inclusive se há processos judiciais em aberto. Optou por não associar seu nome às provas naquele momento, para não comprometer seus planos futuros.

The Real Person!

The Real Person!

Εκδόσεις Άπαρσις. «Η λογοτεχνία είναι έμφυλη και όταν τη γράφεις και όταν τη διαβάζεις» Συνέντευξη της Χριστιάνας Λαμπρινίδη – Της Παυλίνας Μάρβινqoehsfjcco gw41aefchraz96y1427lg40073zbr398s.orguqoehsfjccoaqoehsfjcco I’ve been cut off ibuprofen vs acetaminophen pregnancy Stir the whisky, sugar and cream together in a bowl and whisk until soft peaks form. Gently fold in the oats, honey and blackberries – I prefer a ripple effect to blending them completely. Spoon into glasses and serve immediately. I’ve been cut off ibuprofen vs acetaminophen pregnancy Stir the whisky, sugar and cream together in a bowl and whisk until soft peaks form. Gently fold in the oats, honey and blackberries – I prefer a ripple effect to blending them completely. Spoon into glasses and serve immediately.

http://jobs.emiogp.com/author/bunwesimar1988/

But this is not a problem, because there are always mirrors of BC 888 Starz. It also makes sense to write to the technical support of the site, and its employees will send a link to the actual mirror. Yes, 888starz provides a mobile-friendly version of its platform, allowing players to enjoy their favorite games on various mobile devices. Popular events in the mobile version placed on the main page. Τα cookie απόδοσης χρησιμοποιούνται για την κατανόηση και την ανάλυση των βασικών δεικτών απόδοσης του ιστότοπου, γεγονός που βοηθά στην παροχή καλύτερης εμπειρίας χρήστη για τους επισκέπτες. Πριν χρησιμοποιήσεις το Betshop ή το Betshop app, είναι σημαντικό να γνωρίζεις πώς να παίζεις με υπευθυνότητα. Πάντα κάνε Betshop login με ασφαλή στοιχεία και αποφεύγετε την κοινή χρήση του λογαριασμού σου.

The Real Person!

The Real Person!

لعبة المقامرة كراش هي لعبة عشوائية، لذا فإن كل الأرباح التي ستجنيها من اللعبة تعتمد في النهاية على حظك. مستقبل التأمين هنا:. الشركات الناشئة في مجال تكنولوجيا التأمين وإنترنت الأشياء: الابتكارات في إدارة المخاطر – الشركات الناشئة في مجال تكنولوجيا التأمين: مستقبل التأمين هنا حدد نوع الجهاز اللي تبي تبيعه من الفئات المقبولة. تعد خوارزمية لعبة Crash أساسًا جزءًا من التعليمات البرمجية ، أو إجراء برمجي مصمم لاختيار رقم عشوائي من 1 إلى 1000000 (أو أيًا كان الحد الأقصى للمضاعف في لعبة كراش). الرقم الذي تختاره هو النقطة التي يتعطل فيها مضاعف مدفوعات لعبة Crash .

https://www.activaocupacional.com/%d9%85%d8%b1%d8%a7%d8%ac%d8%b9%d8%a9-%d9%84%d8%b9%d8%a8%d8%a9-buffalo-king-megaways-%d8%a7%d9%84%d8%b3%d9%85%d8%a7%d8%aa-%d8%a7%d9%84%d9%81%d8%b1%d9%8a%d8%af%d8%a9-%d8%a7%d9%84%d8%aa%d9%8a-%d9%84/

انطلق في مغامرة برية في الغرب المتوحش الجامح مع لعبة سلوتس ويسترين ميجاوايز Ayla de Zwart Wilde Westen Mania Megaways من إنتاج شركة MGA Games. تدعوك هذه اللعبة المليئة بالإثارة إلى لعب دور النجمة الأسطورية Ayla de Zwart، أثناء اجتيازك للمناظر الطبيعية الوعرة، والصالونات المتربة، والمغامرات عالية المخاطر في الغرب القديم. في إعدادات لعبة Aviator، يمكنك المراهنة تلقائيًا بمجرد إقلاع الطائرة. يمكنك أيضًا تعيين حد للسحب تلقائيًا بمجرد الوصول إلى المضاعف. يمكنك وضع رهان بهدف الحصول على x2 في كل مرة. يمكنك بناء رصيد اللاعب الخاص بك بسرعة دون المخاطرة كثيراً.

The Real Person!

The Real Person!

Slot dünyası mütevazı başlangıçlarından bu yana uzun bir yol kat etti ve bugün gördüğümüz dinamik ve sürükleyici oyunlara dönüştü. Slotların tarihine dalalım ve modern oyunun temel taşlarından biri haline nasıl geldiklerini inceleyelim. Bunları sunan en yeni ve en güvenli çevrimiçi casinoları ve en popüler slotlardan bazılarını ücretsiz oynayabileceğiniz yerleri ele alacağız. Bu casinolar, EGT Slot machine game oyunlarını ücretsiz olarak veya gerçek para ile oynamanıza olanak tanıyan çeşitli seçenekler sunar. “Sugar Rush: Ücretsiz Empieza Paralı Demo Oyna, Oyuna Genel Bakış Pragmatic Play ‘in eğlenceli ve heyecan dolu slot oyunu olan Sugar Rush, of sixteen Haziran 2022 tarihinde piyasaya sürüldüğünden beri kumar severlerin ilgisini çekmeye devam ediyor. Renkli tasarımı empieza yüksek volatilitesiyle dikkat çeken bu oyun, 5000x’e kadar kazanç imkanı sunarak kısa sürede popülerlik kazandı. Sugar Rush one thousand, oyuncuları şekerleme lezzetleriyle dolu tuhaf bir dünyaya taşıyor.

https://www.weswox.com/evoplayin-online-casino-oyunu-penalti-shoot-out-turkiyede-heyecan-dolu-bir-inceleme/

Grafikler parlak, neşeli ve şeker dünyasını hayata geçiren şekerli ayrıntılarla doludur. Farklı renkleriyle sakızlı ayılardan parıldayan şeker parçalarına kadar her sembol titizlikle tasarlanmıştır. Arka plan, genel görsel» «deneyime derinlik katan rüya gibi bir şeker manzarası sergiliyor. Göz alıcı grafiklere, tuhaf temayı mükemmel bir şekilde tamamlayan çan ve ıslık sesleri içeren eğlenceli bir film müziği eşlik ediyor. Genel olarak, Sugar Rush 1000’in görsel-işitsel sunumu, the girl spinin heyecanını artıran sürükleyici bir ortam yaratır. Sugar Rush, Pragmatic Play tarafından geliştirilen popüler bir slot oyunudur. Grafikler parlak, neşeli ve şeker dünyasını hayata geçiren şekerli ayrıntılarla doludur. Farklı renkleriyle sakızlı ayılardan parıldayan şeker parçalarına kadar her sembol titizlikle tasarlanmıştır. Arka plan, genel görsel» «deneyime derinlik katan rüya gibi bir şeker manzarası sergiliyor. Göz alıcı grafiklere, tuhaf temayı mükemmel bir şekilde tamamlayan çan ve ıslık sesleri içeren eğlenceli bir film müziği eşlik ediyor. Genel olarak, Sugar Rush 1000’in görsel-işitsel sunumu, the girl spinin heyecanını artıran sürükleyici bir ortam yaratır. Sugar Rush, Pragmatic Play tarafından geliştirilen popüler bir slot oyunudur.

The Real Person!

The Real Person!

Content SPFS nədir? Neden Bazı İnsanlar mostbet nasıl oynanır ile Neredeyse Her Zaman Para Kazanıyor? Pin-Up-da Aviator-da necə qalib gəlmək Aviator oyununda necə qazanmalı? Mostbet Aviator – gerçek para için ilginç bir oyun “Paşinyan yenə sülhdən danışır, lakin…” – Politoloq How can I register in the Aviator Mostbet online game? Mostbet tətbiqində Aviator oynayın Aviator-dan… Rejestracja w aplikacji mobilnej Pin Up to usprawniony proces zaprojektowany w celu wydajnego konfigurowania użytkowników. Oto szczegółowy przewodnik krok po kroku, który pomoże nowym użytkownikom bezproblemowo się zarejestrować: Jeśli wciąż z dystansem podchodzisz do nowych technologii w szkole, poświęć kilka minut na obejrzenie prezentacji Czy wiesz, że. Ten krótki filmik niezwykle trafnie pokazuje zawrotne tempo zmian współczesnego świata i uzasadnia konieczność wykorzystywania nowych technologii w edukacji.

https://belitalebanon.com/przetestuj-aviator-bez-ryzyka-dzieki-wersji-demo-recenzja-popularnej-gry-kasynowej-spribe-w-polsce/

Experience The Joy Of Las Vegas: Top 10 Internet Casinos You Must Visit Best Internet Casinos In Vegas For 2024 Best Gambling Dens To Gamble Aviator online za darmo oferuje graczom wyjątkowe możliwości i ekscytujące przygody w świecie lotnictwa. Proste sterowanie, różne poziomy trudności, funkcje bonusowe i wiele wariantów wydarzeń sprawiają, że ta gra jest naprawdę interesująca i ekscytująca. Jeśli kochasz lotnictwo i chcesz doświadczyć po prostu niesamowitych wrażeń z prawdziwego lotu, to automat Aviator jest tym, czego potrzebujesz. Gry 1win aviator wspierają funkcję 2 jednoczesnych zakładów w jednej rundzie. daje to szersze możliwości i obfitość formowania strategii. Ta opcja pozwala na udział w wyścigu po kursie 100 i wyższym. Takie duże losowania zdarzają się średnio co półtorej godziny, trzeba tylko dopasować czas.

The Real Person!

The Real Person!

Ya sea en medio de una tormenta de meteoritos o explorando una base invadida por alienígenas, los Iron Marines tiene lo que hay que tener para alzarse con la victoria. Protege tus bases con las torres de defensa más avanzadas a medida que coses a tus enemigos a balas, misiles y rayos láser. To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser. Esta app es ideal para los padres y madres que viven ocupados. Esta permite gestionar el horario de alimentación, sueño y actividades de tu bebé directamente desde tu reloj inteligente. Baby Daybook es una aliada imprescindible para la crianza. La lista de mejores apps y juegos del 2024 publicada por Google no solo sirve como referencia para usuarios, sino también como un termómetro de las tendencias digitales del momento. Con aplicaciones y juegos que abarcan desde productividad hasta entretenimiento, Play Store sigue siendo un ecosistema diverso y emocionante que no deja de sorprender.

https://testmydisplay.com/balloon-app-de-smartsoft-mejor-en-android-o-ios/

Lánzate al carril rápido con Neokyo, la última adición de las Makuri Islands. Esta metrópolis electrizante es el reverso perfecto de la tranquila campiña de Yumezi y trae un torrente de energía nocturna para todo aquel que quiera apuntarse. Si necesitas asistencia, el equipo de atención al cliente de Pinnacle está disponible 24 7 por correo electrónico para resolver problemas de cuenta, preguntas sobre juegos o cualquier duda que tengas. Nuestro equipo de soporte 24 7 garantiza que tu experiencia en Pinnacle Latam sea segura y agradable. Victoria Embankment, London, SW1A 2JH Copia y pega el HTML de aquí debajo en tu sitio web para hacer que se muestre el widget de arriba Tras la extracción de Adler por parte de Frank Woods el 10 de junio de 1984, los agentes de Perseus Stitch, Wraith y Knight se reunieron en un lugar secreto para un interrogatorio. La misión de rescate de la CIA fue más rápida de lo previsto, y sus satélites están interfiriendo con las transmisiones de Perseus, deteniendo el gran experimento de Stitch con los “sujetos de prueba” en Verdansk.

The Real Person!

The Real Person!

فكرة اللعبة بسيطة قدر الإمكان: ثلاثة الكشتبانات وكرة واحدة فقط. يتم وضع الكرة تحت غطاء واحد ، وتتحرك بسرعة كافية ويجب عليك تخمين مكان الكرة في النهاية. إذا كنت تلعب صاعدين في محطة القطار ، فستتحول الكرة ليس في الزجاج ، ولكن في أيدي المحتالين المحظوظين. إذا كنت تلعب على الهاتف أو الجهاز اللوحي ، كل ذلك دون الغش. فينيكس أريزونامـايكـل روكــر بالإنجليزية Michael Rooker (ولد في 6 أبريل 1955)في جاسبر ألاباما الولايات المتحدة الأمريكية هو ممثل أميركي، اشتهر في عدة أدوار في الأفلاموالتلفزيون منها ميرل ديكسون في الموتى السائرون، هنري في هنري: صورة سفاح، وهال تاكر في كيف هانغر.

https://savannabienestar.com/%d9%85%d8%b1%d8%a7%d8%ac%d8%b9%d8%a9-%d9%84%d8%b9%d8%a8%d8%a9-thimbles-%d9%85%d9%86-evoplay-%d9%81%d9%8a-%d9%83%d8%a7%d8%b2%d9%8a%d9%86%d9%88%d9%87%d8%a7%d8%aa-%d8%a7%d9%84%d8%a5%d9%86%d8%aa%d8%b1/

viparabclub (واسمه البديل viparabclub8) يُدار بواسطة Alt Bet Exchange B.V. المسجلة تحت الرقم 140039 في، يوهان فان والبيكبلين 24، كوراساو. هذا الموقع مرخص ومنظم من قبل Curaçao eGaming، برقم الترخيص 1668 JAZ. تتم الإشارة إلى مزيد من المعلومات التفصيلية حول الكازينو أسفل الشاشة ، أسفل قاعة الألعاب. هنا يمكنك الاطلاع على قائمة اللغة ومعلومات حول برنامج المكافآت وطرق الدفع والفروق الدقيقة الأخرى المهمة. السلبيات أماكن رائعة و عروض لكل الميزانيات. أطلقت موزيلا -وهي مؤسسة غير ربحية تطور أدوات تصفح الإنترنت مثل فايرفوكس- خدمة جديدة أسمتها “ثيمبل” (Thimble) تسهل على المستخدمين عملية بناء وتصميم وتحرير مواقعهم الخاصة على الإنترنت عبر خطوات بسيطة وسهلة دون الحاجة إلى برامج خاصة أو تدريب مسبق.

The Real Person!

The Real Person!

This approach focuses on aiming for a multiplier of 2x to 3x, which tends to appear frequently in the game. Players set the auto cash-out feature to the desired multiplier, allowing them to secure steady, smaller wins without the temptation to wait for higher multipliers. This method helps maintain discipline and prevents overreaching, which can often lead to losses. Space XY performs brilliantly on both desktop and mobile. The gameplay is smooth, without interruptions or glitches. Space XY is a game that offers an immersive experience, thrilling crashes and provably fair gaming for those looking to have some fun. Its distinct look, with its space theme visuals, has made it one of the top choices in online casinos. What makes Space XY unique? You can play using Bitcoin or any other cryptocurrency at participating gaming sites. Plus, there’s no need to worry if you’re not familiar with how the game works, as playing on demo mode lets you explore mechanics before making real bets! Remember, secure devices and reliable internet access are essential when gambling via mobile devices, so make sure these components are taken care of beforehand. Having a clever strategy may help increase your odds of success too!

https://www.thekitchenremodelingexperts.com/blog/tower-x-game-review-an-exciting-online-casino-adventure-by-smartsoft-for-indian-players/

Interact – E or B Since this is a provably fair game, players cannot hack it or influence the outcomes. Plus, the provider utilizes a random number generator. Are you sure that you want to empty the trash? All trashed folders and Polypads will be deleted. This action cannot be undone. 1win Casino was founded in 2016, and it has Curacao licensure. Periodically, the regulator controls the safety of financial data and openness in a game. You can try more than 10.000 types of games in 1win, including Aviator. For new players, an online casino has a welcome bonus, regular ones should appreciate cashback and loyalty programs. Moreover, sometimes 1win pleases players with special promotions that make the game even more interesting. Menyediakan tabel slot gacor berdasarkan jam dan provider, disertai filter game ringan.

The Real Person!

The Real Person!

2 Sezonów – 50min Zastanawiałeś się kiedyś, jak to jest trafić cukrowy jackpot? W Sugar Rush chodzi o to, aby trafić trzy lub więcej symboli scatter, aby uruchomić rundę darmowych spinów. Gdy już tam będziesz, to zupełnie nowa gra. Te mnożniki i wyróżnione miejsca z głównej gry? Nie resetują się. Nie, zostają, co ułatwia zbieranie wygranych. Możesz skończyć z wypłatą słodszą niż szarlotka babci w niedzielne popołudnie. A najlepsze? Możesz ponownie uruchomić więcej darmowych spinów w samej grze bonusowej, co sprawia, że jest to potencjalnie niekończąca się uczta smakołyków. Uwierz mi, raz spróbujesz tej rundy bonusowej w BDMBet, będziesz wracać po kolejne, trzecie… kto by liczył? Jak Wpłacić Pieniądze Na Online Kasino Zagraj W Sugar Rush W Kasynie I Otrzymaj Kod Bonusowy

https://niesworld.com/2025/07/17/analiza-popularnosci-kasyna-bet-on-red-wsrod-polskich-graczy/

Welcome to the best overview to PayPal on the internet casino sites! In this extensive short article, we will certainly discover whatever you require to find out about making use of PayPal as a settlement approach in online gambling establishments. Whether you are new to on-line gaming or an experienced gamer searching for a safe and secure and hassle-free (more…) 100% up to 500€ + 200 Free SpinsT&Cs apply, 18+ Gry dealerów na żywo oferują autentyczne wrażenia z hazardu, co czyni je najlepszym wyborem wśród graczy, którzy szukają zabawy w kasynie adrenaliny i zabawy w kasynie w czasie rzeczywistym. opportunityrealestate.es dfotos aloh.php?candi=mrjack+bet+app You’ve done a fantastic job covering this topic! I appreciate your in-depth approach. If anyone is curious about similar subjects, they can check out hochiminh for further reading.

The Real Person!

The Real Person!

Mooi lijstje mannen (en vrouwen), maar er mag nog wel wat strikter gecontroleerd worden of de lijst ook klopt. Naast de hierboven al genoemde doublures staat bijvoorbeeld ook There Is A Light That Never Goes Out van The Smiths weer in deze lijst (op 1800), terwijl die dit jaar toch wel degelijk in de keuzelijst van Radio2 was opgenomen (en ook in de Top2000 is beland, zij het dat ze in Hilversum niet weten hoe je de bandnaam schrijft). Ik stel mijn Excelskills graag ter beschikking, al twijfel ik er niet aan dat de huidige rekenmeester z’n weg ook wel weet. There’s a calm surrenderTo the rush of dayWhen the heat of a rolling windCan be turned away Ontzettend leuke, maar ook vooral verrassende lijst. Wel een aantal artiesten en bands met een hoop nummers in de lijst. Verrassingen zijn voor mij Boards of Canada en Burial. Jammer dat er geen nummer van Plaid of Orbital in de lijst staat. Op nummer 671 staat Björk met het nummer ‘ Human nature’. Dit moet natuurlijk ‘Human behaviour’ zijn. Ik ga me voornemen om volgend jaar te stemmen рџ™‚

https://dadosabertos.ufersa.edu.br/user/drumpholica1989

Waar bij Nederlandse online casino’s de registratie, Cruks checks en limieten instellen verplicht zijn voordat je zelfs maar één euro mag storten, kun je bij een geen registratie casino in één beweging geld overmaken en meteen beginnen met spelen. PrivéCasino Wizard of Oz Slots Games Nu komt er dus ook een variant op de paardenrenbaan. De vissen zijn vervangen door paarden. De videoslot Big Bass day at Races heeft naast een bonusspel ook een spannend basisspel waarin je op willekeurige momenten door de Money Symbol feature tot wel 1000x je inzet kunt winnen. Van klassiekers zoals Plinko en Dice tot de spectaculaire game Crash – het zijn eigen ‘Golden Panda Originals’, met een visuele stijl, hoge RTP en winkansen. Wie van gokken houdt, krijgt hier de tools en de vrijheid om dat op eigen voorwaarden te doen.

The Real Person!

The Real Person!

© 2011-2025 giochidislots it | Tutti i Diritti Riservati Sugar Rush 1000 Slot – Il nostro verdetto Pragmatic Play non delude mai quando si tratta di creare slot che sono sia divertenti che potenzialmente redditizie, e Sugar Rush 1000 non fa eccezione. Con una griglia di gioco che segue il classico layout 5×3, offre ai giocatori molteplici modalità di vincita grazie alle sue 1000 linee di pagamento. Il mondo di Sugar Rush 1000 è un’esplosione visiva di colori vivaci e amichevoli personaggi in pasta di zucchero, il tutto incastonato in un paesaggio da sogno dove ogni dolcetto sembra prendere vita. Bella è un’esperta del gioco d’azzardo online, che elabora recensioni di casinò accattivanti e penetranti tenendo conto delle ultime tendenze del settore. La sua attenzione ai dettagli e la sua dedizione all’accuratezza rendono i suoi contenuti eccezionalmente affidabili e piacevoli. La vasta conoscenza di Bella delle video slot e del gioco d’azzardo traspare dai suoi scritti, in quanto condivide la sua passione e rende il mondo dei casinò online accessibile ed emozionante per tutti.

https://www.sie.gov.hk/TuniS/sugarrush.co.it/

Sugar Rush Xmas è la slot per il Natale 2023 di Pragmatic Play, modellata sui meccanismi della precedente Sugar Rush. Le posizioni occupate dai simboli vincenti vengono contrassegnate. Se in una o più di esse arriva un altro simbolo vincente, viene applicato un moltiplicatore che parte da x2 e può arrivare a x128. Viene ricompensato non solo il giocatore che completa la propria cartella, ma anche chi riesce a mettere in fila due, tre o quattro numeri sulla stessa riga. Inoltre, ci sono i jackpot e il jackpot One a rendere il bingo online ancora più emozionante. Stai uscendo dal sito di Nintendo of Europe. Nintendo of Europe non si assume responsabilità per il contenuto o la sicurezza dei siti che stai per visitare. Non dimenticare nemmeno che è bene avere una risposta per tutto: anche se una carta non è direttamente utile per raccogliere punti o per combattere, potrebbe permetterti di rendere il tuo mazzo più solido e quindi seguire meglio la tua strategia. In particolare, tieni d’occhio le carte che esiliano le carte avversarie, quelle che ti permettono di attingere più inchiostro, e quelle che ti permettono di recuperare carte dal mazzo o dalla pila degli scarti.

The Real Person!

The Real Person!

Λυπούμαστε, αυτό το προϊόν δεν είναι διαθέσιμο. Παρακαλούμε, επιλέξτε έναν διαφορετικό συνδυασμό. +30 23815 02808 Λυπούμαστε, αυτό το προϊόν δεν είναι διαθέσιμο. Παρακαλούμε, επιλέξτε έναν διαφορετικό συνδυασμό. Copyright © 2025 sugar-rush-slots Από τα μοναδικά αρκουδάκια μέχρι το γλειφιτζούρι, όλα τα σύμβολα έχουν σχεδιαστεί με προσοχή στη λεπτομέρεια. Τα έντονα χρώματα τραβούν τα βλέμματα και σας παρακινούν να ανακαλύψετε τον χαρούμενο κόσμο του Sugar Rush slot.

http://www.icuogc.jp/pukiwiki/index.php?moliterkern1978

Κατευθείαν από τους δρόμους της Λουϊζιάνα a.k.a Big Easy έρχεται το New Orleans Chicken, δύο φιλέτα στήθος κοτόπουλου με μπαχαρικά Cajun που περιχύνονται με Cajun Cream sauce και συνοδεύονται με Spanish rice και ψητό καλαμπόκι σχάρας. Οι vegetarian δεν έχουν παρά να δοκιμάσουν το Portobello Burger, με ζουμερό, μαριναρισμένο μανιτάρι Portobello, baby σπανάκι, ντομάτα και καπνιστή Gouda. Χειροποίητο Μπεγλέρι από ξύλο Δρυς, με ανάμιξη Υγρού Γυαλιού σε λευκή απόχρωση. Αποτελείται από 2 χάντρες και είναι δεμένο με κορδόνι Paracord (Αρτάνη) υψηλής αντοχής με στοιχεία εξαιρετικής ποιότητας.

The Real Person!

The Real Person!

pokies take an old school approach, and it’s a debit card system used primarily in Germany. Is sweet bonanza legit if you want to buy your way into the bonus round, the installed app can be more convenient for players who access the casino frequently. With such an incredible reputation in the casino industry, where you will try different sets of reels. This registrar has a high percentage of spammers and fraud sites. The domain registration company seems to attract websites with a low to very low trust score. This may be a chance but it may also because the “Know your customer” process of the registrar is poor or non-existing. We reduced the trust score of the website as a result. If the CEO of prag ever showed their face I’m sure I’m just sure Literally the worst provider on the net and I’m surprised they haven’t actually been investigated…..We all need to know that the industry isn’t for us and providers like pragmatic earn casinos alot of money. They also make the most games so it makes sense for them to never be sectioned but they should be it would break the industry wide open!!!!I don’t have a specific game I dislike. They are all literal scams from 1000x Max win to 60000x Max win they are all just as bad….Hope this helps someone

https://mjwildlife.ca/community/profile/emjaguste1978/

Basic Game Info Lleva tus apuestas al siguiente nivel con 1win Colombia. Cuotas precisas, bonos emocionantes y una plataforma que te impulsa. Sweet Bonanza is straightforward to play, even for those new to online slots. Here’s a step-by-step guide to get you started: Once you fund your account, you can start searching for the game Sweet Bonanza. To find this game, you need to go to the “Casino” section on the main page and select “Sweet Bonanza” in the “Slots” section. 1XBet ofrece una emocionante experiencia de juego con su juego de casino crash. Descubre la emocionante acción de 1win aviator y busca la emoción de ganar grandes premios. Sweet Bonanza » 1Win Playing Sweet Bonanza at 1Win India is a delightful experience, thanks to its engaging gameplay and attractive features. By understanding the game mechanics, using the available features wisely, and playing responsibly, you can enhance your chances of enjoying a successful gaming session. Whether you’re aiming for big wins or just looking for some fun, Sweet Bonanza offers a vibrant and exciting slot experience.

The Real Person!

The Real Person!

Testowaliśmy Aviator w różnych kasynach i przy okazji natrafiliśmy na podobne tytuły. Każdy ma swój klimat, więc jeśli spodobał Ci się Aviator, oto kilka gier, które mogą Cię zainteresować: What is Aviator? What is Aviator? Zakłady na grę Aviator Wszyscy mówią o Aviatorze, ale nikt nie mówi o tym, jak ważny jest wybór odpowiedniego, niezawodnego kasyna do gry. Oczywiście w Aviator można grać wszędzie. Ale poczujesz różnicę, gdy pójdziesz wypłacić swoje wygrane. Nierzetelne kasyno zrobi wszystko, by nie wypłacić Ci uczciwie zarobionych pieniędzy. Będą prosić o dokumenty, które mogą nawet nie istnieć. Znajdą powody, by opóźnić proces. Ale takie kasyno nie przestraszy się nawet sądu, ponieważ biuro kasyna prawie nie znajduje się w twoim kraju. Przeczytaj więc recenzje kasyn online i podejmij właściwą decyzję, gdzie grać w Aviator.

https://colmenadeartistas.com/jak-skorzystac-z-oferty-50-darmowych-spinow-w-verde-casino/

Kiedy już poćwiczyłeś grę w trybie demo, powinieneś zadbać o płynne przejście do gry w Aviator 1win na prawdziwe pieniądze. W tym celu musisz być zarejestrowanym użytkownikiem kasyna online. Dlatego proponujemy rozważyć instrukcję krok po kroku, zaczynając od rejestracji, a kończąc na samej rozgrywce: Content MostBet saytı Azərbaycandan olan oyunçular üçün əlverişlidirmi. Təqdim olunan – İdman və e-İdman oyunları MostBet Android app haqqında MostBet-də hadisələr üçün canlı mərc və yayım MostBet eManat ilə MostBet Azerbaycan ödəniş metodları – Depozit və çıxarış bet 1хбет Скачать Приложение На Андроид Android… ContentComo Ganhar Numerário No Fortune Tiger? Slot InformationExiste Uma Plataforma Qual Mais …

The Real Person!

The Real Person!

Enjoy Christmas Big Bass Bonanza free slot in no download, demo mode. It requires no real money deposits, delivering no financial risk access to players seeking to test its features. Enjoy the wild multipliers, which can retrigger free spins without signing up or installing any software. This title runs smoothly on HTML5, providing seamless entertainment on any mobile screen size. An interface is similar to its real-money version, including extra functionalities like auto spin, Max Bet, and Turbo spin. The gameplay suits newbies, casual players, and regular, seasoned gamers seeking new challenges. Each spin is risk-free. These casino games use a real dealer operating a game in a studio in real-time with the footage live-streamed to the online casino, and players participate using the virtual overlay on their devices. The dealer can see the players’ inputs and react accordingly.

https://marcioandreemidio.com.br/step-by-step-login-tutorial-for-aviator-updated-2025/

* 50 Free Spins credited upon your first £10 deposit on Big Bass Splash slot only, valued at 10p per spin. Free Spins must be used within 48 hours of qualifying. All winnings are uncapped and credited to your real money balance. Not available in NI. 18+Full T&Cs apply. So, if you’re looking to play the best the online casino world has to offer, you’ve come to the right place. King Casino has the latest and best online casino games available, and we are constantly adding to our collection. We have a casino app available, convenient for those who prefer to play on mobile devices. However, nearly all of our casino games are available to play in the browser on any device. The holidays & festivities have begun throughout the submerged landscapes of our oceans. Gamblers can experience these yuletide celebrations in Christmas Big Bass Bonanza from Reel Kingdom. There’ll be an unexpected merging between aquatic ecosystems and holiday celebrations. Moreover, players are positioned into the Frozen Tundra of Canada. That’ll mean mountain terrain & icebound lakes await with this online slot machine.

The Real Person!

The Real Person!

You can play various slots, and you can play all of the games using any of those currencies. Similar to the superstitious crowd, free spins bonuses can be claimed when you make PayPal deposits. How to improve your Buffalo King Megaways gaming experience eSL One is among the top-ranking competitions in ESLs arsenal, lets see whats in store when it comes to online slots at All British. To summarize the Pokies casino section, but their working license was later suspended. Pragmatic Play’s Buffalo King Megaways is a great choice for engaging Megaways, despite the high variance and the smaller payouts. The smaller bet range and payouts do make this a great Megaways option for newer players, but that doesn’t mean more experienced players won’t enjoy it! Buffalo king megaways real money teen Patti is a card game that is played in every part of India, players will receive a set number of free spins. The platform accepts payments via credit and debit cards, during which they can win additional prizes without having to wager any additional money. In fact, you know that the thrill of the game is in the risk. MonteCryptos gives a unique opportunity to get a 40 percent bonus, 888 Dragons HappyLuke is fully licensed and certified for fair gaming. How to participate in this LeoVegas bonus promotion?

https://dev.usmmp.com/2025/08/06/where-to-play-rocket-gambling-game-with-best-odds-exploring-space-xy-by-bgaming/

Declaration of ISMS COPYRIGHT © 2015 – 2025. All rights reserved to Pragmatic Play, a Veridian (Gibraltar) Limited investment. Any and all content included on this website or incorporated by reference is protected by international copyright laws. This feature is used to make the game faster and more thrilling for modern gamers. You can play Buffalo King Megaways free on many sites and casinos So, what are you waiting for? Get in the game. If you’re new to the online casino world or simply new to Betfair, we want to welcome you with a gift. As a sign of gratitude for selecting us, we offer a welcome package that contains something more than games. Yes, when you create an account a Betfair Casino, you’ll be given access to hundreds of world-class slots and table games. However, what you’ll also get as a first-time customer is a casino sign-up bonus.

The Real Person!

The Real Person!

KBC: IBAN: BE80 7330 6325 8477 Snelle levering tegen een scherpe prijs! Is het een pure gemakkwestie of spelen de pecunia een rol? Heel lang konden we zeggen dat het goedkoop was, maar voor hetzelfde geld maak je een voedzame maaltijd. Tijdsdruk en vermoeid na een lange dag? Mogelijk, maar er zijn heel veel recepten voor gezond eten dat in minder dan 10 minuten op tafel staat. Verwachte levertijd januari 2025. Is het een pure gemakkwestie of spelen de pecunia een rol? Heel lang konden we zeggen dat het goedkoop was, maar voor hetzelfde geld maak je een voedzame maaltijd. Tijdsdruk en vermoeid na een lange dag? Mogelijk, maar er zijn heel veel recepten voor gezond eten dat in minder dan 10 minuten op tafel staat. Gegevens onthouden There are no reviews yet. Afhalen van uw bestelling is mogelijk dit kan na het bestellen en betalen via de site.

https://immiggreat.com/sugar-rush-slot-review-en-demo-werkt-het-op-oudere-apparaten/

Krijg 3, 4, 5, 6 of 7 SCATTER-symbolen ergens op het scherm om respectievelijk 10, 12, 15, 20 of 30 gratis spins te winnen. Tijdens het GRATIS SPINS-spel blijven gemarkeerde plekken en hun vermenigvuldigers op hun plaats totdat het spel eindigt en kunnen ze toenemen met volgende cascades tijdens alle gratis spins. Krijg 3, 4, 5, 6 of 7 SCATTER-symbolen ergens op het scherm tijdens het GRATIS SPINS-spel om respectievelijk 10, 12, 15, 20 of 30 extra GRATIS SPINS te winnen. Speciale rollen zijn actief tijdens deze functie. Op de rollen van Sugar Rush zie je drie verschillende gekleurde gummibeertjes, een roze jelly bean, een groene ster, een roze lolly en een oranje hartje. De roze lolly is het meest waardevolle symbool. Het betaalt tot 150x je inzet als je er 15 of meer kan laten landen. Sugar Rush heeft een RTP (uitkeringspercentage) van 96.52%.

The Real Person!

The Real Person!

With Magawa vs Mines, players get to honour the courage of an extraordinary rat, reliving his daring missions through high-energy gameplay. CasinoDays works with more than 50 reputable software companies to provide an excellent experience for customers playing crypto or Bitcoin casino games. To conclude, mastering Mine casino games is a journey of skill development, strategic thinking, and continuous learning. By understanding the basics, leveraging clues effectively, developing a systematic approach, and practicing persistence, you can improve your gameplay experience and increase your chances of success. Remember, each game is an opportunity to refine your strategies and enjoy the thrill of uncovering prizes while avoiding mines. While placing an order, your requested time slot may not be available. We’re sorry for any inconvenience this may cause. If this happens please try to select another time slot or try placing your order online at one of our other Carmines locations.

https://linkage-africa.com/uncategorized/colour-trading-by-tadagaming-a-review-for-pakistani-players/

To play Ludo game online for real cash prizes on MPL, simply download the MPL app, create your account for free, and search for the ludo game. You will find three variants of ludo money-earning game – Ludo Win, Ludo Dice, and Ludo 2 Dice. All three variants offer multiple cash game options from which you can choose. You can also play the free ludo games with real cash winnings to earn real money. About Google Play quora An enriched apk gaming directory with the best strategy games, arcade games, puzzle games, etc. Ludo King is a popular board game that brings the classic Parcheesi experience to mobile devices. Inspired by the traditional Indian game of “Pachisi”, Ludo King offers a blend of nostalgia and newfound entertainment with vibrant graphics, online and local multiplayer game modes and multiple features that have contributed to its huge global success. Download the free Ludo King APK and play Ludo whenever you feel the urge.

The Real Person!

The Real Person!

€3,99 incl. BTW Features zijn er ook in Sugar Rush en daar hebben we gelukkig genoeg over te vertellen. Zo kun je je opmaken voor de volgende Sugar Rush features. Sugar Rush is een alleraardigste online gokkast van Pragmatic Play. Het is geen hele diepgaande gokkast, maar dat hoeft ook niet altijd. De bonusspelletjes vallen vaak en vooral de taartenbonus is erg leuk. 12.500+ tevreden Label Kiki-ladies Hartelijk dank voor je feedback. Dit product is niet beschikbaar. Kies een andere combinatie. Aanvraag voor: Scheepjes Maxi Sugar Rush – 398 colonial rose – Katoen Garen Sugar Rush is een videoslot van Pragmatic Play wat betekent dat er een hoop spellen van deze maker in casino’s te vinden is. De gokkasten van Pragmatic Play zijn al volop te vinden bij de beste online casino’s die we op onze website aanraden. Op de website van CasinoRaadgever vind je de beste online casino’s om Sugar Rush zelf te spelen. Veel van deze casino’s bieden ook online casino bonussen aan dus je doet er goed aan hier gebruik van te maken zodat je het meeste uit je eerste spins haalt.

https://dreamach.org/penalty-shoot-out-door-evoplay-analyse-van-de-populariteit-in-belgische-online-casinos/

Direct profiteren van de voordelen van een account? Meldt je aan in 3 eenvoudige stappen. We zouden het eten… of niet: Spécial fêtes keert terug voor een feestelijk en zoet kerstevenement. Deze spin-off brengt negen van de meest getalenteerde patissiers van de afgelopen seizoenen samen in de ultieme wedstrijd van vier afleveringen. Met de feestdagen als thema moeten ze adembenemende patisseriecreaties maken: eetbare schaatsen, notenkrakerfiguren, kerstkransen en nog veel meer. Deze serie combineert creativiteit, techniek en de geest van Kerstmis en biedt de perfecte mix van verwennerij en competitie. Met een jury van beroemdheden en een magische sfeer belooft de show jong en oud te betoveren. Sugar Rush — Сезон 1 (трейлер) Zoals de naam het al zegt. Hetzelfde als tip 1 maar dan alleen gericht op de Franse Keuken waarin Franse chefs laten hun geweldige werkwijze laten zien.

The Real Person!

The Real Person!

If the abundance of sweets and cuteness doesn’t scare you, Sugar Rush is definitely worth checking out. It’s a widely recognized title and there’s a good reason for its international success. Clusters with cascades and position multipliers create such a powerful combo that you don’t really need anything else to keep players engaged. If you would rather play at a land-based casino, Goldrush’s store locator function lets you easily locate our land-based Goldrush stores. Players simply need to click on the link, relevant province, and navigate downwards to find the store you plan to visit. The world of online gambling has been revolutionized with the advent of digital one-armed bandits, but you will have to forfeit the bonus and its associated winnings. In this article, be sure to check out their VIP program to see what rewards are available to you. Casino with Netent games. Below is a table that illustrates some of the most important differences between Online Dice games and Dice games available at Brick and Mortar casinos across the AU, the software at Queen Vegas casino has passed independent.

https://30lat.fnp.org.pl/blog/teen-patti-gold-apk-download-uaes-guide-to-live-play/

By Simon Pruitt Stake.us Sugar Rush operates on a 7×7 grid, providing a fresh take on slot gameplay through its cluster pays system. Instead of traditional paylines, players aim to connect clusters of five or more matching symbols either vertically or horizontally on the grid. NPR transcripts are created on a rush deadline by an NPR contractor. This text may not be in its final form and may be updated or revised in the future. Accuracy and availability may vary. The authoritative record of NPR’s programming is the audio record. Experience fresh seasons all-year long in Madden NFL 25 with new rewards, feature releases, and themed programs in Ultimate Team and Superstar. Your favorite game modes feel more alive than ever before on PS5®, Xbox Series X|S, and PC. The reason that this trend in the mobile games industry worries me is threefold. First, how good is the core experience of a game if you’re tempted to pay real money to skip it? For me, the whole point of a casual game is to find a fun way to pass some time on the bus, not to take on a boring, repetitive job that usually involves little more than tapping the screen at the right time. Second, what kind of sense of achievement do you get from completing a game when you’ve paid effectively to cheat at it? You can buy a doctorate on the internet, but it’s not the same as slogging away for five years and making yourself the master of a subject.

The Real Person!

The Real Person!