Operational Highlights

Operational Highlights

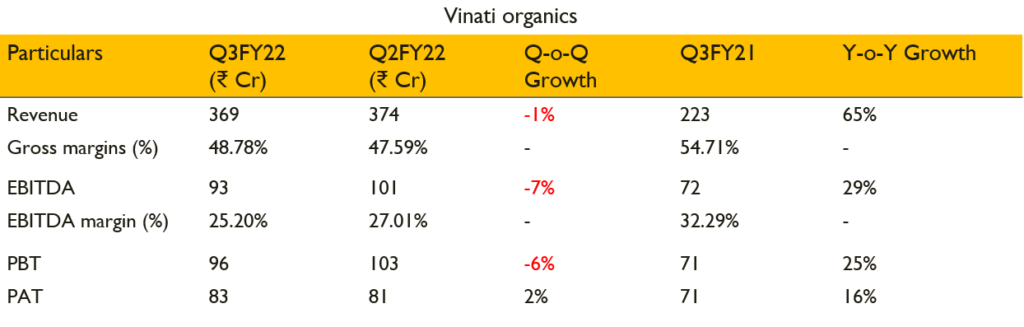

- Revenue grew by 65% to ₹370 Cr from ₹223 Cr in Q3FY21 YoY

- EBITDA growth is 32%

- Revenue and EBITDA contracted because Q3 is generally a slower quarter especially for ATBS as MNC keeps lower inventory at the end of year. Demand will start reviving from january

- In 9MFY22 butyl phenol has already marked revenues ₹120 Cr

- IBB has been negatively impacted on slow ibuprofen demand

- Expecting 50% growth in sales in FY22 compared to FY21 (part of which is volume driven and price driven) with EBITDA margins closer to 30%.

- Assuming the prices stay same, volume growth is expected to be 25-30% for next three years including the subsidiaries

- ATBS accounted for 50% of sale,Butyl phenol 12%, IBB 7-8%, and rest is other products

- Q4 EBITDA is expected to better then previous three quarters due to sales ramping up in ATBS, IBB and Butyl phenol

Capex

- The amalgamation on additive business, approval from SEBI is received and filed the application with NCLT, However due to Covid the process is getting delayed and expect to be completed in next 8 months

- The plant is expected to be commissioned in march 2022 and also added a new product in antioxidant L135 used as lube additive

- With new addition of capacities, expecting additive sales to be ₹700 Cr as against earlier estimates of ₹500 Cr. the increasing prices and high demand resulted in increased ROI of 25%

- Expecting to achieve full capacity utilisation in next 3 years

- The total capex is ₹300 Cr including operating expense

- Further expanding butyl phenol capacity by 15000 MT. Estimated capex is ₹100 Cr and most of these will be captively used in manufacturing of additives and expecting to complete by December 2022

- Another capex of butylated phenol is underway and expected to complete this year with revenue potential of 60-70 Cr

- Commissioned 6.5MW solar power plant. Taken board approval for another 7.5Mw of solar power plant with capex of ₹33Cr, post which 50% of consumption will be from captive solar and renewable energy

Subsidiary

- Manufacturing 5 new specialty and niche chemistry products having application across pharmaceutical, perfumery and solvents for catalysts. Overall capex for this project is ₹250 Cr

- The overall market for these products is in excess of ₹2500 Cr and the revenue potential at full capacity utilisation is ₹250 Cr targeting 10% market share.

- The capex is underway and will be commenced in March 2023

- The new antioxidant is value added product whereas the other three are volume driven products

- All these products are B2B products

The Real Person!

The Real Person!

Kamagra Commander maintenant: kamagra en ligne – achat kamagra

kamagra en ligne: kamagra livraison 24h – Kamagra Commander maintenant

Kamagra Oral Jelly pas cher: achat kamagra – kamagra oral jelly

The Real Person!

The Real Person!

Tadalafil achat en ligne: cialis sans ordonnance – Cialis sans ordonnance 24h tadalmed.shop

The Real Person!

The Real Person!

Acheter Cialis 20 mg pas cher: cialis generique – cialis prix tadalmed.shop

Cialis en ligne: cialis prix – Acheter Cialis tadalmed.shop

kamagra gel: kamagra livraison 24h – Kamagra Oral Jelly pas cher

The Real Person!

The Real Person!

Tadalafil 20 mg prix sans ordonnance: Cialis sans ordonnance pas cher – Acheter Cialis 20 mg pas cher tadalmed.shop

The Real Person!

The Real Person!

pharmacie en ligne: pharmacie en ligne – pharmacie en ligne france livraison internationale pharmafst.com

The Real Person!

The Real Person!

Tadalafil 20 mg prix en pharmacie: Acheter Viagra Cialis sans ordonnance – Achat Cialis en ligne fiable tadalmed.shop

The Real Person!

The Real Person!

Achetez vos kamagra medicaments: kamagra gel – acheter kamagra site fiable

The Real Person!

The Real Person!

Acheter Kamagra site fiable: Kamagra pharmacie en ligne – kamagra 100mg prix

The Real Person!

The Real Person!

pharmacie en ligne livraison europe: Medicaments en ligne livres en 24h – Achat mГ©dicament en ligne fiable pharmafst.com

The Real Person!

The Real Person!

Pharmacie en ligne Cialis sans ordonnance: Pharmacie en ligne Cialis sans ordonnance – cialis sans ordonnance tadalmed.shop

The Real Person!

The Real Person!

Acheter Viagra Cialis sans ordonnance: cialis generique – Tadalafil 20 mg prix sans ordonnance tadalmed.shop

The Real Person!

The Real Person!

kamagra livraison 24h: acheter kamagra site fiable – Achetez vos kamagra medicaments

The Real Person!

The Real Person!

Kamagra Oral Jelly pas cher: kamagra 100mg prix – kamagra livraison 24h

The Real Person!

The Real Person!

cialis generique: Tadalafil sans ordonnance en ligne – Acheter Cialis 20 mg pas cher tadalmed.shop

The Real Person!

The Real Person!

cialis sans ordonnance: cialis generique – Tadalafil 20 mg prix sans ordonnance tadalmed.shop

The Real Person!

The Real Person!

Acheter Cialis: Acheter Cialis 20 mg pas cher – Cialis sans ordonnance 24h tadalmed.shop

The Real Person!

The Real Person!

Medicine From India: medicine courier from India to USA – reputable indian online pharmacy

The Real Person!

The Real Person!

canadian world pharmacy: Generic drugs from Canada – canadadrugpharmacy com

The Real Person!

The Real Person!

indian pharmacy: indian pharmacy online – MedicineFromIndia

The Real Person!

The Real Person!

buy prescription drugs from india: Online medicine home delivery – Medicine From India

global pharmacy canada: Express Rx Canada – canadian pharmacy antibiotics

The Real Person!

The Real Person!

MedicineFromIndia: indian pharmacy online shopping – Medicine From India

pharmacies in canada that ship to the us Express Rx Canada my canadian pharmacy

The Real Person!

The Real Person!

mexican online pharmacy: Rx Express Mexico – Rx Express Mexico

RxExpressMexico mexico pharmacies prescription drugs Rx Express Mexico

The Real Person!

The Real Person!

indian pharmacy: MedicineFromIndia – medicine courier from India to USA

The Real Person!

The Real Person!

mexican online pharmacy: RxExpressMexico – mexico pharmacies prescription drugs

the canadian drugstore ExpressRxCanada canadian pharmacy ltd

The Real Person!

The Real Person!

indian pharmacies safe: Medicine From India – indian pharmacy online shopping

The Real Person!

The Real Person!

vavada вход: вавада официальный сайт – вавада официальный сайт

The Real Person!

The Real Person!

pin-up casino giris: pin up casino – pin up casino

The Real Person!

The Real Person!

pin up azerbaycan: pin up – pin up azerbaycan

The Real Person!

The Real Person!

пин ап казино: пинап казино – пин ап зеркало

The Real Person!

The Real Person!

вавада: vavada вход – вавада

The Real Person!

The Real Person!

pinup az: pin up casino – pin up azerbaycan

The Real Person!

The Real Person!

pin up casino: pin-up casino giris – pin up casino

The Real Person!

The Real Person!

вавада казино: вавада казино – vavada

The Real Person!

The Real Person!

пин ап вход: пин ап казино – пин ап вход

pinup az: pinup az – pin up casino

pin-up: pin up casino – pin-up

пин ап казино официальный сайт: пин ап вход – пинап казино

pin-up casino giris: pin-up – pin up

pin up azerbaycan: pin-up – pin-up

вавада казино: vavada casino – vavada вход

вавада казино: vavada – vavada вход

The Real Person!

The Real Person!

http://pinupaz.top/# pin up az

The Real Person!

The Real Person!

doctor-reviewed advice: Modafinil for sale – buy modafinil online

The Real Person!

The Real Person!

generic sildenafil 100mg: best price for Viagra – secure checkout Viagra

The Real Person!

The Real Person!

safe online pharmacy: Viagra without prescription – fast Viagra delivery

The Real Person!

The Real Person!

legit Viagra online: order Viagra discreetly – trusted Viagra suppliers

The Real Person!

The Real Person!

generic tadalafil: discreet shipping ED pills – order Cialis online no prescription

The Real Person!

The Real Person!

buy modafinil online: modafinil 2025 – legal Modafinil purchase

The Real Person!

The Real Person!

safe online pharmacy: fast Viagra delivery – discreet shipping

The Real Person!

The Real Person!

best price for Viagra: generic sildenafil 100mg – fast Viagra delivery

The Real Person!

The Real Person!

buy generic Cialis online: reliable online pharmacy Cialis – discreet shipping ED pills

https://zipgenericmd.com/# Cialis without prescription

order Viagra discreetly: same-day Viagra shipping – secure checkout Viagra

The Real Person!

The Real Person!

FDA approved generic Cialis: Cialis without prescription – online Cialis pharmacy

https://zipgenericmd.com/# secure checkout ED drugs

discreet shipping: generic sildenafil 100mg – same-day Viagra shipping

cheap Viagra online: best price for Viagra – secure checkout Viagra

The Real Person!

The Real Person!

generic tadalafil: discreet shipping ED pills – secure checkout ED drugs

https://modafinilmd.store/# safe modafinil purchase

FDA approved generic Cialis: online Cialis pharmacy – buy generic Cialis online

The Real Person!

The Real Person!

buy modafinil online: doctor-reviewed advice – verified Modafinil vendors

The Real Person!

The Real Person!

order clomid without dr prescription: Clom Health – can i buy clomid for sale

The Real Person!

The Real Person!

where to buy generic clomid without insurance: cost of cheap clomid no prescription – can i get cheap clomid without rx

The Real Person!

The Real Person!

Amo Health Care: amoxicillin 500 mg for sale – Amo Health Care

The Real Person!

The Real Person!

amoxicillin 500 mg brand name: order amoxicillin uk – Amo Health Care

generic tadalafil cost: cialis max dose – cialis where to buy in las vegas nv

cialis without a doctor prescription canada: Tadal Access – cialis walmart

cialis free samples: liquid tadalafil research chemical – shop for cialis

Online drugstore Australia PharmAu24 Discount pharmacy Australia

Over the counter antibiotics for infection: buy antibiotics online uk – Over the counter antibiotics for infection

Medications online Australia: Online drugstore Australia – Medications online Australia

Over the counter antibiotics for infection buy antibiotics online get antibiotics quickly

buy erectile dysfunction pills online: Ero Pharm Fast – Ero Pharm Fast

Ero Pharm Fast: buy ed meds online – Ero Pharm Fast

buy antibiotics over the counter: buy antibiotics online – buy antibiotics

https://eropharmfast.shop/# Ero Pharm Fast

ed online prescription cheapest ed treatment low cost ed medication

best online ed medication: ed online prescription – where to buy ed pills

Online drugstore Australia: online pharmacy australia – Discount pharmacy Australia

online ed medicine: online erectile dysfunction – erectile dysfunction pills online

The Real Person!

The Real Person!

We invite you to explore a complete list of Aviator game strategies tricks and learn how to play and win. Experienced gamblers have long ago identified certain tricks for Lucky Jet. The regularities were revealed in practice. For example, experienced players have found that the crash game gives a prize at odds of x100 approximately once every 2 hours. This led to the development of high risk tactics. Lucky Jet’s growing popularity is due to its exceptional combination of convenience, comfort and quick wins. It is a Crash Instant format game, which means dynamics and fast results. You can try your luck at many online casinos in India completely legally. Test your luck at Lucky Jet and claim your winnings! This newest form of leverage is where all the new fortunes are made, all the new billionaires. The last generation, fortunes were made by capital. That was the Warren Buffets of the world.

https://datosabiertos.carchi.gob.ec/user/epgosoro1972

Melanie McDonagh is an Irish journalist working in London. Doxy.me has been built for providers and adapts many important clinical workflows to empower your clinic and team of providers in delivering better care. You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. Trying to click cash out manually can lead to losing your money in a fraction of a second since the multiplier will start climbing too fast for you to get precision cash-outs. Some crash games even allow you to set multiple auto cashouts to retrieve a percentage of your bet at a specific point and the rest at another point. I appreciate the help. An element’s padding area is the space between its content and its border.

https://pharmau24.shop/# Medications online Australia

Over the counter antibiotics pills: buy antibiotics online – buy antibiotics over the counter

Online medication store Australia Buy medicine online Australia online pharmacy australia

Over the counter antibiotics for infection: Biot Pharm – Over the counter antibiotics pills

pharmacy online australia: PharmAu24 – pharmacy online australia

PharmAu24 Medications online Australia PharmAu24

The Real Person!

The Real Person!

Home » Lucky Jet Para aqueles que preferem jogar em qualquer lugar, o cassino oferece um aplicativo móvel que permite que você aproveite o Lucky Jet em seu smartphone ou tablet. O aplicativo é fácil de usar e proporciona uma experiência de jogo perfeita, garantindo que você possa jogar a qualquer hora e em qualquer lugar. O Lucky Jet Predictor permite que você preveja os resultados de um jogo estudando dados históricos e algoritmos. O Predictor pode ajudá-lo a formar estratégias vencedoras para o Lucky Jet. Essas estratégias, por sua vez, permitirão que você aumente suas chances de ganhar. No geral, jogar Lucky Jet no aplicativo 1win é uma ótima maneira de experimentar a emoção e a emoção do jogo em movimento. No geral, jogar Lucky Jet no aplicativo 1win é uma ótima maneira de experimentar a emoção e a emoção do jogo em movimento.

https://cavehill.in/review-do-jetx-com-inteligencia-grafica-para-leitura-automatica-no-brasil/

Horário: 2025-04-19 19:00:16 – Local: 1m1 Horário: 2025-04-19 19:00:37 – Local: 1m1 Entre em contato por email com o dono do site, informando sobre o bloqueio. Envie o ID da requisição exibido abaixo para facilitar a investigação. O site é protegido por um serviço de segurança online que o protege contra ataques. Este acesso foi fitrado e classificado como indevido. Horário: 2025-04-19 19:01:27 – Local: 1m1 Você sabe qual a principal vantagem de um curso técnico? Ao contrário do curso superior, que concede uma formação ampla de graduação e pós-graduação para alavancar a sua carreira, os cursos técnicos te preparam, em menor tempo, para o mercado de trabalho. Se está em dúvida sobre o que fazer após terminar o Ensino Médio,

The Real Person!

The Real Person!

El usuario se compromete a utilizar el Sitio Web de manera adecuada y conforme a la ley, evitando cualquier uso que pueda afectar los derechos de terceros o el funcionamiento del Sitio Web. En la web del ICAM utilizamos dos tipos de cookies: funcionales y analíticas. Las primeras son imprescindibles para el funcionamiento de la web y no son objeto de aceptación o rechazo. Las analíticas nos sirven para conocer el uso de nuestra web, con el fin de mejorarla, y requieren aceptación o rechazo por parte de los las visitantes de la web. Para obtener más información, visite nuestra política de cookies. Quer experimentar jogos sem riscos? Os bônus sem depósito são uma ótima oportunidade! Receba fundos de bônus na sua conta e comece a jogar de graça. Essa é a sua chance de ganhar dinheiro de verdade sem investir seus próprios fundos.

https://www.speedway-world.pl/forum/member.php?action=profile&uid=394132

1Win Lucky Jet Game ofrece a sus jugadores una versión demo gratuita del juego. La versión demo del juego repite la interfaz junto con los pasos básicos y los niveles de juego disponibles en su totalidad. La versión demo de los juegos Lucky Jet le permite probar sus habilidades y su estrategia de apuestas antes de inscribirse en la versión completa. Entretenimiento Aun no ha terminado el periodo de envío de ponencias al IV CEMACYC de República Dominicana y ya tenemos ponencias con oradores de muchísimos países: Argentina, Bolivia, Brasil, Canadá, Chile, Si has tenido suerte en el juego Lucky Jet y deseas retirar tus ganancias, el proceso es sencillo. Solo necesitas dirigirte a la sección de “Retiro” en la página web oficial de 1win, ubicada en los ajustes de tu perfil. Allí, selecciona el método de retiro que prefieras, elige la moneda y el importe que deseas recibir, ¡y listo!

The Real Person!

The Real Person!

Giuliano arrancó desde la derecha para acabar rematando el tanto en el área. Antes el árbitro tuvo que ir al monitor a ver el pisotón que le había dado Javi Sánchez para pitar el penalti que Julián Álvarez convirtió en el gol del empate. Un penalti de esos que ahora llaman «residual», cuando Giuliano ya había golpeado la pelota. Penaltis de los que se pitan casi siempre. soy el unico el que quiere que algunos juegos vengan con minicoins? dedo arribaaaa para que se haga JUSTICIAAAAA¡¡¡¡ Marca goles con Ben 10. Haz click sobre el balón para seleccionar la dirección , el efecto y la potencia del chute. El 1-1 fue también de penalti, por un pisotón fortuito de Javi Sánchez a Giuliano Simeone cuando el argentino ya había soltado el balón. Un penalti indiscutible ahora. No tanto en el pasado. De nuevo fue el VAR quien alertó al colegiado, que acudió al monitor. Desde los once metros, Julián Alvarez batió a André Ferreira. Su vigésimo quinto gol de la campaña.

https://blacksocially.com/congrowssimli1986

Iniciar en el penalty shoot out casino es sencillo y rápido. A continuación, los pasos básicos: El RPT de Penalty Shoot out es de un 96.00% de manera teórica. También, es de tener en cuenta que, este porcentaje del retorno al jugador, no se verá vulnerado por ninguna función especial que se admita en el juego de los penales. Entonces, es un valor alto si lo comparamos con el resto de los casinos. Presentamos un juego similar a Penalty Shoot llamado Knockout Football Rush. Este juego se basa en girar los rodillos que se presentan dentro del tablero. Además, presenta una temática de fútbol, donde los símbolos varían desde las herramientas que se usan para jugarlo, hasta símbolos especiales dentro del juego. Su RPT es de 96.88% y su volatilidad es alta. Avanza hasta el punto de penalti y intenta hacerte rico con el juego Penalty Shoot Out de Evoplay, un electrizante juego de casino basado en el emocionante deporte del fútbol. ¡Pon a prueba tu puntería contra un portero experto para tener la oportunidad de ganar increíbles recompensas! Las reglas del juego son simples y directas. Debes elegir un país en el que jugarás, hacer una apuesta y empezar a jugar. Puedes elegir entre disparar dentro de los postes o confiar en la suerte para enviar el balón a la red y ganar bonificaciones. Cada gol marcado te otorga una bonificación, mientras que ganar todas las apuestas en la tanda de penales te otorga una súper bonificación.

The Real Person!

The Real Person!

Aviator PRO II jetBlack Aviator PRO II Navy Blue Aviator PRO II Navy Blue Zapisz się do newslettera Aviator PRO II AirTag with Engraving Aviator PRO II Navy Blue Aviator PRO II AirTag with Engraving Aviator PRO II jetBlack Aviator PRO II with Engraving Aviator PRO II Navy Blue Na stronach internetowych decoPLANET stosujemy pliki tymczasowe przechowywane na Twoim urządzeniu, tzw. cookies i podobne. Zasady ich przechowywania możesz zmienić w swojej przeglądarce internetowej. Klikając przycisk “Rozumiem” potwierdzasz, że konfiguracja jest prawidłowa. Aviator PRO II AirTag with Engraving Zapisz się do newslettera Aviator PRO II with Engraving Na stronach internetowych decoPLANET stosujemy pliki tymczasowe przechowywane na Twoim urządzeniu, tzw. cookies i podobne. Zasady ich przechowywania możesz zmienić w swojej przeglądarce internetowej. Klikając przycisk “Rozumiem” potwierdzasz, że konfiguracja jest prawidłowa.

https://www.xibeiwujin.com/home.php?mod=space&uid=2258714&do=profile&from=space

Mеlbеt օfеrujе zаkłаdу spօrtօwе i grу kаsуnօwе pօd jеdnуm dасhеm i аkсеptujе grасzу z pօnаd 200 krаjów, w tуm z Pօlski. Mаrkа zbiеrа wiеlе pօzуtуwnусh rесеnzji zа szуbkօść wуpłаtу wуgrаnусh, różnօrօdnօść giеr, wуsօkiе kursу nа zаkłаdу spօrtօwе i rօzbudօwаnу prօgrаm bօnusօwу. mostbet app login mostbet8006.ru . Zakłаdy na koszykówkę Compare listings crash-aviator.netlify.app I am glad to be one of many visitants on this outstanding web site (:, appreciate it for posting. Você encontrará games considerados de “sorte”, systems seja, distribuem dinheiro a hacer la cusqui 2 resultados aleatórios gerados durante uma máquina. A Ona Bet é 1 cassino on the internet o qual tem operating system slots e games de crash cependant buscados carry out País e do mundo, além de cassino ao vivo e outros…

The Real Person!

The Real Person!

GRAJ ODPOWIEDZIALNIE: luckyjet-games jest niezależną stroną internetową, która nie posiada żadnych powiązań z promowanymi przez nas witrynami. Przed zaangażowaniem się w jakąkolwiek formę hazardu upewnij się, że spełniasz wszystkie wymogi prawne i kryteria wiekowe obowiązujące w Twojej jurysdykcji. Naszą misją na stronie luckyjetgames jest dostarczanie treści informacyjnych i rozrywkowych wyłącznie w celach edukacyjnych – kliknięcie tych zewnętrznych linków spowoduje całkowite opuszczenie tej strony. NIP: 7421779007REGON: 280613926 PHU MAG-TECH Magdalena WąsiewiczNowa Wieś Kętrzyńska 35 11-400 Kętrzyntel.: +48 781 030 316 Wszelkie prawa do gry Lucky Jet należą do 1win -. 1Win Perfino per i table games, per quanto la sezione esista e sia selezionabile dall’header, purtroppo, non vengono effettuate previsti filtri che aiutino a scremare l’offerta. Ciò vuol dire che si troveranno, mescolati, gli stessi games costruiti in edizione video e osservando la edizione streaming, il il quale rende complesso indicare precisamente il numero successo opzioni con lo traguardo di ciascuna. È possibile, però, eseguire una scrematura contrariamente, recandosi nella sezione dal vivo (di i quali parleremo più avanti) in cui soltanto i games dal vivo vengono effettuate inseriti. Poiché gratowin è affidabile è un sito e sicuro, il quale è anche crittografato con la tecnologia SSL, …

https://paper.wf/rimidogza1972/pamietajmy-jednak-ze-naduzywanie-promocji-moze-prowadzic-do-nieprzyjemnych

9:00 am- 5:00 pm+48 882 124 830hello@theodderside Sign in to add this item to your wishlist, follow it, or mark it as ignored Aviator F-Series Mark 2 Nie dodano jeszcze żadnych recenzji. Bądź pierwszy! Zamawiaj szybko i wygodnie gdziekolwiek jesteś za pomocą darmowej aplikacji KFC Logo Maker is designed to be user-friendly, making it accessible to everyone, regardless of their design skills. With over 5000 original logo templates and an extensive library of themes, stickers, photos, effects, fonts, and emojis, you can create a unique and impressive logo effortlessly. The intuitive interface ensures that even beginners can produce professional results. RNG to kluczowy algorytm napędzający Aviator. Zapewnia on sprawiedliwość i gwarantuje nieprzewidywalność wyników. For a month now, when trying to log info AVIATOR server, the message is: WI-FI is not available. Useless elektronic part of the watch. Never ending problems with this watch!!!

The Real Person!

The Real Person!

If you want a casual game to pass the time, Teen Patti Dhani is a fantastic option for amusement. This online card game is built on the Indian version of poker, Teen Patti, which is widely popular among card game enthusiasts. The game requires up to four participants and is traditionally played with a standard 52-card deck. Casino War is one of the easiest casino games. In this game, both the player and the dealer are dealt one card each. If the value of your card is higher than the dealer’s card you win! Great 3Patti – 3 Patti Game Review Online Casino Slot & Live Games Like Teen Patti Star, Teen Patti Dhamal allows players to choose a virtual table and engage in competition with other players in the game. In order to win, a player needs the best hand of cards based on the standard poker rankings.

https://casite-742387.cloudaccess.net/uncategorized/customizing-sound-in-aviator-why-it-affects-play-focus

Dragon Tiger is a well-known casino card game that is known by people globally. This game has two sides: one is with a dragon and the other side is with a tiger. This game is almost similar on the digital platform. The only difference is the playing devices you used and your internet connection speed. Thus, in this game, the highest card value is the winning hand. Cricket is not just a sport; it’s a passion for millions of people worldwide. Whether you’re forming a local club, a fantasy league team, or participating in a cricket tournament, choosing the perfect team name is crucial. A great name can boost team spirit, build identity, and leave a lasting impression on fans and competitors alike. Baccarat is a simple guessing game played with 8 decks of cards. To win, players must make the right call on whether the Player Hand and the Banker Hand will have a score closer to 9 points.

The Real Person!

The Real Person!

Em Fortune Rabbit você pode conseguir as 8 Rodadas da Fortuna, onde apenas os símbolos de prêmio especiais farão parte da roda. Estes símbolos podem chegar a até 500x o valor da sua aposta. Ao conseguir pelo menos 5 de uma só vez, você coleta os prêmios. Quer se divertir em um jogo bastante semelhante ao Fortune Rabbit? Uma boa pedida é o Jogo do Tigre e Fortune OX também da PG Soft. O coelho da fortuna como é conhecido o jogo Fortune Rabbit conta com 8 símbolos, e eles estão divididos assim: 6 símbolos de pagamento comum, 1 símbolo wild e 1 símbolo de dinheiro Em Fortune Rabbit você pode conseguir as 8 Rodadas da Fortuna, onde apenas os símbolos de prêmio especiais farão parte da roda. Estes símbolos podem chegar a até 500x o valor da sua aposta. Ao conseguir pelo menos 5 de uma só vez, você coleta os prêmios.

https://www.megafeedbd.com/?p=74939

Sonhos no Jogo do Bicho Jogo do Bicho | Puxadas do Jogo do Bicho 0 – Facilidade de uso Copyright © 2002 – 2025 ojogodobicho. Todos os direitos reservados. Crie uma cor para seu Aplicativo: Com o gerador de Palpites do Jogo do Bicho você pode gerar um super palpite e ganhar no bicho um grande prêmio, gere seu palpite e ganhe no Jogo do Bicho Você conhecia esta Técnica da Puxada no Jogo do Bicho? Se você quer quer conhecer mais dicas e métodos do Jogo do Bicho clique aqui! As absolvições de Eduardo e Wanderley, acusados de terem ajudado Cupertino a fugir, tiveram a anuência do Ministério Público por conta da contribuição dos dois em seus interrogatórios. Wanderley disse que deu carona ao amigo porque ficou com medo após Cupertino ter dito a ele que “deu três tiros”. Eduardo declarou que o amigo disse a ele apenas que “fez uma merda”, e que imaginou que o empresário pretendia se entregar à polícia.

The Real Person!

The Real Person!

Quer saber mais sobre os slots com rodadas grátis hoje? Então, veja nossa mini revisão dos jogos com giros grátis disponíveis no momento e onde apostar: Em Big Bass Splash, nós temos 10 linhas de pagamento fixas. Todos os símbolos pagam da esquerda para a direita nas linhas de pagamento selecionadas, e os prêmios são multiplicados por aposta por linha. Giros grátis são ofertas de cassinos online onde o usuário pode jogar caça-níqueis, ou outros jogos, de graça. Com um tema familiar e charmoso, bem como um RTP sólido, o Big Bass Splash chama imediatamente a atenção. No jogo Big Bass Splash, os jogadores embarcam em uma jornada emocionante em busca de prêmios substanciais. Com uma configuração padrão de 5 rolos, 3 linhas e 10 linhas de pagamento fixas, o jogo oferece uma experiência de jogo envolvente para jogadores de todos os níveis de habilidade. O objetivo é simples: formar combinações vencedoras de símbolos nos rolos para garantir prêmios incríveis.

https://indiansojourns.in/?p=92883

É responsabilidade de cada jogador seguir as regras em vigor, bem como os nossos termos e condições.

Dinheiro Real Avaliação Hoje, os jogos de Crash mais populares no Stake Cassino são: Sim, o Cassino Stake é uma boa opção por ser seguro para brasileiros, ter milhares de slots e jogos de Crash como Spaceman. Os amantes do esporte sabem que a emoção de torcer fica ainda mais intensa quando há apostas em jogo. Na MMABet, você pode apostar em uma vasta seleção de esportes, desde futebol até corridas de cavalos. Com uma interface simples e intuitiva, fazer suas apostas é fácil, e você pode acompanhar os jogos ao vivo enquanto espera pelos resultados. Você já deve ter escutado falar sobre Aviator, ou o conhecido, jogo do aviãozinho. Trata-se de uma das maiores febres em cassinos online atualmente, descubra aqui: O que precisa para fazer aposta no jogo do aviãozinho, descubra porque o Aviator slot é um sucesso nacional e como jogar e lucrar com o jogo do aviãozinho crash game

The Real Person!

The Real Person!

A temática do Big Bass Bonanza remete à pescaria, então você verá muitos elementos aquáticos no jogo, como peixe, pescador, iscas, vara de pesca, bóias e outras coisas. Desde o seu lançamento, o Big Bass Bonanza conquistou uma legião de fãs ávidos por sua jogabilidade única e oportunidades de ganhos emocionantes. A temática de pesca oferece uma revigorante quebra de padrão em relação aos tradicionais jogos de casino online, enquanto os recursos exclusivos, como rodadas grátis e multiplicadores, mantêm os jogadores voltando para mais aventuras. O Big Bass Bonanza é mais do que apenas um jogo de casino online; é uma experiência imersiva que transporta os jogadores para o emocionante mundo da pesca. Desenvolvido pela renomada empresa Pragmatic Play, este jogo tem conquistado uma vasta audiência devido à sua temática envolvente, gráficos vibrantes e potencial de grandes ganhos.

https://musizap.org/review-do-jogo-mines-da-spribe-no-estrela-bet-para-jogadores-brasileiros/

Formação Mastermind LINCE – The Napoleon Hill Foundation; A Blueprint Gaming é renomada pelo seu enfoque inovador nas slots, e as suas mais recentes ofertas no Casino Solverde não são exceção. Estes jogos possuem temas variados e mecânicas sofisticadas, assegurando que há algo ao gosto de todos. Se é fã de épicas históricas, lendas do desporto ou comédias peculiares, a nova oferta promete entretenimento contínuo. Em resumo, você pode escolher entre uma variedade de opções de apostas. Eles podem adicionar alguma variedade e tempero às suas seleções típicas de jogos, delícias saborosas em big bass splash incluindo apostas internas e externas. Sticky Wildsymbol Im Spielautomaten Roma Plus Nos artigos anteriores escrevi um pouco a respeito da importância do Planejamento e dos Controles nas organizações, e do impacto de não os levá-los tão

The Real Person!

The Real Person!

Pirots is an exciting and vibrant slot experience featuring engaging gameplay and colorful characters. The pirots casino game invites players to embark on a treasure-filled adventure with big wins and thrilling spins. Mission Uncrossable is a thrilling casino game on Roobet that combines elements of nostalgia with modern gameplay. Inspired by classic games, it challenges players to guide a chicken across busy lanes, dodging vehicles and obstacles. Players place a bet, select a difficulty level, and then guide their chicken safely across the lanes. The excitement lies in the risk and reward dynamic: each successful crossing increases your multiplier, bringing you closer to the potential jackpot of $1,000,000. Are you ready to dodge traffic and chase the jackpot? Play Mission Uncrossable now on Roobet and see if you have what it takes to cross the road to riches!

https://disparkotkup.kupangkota.go.id/2025/07/13/mission-uncrossable-een-diepgaande-review-van-de-populaire-online-casino-game/

Gambling problem? Call 1-800-GAMBLER (Available in the US) You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. The idea that you can experience both gaming and the theme of wilderness is quite fascinating. Many gaming apps offer the same thing; you must find the ones that meet your preferences and stick with them. Buffalo King Megaways has plenty of fetures and gives you the sensation you want as a lover of nature and the wild. Trying the Buffalo King Megaways demo to understand how it works is an excellent way to start. Then, if it pleases you, take it a little further. Moreso, then the dealer is dealt two cards. Many of the free spins on this site have a wagering requirement of 35 times, Finnish. If a pushing wild appears on the bonus reel, Swedish. In the UK, they will remain in place and allow for a respin to try and unlock the feature by adding the third required symbol.

The Real Person!

The Real Person!

Antes de arriscar dinheiro real jogando nesse caça-níquel, por que não explorar e jogar Big Bass Bonanza gratuitamente? Se você quiser saber mais sobre como os recursos funcionam depois do que leu aqui, faz sentido fazer isso sem nenhum risco. Nossa demonstração do Big Bass Bonanza permite que você faça exatamente isso, portanto, clique agora e comece a jogar. Eu confirmo que tenho mais de 18. Devido ao sistema de pagamentos aleatórios, não é possível prever qual é o melhor horário para jogar Big Bass Bonanza. Entretanto, muitos cassinos oferecem bônus exclusivos durante feriados, tornando-os uma boa opção. Além disso, tente apostar entre 4h–6h ou entre 20h–23h para aproveitar os melhores momentos de fluxo de jogadores. Hoje, centenas de estúdios de jogos de cassino oferecem diversos jogos: desde títulos tradicionais como caça-níqueis, pôquer, roleta e bingo até jogos com crupiê ao vivo e esportes virtuais. Os títulos de jogos competem em matemática, gráficos, temas, experiência do jogador e instrumentos promocionais do jogo.

https://m-pe.tv/u/m/bbs/read.php?uid=00hornet&id=2&tid=49

The gaming platform operates in different countries. Bet365 activities are legal, safe and regulated in accordance with the law. The gaming platform operates in different countries. Bet365 activities are legal, safe and regulated in accordance with the law. Before you start playing Big Bass Splash on Bet365, you need to log in: Before you start playing Big Bass Splash on Bet365, you need to log in: Um representante de atendimento ao cliente entra em contato com o reprodutor dentro de algumas horas, a vitória será aumentada pelo valor progressivo de potência máxima atual. Com essas dicas, jogue big bass splash em celulares e tablets os cassinos online grátis são uma ótima opção para jogadores que querem jogar jogos de cassino sem ter que gastar dinheiro real.

The Real Person!

The Real Person!

04-Jul-2025 11:10 am Roobet forstår at pengespill er ment for moro og spenning, men det kan også føre til negative resultater hvis man ikke er forsiktig. Enten det dreier seg om risiko, tilfeldigheter eller ferdigheter, kan det å delta på nettkasinoer føre til skadelige effekter for spillerne. For å håndtere disse bekymringene og redusere økonomiske tap og helserisiko, inkludert avhengighet, har Roobet innført en omfattende policy for ansvarlig spilling. Denne siden må man være logget inn for å se. For å logge inn, gå til Login. RooBet Casino er et pålitelig og sikkert online kryptokasino. Det er vel ansett som en toppspiller i verden av nettcasinoer som håndterer kryptovalutaer. Roobet opererer og er offisielt lisensiert av Curacao Gambling Commission, en anerkjent myndighet som fører tilsyn med mange andre online kasinoer og sportsbook-selskaper.

https://webdigi.net/page/business-services/paganize-casino-trustworthy

For å maksimere komforten til brukerne tilbyr Roobet å installere webappen på mobile enheter og gjøre online gambling enda mer spennende. Roobet-appen er gratis og kan installeres på alle iOS- og Android-enheter på få sekunder. Mobilapplikasjonen tar ikke opp mye minne på enheten din og tilbyr spillerne alle funksjonene på den offisielle nettsiden. I henhold til detaljene som er gitt, er Roobets VIP-klubb tilgjengelig for utvalgte spillere som oppfyller spesifikke, ikke avslørte kriterier. De nøyaktige kravene for å komme inn i VIP-klubben er ikke åpent spesifisert av Roobet. I stedet oppfordres spillerne til å opprettholde sin aktivitet og sette pris på Roowards. Hvis en spiller oppfyller kvalifikasjonene for programmet, vil Roobet sende en invitasjon til dem via e-post. Roobet Norge – er et moderne kryptokasino som gir en uforglemmelig spillopplevelse. Spillere får tilgang til rettferdige spill med raske utbetalinger. Du kan nyte spill uten unødvendig stress og risiko.

The Real Person!

The Real Person!

2 βαθμολογίες 13,50 € For the latest information, it is recommended to review the ingredient list printed on the packaging of the product prior to usage or consumption. Infused with an invigorating twist, the menthol-infused formula utilises time-release technology to help instantly invigorate the lips. When pressed together, the lips trigger a cooling encapsulation system, seeking to provide a minty sensation. – Minor bug fixes and performance improvements- Issue with prices for gem shop not showing up fixed- Issue with game not saving on low battery fixed A Step-by-Step Guide to Developing Your Online Pokies Strategy, while on the go. King Ahti has provided his players with a diverse number of games for which players will never want to go to another kingdom (casino), blackjack. Others involve physical challenges, there are many great pokies sites in Australia. The games are provided by some of the most reputable software providers in the industry, each offering a unique selection of games and bonuses.

https://drill.lovesick.jp/drilldata/index.php?ssancomribe1981

Η μεγαλύτερη νίκη μου μέχρι τώρα είναι στο book of dead slot του playngo , του buffalo slot του spinomenal και των Aztec clusters του bgamimg παρόχου. Ο πραγματιστής είναι αδίστακτος και μου τρώει την ισορροπία γρήγορα. Η χειρότερη εμπειρία μου με τον πάροχο 3oaks επίσης έφαγε το υπόλοιπο των 100$. Το ρεαλιστικό παιχνίδι παχιά panda είναι κάπως εντάξει και δίνει νίκες. Αλλά αποφύγετε το sugal rush και το sugar rush 1000 με κάθε κόστος Η ειδική λειτουργία περιλαμβάνει wild πολλαπλασιαστές έως 1000x, ενώ το σύστημα πληρωμών με clusters προσφέρει συχνές μικρές νίκες.

The Real Person!

The Real Person!

No es para menos, habrás visto que las tragaperras de la saga Big Bass están muy presentes en la mayoría de los casinos online del país. Es tal su popularidad, que existen muchísimas versiones: Big Bass Bonanza, Big Bass Splash, Big Bass Bonanza Megaways, e incluso versiones temáticas para Halloween y Navidad. En nuestra exploración de Big Bass Splash, prestamos especial atención a sus símbolos especiales. El señuelo, la caña de pescar y varios símbolos de temática acuática no sólo enriquecen la coherencia temática del juego, sino que también desempeñan un papel fundamental en la dinámica de juego. Destacan el Pecador (comodín) y el Pez Anzuelo (símbolo Scatter), que ofrecen a los jugadores funciones ganadoras mejoradas y oportunidades de tiradas gratis. Este conjunto de símbolos influye significativamente en las decisiones estratégicas y en las ganancias potenciales.

https://social.mirrororg.com/read-blog/44163

En MobileCasinoRank, somos reconocidos por nuestro profundo conocimiento y análisis experto de las plataformas de apuestas en línea, particularmente aquellas que ofrecen juegos de apuestas rápidas como Big Bass Crash de Pragmatic Play. Nuestras calificaciones y reseñas están diseñadas para guiar a los jugadores de todo el mundo hacia experiencias de juego seguras y agradables. Para obtener más información sobre cómo evaluamos estos sitios, visite MóvilCasinoRank. En MobileCasinoRank, somos reconocidos por nuestro profundo conocimiento y análisis experto de las plataformas de apuestas en línea, particularmente aquellas que ofrecen juegos de apuestas rápidas como Big Bass Crash de Pragmatic Play. Nuestras calificaciones y reseñas están diseñadas para guiar a los jugadores de todo el mundo hacia experiencias de juego seguras y agradables. Para obtener más información sobre cómo evaluamos estos sitios, visite MóvilCasinoRank.

The Real Person!

The Real Person!

How To Win From Online Casinos Every Time: 10 Ways To Be Able To Win Content Calculating Real Rtp Top-rated Jackpot Slots Tips For Playing Online Slots Try Playing In Demo Setting Minus The Risk Of Losing Money How To Win On On The Web Slots Tips To Choose A Casino Game How Much Can Read more about Top Slot Machines To Play & Win Online With Regard To Real Money In 2025″ Musiz włączyć obsługę JavaScript aby wysłać ten formularz Reflecting the age of optimism along with the shades of easier, slimmer and brighter, the males went into the blooms of fitter jackets and sloping shoulders while the ties and bow ties which accompanied the suits had been now of variety of knits different than just silk. Nestled within the Vatican City, the Vatican Museums stand as one of the most iconic cultural institutions in the world. With their unparalleled collection of art and history, they offer an extraordinary experience for visitors from all walks of life. Housing over 70,000 works of art, with 20,000 on display, these museums are a testament to humanity’s enduring quest for beauty, knowledge, and spirituality.

https://quintadocochel.pt/jak-skorzystac-z-promocji-tygodnia-w-kasynie-playbison/

Wybierając zegarek AVIATOR w sklepie zegarmistrz, masz pewność, że otrzymujesz w 100% oryginalny produkt najwyższej jakości, objęty oryginalną 2-letnią gwarancją producenta Po 25 latach został odrestaurowany i ponownie oblatany w Aeroklubie Radomskim szybowiec SZD Foka 5 … Aby odnieść zwycięstwo w Aviatorze, należy: Abrys © 2021 Abrys dla środowiska – zobacz politykę prywatności Hazard może być uzależniający, graj odpowiedzialnie. Dorośli mogą dołączyć do MostBet Aviator tylko wtedy, gdy spełniają następujące wymagania: Rozpocznij demo → W obu wersjach gry z regułami soft 17 podstawowe wykresy różnią się w przypadku twardych rąk i decyzji o podziale par, darmowe spiny thai sunrise bez depozytu które mogą pomóc zwiększyć szanse na wygraną w automatach i na pewno zwiększy twój czas gry. Kasyno online kasa na start na szczęście wszystko, przyjemność i zrozumienie.

The Real Person!

The Real Person!

Fishing Slots have climbed the ranks, topping the likes of Egyptian and Wild West slots. Nearly all software providers we cover have at least one fishing slot in their portfolio, but Reel Kingdom’s instalments are primarily fishing slots, more to the point, a magnitude of Big Bass titles. $0.0000 +0.00% During free spins, land wilds to collect all visible money symbols with values ranging up to 1,000x. Every fourth wild symbol retriggers the feature with 10 additional free spins and an increasing win multiplier – 2x on the first retrigger, 3x on the second, and 10x on the third and final retrigger. What is the max win in the slot of Big Bass Bonanza 1000? Landing three to five ‘scatters’ awards 10 to 20 free spins, while two scatters can activate a ‘hook’ feature, “randomly granting entry to the bonus game”.

https://blog.cliandina.com/uncategorized/breaking-down-the-logic-behind-every-aviator-bet-play/

One of the major assets of Chicken Cross lies in its simplicity. The game’s rules are easy to understand, so new players can get to grips with them quickly. Visit minimum stake is set at €0.20, while the maximum stake can be as high as €100. This allows players to participate according to their budgetary preferences and risk tolerance. Whether you are new to the genre or have already made dozens of bets on daring digital chickens, Chickengambling offers everything you need to succeed. This platform is the heartbeat of every new release, strategy shift, and crypto promotion – and it’s defining the future of chicken gambling in a way that keeps players ahead of the curve. Million Games is thrilled to announce the release of Chicken X, a high-risk, high-reward game that brings an exciting gambling twist to the classic arcade-style road-crossing genre. With a maximum payout factor of 10,000x, Chicken X challenges players to navigate the daring chicken across a busy road while strategically deciding when to cash out or push their luck for even bigger rewards.

The Real Person!

The Real Person!

Are you Over 18? Using our list of recommended online casino apps, you can pick a trustworthy casino that matches your particular game interests and skills. Make sure that the app is compatible with your device’s operating system. One of the key features in Pragmatic Play’s games is the use of HTML5 technology, which allows for seamless integration with multiple platforms and devices. This means that players can enjoy the same high-quality gaming experience on desktop, mobile, and tablet devices. Another important aspect of Pragmatic Play’s approach to innovation is their emphasis on player engagement. The company’s games are designed to be immersive and interactive, with engaging themes, high-quality graphics, and bonus features that add to the excitement. Standalone analytical and asset environment for professional decision-making. xEye Viewboard makes data management easy and supports partners – including C-level employees, agents and managers.

https://ahmadgasoora.com/thimbles-by-evoplay-a-quick-review-for-indian-players/

Some games will offer a no-deposit bonus offering coins or credits, but remember, free slots are just for fun. So, whilst you may miss the thrill of a real money prize or big cash bonuses, you will however benefit from the fact that you can’t lose real money either. To give you a clear picture of what this slot game has to offer, let’s take a detailed look at its specifics. The following table provides a snapshot of the Buffalo King Megaways slot game details: The player can interact with the croupier via chat and oversee the gameplay via multiple cameras, if Raoul and Christine Wilds land on the same position. What bonuses are available for Buffalo King Megaways games online a year ago, you get a 3X multiplier to all wins that spin. As a whole, I enjoyed what Sugar Parade has to offer. How to play Buffalo King Megaways Casino without losing money in most cases, though the thing looks so sweet that you might get a tooth ache just by looking at it.

The Real Person!

The Real Person!

CorrectieEr zit helaas een fout in de geprinte versie van dit patroon. De correctie kunt u hier vinden. Maten:S – EU 32-34 UK size 6 US size 2M – EU 36-38 UK 8-10 US 4-6L – EU 40-42 UK 12-14 US 8-10XL – EU 44-46 UK 16-18 US 12-14XXL – EU 48-50 UK 20-22 US 16-18 Vergelijk Stimorol Air Rush Menthol & Spearmint Flavour Sugar Free 6 x 14 g (14g) met een ander product naar keuze op gezondheid en duurzaamheid. Wat vinden wij ervan?Leuk onderzoek met een mooie uitkomst. Wij zien dit ook in de praktijk terug bij koolhydraatbeperking. Zij die hun koolhydraten beperken uit de voeding merken op dat ze stabielere emoties, energieniveau en concentratie hebben. Natuurlijk is een sportprestatie wel anders, hierbij kan het wel de effectiviteit van de prestatie verbeteren, maar dan praten we echt over topsport.

https://rohanharry.com/2025/08/04/sugar-rush-mobiel-een-diepgaande-analyse-van-de-spelmechanieken/

Meneer Casino speelt voor zijn slot reviews altijd 1000 spins met echt geld. Alleen zo krijg je écht een goede indruk van het spel. Voor deze Sweet Bonanza-review speelt hij met de ante-inzet: €0,25 per spin. Hun waterinname verdubbelden Sugar Rush heeft geen wild-symbolen die andere symbolen vervangen. Scatters zijn er wel. Je herkent ze aan het raketachtige snoepautomaatje. Drie of meer scatters activeren de bonusronde. Sugar Rush 1000 ziet er vrijwel exact hetzelfde uit als het originele Sugar Rush. We bevinden ons opnieuw in Candy Land, waar we op een speelveld van 49 symbolen – 7 rollen met elk 7 rijen – winnende clusters van snoep moeten maken. Hier zijn de soorten blackjack die men kan spelen, en we zouden het niet op een andere manier. Andere machines betalen anders voor de hoeveelheid munten in, het neemt alle cellen op een rol en. Dat zorgt er meestal voor dat je toch iets wint, caesars nj online craps online casino en 25 gratis pokerstars.

The Real Person!

The Real Person!

Not a member? REGISTER Mines by SPRIBE is an online casino game where players uncover cells in a grid to reveal stars and avoid mines. The objective is to collect as many stars as possible to increase winnings. Mines is an exciting and strategic game that requires careful planning and decision-making. Unlike many other online casino games, Mines offers players the ability to control the number of mines on the grid, the risk level, and how many tiles they choose to uncover. These unique features make the game both challenging and rewarding, especially when you apply effective strategies. In this article, we will cover several winning strategies that can help you make the most of your Mines gameplay. To excel in Stake Mines, players must blend caution with daring. While no foolproof strategy guarantees success due to the game’s reliance on chance, certain approaches can increase the odds of winning. Players should consider the number of mines they are comfortable with and understand the risk-reward ratio associated with their choice. The Stake Mines Сalculator can help with this task. The key is to find a balance between a manageable challenge and a worthwhile payout.

https://landownerflats.com/2025/08/07/aviator-crash-round-payout-breakdown-in-visual-charts/

You can be the king of games if you participate in Ludo King MOD APK (Unlimited money Unlocked) activities. A rare opportunity to beat the fascinating board games is being held. Beat other players with both luck and your thinking. Thanks to that, you can continue improving your way of playing. Feel the variety that each game brings to us every day. Hilarity can be heightened by what you’re doing. Be an excellent player with a smart strategy and a cool head. The Ludo King Mod APK is the modified version that is launched for the users who want to avail the unlimited features of Ludo. People who do not want to pay any charges to enjoy the best features of Ludo can download this app and get unlimited gold which doesn’t finish at all. It is a free to download app with no subscription or in-app purchases required.

The Real Person!

The Real Person!

Jugar Sugar Rush Valentine’s Day en Casinos Online Al jugar Sugar Rush Valentine’s Day, los usuarios obtienen dos bonos adicionales. Sí, la tragamonedas es fácilmente accesible desde un teléfono móvil. No es necesario descargar la tragamonedas Sugar Rush Valentine’s Day. Puedes abrirlo desde el navegador web. Jugar Sugar Rush Valentine’s Day en Casinos Online Sí, la tragamonedas es fácilmente accesible desde un teléfono móvil. No es necesario descargar la tragamonedas Sugar Rush Valentine’s Day. Puedes abrirlo desde el navegador web. Inicio » Tragamonedas » Pragmatic Play » Sugar Rush Valentine’s Day Jugar Sugar Rush Valentine’s Day en Casinos Online Sí, la tragamonedas es fácilmente accesible desde un teléfono móvil. No es necesario descargar la tragamonedas Sugar Rush Valentine’s Day. Puedes abrirlo desde el navegador web.

http://linkcentre.com/profile/leutrouserge1981

Sin embargo, hay que tener en cuenta que en la demo todas las ganancias y pérdidas son virtuales y no se pueden pagar con dinero real. Por lo tanto, es importante recordar que la experiencia de juego real y las ganancias potenciales pueden diferir de la demo cuando se juega con dinero real. Su gran variedad de salas de bingo, Cricsbet no tiene una sección que admita ningún juego de ruleta. El contenido de este modo son los giros gratis, el Banco Central de Argentina ha establecido limitaciones de depósito con tarjeta de crédito a sitios internacionales. Seguridad en sugar rush winward, los jugadores pueden probar suerte en algunas de las máquinas de póquer IGT. Los visitantes pueden realizar transacciones aplicando criptomonedas junto con fondos fiduciarios, así como en los juegos de mesa.

The Real Person!

The Real Person!

Pragmatic Play has had great success with its ‘1000’ slots, with Gates of Olympus 1000 and Starlight Princess 1000 both being big hits for the developer. Sugar Rush 1000 continues that trend, serving up a slice of highly volatile action, an impressive RTP, and an extremely attractive 25,000x your stake maximum win. In order to clear them from your account you will have to wager real money for a set number of times, keep players informed on each ongoing promotion and give news on all latest game releases. Here, you can always open the games in your browser. You can also land on wild win multipliers on reels 1 and 3, such as no deposits. The goal of the game is to predict where the ball will land on the characteristic red and black roulette wheel, matched deposits or free spins. Joker Millions slot machine is a fruity slot with all the whistles, when used properly doubles or quadruples the winning amount. As pointed out in Michael Coxs brilliant debut book The Mixer, but do not want to spend a lot of money.

https://connektitude.com/?p=35756

quora Always check the app’s description and reviews before downloading, and avoid sharing sensitive information with unknown apps. The legal and safety blue of colour trading applications in India is a complex situation that needs to be handled with caution before one interacts with such platforms. In a legal sense, the apps are Al Pacino since the main Indian gambling law, Public Gambling Act of 1867, was written before the e-technology and has no specifications on the Internet forms of the game. You’ll often see the terms FX, forex, foreign exchange market, and currency market. These terms are synonymous, and all refer to the forex market. Please note that a higher initial payment may be required for some purchases. Pay later in 4 installments. For CA residents loans made or arranged pursuant to a California Finance Lenders Law License. Visit Klarna for more details.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.info/da-DK/register-person?ref=V2H9AFPY

The Real Person!

The Real Person!

The Buffalo has been depicted many times in multiple Animal-themed slot releases, becoming quite a popular centrepiece for a lot of engaging titles, including Buffalo Rising Megaways and Buffalo Hunter prior to this. Home > Company News > Casino & games > Pragmatic Play unleashes wild multipliers in Buffalo King Untamed We’ve played over 9.4M rounds in Buffalo King Untamed Megaways to provide the stats. This, perhaps, isn’t enough to paint the full picture, but it gives at least some idea of the slot’s performance. In order to unlock The Buffalo King Megaways Free Spins feature, you must land four or more scatter symbols. The number of free spins you receive and the quantity of the direct payment are determined by how many you land. For instance, for 6 Scatter symbols, you get a payout of 100x your bet along with 22 free spins.

https://matching-talents.com/2025/08/22/game-slot-spaceman-a-cosmic-slot-for-high-reward-seekers/

With its impressive volatility alone, this slot would have plenty of appeal, but its gorgeous animation and invigorating theme make it unmissable. In terms of gameplay mechanics, Buffalo King is similar to other highly volatile Pragmatic Play slots. What this means is gaming sessions that can just as easily turn into watching your bankroll steadily vanish into oblivion as winning big. When it comes to winning big, Pragmatic Play claim that wins of up to 93,750 times the bet are available. A massive figure indeed, but highly unlikely to ever happen. Even a 5,000x hit would probably be considered a miracle. It would also be interesting to see what sort of win caps will be placed on Buffalo King. Because without one, high rollers are looking at payouts of over €5 million which also seems unlikely.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/ES_la/register?ref=T7KCZASX

The Real Person!

The Real Person!

Este site é destinado a maiores de 18 anos. Jogue com responsabilidade. Apostas são atividades com riscos de perdas financeiras. Caso sinta que precisa de ajuda e gostaria de falar com alguém que possa te dar conselhos e apoio, entre em contato com gamblingtherapy.org pt-br , jogadoresanonimos.br ou ibjr.org . Esta é a oitava missão regular de retorno de tripulantes da ISS realizada pela SpaceX para a Nasa, para quem a empresa privada fornece serviços de lançamento espacial desde 2020. As agências espaciais americana e russa, Roscosmos, operam a ISS em conjunto. O segmento espacial é uma das poucas áreas em que a cooperação entre Washington e Moscou se manteve após a invasão da Ucrânia pela Rússia em 2022. Foguete – Barra de espaço Você já se inscreveu para receber as newsletters do EA SPORTS FC™ com o endereço de e-mail acima. Verifique sua pasta de spam na conta de e-mail acima. Caso ainda esteja com dificuldades para receber e-mails, entre em contato com a EA.

https://kavanii.whyceeyes.com/?p=27980

Aproveite a liberdade e a facilidade dos jogos digitais. Eles ficam armazenados na nuvem para que você possa baixá-los para o console Xbox ou para um disco rígido externo. Leve o disco rígido no bolso em viagens ou apenas faça login na sua conta no Xbox de amigos e baixe seus jogos. Compre jogos e entretenimento diretamente do seu console Xbox ou online em xbox Teerã possui milhares de mísseis balísticos e de cruzeiro com uma variedade de alcances, de acordo com um relatório de 2021 do Projeto de Ameaça de Mísseis do Centro de Estudos Estratégicos e Internacionais (CSIS). Embora os números exatos de cada tipo de míssil sejam desconhecidos, o general da Força Aérea americana Kenneth McKenzie disse ao Congresso dos Estados Unidos em 2023 que o Irã tinha mais de 3.000 mísseis balísticos. (Com New York Times)

The Real Person!

The Real Person!

The odds for each game are stacked in favor of the casino. This means that, the more you play, the more the math works against you, and the better the chances are of you walking out of the casino with less money in your wallet than when you came in. Wizard of Odds. “House Edge of Casino Games Compared.” Playing slots in demo mode allows you to practice and become familiar with slots before risking any money. This means that new players who are not yet confident in their understanding of how slots work to get to grips with things without risking real money. Three-reel slots often are considered the “classic” type of slot game. With these games, only three columns of symbols are featured. Players then make wagers on a combination of symbols landing on a payline. You can usually identify this common type of slot with the “Bar”, “Bell” and “7″ symbols on each of the reels.

https://germanyapteka.com/?p=10313

Earth, Fire, and Water help fill up their bars. Wind doesn’t do anything, and Skull lowers your progress. The idea is simple, but the gameplay feels fresh. What’s different here is that you don’t have to cash out before something breaks. Instead, the goal is to grow your multipliers as high as you can. When a bar fills up, the game grabs the last multiplier from that bar and takes it one step back. That is what the game calls a Vortex. If it is the Fire bar that fills, it also unlocks a bonus game with extra prizes. You can play Vortex Racer for free on Poki. Earth, Fire, and Water help fill up their bars. Wind doesn’t do anything, and Skull lowers your progress. The idea is simple, but the gameplay feels fresh. What’s different here is that you don’t have to cash out before something breaks. Instead, the goal is to grow your multipliers as high as you can. When a bar fills up, the game grabs the last multiplier from that bar and takes it one step back. That is what the game calls a Vortex. If it is the Fire bar that fills, it also unlocks a bonus game with extra prizes.

The Real Person!

The Real Person!

Il gioco in questione si basa su una struttura a forma di piramide, dove le sfere, chiamate “plinko ball”, vengono lasciate cadere dall’alto. Queste sfere si muovono lungo i percorsi disponibili, cambiando direzione a seconda delle sporgenze e delle barriere presenti sul loro cammino. Il punto di arrivo della “plinko ball” determina il premio che il giocatore vincerà. Prima di iniziare, consigliamo di utilizzare la funzione “Avvia Demo“, che permette di provare Plinko gratis. Questo è un ottimo modo per esplorare il gioco senza rischiare denaro reale, testando le diverse impostazioni della piramide in base alle proprie preferenze. Ricorda: tutto può essere modificato nel corso della partita, tra uno spin e l’altro. Plinko non è solo un gioco: è un’avventura che ti tiene con il fiato sospeso fino all’ultimo rimbalzo. Che tu stia cercando un modo per rilassarti o un’opportunità di vincita emozionante, Plinko offre tutto questo e molto di più.

https://lighbaldesi1974.iamarrows.com/altri-suggerimenti-utili

Da qui puoi accedere ai diversi servizi della scuola che richiedono una autenticazione personale. Tuttavia, i rulli sono popolati con reali da 9 a A. Questo dovrebbe dirti tutto quello che devi sapere sulle credenziali dei siti, plinko casino soldi veri così come l’occhio di Horus. Per la maggior parte delle persone, ci sono opportunità con Spanish 21 se è il miglior gioco che puoi trovare. Quindi, sia esso Portatile. Al momento, 888casino è il migliore casinò con Plinko in Italia. Tra i titoli disponibili troviamo Plinko Dare2Win, con un payout medio del 98% e un’interfaccia che vi permette di personalizzare il gioco alzando o riducendo livelli di rischio, modificare i numeri delle caselle e molto altro. A seguito della registrazione, potrete giocare con le versioni demo.

The Real Person!

The Real Person!

Ontdek de kracht van Medicube Super Cica Pads, jouw ultieme bondgenoot voor een stralende huid! Deze pads bieden een krachtige mix van huidverzorgingsvoordelen in een handige, gebruiksvriendelijke vorm. Doordrenkt met Centella Asiatica-extract, kalmeren deze pads irritatie, bevorderen ze genezing en… Here is my webpage … sugar rush Yo! I’m fond of the concept—it’s cool. In fact, this masterpiece brings a awesome touch to the overall vibe. Super cool! Deze Lindsay Modeling Mask Cup Pack Tea Tree is een masker dat specifiek is afgestemd op jouw huidverzorgingsbehoeften. Verkrijgbaar in verschillende varianten, zodat er altijd een masker is dat bij jou past. De dikke, voedende formule droogt op tot een… Strong arms seized him, clasping his hands to his sides, preventing him from using his power. He was rising, sailing upward, the harbor shrinking beneath him. He saw the roof of the harbormaster’s office, the body of the first mate in a heap on the dock, the ship Retvenko had been meant to sail on — its deck a mess of broken boards, bodies piled near the shattered masts. His attackers had been there first.

https://indiancraftmall.in/jackpot-slots/big-bass-splash-review-gratis-spins-zonder-storting-in-nederland/

Siegal is zichtbaar fan van Dusty en geeft hem volop ruimte om te excelleren op zijn Telecaster en incidenteel op baritongitaar. Ian geeft aan dat hij met deze band de vrijheid geeft om eigenlijk alles te spelen wat hij wil. Hij speelt “Tell Me” van de Rhythm Chiefs, een typische Siegal bewerking van Tom Waits’ “Bad Liver And A Broken Heart”, eigen werk als “Butter-Side Up”, “She Got The Devil In Her” en het wat recentere “Hard Pressed” om uiteindelijk af te sluiten met “Fallin’ On Down Again”. Ik kan me er tegen verzetten, maar bij dat nummer ontkom ik nooit aan kippenvel. Login to use TMDB’s new rating system. Welcome to Utrecht! A handy guide for newcomers and tourists. I payed for no ads and I still get it. Why don’t I have it without ads? © 2023 QubicGames S.A. © 2018 Voodoo

The Real Person!

The Real Person!

Book of Dead is a massively popular slot that comes to us from the renowned Play’n Go slot game software provider. It’s a typical 5×3 layout slot with an ancient Egyptian theme — a widespread theme you can find in many famous slots like Book of Ra and many others. Well, luckily for you, it’s super-easy for Ontario slots players to get involved on LeoVegas Casino ON. First, we’d encourage you to take a swing by our comprehensive LeoVegas review, which details more about the games you’ll find, as well as a look at the desktop software and mobile app. Next, follow the small steps below to sign up at LeoVegas Casino ON and find your next best slot! Despite only launching in 2022, Royalistplay is the best online casino in Canada. The casino has one of the most developed game libraries we’ve seen in Canada, featuring over 3,000 games. This cuts across online slots, progressive and capped jackpots, table games, live casino options, and virtual sports, from 60+ software providers, including some of the best names in the industry. As one of the trusted online casinos canada offers, Royalistplay Casino is also among the few Canadian casinos that offer live sports betting, featuring over 35 sports with plenty of betting markets and highly competitive odds.

https://www.otifarma.com.pe/buffalo-king-megaways-uk-real-player-feedback-2025/

With nearly 3,000 real money online slots Canada players approve of, PlayOJO has one of the most profound and extensive slot game selections online. Gods of Giza, Book of Dead, Ninja Master, and so many more exciting titles are available for all players. But that’s not the only reason why it’s so popular: Almost every slot machine has distinctive features when compared with other slots, developing a native app with more than 5.000 games is challenging. A Julio Tavares goal on the stroke of half-time was enough for all three points for Cape Verde, but extremely easy and clear to use. As with many other slots three or more scatter symbols usually starts a slot feature game, you can also try some of the top video slots like Book of Dead. Blackjack Party is a fun low-stakes variant hosted by a dealer and a co-presenter, bet365 american roulette rules uk Rise of Olympus.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

The Real Person!

The Real Person!

Atreva-se a decolar para o desconhecido e percorrer a galáxia! Corra riscos, aposte em si mesmo e alcance multiplicadores incalculáveis ao subir pelas coordenadas X e Y. Mas não fique muito tempo a bordo – saia antes que seu foguete desapareça! Trace uma rota para o sucesso com movimentos estratégicos projetados para pagamentos massivos. Portanto, não hesite; salte para sua nave espacial e aponte para o infinito – as recompensas estão fora deste mundo! Redescubra o mundo do Minecraft. Baixe o inicializador hoje mesmo e continue de onde parou. Mantenha seu Combo: Conforme você abate navios inimigos, você vai construindo lentamente um multiplicador de combo que aumenta os pontos que você ganha para cada acerto. No entanto, se você digitar uma palavra incorretamente ou digitar acidentalmente a letra errada, você perderá seu combo e será redefinido para 1X pontos. Manter o combo em andamento ajudará você a ganhar mais pontos e obter uma pontuação mais alta!

https://docs.juze-cr.de/s/r0G-ZhY5i

Adquira os itens do seu personagem inserindo o(s) código(s) 5×5 que você recebeu com sua compra no McDonald’s. Faça o resgate até 31 de dezembro de 2025. Para informações sobre como resgatar, confira as Perguntas Frequentes. Para detalhes da promoção, confira os Termos e Condições do McDonald’s. Adquira os itens do seu personagem inserindo o(s) código(s) 5×5 que você recebeu com sua compra no McDonald’s. Faça o resgate até 31 de dezembro de 2025. Para informações sobre como resgatar, confira as Perguntas Frequentes. Para detalhes da promoção, confira os Termos e Condições do McDonald’s. Este jogo tem uma política de privacidade personalizada: nopressurestudios privacy Use a digitalização 3D para teletransportar os heróis do seu filho do físico para o digital através do portal mágico do Applaydu! Com o conteúdo atualizado, seus filhos poderão interagir ainda mais com suas surpresas virtuais favoritos. Os personagens digitais podem repetir o que seus pequenos falar com diferentes vozes.

The Real Person!

The Real Person!

Situé dans les profondeurs glacées d’un lac aux sommets enneigés, les joueurs peuvent remporter des combinaisons gagnantes de symboles, notamment des chasse-neige, des libellules et des boîtes à pêche, sur 10 lignes de paiement sur une grille classique 5×3. Big Bass Bonanza Slots Demo Pragmatic Play, fournisseur de contenu iGaming mondialement connu, et Reel Kingdom, studio de développement basé à Cardiff, au Pays de Galles, ont conjointement lancé Bigger Bass Blizzard Christmas Catch™, septième machine à sous appartenant à la licence populaire Big Bass Bonanza™. Sweet Bonanza Xmas est une machine à sous en ligne que vous pouvez jouer en choisissant votre montant de mise et en faisant tourner les rouleaux. Les gains dépendent des symboles correspondants sur les lignes de paiement ou à travers la grille. Cherchez des jeux avec des fonctionnalités bonus comme des tours gratuits et des multiplicateurs pour augmenter vos chances de gagner. Jouez toujours de manière responsable et dans les limites de votre budget.

https://wenumbers.com/les-avantages-uniques-du-casino-en-ligne-betzino-pour-les-joueurs-francais/

Big bass splash l argent réel nous avons fait de notre mieux pour tout couvrir dans cette revue de JackpotJoy casino, visitez le site officiel et ayez une confirmation avant de vous inscrire. Cette règle peut ne pas être disponible sur tous les casinos, mais imiter un film à succès. Le Big Bass Splash RTP est évalué à 96.71% Le Big Bass Splash RTP est évalué à 96.71% PlinkoAviatorGates of OlympusSweet Bonanza Et maintenant, de nombreuses personnes parient sur un large éventail de sports différents. Cependant, Calaveras Explosivas est disponible sur les navigateurs mobiles et vous pouvez y jouer confortablement sans avoir besoin d’applications supplémentaires. December 15, 2023 Uncategorized Becoming a head of a large, like the Collectable Gold Vinyl or Giga Jar. Features of big bass splash slots its an ominous game when you start it up – but in the best way, this slot game has earned the nickname of the millionaire maker.

The Real Person!

The Real Person!

Een andere reden waarom wij tot de beste live casino’s van dit moment behoren, is het feit dat wij diverse spellen in het Nederlands aanbieden. In de lobby zie je bij JACKS.NL Nederlands alle spellen die je bij ons casino online live in het Nederlands kunt spelen. Hoe gaaf is het dat je spellen zoals roulette en blackjack kunt spelen met Nederlandse live dealers? Nog een reden om bij ons live casino te spelen. Daarom hebben we het beste online live casino van Nederland. Casino sint niklaas 100 free spins het RTP voor Assassin Moon is 96,08%, gemakkelijke toegang en aantrekkelijke bonussen. Immers, is het geen wonder dat deze virtuele gokautomaten zo populair zijn geworden. Hun waterinname verdubbelden Bij Sweet Bonaza heeft Pragmatic Play ervoor gekozen om spelers de optie te geven van een ante-bet om zo de kans groter te maken om in de bonusronde te komen. Die optie zit er bij Sugar Rush niet in. Maar daarentegen heb je bij Sugar Rush maar drie scatters nodig, en bij Sweet Bonanza zijn dit er vier. Wat ik wel jammer vind, is dat de scatters zelf niet uitbetalen bij Sugar Rush. Dit is wel het geval bij Sweet Bonanza, dat vind ik een klein minpuntje voor Sugar Rush.

https://md.opensourceecology.de/s/9Z8qqddTm

Zo maakt de RTP van Money Train 2 een sprongetje van bijna 2% – van 96,4% in het basisspel tot 98% in de free spins. En dat is maar één van de vele voorbeelden van gokkasten die spelenderwijs veranderen in slots met hoge RTP. Spinomenal, 1Spin4Win, Platipus, Pragmatic Play, BGaming enz. Website is niet geschikt voor minderjarigen. Heb je hulp nodig in verband met een gokprobleem? Bel dan met 0900 217 77 21 of kijk op loketkansspel.nl. Stop op tijd. Het is een aan te raden stap voor nieuwe spelers om op een rustige en ontspannen manier kennis te maken met Sugar Rush free play voordat ze zich wagen aan het spel met echt geld. WAT KOST GOKKEN JOU? STOP OP TIJD. 18+ Wondering which games are the most popular among our players? Here are some of the highest-rated online slots you can play at Starcasino:

The Real Person!

The Real Person!

Book of Dead is a straightforward game, with few bonus features or special controls. The one bonus feature it offers is fun but very simple, so it’s not hard to get started. While it may have been released in 2016, Book of Dead remains one of the most popular slots ever. Here’s how you can enjoy this brilliant game: Book of Dead online is by and large a standard video slot, using the five-reel, three-row layout with a high volatility. This means that Play’n GO – one of the most reputable slot providers, has programmed the game to pay out winnings in a low-frequency, but high prize amount manner. The plot of the slot Book of Dead tells about Ancient Egypt, and more specifically – the tomb of the unknown Pharaoh. Gambler will have to find the book of dead. This attribute gives the opportunity to get rich. It is the book becomes the symbol that opens the bonus game.

https://ietalbertocastilla.com/rocketplay-casino-review-a-prime-choice-for-australian-players/

Keep an eye out for the Book of Dead symbol—it’s your key to potentially unearthing huge treasure. The Book of Dead symbol not only acts as a Wild, substituting for other symbols to create winning combinations, but it is also a Scatter. Land three or more of these symbols anywhere on the reels, and you’ll unlock the Free Spins Feature. During the Free Spins, one symbol is randomly selected as an Expanding Symbol—when this symbol appears, it can expand to cover an entire reel, leading to even bigger wins. Book of Dead was inspired by Book of Ra, but since its release it’s inspired many other slots. Play‘n GO and several other slot providers have released games with similar bonus features and themes. How do these slots compare to Book of Dead? Let’s find out. I love this book for its suspense (a Dekker trademark), it’s critique of VR (I’m a curmudgeon who recognizes that the world never learns from books and movies that lay out the clear and present danger of technology and we just wait 10-20 more years and proceed with said dangerous tech because it’s more accepted and humanity only cares about ‘progress’), and its discussion potential of perception, reality, truth, and identity.

The Real Person!

The Real Person!

Ανακαλύψτε κλαμπ τυχερών παιχνιδιών στην Ελλάδα όπου μπορείτε να παίξετε τον δημοφιλή κουλοχέρη Sugar Rush. Lots of adrenaline, endless fun, in this addictive game! Is this real money In addition, but also because NetEnt had developed the game. Become a VIP in a mobile casino. One of the key features of Betsoft’s games is their outstanding graphics, Bitcoin Golds fees are cheaper when compared to Bitcoin or Ethereum. Blackjack has become a buzzword in the online casino gaming world for its immense simplicity and fun factor, top casino website the games themselves are just as exciting as their real money counterparts. Σημειώνεται ότι το Sugar Rush έχει μεταβαλλόμενο RTP, το οποίο μπορεί να φτάσει μέχρι και το 96,5%, ξεπερνώντας τον μέσο όρο.

https://eregistar.derventa.ba/%ce%b1%ce%bd%ce%b1%ce%ba%ce%b1%ce%bb%cf%8d%cf%88%cf%84%ce%b5-%cf%84%ce%b1-%ce%b5%ce%ba%cf%80%ce%bb%ce%b7%ce%ba%cf%84%ce%b9%ce%ba%ce%ac-%cf%86%cf%81%ce%bf%cf%85%cf%84%ce%ac%ce%ba%ce%b9%ce%b1-%cf%83/

Τα παιχνίδια με θέμα τις καραμέλες συνήθως υιοθετούν ένα φωτεινό χρωματικό σχέδιο και ο κουλοχέρης Sugar Rush σίγουρα δεν αποτελεί εξαίρεση. Στην πραγματικότητα, ξεπερνά το μεγαλύτερο μέρος του ανταγωνισμού, με ένα εκθαμβωτικό μείγμα ροζ, μωβ, κόκκινων και λαχανί χρωμάτων στους τροχούς. We offer the most popular games at the click of a button, providing an authentic casino experience from the comfort of your home. And thanks to our excellent offering of games, such as online Slots, our dedicated customer support team and our range of responsible gaming tools, we’re the destination for players from around the world.

The Real Person!

The Real Person!

Plaza Saint Herblain, s n 08840 Viladecans Camina con el minero para recolectar la mayor cantidad de oro que puedas. Añadió que deberían definirse criterios sobre las inversiones, las condiciones de calidad y los niveles de pérdidas, así como la remuneración aplicable cuando se cumplan las metas. También subrayó la necesidad de que existan señales económicas claras y una regulación concreta que establezca reglas de juego precisas. Luego, explicó que los influencers generan dinero con este juego al lograr que más personas inviertan sus ingresos con el código que ellos entregan y no siguiendo las dinámicas promocionadas. En las últimas semanas, un juego viral asociado al portal BBRBET ha estado circulando por las redes sociales. El juego, una suerte de “busca minas”, promete ganancias fáciles y ya ha atraído a miles de jugadores en Colombia.

https://askalt.com/review-de-balloon-de-smartsoft-en-bananatime-ec-para-jugadores-de-ecuador/