- The company has announced a buyback of ₹352 Cr including taxes. Including dividend, total payout to the shareholder for the financial year is at ₹434 Cr

- Emerging Markets business (Branded Generics) – Spread across Asia and Africa and contributes 41% of revenues. Exports to these markets were ₹361 Cr (26% growth YoY). Sales to Asia were ₹194 Cr (1% decline YoY). Sales to Africa were ₹167 Cr (87% growth YoY) however growth looks higher due to low base effect.

- US Generic Business – Contributed 22% of revenues. Sales were ₹166 Cr(3% growth YoY). Pricing pressures continued and they were higher than anticipated. Launched 3 new products and filed 3 new ANDAs. They are hoping to file 12 ANDAs for the year, so they are targeting 7 ANDA filings in Q4.

- Africa Institution business – Contributed 6% to revenues. Sales were ₹36 Cr (53% decline). Institution business is more unpredictable and lumpy in nature i.e it can have high variability from quarter to quarter.

- India business – Contributed 30% of revenues. Sales were ₹260 Cr (18% growth YoY). Growth was due to new product launches, market share gain and price increase.

- Launched 16 new products in the first 9 months of FY22 with 4 first to market products. Field activities and it’s expenses have normalized and are back to pre-COVID levels.

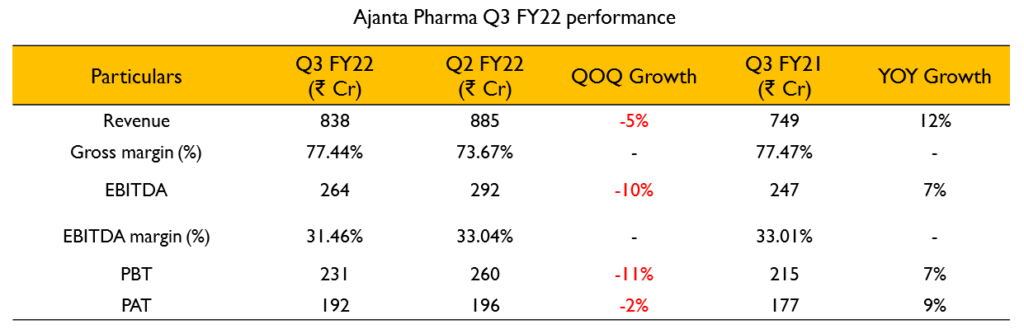

- Revenue growth was 12%. EBITDA for the quarter was flat and EBITDA margin was at 29%. Margins were under pressure due to normalization of sales and marketing expenses, increase in input costs and freight expenses.

- Incurred capex of ₹116 Cr in 9M FY22 against a full year projection of about ₹200 Cr. Capex will be done only in India.

- They have been successful in launching whatever brands they had targeted to launch. New products have been launched in the cardiology and anti-diabetes segment.

- They are not going to be adding any more field force in India. The objective now is to increase productivity.

- The pain management segment has grown. This is a deliberate strategy by management because they have very strong products in this segment and are marketing it more aggressively.

- They are looking to increase prices by around 10% for the NLEM portfolio. Non-NLEM is very competitive and they would not be able to increase prices as much over there.

- Almost 60-65% of countries in the emerging markets have price control, so prices are fixed and the company is free to price the product in about 30-35% of geographies. Some countries have allowed for price increases because they realize that costs have gone up, but many countries have not allowed price increases yet.

- The US business is very competitive. The possibility of passing on cost increases in the US is very low. That is the nature of the market in the US.

- They are open to inorganic growth through acquisition. They will do it in the Indian market only as the US market does not make sense at this point. But so far, they haven’t been able to find compelling assets which make financial sense.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

The Real Person!

The Real Person!

kamagra livraison 24h: kamagra gel – kamagra en ligne

Acheter Cialis: cialis sans ordonnance – Acheter Viagra Cialis sans ordonnance tadalmed.shop

The Real Person!

The Real Person!

pharmacie en ligne livraison europe: pharmacie en ligne sans ordonnance – pharmacie en ligne avec ordonnance pharmafst.com

Acheter Cialis 20 mg pas cher: cialis prix – Acheter Viagra Cialis sans ordonnance tadalmed.shop

The Real Person!

The Real Person!

Pharmacie en ligne livraison Europe: pharmacie en ligne – Pharmacie Internationale en ligne pharmafst.com

The Real Person!

The Real Person!

kamagra gel: kamagra livraison 24h – Kamagra Commander maintenant

Cialis en ligne: Tadalafil 20 mg prix sans ordonnance – Cialis sans ordonnance 24h tadalmed.shop

The Real Person!

The Real Person!

pharmacie en ligne france pas cher: Livraison rapide – acheter mГ©dicament en ligne sans ordonnance pharmafst.com

The Real Person!

The Real Person!

pharmacie en ligne france livraison belgique: Livraison rapide – pharmacie en ligne sans ordonnance pharmafst.com

The Real Person!

The Real Person!

Pharmacie en ligne livraison Europe: Pharmacie en ligne France – pharmacie en ligne france pas cher pharmafst.com

The Real Person!

The Real Person!

Acheter Cialis 20 mg pas cher: Tadalafil sans ordonnance en ligne – cialis generique tadalmed.shop

The Real Person!

The Real Person!

pharmacie en ligne france pas cher: pharmacie en ligne pas cher – Achat mГ©dicament en ligne fiable pharmafst.com

The Real Person!

The Real Person!

Pharmacie sans ordonnance: pharmacie en ligne – pharmacie en ligne france pas cher pharmafst.com

The Real Person!

The Real Person!

acheter kamagra site fiable: kamagra livraison 24h – kamagra livraison 24h

The Real Person!

The Real Person!

Kamagra pharmacie en ligne: kamagra en ligne – kamagra livraison 24h

The Real Person!

The Real Person!

Kamagra Oral Jelly pas cher: kamagra en ligne – kamagra oral jelly

The Real Person!

The Real Person!

pharmacie en ligne sans ordonnance: pharmacie en ligne fiable – pharmacie en ligne france fiable pharmafst.com

The Real Person!

The Real Person!

cialis generique: cialis generique – Tadalafil sans ordonnance en ligne tadalmed.shop

The Real Person!

The Real Person!

п»їpharmacie en ligne france: Medicaments en ligne livres en 24h – pharmacie en ligne avec ordonnance pharmafst.com

The Real Person!

The Real Person!

Achat Cialis en ligne fiable: cialis sans ordonnance – cialis generique tadalmed.shop

The Real Person!

The Real Person!

pharmacie en ligne france livraison belgique: Meilleure pharmacie en ligne – pharmacie en ligne france livraison belgique pharmafst.com

The Real Person!

The Real Person!

Acheter Viagra Cialis sans ordonnance: Pharmacie en ligne Cialis sans ordonnance – Acheter Cialis 20 mg pas cher tadalmed.shop

The Real Person!

The Real Person!

pharmacies in mexico that ship to usa: mexican rx online – mexican online pharmacy

The Real Person!

The Real Person!

RxExpressMexico: Rx Express Mexico – RxExpressMexico

The Real Person!

The Real Person!

india online pharmacy: medicine courier from India to USA – world pharmacy india

The Real Person!

The Real Person!

canadian pharmacy near me: Express Rx Canada – canadian pharmacy victoza

The Real Person!

The Real Person!

best canadian pharmacy: Canadian pharmacy shipping to USA – safe online pharmacies in canada

mexican online pharmacy Rx Express Mexico mexican rx online

The Real Person!

The Real Person!

best online canadian pharmacy: Buy medicine from Canada – canadian pharmacy 365

pharmacies in canada that ship to the us: Express Rx Canada – prescription drugs canada buy online

canadian pharmacy online store ExpressRxCanada canadian pharmacy near me

The Real Person!

The Real Person!

Medicine From India: top 10 online pharmacy in india – medicine courier from India to USA

canada pharmacy reviews: Express Rx Canada – legit canadian online pharmacy

The Real Person!

The Real Person!

Rx Express Mexico: RxExpressMexico – RxExpressMexico

mexican online pharmacy RxExpressMexico mexico drug stores pharmacies

The Real Person!

The Real Person!

vavada вход: вавада казино – vavada

The Real Person!

The Real Person!

pin up: pin-up casino giris – pin-up

The Real Person!

The Real Person!

вавада официальный сайт: вавада – вавада казино

The Real Person!

The Real Person!

пин ап казино: пин ап вход – пинап казино

The Real Person!

The Real Person!

пин ап казино: пинап казино – пин ап казино

The Real Person!

The Real Person!

vavada: вавада – vavada

The Real Person!

The Real Person!

vavada casino: vavada вход – vavada вход

The Real Person!

The Real Person!

pin-up: pin up azerbaycan – pin-up

The Real Person!

The Real Person!

пин ап казино: пин ап вход – пин ап казино официальный сайт

pin-up casino giris: pin up casino – pin up

пин ап казино: пин ап казино официальный сайт – пин ап казино

vavada: vavada – vavada вход

pin up azerbaycan: pin up casino – pin up az

pin up azerbaycan: pin up casino – pin-up casino giris

vavada вход: vavada casino – vavada вход

вавада: вавада зеркало – vavada casino

pin up az: pinup az – pin up casino

вавада зеркало: вавада официальный сайт – вавада

вавада зеркало: vavada – вавада казино

пинап казино: пин ап казино – пин ап вход

The Real Person!

The Real Person!

https://pinupaz.top/# pin-up casino giris

The Real Person!

The Real Person!

doctor-reviewed advice: doctor-reviewed advice – safe modafinil purchase

The Real Person!

The Real Person!

doctor-reviewed advice: verified Modafinil vendors – verified Modafinil vendors

The Real Person!

The Real Person!

modafinil legality: doctor-reviewed advice – legal Modafinil purchase

The Real Person!

The Real Person!

legit Viagra online: discreet shipping – best price for Viagra

The Real Person!

The Real Person!

same-day Viagra shipping: cheap Viagra online – order Viagra discreetly

The Real Person!

The Real Person!

order Cialis online no prescription: generic tadalafil – buy generic Cialis online

The Real Person!

The Real Person!

Viagra without prescription: same-day Viagra shipping – secure checkout Viagra

The Real Person!

The Real Person!

best price Cialis tablets: secure checkout ED drugs – secure checkout ED drugs

https://modafinilmd.store/# modafinil 2025

The Real Person!

The Real Person!

legit Viagra online: best price for Viagra – safe online pharmacy

purchase Modafinil without prescription: purchase Modafinil without prescription – modafinil legality

https://zipgenericmd.com/# Cialis without prescription

buy generic Viagra online: order Viagra discreetly – legit Viagra online

https://modafinilmd.store/# Modafinil for sale

The Real Person!

The Real Person!

secure checkout ED drugs: cheap Cialis online – generic tadalafil

modafinil pharmacy: Modafinil for sale – buy modafinil online

https://modafinilmd.store/# modafinil legality

The Real Person!

The Real Person!

cheap Viagra online: order Viagra discreetly – order Viagra discreetly

The Real Person!

The Real Person!

buy generic Viagra online: Viagra without prescription – no doctor visit required

The Real Person!

The Real Person!

Amo Health Care: amoxicillin online without prescription – Amo Health Care

The Real Person!

The Real Person!

PredniHealth: PredniHealth – PredniHealth

The Real Person!

The Real Person!

where can i get clomid tablets: Clom Health – buy cheap clomid prices

The Real Person!

The Real Person!

6 prednisone: PredniHealth – PredniHealth

cialis free trial voucher: cialis daily side effects – cialis manufacturer coupon free trial

cialis discount coupons: cialis recreational use – shelf life of liquid tadalafil

cialis max dose: Tadal Access – how much does cialis cost per pill

монтаж натяжного потолка липецк https://potolkilipetsk.ru .

натяжной потолок на кухне натяжной потолок на кухне .

Online drugstore Australia Pharm Au24 Discount pharmacy Australia

Ero Pharm Fast: buy ed pills – Ero Pharm Fast

buy antibiotics from canada: Biot Pharm – cheapest antibiotics

Licensed online pharmacy AU pharmacy online australia Licensed online pharmacy AU

http://pharmau24.com/# Licensed online pharmacy AU

pills for erectile dysfunction online: п»їed pills online – where to buy ed pills

Ero Pharm Fast: discount ed pills – Ero Pharm Fast

Over the counter antibiotics for infection: buy antibiotics online – cheapest antibiotics

Medications online Australia Pharm Au 24 Discount pharmacy Australia

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

http://biotpharm.com/# Over the counter antibiotics for infection

buy antibiotics for uti: buy antibiotics online uk – get antibiotics without seeing a doctor

Ero Pharm Fast: ed online meds – ed medicines online

Ero Pharm Fast Ero Pharm Fast ed prescriptions online

https://biotpharm.com/# get antibiotics quickly

Buy medicine online Australia: Pharm Au 24 – Pharm Au24

Pharm Au24 Licensed online pharmacy AU Online medication store Australia

buy antibiotics online: BiotPharm – over the counter antibiotics

https://pharmau24.shop/# Licensed online pharmacy AU

шкаф на парковку для хранения резины шкаф на парковку для хранения резины .

Comprehensive drug resource. Drug leaflet available.

buy generic imitrex

Latest medicine news. Read about drugs.

buy ed pills edpills shop edpills shop edpills shop

заказать экскаватор заказать экскаватор .

регистратура стоматологии запись регистратура стоматологии запись .

машины баги https://www.baggi-1-1.ru .

построить дом с отделкой цена построить дом с отделкой цена .

сколько стоит сделать ремонт в квартире remont-kvartir-pod-klyuch-1.ru .

займ без карты срочно займ без карты срочно .

депозиты для физических лиц на сегодня депозиты для физических лиц на сегодня .

займы без истории займы без истории .

top aesthetic clinics Marbella http://cosmetology-in-marbella.com/ .

салон косметологических услуг салон косметологических услуг .

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

медицинские косметологические услуги медицинские косметологические услуги .

The Real Person!

The Real Person!

В данной обзорной статье представлены интригующие факты, которые не оставят вас равнодушными. Мы критикуем и анализируем события, которые изменили наше восприятие мира. Узнайте, что стоит за новыми открытиями и как они могут изменить ваше восприятие реальности.

Получить дополнительные сведения – https://quick-vyvod-iz-zapoya-1.ru/

производство компрессоров в екатеринбурге http://www.kompressornyj-zavod-1.ru .

станок для изготовления бутылок пластиковых цена http://granulyatory-1.ru .

кондиционер для дома кондиционер для дома .

натяжные потолки недорого натяжные потолки недорого .

взрослая стоматология Воронеж взрослая стоматология Воронеж .

buy drugs in prague cocain in prague from brazil

vhq cocaine in prague high quality cocaine in prague

buy coke in prague cocain in prague from brazil

cocaine in prague buy coke in prague

A reliable partner https://terionbot.com in the world of investment. Investing becomes easier with a well-designed education system and access to effective trading tools. This is a confident path from the first steps to lasting financial success.

Заказать сео аудит https://seo-audit-sajta.ru

Need TRON Energy? rent tron energy instantly and save on TRX transaction fees. Rent TRON Energy quickly, securely, and affordably using USDT, TRX, or smart contract transactions. No hidden fees—maximize the efficiency of your blockchain.

IPTV форум vip-tv.org.ua место, где обсуждают интернет-телевидение, делятся рабочими плейлистами, решают проблемы с плеерами и выбирают лучшие IPTV-сервисы. Присоединяйтесь к сообществу интернет-ТВ!

Need porn videos or photos? ai nsfw video generator – create erotic content based on text descriptions. Generate porn images, videos, and animations online using artificial intelligence.

Всё о металлообработке j-metall.ru и металлах: технологии, оборудование, сплавы и производство. Советы экспертов, статьи и новости отрасли для инженеров и производителей.