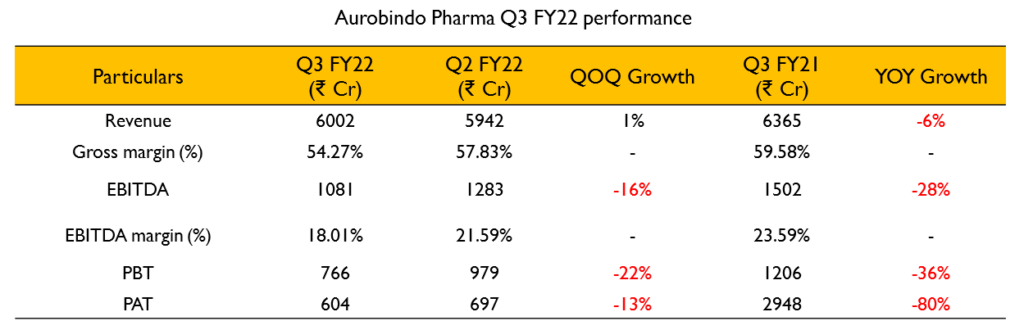

- Revenues for the quarter stood at ₹6002 Cr (1% decline YoY). EBITDA was at ₹1016 Cr (20% decline YoY) for the quarter. EBITDA margins for the quarter were 16.9%. PAT stood at ₹604.3 Cr (80% decline YoY).

- Revenue from formulations was ₹4992 Cr (12% decline YoY). Formulations contributed about 83% of total revenues. Revenue from the API business stood at ₹1010 Cr (48% growth YoY) and contributed about 17% of revenues.

- The revenues from the US formulation business declined by 4.4% YoY to ₹2745.2 Cr and accounted for 45.7% of revenues.

- During the quarter, they filed 5 ANDAs including 3 injectables. They also received approval for 4 ANDAs including 1 injectable. The company has launched 7 products during the quarter including 4 injectables.

- Europe revenue in Q3 FY22 posted a growth of 1.4% YoY to ₹1694.3 Cr. Europe Formulations accounted for 28% of revenues. Revenue from Growth Markets formulations was largely flat on a YoY basis and grew by 2.8% QoQ to ₹397 Cr and accounted for 6.6% of revenue. ARV business revenue for Q3 FY22 stood at ₹155.7 Cr, a decrease of 64.9% YoY and improved 7.4% QoQ, accounting for 2.6% of revenues.

- R&D expenditure for the quarter stood at 6.6% of the revenue.

- Raw material costs increased by 4% on average during the quarter and the freight costs increased more than 20% QoQ. .

- Out of the total decline in gross margins, about 1.25% is due to change in product mix and the rest is high raw material costs.

- They are going to enter the Domestic Branded Formulations market – most likely through an inorganic opportunity. They currently have strong cash flows and will be receiving another $300 million cash flow in the next 4-5 quarters.

- The branded generics business in India is changing where you don’t need to hire thousands of market reps anymore. Their goal is to reach ₹1000 Cr sales within 1 year of entering the domestic market.

- They received a repeat warning letter for the Unit 1 plant which they will try to resolve in the next one year. They also have a US plant which has received a repeat warning letter since it is a 68 year old building. It is a small plant with $2.5 million sales and it is loss making. They are considering shutting down that plant. There is an audit ongoing in the Unit 5 sterile API plant.

- All their plants are due for inspection now as USFDA has not been conducting in-person audits for close to 2 years.

- They have scheduled launches of 10-15 products for FY23. They also have a significant number of launches for FY24 which will help them reach revenues of $650-700 million in FY24 for the injectables business.

- Under the PLI scheme, they will be manufacturing 15,000 tons of Penicillin G at Kakinada. The land has been acquired and the work is ongoing, the total capex required is going to be ₹1850 Cr and they have already spent close to ₹500 Cr. It was scheduled to start in FY23 but they have received an extension from the government upto end of FY24 due to COVID related issues.

- They have filed their second oncology biosimilar with the European Medicine Agency. They have 3 more biosimilar in Phase 3 clinical trials and are looking to file one of them which is an oncology monoclonal antibody in the next financial year.

- There may be some raw material issues from China in the coming quarter. Due to the Winter Olympics they may face some controls on manufacturing which can cause shortages.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

kamagra pas cher: achat kamagra – kamagra 100mg prix

The Real Person!

The Real Person!

Cialis sans ordonnance 24h: Tadalafil sans ordonnance en ligne – Cialis en ligne tadalmed.shop

cialis sans ordonnance: Cialis generique prix – Acheter Cialis 20 mg pas cher tadalmed.shop

The Real Person!

The Real Person!

Cialis en ligne: Pharmacie en ligne Cialis sans ordonnance – Achat Cialis en ligne fiable tadalmed.shop

The Real Person!

The Real Person!

Achat Cialis en ligne fiable: Tadalafil 20 mg prix sans ordonnance – cialis generique tadalmed.shop

Tadalafil 20 mg prix en pharmacie: Achat Cialis en ligne fiable – Cialis generique prix tadalmed.shop

The Real Person!

The Real Person!

pharmacie en ligne france fiable: pharmacie en ligne sans ordonnance – pharmacie en ligne france pas cher pharmafst.com

Acheter Viagra Cialis sans ordonnance: Pharmacie en ligne Cialis sans ordonnance – Tadalafil 20 mg prix sans ordonnance tadalmed.shop

The Real Person!

The Real Person!

Tadalafil achat en ligne: cialis sans ordonnance – Achat Cialis en ligne fiable tadalmed.shop

The Real Person!

The Real Person!

kamagra gel: kamagra gel – kamagra en ligne

The Real Person!

The Real Person!

Cialis sans ordonnance 24h: Cialis generique prix – cialis sans ordonnance tadalmed.shop

The Real Person!

The Real Person!

achat kamagra: kamagra gel – kamagra oral jelly

The Real Person!

The Real Person!

kamagra pas cher: Acheter Kamagra site fiable – Acheter Kamagra site fiable

The Real Person!

The Real Person!

pharmacie en ligne sans ordonnance: Livraison rapide – pharmacies en ligne certifiГ©es pharmafst.com

The Real Person!

The Real Person!

achat kamagra: achat kamagra – kamagra gel

The Real Person!

The Real Person!

cialis generique: Cialis sans ordonnance 24h – Tadalafil achat en ligne tadalmed.shop

The Real Person!

The Real Person!

vente de mГ©dicament en ligne: Pharmacie en ligne France – pharmacie en ligne livraison europe pharmafst.com

The Real Person!

The Real Person!

pharmacie en ligne avec ordonnance: Pharmacie en ligne livraison Europe – pharmacie en ligne sans ordonnance pharmafst.com

The Real Person!

The Real Person!

Pharmacie en ligne Cialis sans ordonnance: cialis sans ordonnance – Cialis generique prix tadalmed.shop

The Real Person!

The Real Person!

Acheter Kamagra site fiable: Achetez vos kamagra medicaments – kamagra pas cher

The Real Person!

The Real Person!

pharmacie en ligne: pharmacie en ligne pas cher – Pharmacie sans ordonnance pharmafst.com

The Real Person!

The Real Person!

п»їpharmacie en ligne france: Pharmacies en ligne certifiees – pharmacie en ligne sans ordonnance pharmafst.com

The Real Person!

The Real Person!

pharmacie en ligne sans ordonnance: pharmacie en ligne pas cher – Achat mГ©dicament en ligne fiable pharmafst.com

The Real Person!

The Real Person!

mexican rx online: Rx Express Mexico – mexico pharmacy order online

The Real Person!

The Real Person!

indian pharmacy online: MedicineFromIndia – MedicineFromIndia

The Real Person!

The Real Person!

canada pharmacy online: Express Rx Canada – online canadian pharmacy review

The Real Person!

The Real Person!

canadian valley pharmacy: Generic drugs from Canada – canada drugstore pharmacy rx

mexico pharmacies prescription drugs mexico pharmacy order online mexico pharmacies prescription drugs

canada pharmacy online legit: Canadian pharmacy shipping to USA – onlinecanadianpharmacy 24

The Real Person!

The Real Person!

Rx Express Mexico: mexican rx online – mexican rx online

MedicineFromIndia Medicine From India indian pharmacy online shopping

Medicine From India: indian pharmacy online – indian pharmacy online shopping

The Real Person!

The Real Person!

prescription drugs canada buy online: Canadian pharmacy shipping to USA – certified canadian international pharmacy

The Real Person!

The Real Person!

indian pharmacy: Medicine From India – Medicine From India

mexican online pharmacy RxExpressMexico Rx Express Mexico

canadian pharmacy uk delivery: Generic drugs from Canada – canadian pharmacy ltd

The Real Person!

The Real Person!

indian pharmacy online: medicine courier from India to USA – indian pharmacy online

Online medicine order MedicineFromIndia Online medicine home delivery

medicine courier from India to USA: medicine courier from India to USA – indian pharmacy online

The Real Person!

The Real Person!

indian pharmacy online: indian pharmacy – indian pharmacy

The Real Person!

The Real Person!

vavada casino: vavada вход – вавада

The Real Person!

The Real Person!

вавада зеркало: вавада официальный сайт – вавада

The Real Person!

The Real Person!

pin up casino: pin up casino – pinup az

The Real Person!

The Real Person!

пин ап вход: пин ап зеркало – пин ап вход

The Real Person!

The Real Person!

вавада зеркало: vavada casino – вавада официальный сайт

The Real Person!

The Real Person!

pin up: pinup az – pinup az

The Real Person!

The Real Person!

vavada casino: вавада казино – вавада зеркало

The Real Person!

The Real Person!

pin up: pin-up casino giris – pin-up

вавада официальный сайт: вавада официальный сайт – вавада казино

вавада: вавада – vavada casino

вавада зеркало: вавада казино – вавада зеркало

пин ап казино официальный сайт: пин ап казино официальный сайт – пин ап казино

пин ап зеркало: пин ап казино – пин ап вход

pin up вход: пин ап казино – пинап казино

вавада казино: vavada вход – vavada

вавада официальный сайт: vavada вход – вавада зеркало

vavada вход: vavada вход – vavada casino

вавада казино: vavada casino – вавада зеркало

pin up azerbaycan: pin-up casino giris – pin up az

pin-up casino giris: pin up az – pin-up casino giris

pin-up: pin-up – pin up

vavada casino: вавада зеркало – вавада

пинап казино: пинап казино – пин ап зеркало

The Real Person!

The Real Person!

discreet shipping ED pills: buy generic Cialis online – best price Cialis tablets

The Real Person!

The Real Person!

same-day Viagra shipping: buy generic Viagra online – safe online pharmacy

The Real Person!

The Real Person!

generic sildenafil 100mg: legit Viagra online – legit Viagra online

The Real Person!

The Real Person!

safe online pharmacy: no doctor visit required – order Viagra discreetly

The Real Person!

The Real Person!

Viagra without prescription: legit Viagra online – fast Viagra delivery

The Real Person!

The Real Person!

modafinil pharmacy: purchase Modafinil without prescription – modafinil pharmacy

The Real Person!

The Real Person!

discreet shipping ED pills: online Cialis pharmacy – Cialis without prescription

The Real Person!

The Real Person!

modafinil pharmacy: safe modafinil purchase – modafinil pharmacy

https://modafinilmd.store/# Modafinil for sale

The Real Person!

The Real Person!

doctor-reviewed advice: Modafinil for sale – verified Modafinil vendors

legal Modafinil purchase: modafinil pharmacy – purchase Modafinil without prescription

The Real Person!

The Real Person!

order Cialis online no prescription: generic tadalafil – order Cialis online no prescription

https://maxviagramd.com/# cheap Viagra online

purchase Modafinil without prescription: modafinil pharmacy – modafinil pharmacy

The Real Person!

The Real Person!

Modafinil for sale: modafinil legality – Modafinil for sale

https://zipgenericmd.shop/# affordable ED medication

cheap Cialis online: reliable online pharmacy Cialis – order Cialis online no prescription

The Real Person!

The Real Person!

modafinil legality: modafinil legality – safe modafinil purchase

http://modafinilmd.store/# buy modafinil online

The Real Person!

The Real Person!

same-day Viagra shipping: legit Viagra online – same-day Viagra shipping

The Real Person!

The Real Person!

amoxicillin azithromycin: amoxil pharmacy – Amo Health Care

The Real Person!

The Real Person!

where to buy cheap clomid tablets: Clom Health – where can i get clomid without prescription

The Real Person!

The Real Person!

PredniHealth: cortisol prednisone – prednisone 20

The Real Person!

The Real Person!

PredniHealth: india buy prednisone online – PredniHealth

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/en/register-person?ref=JHQQKNKN

cialis patent expiration date: TadalAccess – when should i take cialis

cialis san diego: TadalAccess – is cialis covered by insurance

canada pharmacy cialis: TadalAccess – does medicare cover cialis for bph

Medications online Australia: Licensed online pharmacy AU – Licensed online pharmacy AU

Online drugstore Australia: Pharm Au 24 – Licensed online pharmacy AU

http://biotpharm.com/# get antibiotics quickly

Online medication store Australia: PharmAu24 – Online drugstore Australia

over the counter antibiotics: buy antibiotics online uk – get antibiotics without seeing a doctor

Buy medicine online Australia: Pharm Au24 – PharmAu24

http://eropharmfast.com/# Ero Pharm Fast

antibiotic without presription: Biot Pharm – buy antibiotics over the counter

Licensed online pharmacy AU: Pharm Au 24 – Licensed online pharmacy AU

п»їed pills online: Ero Pharm Fast – get ed meds today

buy ed meds: discount ed pills – where can i get ed pills

http://biotpharm.com/# buy antibiotics for uti

Ero Pharm Fast: Ero Pharm Fast – best online ed medication

buy antibiotics for uti: BiotPharm – buy antibiotics from canada

http://pharmau24.com/# Buy medicine online Australia

PharmAu24: Online medication store Australia – pharmacy online australia

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

What’s Taking place i aam new to this, I stumbled upon this I

have found It positively helpful and it hass helped me out loads.

I’m hoping to contribute & assist other users like its aided me.

Good job. https://glassiuk.wordpress.com/

Do you mind if I quote a couple of your articles as long asI provide credit and sources back to your website?My blog site is in the very same niche as yours and my users would certainly benefit from some of the information you present here.Please let me know if this okay with you. Thanks! https://www.binance.info/sl/register-person?ref=OMM3XK51