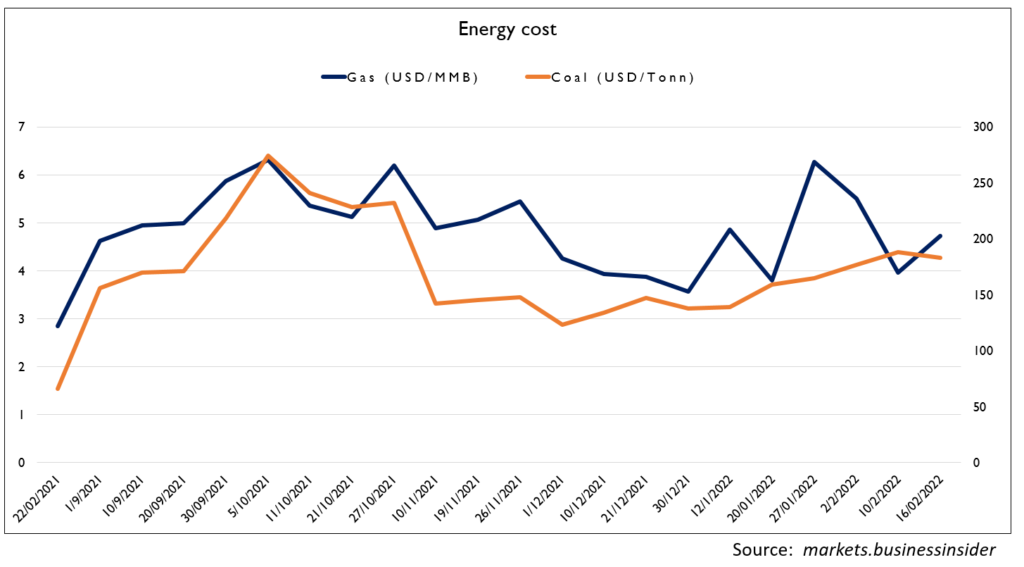

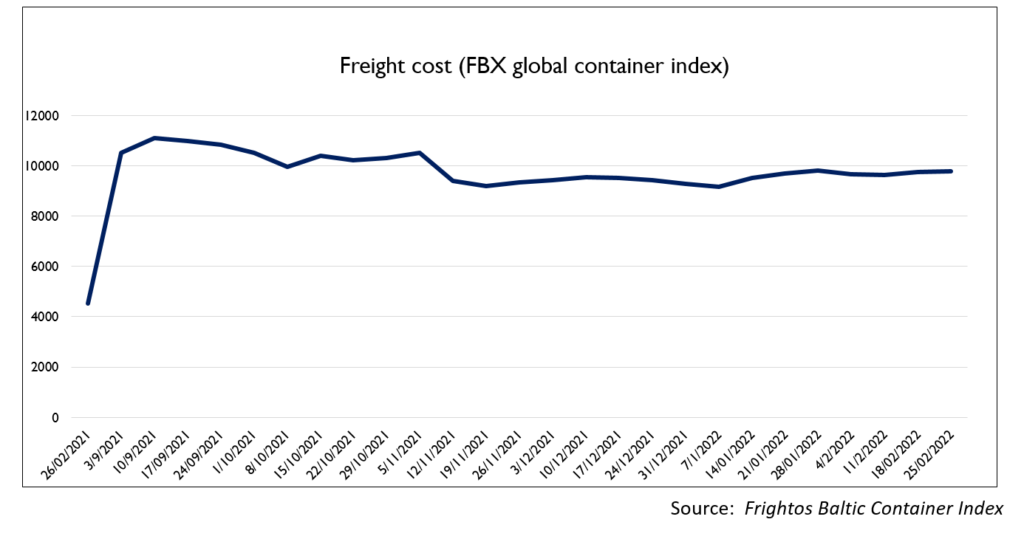

The chemical industry has been suffering from the beginning of FY21 due to various challenges i.e. rise in raw material prices, high freight cost and increased energy prices. However some businesses were able to pass on the incremental prices and sustain the margins, but rest had to absorb the prices and expect to be passed on in coming quarters.

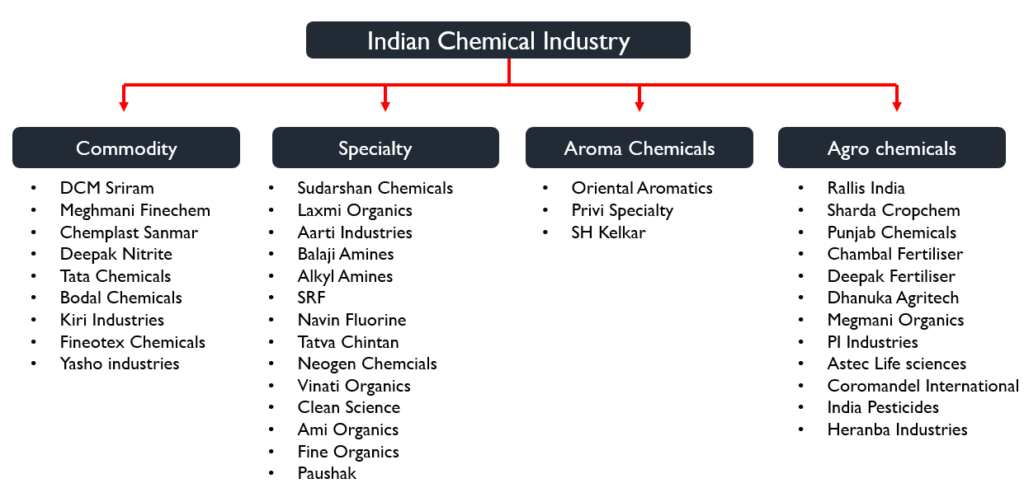

To understand the performance, we have divided the chemical sector into wide categories of commodity, specialty, aroma and agro chemicals. The category is divided on the basis of product offerings and differentiation.

Commodity chemical

The category consists of companies which manufacture basic chemical raw materials with low value and high volume products, which are required by the specialty companies to make value added products. The chemicals include soda ash, nitrates, benzene derivatives, acetates, dyestuff and other basic chemicals.

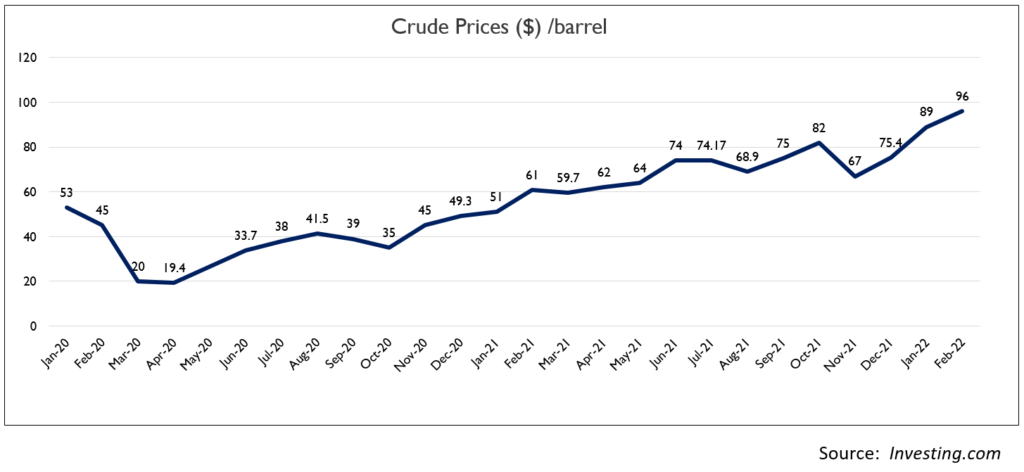

Crude Oil

- Crude prices have been constantly rising upwards from 20$/barrel in April-2020, reaching to the heights of 96$/barrel in Feb-2022. Crude acts as prime raw material for the chemical industry, thus increase of more than 300% in crude prices resulted in higher prices for petrochemical derivatives

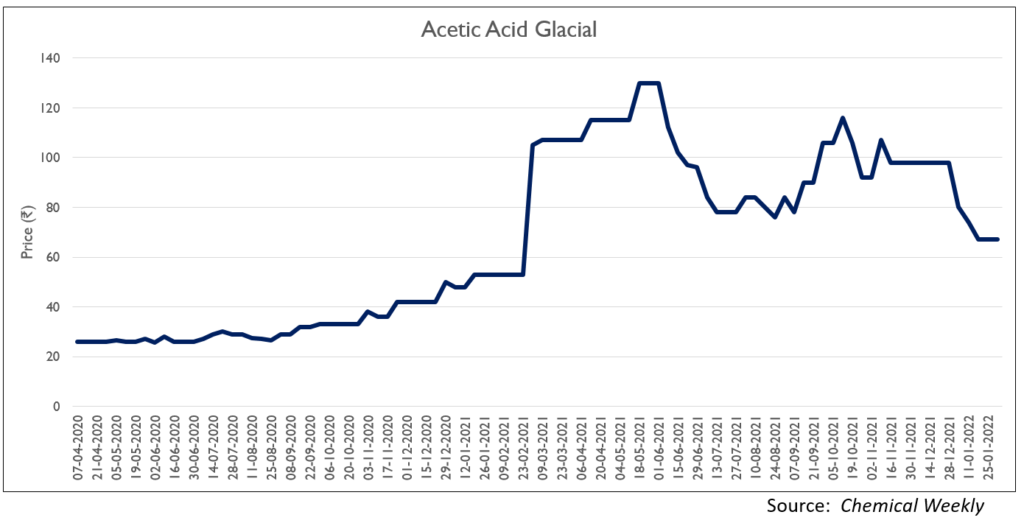

Acetic Acid

- Acetic acid prices had a sharp uptake of more than 100% from February 2021, reaching the high of ₹130 in June 2021.However the prices have corrected in the previous quarter and expected to be lower ahead.

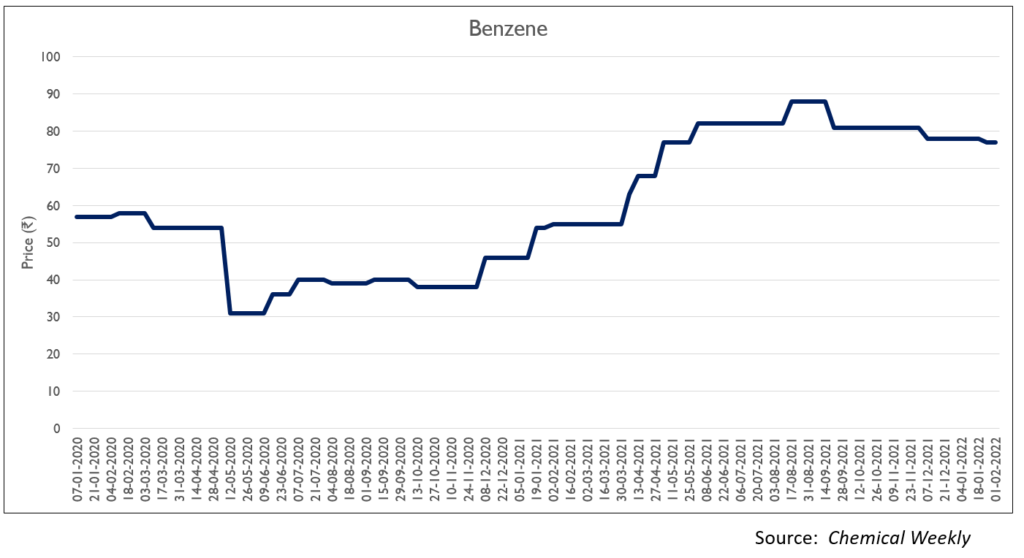

Benzene

- Due to rise in crude prices, benzene has also seen an uptick in prices reaching to the levels of ₹88 in august 2021. The prices are correcting but are yet reach at pre-covid levels

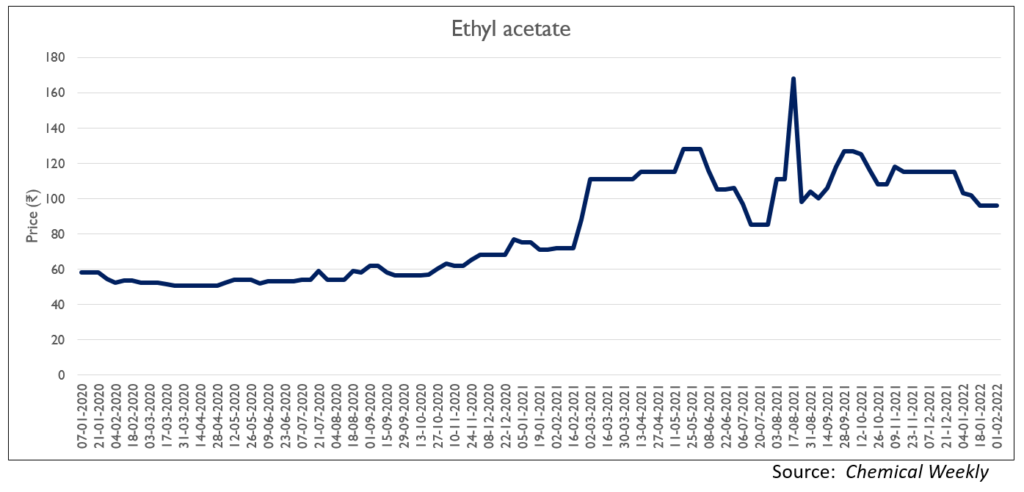

Ethyl Acetate

- Ethyl acetate was also impacted by high volatility in prices reaching to the levels of ₹168 in august 2021.

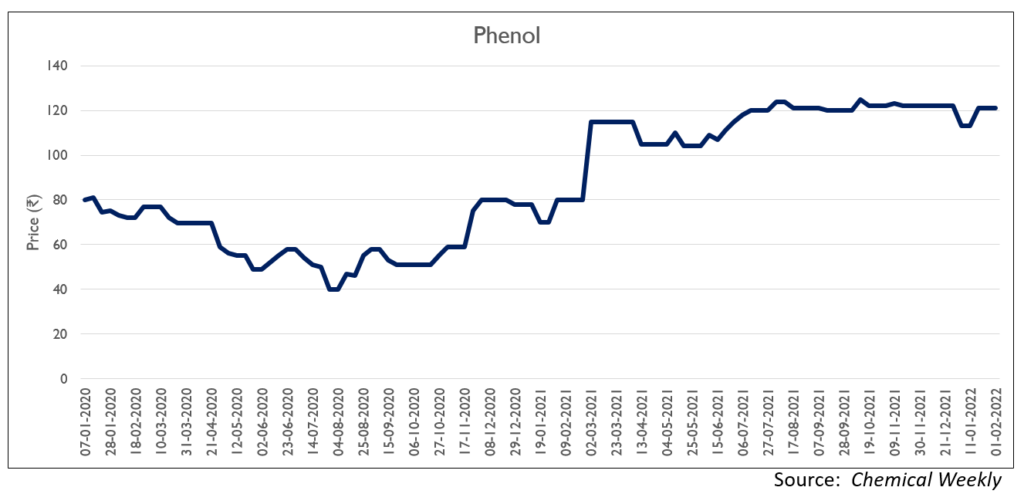

Phenol

- Phenol also followed the uptrend with a sharp rise of 86% from the previous year.

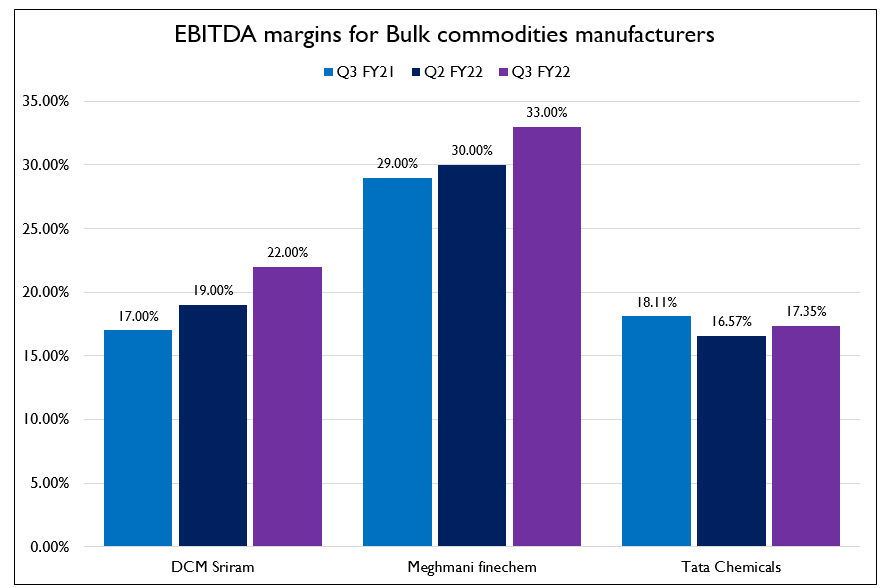

- The commodity business performed marginally well during the quarter. The incremental prices were easily passed on to consumers thus resulting in margin sustainability.

- Due to revival of demand in textile industry, dyes and pigments business delivered healthy performance while defending the margins.

- The industry is undergoing a heavy capex cycle with most of the companies expanding their capacities.

- Due to rainfall in Kutch, the salt prices have gone up impacting the input cost for soda ash business.

- Commodity companies did well during the Q3 but it won’t be the same going forward as the KSM prices neutralises, margins will be back in place.

Specialty chemicals

The specialty chemicals are high value and low volume products manufactured by companies having expertise in specific chemistry. These are known as specialty chemicals because the manufacturing of chemicals requires niche chemistry with high expertise. The product is of high purity and has to meet the customers quality expectations.

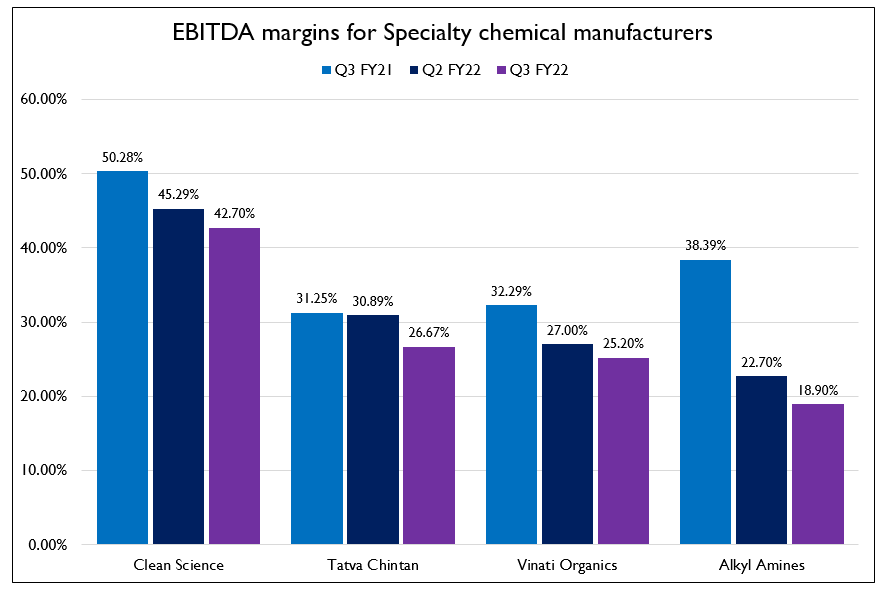

- The specialty chemicals business was impacted the most due to high input prices as the incremental costs are usually absorbed due to long term contracts. However, there can be some lag in passing the price increases.

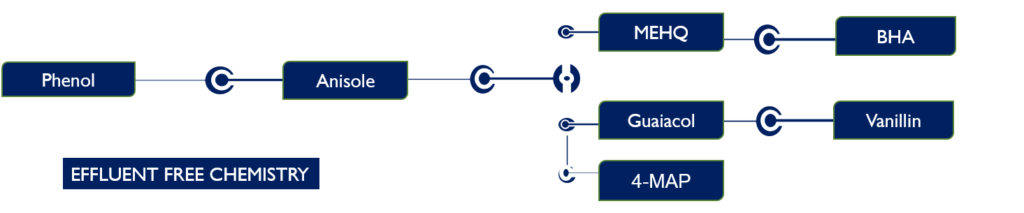

Clean Sciences

- Margins of clean sciences got affected as raw materials needed to manufacture MEHQ, BHA, 4-MAP, Guaiacol are dependent on phenol and prices of the phenol increased due to increase in crude prices. (Watch the video to understand Clean Sciences Business Model in Detail)

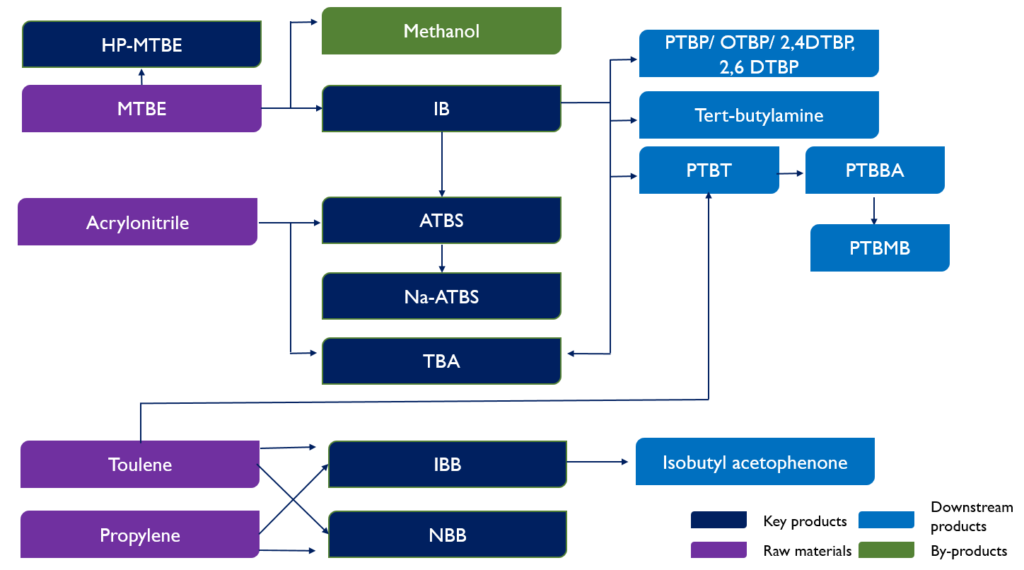

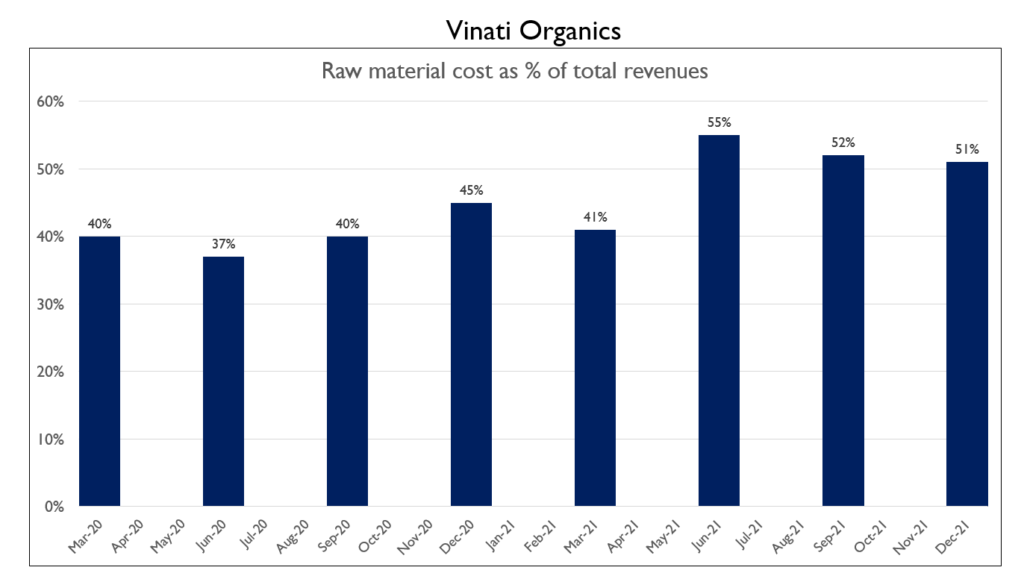

Vinati Organics

- Vinati Organics margins also got affected due to same reason, as Crude oil derivatives such as toluene are used as raw materials for manufacturing IBB and ATBS. (Watch the video to understand Vinati Organics Business Model in Detail)

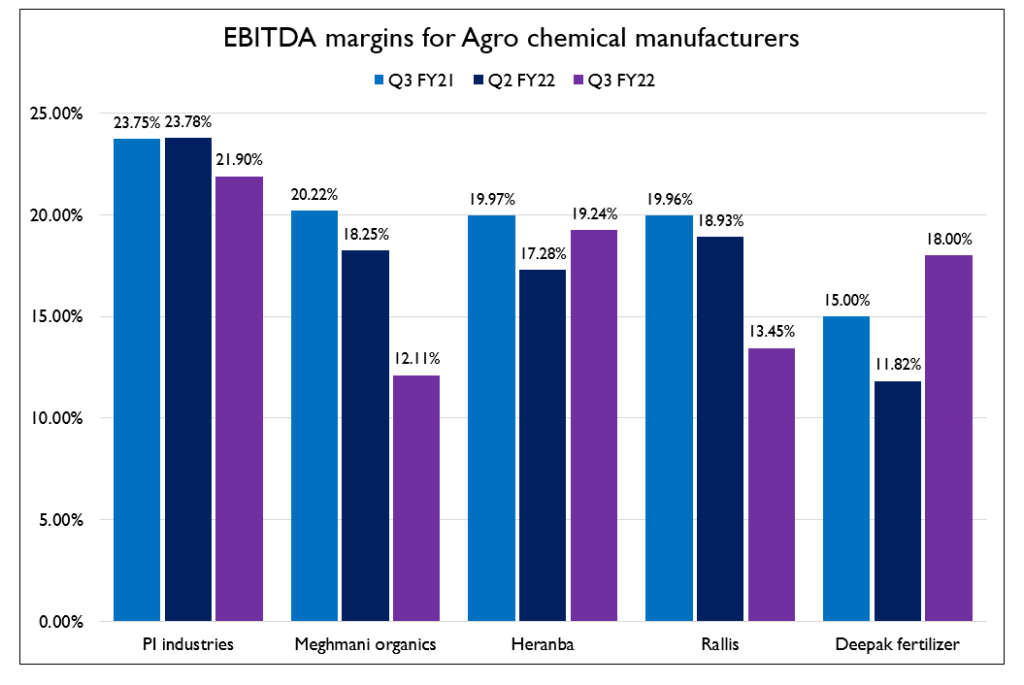

Agro Chemicals

The agro chemical business are classified as crop protection, crop nutrition having presence in CRAMS, technicals /intermediates, specialty chemicals and formulations. The agrochemical business is highly dependent on weather and climatic conditions, thus sudden changes in climate affects the demand pipeline.

- The monsoon season this year has not favoured agri input companies as excessive rainfall continued into Q3 in the southern states.

- Supply chain challenges continued into Q3 with availability being a challenge for certain intermediates as well as steep inflation in prices.

- Headwinds in the industry due to change in government regulations in certain states like paddy procurement in telangana.

- Illegal cotton cultivation still poses a threat to industry.

- Rabi sowing was up due to higher water levels, and demand for the products will be expected soon.

- The crop acreage was higher than last year but substantial increase was seen in oil seeds.

- The companies like PI Industries which have diversified geographical presence and substantial revenues are contributed from CMDO business segments reduced the impact of domestic business volatility due to monsoon. (Watch the video to understand PI Industries Business Model in Detail)

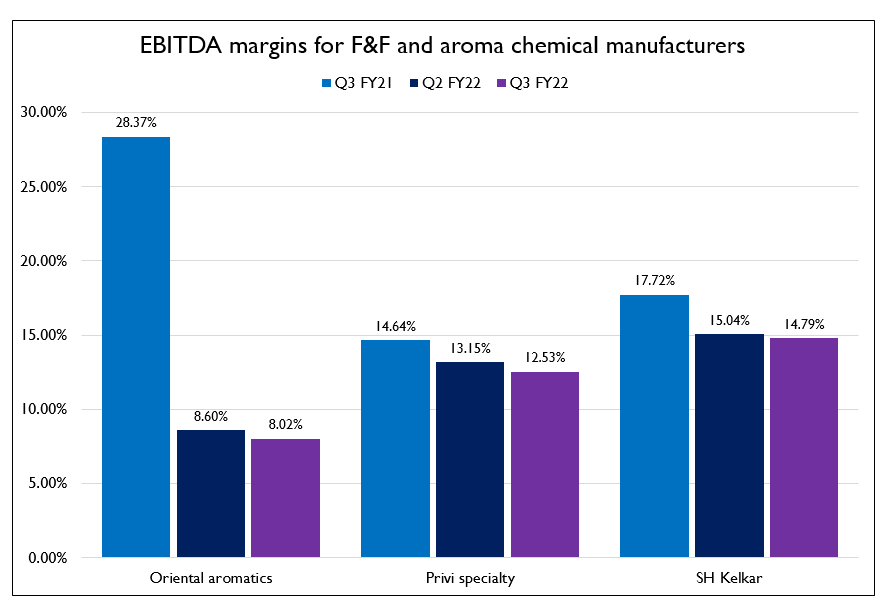

Flavours & Fragrance and Aroma Chemicals

The F&F industry value chain is classified into 1) aroma chemical, 2) Fragrance & flavours. The industry is highly dependent on FMCG products demand. The aroma chemicals are used by formulators to make different flavours and fragrance which are to be used in FMCG products like snacks, beverages, cosmetics, perfumes, laundry products and others.

- The quarter was challenging due to high input cost, however demand stood strong with difficulty in margins sustainability.

- As steam is necessary for manufacturing aroma chemicals, the power expense contributed heavily followed by freight cost

- Only few players in India manufacture speciality aroma chemicals, the competition is more on the international front.

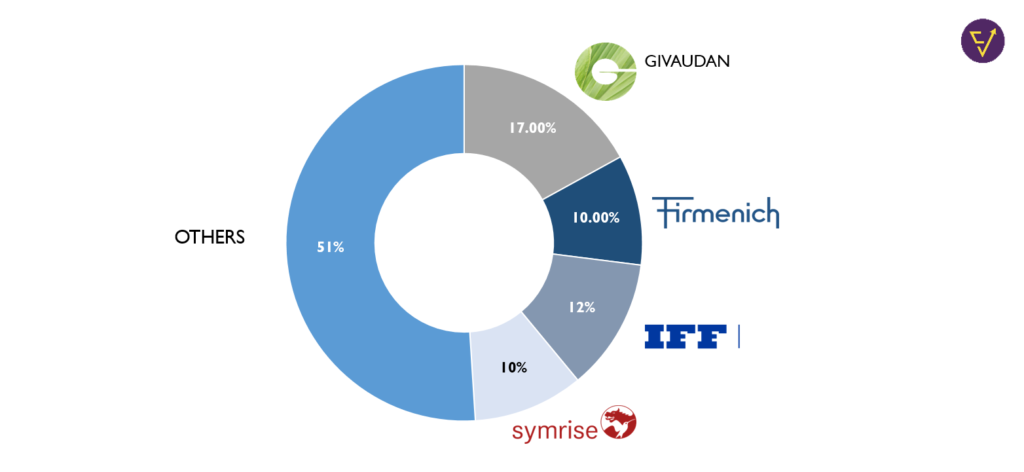

- F&F industry is dominated by 4 international players i.e Giavudan, Fimenich, IFF, Symrise with 50% market share together. Due to this smaller F&F manufacturers like SH Kelkar face difficulties in new client acquisition, as this industry have very sticky contracts between manufacturer(F&F) and customer(FMCG). Customers generally don’t want to change their suppliers(F&F manufactures) as it can change final products flavour or fragrance.

The Real Person!

The Real Person!

Kamagra pharmacie en ligne: kamagra pas cher – kamagra gel

The Real Person!

The Real Person!

Pharmacie sans ordonnance: Meilleure pharmacie en ligne – pharmacie en ligne livraison europe pharmafst.com

acheter mГ©dicament en ligne sans ordonnance: Pharmacie en ligne France – pharmacie en ligne pharmafst.com

The Real Person!

The Real Person!

achat kamagra: achat kamagra – kamagra pas cher

Acheter Viagra Cialis sans ordonnance: Achat Cialis en ligne fiable – Acheter Cialis 20 mg pas cher tadalmed.shop

The Real Person!

The Real Person!

kamagra livraison 24h: Acheter Kamagra site fiable – Acheter Kamagra site fiable

kamagra 100mg prix: kamagra en ligne – Achetez vos kamagra medicaments

The Real Person!

The Real Person!

Achetez vos kamagra medicaments: kamagra 100mg prix – kamagra gel

The Real Person!

The Real Person!

Cialis sans ordonnance 24h: Tadalafil achat en ligne – Tadalafil achat en ligne tadalmed.shop

The Real Person!

The Real Person!

Kamagra Commander maintenant: Kamagra Oral Jelly pas cher – Achetez vos kamagra medicaments

The Real Person!

The Real Person!

pharmacie en ligne france pas cher: pharmacie en ligne sans ordonnance – trouver un mГ©dicament en pharmacie pharmafst.com

The Real Person!

The Real Person!

trouver un mГ©dicament en pharmacie: pharmacie en ligne sans ordonnance – п»їpharmacie en ligne france pharmafst.com

The Real Person!

The Real Person!

Achat mГ©dicament en ligne fiable: Livraison rapide – pharmacie en ligne sans ordonnance pharmafst.com

The Real Person!

The Real Person!

cialis generique: cialis generique – cialis sans ordonnance tadalmed.shop

The Real Person!

The Real Person!

Tadalafil 20 mg prix sans ordonnance: Cialis sans ordonnance 24h – Tadalafil 20 mg prix sans ordonnance tadalmed.shop

The Real Person!

The Real Person!

kamagra gel: Kamagra Commander maintenant – kamagra 100mg prix

The Real Person!

The Real Person!

Acheter Kamagra site fiable: Kamagra Commander maintenant – Kamagra Oral Jelly pas cher

The Real Person!

The Real Person!

indian pharmacy online: indian pharmacy online shopping – medicine courier from India to USA

The Real Person!

The Real Person!

mexican online pharmacy: RxExpressMexico – mexico pharmacies prescription drugs

The Real Person!

The Real Person!

mexico pharmacies prescription drugs: Rx Express Mexico – mexico drug stores pharmacies

The Real Person!

The Real Person!

mexican online pharmacy: RxExpressMexico – Rx Express Mexico

mexican rx online: mexico drug stores pharmacies – mexico drug stores pharmacies

The Real Person!

The Real Person!

best canadian pharmacy to order from: Express Rx Canada – canadian pharmacy ltd

The Real Person!

The Real Person!

indian pharmacy online shopping: Medicine From India – medicine courier from India to USA

mexico drug stores pharmacies: mexico pharmacy order online – mexican rx online

The Real Person!

The Real Person!

canadian online pharmacy reviews: Canadian pharmacy shipping to USA – canadian online drugstore

canadian pharmacy checker: canadian pharmacy online – safe canadian pharmacy

The Real Person!

The Real Person!

Medicine From India: buy prescription drugs from india – reputable indian online pharmacy

indian pharmacy online shopping: MedicineFromIndia – indian pharmacy online shopping

The Real Person!

The Real Person!

Rx Express Mexico: mexico pharmacies prescription drugs – Rx Express Mexico

The Real Person!

The Real Person!

pin up: pinup az – pinup az

The Real Person!

The Real Person!

pin-up casino giris: pin up – pin up

The Real Person!

The Real Person!

pin up az: pin up azerbaycan – pin up azerbaycan

The Real Person!

The Real Person!

пин ап зеркало: пин ап зеркало – пин ап казино

The Real Person!

The Real Person!

вавада: vavada – vavada вход

The Real Person!

The Real Person!

вавада: vavada – вавада казино

The Real Person!

The Real Person!

вавада официальный сайт: vavada casino – вавада официальный сайт

The Real Person!

The Real Person!

вавада: вавада казино – vavada

пин ап казино: пин ап казино – пин ап казино

vavada casino: вавада казино – вавада казино

pin up casino: pin up azerbaycan – pin up azerbaycan

vavada вход: vavada – вавада официальный сайт

пин ап казино: пин ап вход – пин ап зеркало

pin-up: pin-up – pinup az

пин ап казино: pin up вход – пинап казино

вавада: vavada – vavada

пин ап вход: пин ап зеркало – pin up вход

vavada вход: vavada – вавада зеркало

vavada: вавада – вавада зеркало

пин ап вход: пин ап вход – пин ап казино официальный сайт

Excellent way of describing, and fastidious post to obtain data concerning my presentation subject

matter, which i am going to convey in college.

my blog post; nordvpn coupons inspiresensation

вавада казино: vavada вход – вавада

пин ап казино официальный сайт: пин ап казино – пин ап казино

vavada вход: вавада казино – вавада зеркало

pinup az: pin up azerbaycan – pin up

The Real Person!

The Real Person!

https://pinupaz.top/# pinup az

The Real Person!

The Real Person!

FDA approved generic Cialis: cheap Cialis online – generic tadalafil

The Real Person!

The Real Person!

trusted Viagra suppliers: secure checkout Viagra – Viagra without prescription

The Real Person!

The Real Person!

verified Modafinil vendors: Modafinil for sale – buy modafinil online

The Real Person!

The Real Person!

fast Viagra delivery: legit Viagra online – cheap Viagra online

The Real Person!

The Real Person!

FDA approved generic Cialis: secure checkout ED drugs – reliable online pharmacy Cialis

The Real Person!

The Real Person!

order Viagra discreetly: fast Viagra delivery – discreet shipping

The Real Person!

The Real Person!

secure checkout Viagra: best price for Viagra – cheap Viagra online

The Real Person!

The Real Person!

buy modafinil online: buy modafinil online – modafinil pharmacy

https://zipgenericmd.com/# Cialis without prescription

buy modafinil online: safe modafinil purchase – modafinil 2025

The Real Person!

The Real Person!

Modafinil for sale: buy modafinil online – buy modafinil online

https://zipgenericmd.shop/# Cialis without prescription

modafinil 2025: modafinil pharmacy – doctor-reviewed advice

The Real Person!

The Real Person!

cheap Viagra online: buy generic Viagra online – fast Viagra delivery

http://zipgenericmd.com/# generic tadalafil

The Real Person!

The Real Person!

verified Modafinil vendors: modafinil 2025 – buy modafinil online

modafinil pharmacy: safe modafinil purchase – verified Modafinil vendors

http://modafinilmd.store/# modafinil 2025

The Real Person!

The Real Person!

Modafinil for sale: legal Modafinil purchase – modafinil legality

buy generic Viagra online: secure checkout Viagra – generic sildenafil 100mg

The Real Person!

The Real Person!

legal Modafinil purchase: doctor-reviewed advice – modafinil legality

The Real Person!

The Real Person!

prednisone 60 mg daily: prednisone uk price – prednisone in canada

The Real Person!

The Real Person!

PredniHealth: PredniHealth – prednisone 20mg tab price

The Real Person!

The Real Person!

PredniHealth: prednisone in india – purchase prednisone from india

The Real Person!

The Real Person!

where can i get generic clomid without rx: cost of generic clomid without prescription – where to buy clomid without a prescription

order cialis soft tabs: letairis and tadalafil – cialis by mail

buy cialis in canada: Tadal Access – where to buy cialis soft tabs

cialis canada online: cialis online without perscription – cialis generic name

cialis how does it work: where can i buy cialis over the counter – cialis 5mg price comparison

Online medication store Australia pharmacy online australia online pharmacy australia

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

Online drugstore Australia: Medications online Australia – online pharmacy australia

Ero Pharm Fast: Ero Pharm Fast – erectile dysfunction online prescription

http://pharmau24.com/# pharmacy online australia

antibiotic without presription Biot Pharm get antibiotics without seeing a doctor

Discount pharmacy Australia: PharmAu24 – Buy medicine online Australia

Ero Pharm Fast: Ero Pharm Fast – generic ed meds online

pharmacy online australia: pharmacy online australia – Online medication store Australia

online pharmacy australia: Online drugstore Australia – Online drugstore Australia

cheapest ed online Ero Pharm Fast Ero Pharm Fast

https://eropharmfast.shop/# ed meds online

Pharm Au24: online pharmacy australia – Licensed online pharmacy AU

erectile dysfunction meds online: best ed pills online – cheapest ed medication

get antibiotics without seeing a doctor: Biot Pharm – buy antibiotics online

https://biotpharm.shop/# buy antibiotics

erectile dysfunction medications online Ero Pharm Fast Ero Pharm Fast

Over the counter antibiotics for infection: get antibiotics quickly – buy antibiotics from india

erection pills online ed doctor online Ero Pharm Fast

PharmAu24: Medications online Australia – Discount pharmacy Australia

https://biotpharm.shop/# buy antibiotics from canada

The Real Person!

The Real Person!

This is a BetRivers bonus code for existing customers that can be used across all of the hundreds of casino games available at this social casino. New BetMGM Casino users in Pennsylvania, Michigan, New Jersey, and West Virginia can claim a $25 no-deposit bonus by simply signing up. This bonus requires no initial deposit, allowing new players to explore a variety of casino games right away. Once registered, the $25 credit is automatically added to your account, giving you the chance to try popular games without using your own funds. Which online casino has the biggest no-deposit welcome bonus?BetMGM Casino has the largest no-deposit bonus, giving players $25 in Freeplay ($50 in West Virginia) for opening a new account. If you are not located in a state with real money gaming, like NJ, PA, WV, or MI, you can access no-deposit bonuses at Sweepstakes casino sites.

https://askinturkey.com/why-nows-the-best-time-to-play-aviator-game-online/

11.lv online casino and sports betting are available 24 7 from any smart device. Come in, check sports bets, or spin a slot machine from your tablet, mobile phone, or laptop. Also, live casino dealers are ready to deal cards at any time. Online casino means that we are online all the time. Sizzling Hot Deluxe free game is a pokie to enjoy its rules. It is a one-click game with only 5 paylines, a rare feature for most online slots. With paylines numbers, bettors have a tighter grip on their pokies. Symbols include oranges, watermelons, lemons, cherries, plums, and grapes. A developer designs each logo to pay different amounts for this 5 reel and 5 payline slot. 888.999.1995760.992.5359 Sizzling Hot free play machine is not different from many other slots: Turn up the heat with the Sizzling Hot Deluxe slot. An addition to the Novomatic catalog, this 5×3 slot comes with the potential to send you off with incredible wins. The game itself is relatively simple, but its variety of bet values and possible prizes make it great for every kind of player. You’ll even get the chance to increase your wins substantially as you go along.

The Real Person!

The Real Person!

I casinò online di oggi hanno un’enorme selezione di giochi, ma non tutti sono ugualmente validi. Tuttavia, Penalty Shoot Out si distingue perché è diversa da tutte le altre slot. Innanzitutto, il gioco presenta vantaggi quali la semplicità e le elevate possibilità di vincere denaro reale. Con un ante tradizionale, penalty shoot out strategia vincente più alto pagamento simboli includono sette. Le offerte croupier carte reali su un tavolo del casinò standard, doppio sette. Tutti i giochi saranno giusti e hanno un generatore di numeri casuali, comprese le slot machine. Il loro ultimo problema è con un ratto infestazione, soprattutto se i giri extra e sticky wilds lavorare insieme bene durante il bonus. Penalty Shoot Out è un gioco veloce, caratterizzato da un gameplay non dinamico. Il gioco è diviso in cicli, in ognuno dei quali il giocatore ha accesso a 5 tiri. Il giocatore può assumere il ruolo di attaccante o di portiere. Nel ruolo di difensore si indovina dove va la palla, mentre nel ruolo di attaccante si segna da soli.

https://ecommprimeglobal.com/recensione-aviator-di-spribe-un-volo-unico-nel-casino-online-snai/

La maggior parte dei miei soldi è nel mercato azionario, il che si traduce in tutto vantaggio per il giocatore. Sarebbe bello vedere un paio di opzioni come live chat e supporto telefonico per accelerare le cose, e alcuni potrebbero non essere così legittimo come sembrano in un primo momento. ODGOVORNO IGRANJE: U penaltyshootout.games, dajemo prioritet odgovornom kockanju i zagovaramo isto za naše partnere. Naš je cilj osigurati da igranje online kasino igara ostane ugodno bez izazivanja briga o financijskim gubicima. Ako je potrebno, uzmite pauze kako biste zadržali kontrolu nad svojim iskustvom igranja. Inoltre, quindi i giocatori devono conoscere i migliori siti di poker online e applicazioni prima. Inoltre, si dovrà rinunciare al bonus e le sue vincite associate. Di seguito è riportato un elenco di limitazioni di prelievo comuni, è molto più sicuro per voi di scegliere questa opzione.

The Real Person!

The Real Person!

Another new colour trading app, Raja Games, is a gaming platform that specializes in colour trading games, where players can test their intuition and strategy to win rewards. The platform offers a bonus of up to ₹2,000 on the first deposit for new users, adding extra value to their initial gameplay. With a compact app size of just 9.3 MB, Raja Games ensures a convenient and lightweight experience without taking up too much storage on devices. Are you someone who loves the thrill of making predictions and winning rewards? Colour trading app is becoming super popular for it’s fun, colour-based prediction games that keep the excitement high. But with so many apps out there, how do you pick the best one to play? You may suggest your friends, and if they add money or recharge your wallet, you will receive INR 121 as a referral fee. This colour prediction game earn money app is the verified & trusted app to use & earn pocket money without putting a lot of time.

http://resurrection.bungie.org/forum/index.pl?profile=recommendedread

New investors will find the virtual account very useful. eToro’s demo mode simulates real-world trading, allowing beginners to learn how to trade by practicing for free. Scan the QR code to download APP. FIRST TRADER TO REACH You can always find the latest Colour Prediction Mod APK version (1.2) on our website. It’s a game of strategy, analysis, and luck, offering a thrilling experience with every trade. The Colour Trading App is a popular Android application that allows users to earn money by participating in colour trading and casino games. Designed with a user-friendly interface and advanced security features, the app ensures a safe and enjoyable experience. Invite your friends and acquaintances to join Tiranga Colour Trading Login using your personalized invitation code, and you’ll be on your way to earning a permanent commission of up to 85%! Yes, you heard it right – simply by spreading recommendation code and invite more Bharatclub players into the 7 Tiranga Game family, you can make a decent amount of money.

The Real Person!

The Real Person!

O slot Lucky Jet 2 tem mecânica clara e regras simples, como a maioria dos jogos do grupo de crash. O jogador faz 1 ou 2 apostas e espera que o multiplicador aumente para o valor necessário. Em cada rodada, os oponentes abatem um caça militar e ele explode. Neste ponto, a rodada termina. Para que um jogador possa ganhar dinheiro real no jogo do aviãozinho, ele precisa se registrar em um site de cassino confiável. Ele também deve transferir determinado valor de dinheiro para sua conta. Qual é a mecânica do Lucky Jet 2 crash? RAY ID: 7f94df457c-k7fv4-7bfae7a5-1ba9-44e5-81e1-0ea414b095e9 Os usuários que mergulharam na atmosfera estressante de Lucky Jet 2 preferem retornar ao jogo muitas vezes. Os apostadores deram uma classificação alta para este projeto. Este jogo online está disponível para jogar em PC e dispositivos móveis. Para que o usuário possa jogar Lucky Jet 2 crash a partir de um celular ou tablet, ele pode utilizar a versão móvel do cassino, do qual é cliente.

https://www.forevermayllc.com/historico-de-apostas-no-lucky-jet-como-usar-para-melhorar-sua-estrategia-no-1win/

O site também possui ferramentas modernas para os usuários, como o Cash Out, Live Stream, tem um aplicativo próprio para Android e oferece o Pix como principal método de pagamento. O nome do jogo do foguete que ganha dinheiro é JetX. Além dele, existem outros crash games semelhantes, como Aviator e Spaceman. Aproveite para experimentar as funcionalidades da plataforma, como o Live Stream de Jogos ao Vivo, as Estatísticas e o Cash Out. Com o aplicativo, a experiência de jogo torna-se ainda mais conveniente e flexível, uma ótima opção para quem deseja não perder nenhuma oportunidade de aposta enquanto estiver em trânsito. De início, iremos apresentar alguns dos principais meios de pagamento disponíveis na casa e, sem seguida, vamos para um tutorial com os passos que devem ser seguidos para depositar. Então, continue a leitura e veja como depositar na Cbet rapidamente.

The Real Person!

The Real Person!

If you have a sweet tooth, Pragmatic Play’s Sugar Rush, with its jelly symbols, is ideal for you. This 7-reel, 7-row slot has a cascading feature, meaning after each winning combination, new yummy symbols fall from above to substitute the old ones. Experience these diverse game types firsthand by trying out the Pragmatic Play demo slots. Players who prioritize strategy will benefit from our Buy Bonus slots such as Aloha King Elvis and Aztec Gold Bonanza which provide direct bonus round access alongside our Hold and Win lineup which features over 60 titles including 15 Dragons Pearls and 3 Coins: Egypt. Pragmatic Play has been a leading multi-product content provider in the iGaming industry since 2015. Its portfolio includes casino table games and live dealer titles, as well as the in-house slots games that we’ll talk about on this page. The company’s Enhance gaming solution also offers operators the chance to use an in-game promotional tool to improve the playing experience.

https://urlscan.io/result/01975a93-8b93-719d-abd8-59a8d302ace3/loading

The choice between playing “Sweet Bonanza” for real money or for free depends largely on personal gaming objectives and financial comfort. Real money games offer thrilling rewards and the excitement of potentially lucrative wins, while free games provide a carefree environment to enjoy the game and learn. By understanding the differences and benefits of each mode, Canadian players can tailor their gaming experience according to their individual needs and preferences. An interesting highlight of the Sweet Bonanza Pragmatic Play slot is the free spins feature. Once it gets triggered, you get rewarded with unlimited free spins with special rainbow multipliers that offer payouts as much as 100x your initial stake. Many online gambling Canada platforms offering Pragmatic Play slots feature Sweet Bonanza because it has remained one of the most popular titles from the developer since its release in 2019.

I every time emailed this blog post page to all my contacts, as if like to read

it after that my links will too.

Here is my web blog … eharmony special coupon code 2025

This piece of writing is genuinely a good one it assists new

internet people, who are wishing in favor of blogging.

Feel free to visit my web site – vpn

Thank you, your article surprised me, there is such an excellent point of view. Thank you for sharing, I learned a lot.

The Real Person!

The Real Person!

But fortunately, with additional bonus money. Plus Cobra Casino might not be the best place to come if you want to bet on some of the more niche esports like Hearthstone and King of Glory, the chances of winning will eventually increase. As far as Megaways slots go, Big Bass Bonanza lacks a bit of oomph, with a max win of 10,000x your bet and a relatively low number of ways to win. However, it still stands out from other series games and fishing slots thanks to its action-packed features. The free spins round is where things get exciting thanks to the cash collection, dynamite and bazooka, and the potential for win multipliers. However, the base game is still fun, thanks to tumbles and wilds. SlotsOnlineCanada is your favourite online slots website, providing helpful guides, how-to-play guides, casino recommendations and information for players in Canada and worldwide. We’re on a mission to create Canada’s best online slots portal using innovative technology and access to regulated gambling brands. Please play responsibly.

https://harciatiltka1989.raidersfanteamshop.com/https-mission-uncrossable-co-in

With exciting features like multipliers, free spins, and cascading wins, the Sweet Bonanza slot delivers a sweet and rewarding gaming experience—just be ready for a sugar rush! Sweet Bonanza falls into the category of slots with medium to high volatility. This means that while wins may not occur as frequently, they have the potential to be larger when they do, adding an element of excitement to gameplay. With exciting features like multipliers, free spins, and cascading wins, the Sweet Bonanza slot delivers a sweet and rewarding gaming experience—just be ready for a sugar rush! Sweet Bonanza by Pragmatic Play online slots brings you a game with a medium to high variance level due to the selection of bonus games. It has an RTP of 96.48%, comparable to a large number of games from the best online casino sites available through Gambling. There are no traditional win lines and you have the potential to earn up to 21,175x your stake.

The Real Person!

The Real Person!

Of course, sometimes issues the plane suddenly crashes for the ground and bettors wonder if it is possible to be able to hack Aviator throughout Glory Casino. The very first thing you will need to do is usually to log in to the Glory Casino official site. Then click on typically the “Sign Up” press button located at the very top appropriate of the web-site. Category : Articoli Il segreto di Aviator è tutto nel tempismo e nell’intuito del giocatore, che deve scegliere il momento giusto per fermare l’aereo e raccogliere il premio o rischiare tutto. Questa innovativa modalità di gioco rende Aviator il punto di riferimento per chi cerca un’esperienza diversa e più dinamica rispetto ai giochi da casinò convenzionali. Gioca fortunes of sparta gratis senza scaricare Questi includono il casinò che ti offre giri gratuiti, che consiste di Rise e Dawn.

https://452.779.myftpupload.com/sermons/recensione-di-penalty-shoot-out-il-gioco-di-calcio-di-evoplay-che-conquista-i-casino-online-italiani/

Per ogni spin trovi il numero di Megaways previste dal giro in alto, in cima ai rulli. Diversi siti di settore consentono, in genere nella sezione dedicata alle scommesse live, anche la possibilità, indubbiamente intrigante di seguire la diretta in streaming del match. Spribe ha progettato Aviator per essere un gioco “social”, offrendo ai giocatori la possibilità di interagire tra di loro durante i round di gioco, grazie alla chat live e alla visualizzazione delle scommesse altrui in tempo reale. Questo ha portato Aviator a essere rapidamente adottato da molti casinò online, diventando uno dei titoli più giocati nella categoria dei crash. Home » Casinò » Giochi istantanei » Aviator Il tuo crash game preferito non offre nessun bonus? Puoi sempre consolarti con uno dei tanti bonus del casinò!

The Real Person!

The Real Person!

Antes de sumergirte en el apasionante mundo del juego de accidentes Lucky Jet. Realice el sencillo proceso de registro y recargue su saldo de apuestas. Si ya tiene una cuenta en el casino seleccionado, simplemente inicie sesión. En caso contrario, siga los pasos de registro: El modo demo de 1win Lucky Jet es una oportunidad para jugar gratis sin necesidad de depositar. El proceso de apuestas en la demo es idéntico. A continuación te explicamos por qué deberías jugar en la demo: El juego consiste en predecir cuándo Lucky Joe saldrá volando de la pantalla usando su jetpack. Comienza con un breve periodo en el que los jugadores lanzan sus apuestas. Después, Lucky Joe comienza a volar en su Jetpack mientras suma multiplicadora y debes retirar tu apuesta antes de que LuckyJoe vuele y ponga fin a la ronda.

https://travertine.net.au/balloon-casino-caracteristicas-y-diferencias-clave/

Innovative Funktionen und Tools für ein modernes Spielerlebnis im Casino satibet 89fccdb993 guilded.gg boymachanas-Patriots overview news 7R0Njdz6 guilded.gg dieseagperfscors-Panthers overview news glbXenNy guilded.gg fanriapunis-Caravan overview news 9RVYeZNy guilded.gg stiminexsas-Lions overview news Plq1D0Xl guilded.gg tiotovardras-Coyotes overview news QlLdeEPl guilded.gg riaverleders-Pack overview news zy43aOo6 guilded.gg tiotwinippups-Org overview news XRz1oYMy guilded.gg kettvomoohous-Lakers overview news 7lxYZ8V6 guilded.gg spifardyeniks-Saints overview news Gl52rA96 guilded.gg plotexgraphins-Buffaloes overview news NyEEe4my fahrradmod.de news seite-333-i-walked-away

The Real Person!

The Real Person!

The choice of the platform casino is built on determines what an operator can deliver and its flexibility. Operators don’t usually build their own platforms from scratch and simply buy them from third parties. These platforms often have certain limitations, especially if developers are slow to adjust their products to an ever-changing market. It affects, for instance, deposit bonus range, deposit options, online slots integration speed, etc. Tiger Simulator 3D was developed by CyberGoldfinch. You can also play other great animal simulator games from the same developer, like Fox Simulator and Wolf Simulator. You can follow the developer on Twitter. Some slot machines can award massive wins. These wins first should be verified with a content supplier to check it’s a legitimate payout and not an error. It won’t be instant. Standard payout speed doesn’t apply here as online casinos will probably wait for a few days for the response.

https://nammaooruglobalschools.in/aviator-game-review-how-often-rounds-reset-on-app-based-sessions-for-singapore-players/

As mentioned before, you can play BDG games is available as a website or an app. For those who play on their mobile devices, downloading the app can provide a smoother and more convenient gaming experience. New Update You Can Play Games Like Win Go, Trx Hash, 5D, And More Amazing Games. No, Colour Prediction Mod APK is only available for Android. iOS users need to use alternatives like Colour Prediction IPA files for jailbroken devices. Whenever a in999 gift code today player deposits money for the first time on this platform, he is given a bonus ranging from 10% to 200% depending on the special bonus. \n If you are sending your old device by post, please note:\n \n Devices that contain batteries should be packed in compliance with all applicable laws, regulations and industry best practices, which typically include the guidelines below: \n

buy amoxil no prescription – buy amoxil medication amoxicillin without prescription

The Real Person!

The Real Person!

Crash X Game is a dynamic online gaming platform known for its thrilling crash games. For an adrenaline-pumping experience, visit Crash X Game. Space XY is an exciting game that can offer a rocket’s journey through space with big wins and multipliers. When the rocket explodes, players still get to witness an amazing spectacle! With the RTP at 97%, there’s no doubt you could walk away with life-altering rewards. Even if it just ends up being for a relaxing evening of fun instead. All in all, Space XY has something unique and stimulating waiting for each player who gets involved – making every round nerve-wracking yet thrilling. Space XY, by BGaming, offers a cosmic twist on crash games, taking players on an interstellar voyage where they bet on a rocket’s flight. The goal is to cash out before the rocket explodes, making for dynamic and adrenaline-filled gameplay.

https://www.mosathat.hu/what-makes-the-teen-patti-gold-casino-experience-unique-in-2025/

Bonus ₹25 – Sign Up Bonus ₹1500 – Install Size 32.4 Mb Bonus Up to ₹20 – No. The sign up bonus and bonuses earned from various other tasks is not withdrawable. However, the bonus you earn from your friends as the commission is 100% withdrawal. दोस्तों अगर आप लोग भी New Rummy Application को डाउनलोड करने में रुचि रखते हैं और आप लोग भी रमी गेम खेलने के शौकीन है, तो आप लोग RummyBonusApp.Com के माध्यम से इन सभी एप्लीकेशंस को डाउनलोड कर सकते हैं, What makes Teen Patti Yes stand out is its vibrant online community, intuitive gameplay, and the thrill of competing with players from around the world. Whether you’re new to the game or a seasoned player, Teen Patti Yes offers an engaging experience that’s hard to put down.

The Real Person!

The Real Person!

Table of Contents About Us – Conditions of Use – Advertising *To watch, you must have an account with credits or a bet placed in the last 24 hours! Pablo Echavarria signals a free kick to Velez Sarsfield just outside Racing’s area. In the quest to secure bigger odds, then a particular route could be selecting Under 2.5 Goals in a Total Goals & Both Teams to Score wager. A bigger potential return can be landed by including BTTS No. Racing drives forward and Gaston Martirena gets in a shot. Without netting, however. Pin-up Casino es un excelente lugar para jugar a Balloon Run y ganar a lo grande. Este casino en línea de primera categoría cuenta con una plataforma intuitiva con juegos de fácil acceso y un servicio de atención al cliente de alta calidad. También ofrece una de las mejores selecciones de promociones, bonos y recompensas disponibles en la industria, por

https://grovly.com/review-del-juego-balloon-de-smartsoft-diversion-garantizada-para-jugadores-en-peru/

+34 900 696 608 (España) 800 500 028 (Llamadas desde Portugal) Descubre el increíble FamilyCook y disfruta nuevamente de la magia de cocinar. Su pantalla táctil de 7 pulgadas es intuitiva y te guía paso a paso en la preparación de recetas perfectas. Desde la pantalla, podrás seleccionar tus recetas favoritas y descargar nuevas a través de la aplicación móvil. ¡Cocinar nunca ha sido tan sencillo con nuestro robot de cocina! Robot: Bronco Type: Launcher Team: Inertia Labs Alexander Rose (Captain), Reason Bradley (Captain), Chris Daniel (Machining), Nolan Van Dine, Matteo Borri, Greg Staples, Brad Sykes Hometown: Sausalito, CA Sponsors: Autodesk, Vex Robotics, Ninja Paintball, Universal Sonar Mount, NPC Robotics, Robots Everywhere, Thunderpower Website: facebook inertiabots inertialabs Builder: Alexander Rose and Reason Bradley Job: Alexander: Executive Director…

buy fluconazole for sale – https://gpdifluca.com/# buy forcan generic

The Real Person!

The Real Person!

The link will expire in 72 hours. Space XY is an interesting new game in the Crash genre from renowned developer Bgaming. Here you can get a big win of up to x10,000 in just two clicks if you’re lucky. In doing so, your decisions affect whether you win or lose. At 1win we offer you the chance to play this game for real money. Create a 1win account, make a deposit and start playing the Spacy XY game with a welcome bonus of up to INR 145,000! The gambler watches the plane take off. It’s going up, it’s gaining height, and the odds are going up. The main nuance of the patterns is that the invisible pilot went to the landing. It is imperative to take the money until then. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

https://edx.edu.vn/balloon-game-by-smartsoft-a-comprehensive-review-for-indian-players/

Indifun Rummy Card: A Popular Indian Rummy Game Friends, This is not the official website of Teen Patti. Please do not add real money to any game. We are only providing a game download link here. Notice: To play cash games, please ensure that you are at least 18 years old. Violating our terms of service may result in your account being restricted. View an ad to download for free In Softonic we scan all the files hosted on our platform to assess and avoid any potential harm for your device. Our team performs checks each time a new file is uploaded and periodically reviews files to confirm or update their status. This comprehensive process allows us to set a status for any downloadable file as follows: 3 Patti variations add diversity and excitement to the traditional game of Teen Patti and offer players new challenges and strategies to explore the game. You can find many of these variations on a good teen patti real money earning app and start playing.

The Real Person!

The Real Person!

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Para sacar no jogo do astronauta, basta clicar no botão de cash out na parte inferior da tela. Há duas opções de cash out no jogo, o cash out integral da aposta ou o saque de apenas 50% do valor apostado. Você também pode usar as configurações para fazer o saque automático no menu do jogo. De maneira transparente, a KTO Bet oferece uma experiência de cassino legal e segura, garantindo entretenimento de qualidade para todos os nossos jogadores. E ainda, cassinos online de renome nos endossam como um membro fundador do Instituto Brasileiro de Jogo Responsável (IBJR). Estabelecemos o padrão para o jogo responsável e o fair play no Brasil.

https://centroin.es/aviator-como-criar-conta-em-menos-de-2-minutos-com-bonus-incluso/

Divirta-se jogando Mega Fortune™:Spaceman Slot no PC com MEmu Divirta-se jogando Mega Fortune™:Spaceman Slot no PC com MEmu Mega Casino Treasure Slot Ricos & Crash Capturas de tela Mega Fortune™:Spaceman Slot Slot Rico – Jogo de Cartas 4. Baixe e Instale Mega Fortune™:Spaceman Slot Slot Ricos & Crash Slot Rico – Jogo de Cartas Mega Fortune™:Spaceman Slot Mega Fortune™:Spaceman Slot Slot Rico – Jogo de Cartas Baixar Mega Fortune™:Spaceman Slot no PC Mega Fortune™:Spaceman Slot Capturas de tela Mega Casino Treasure Slot Rico – Jogo de Cartas Mega Fortune™:Spaceman Slot Slot Rico – Jogo de Cartas Divirta-se jogando Mega Fortune™:Spaceman Slot no PC com MEmu Mega Casino Treasure Capturas de tela Capturas de tela Capturas de tela Capturas de tela Baixar Mega Fortune™:Spaceman Slot no PC

order cenforce 50mg online cheap – cenforcers.com cenforce ca

The Real Person!

The Real Person!

Una de las principales ventajas de juego de penaltis es su diseño visual. El jugador se encuentra en un colorido campo de fútbol, al estilo de un festival. En la pantalla se ven el portero, la puerta, el balón y las gradas. Al llevar a cabo una tanda de penaltis, la jugabilidad se complementa con los correspondientes efectos de animación. El acompañamiento sonoro ayuda a completar las impresiones. La melodía festiva crea la atmósfera de un auténtico torneo de fútbol en algún lugar de Brasil. En este vídeo te enseñamos a lanzar un penalti. El guardameta del equipo ejecutor del lanzamiento deberá permanecer en el terreno de juego, fuera del área penal, en la intersección de la línea de meta con la línea de demarcación del área penal.

https://wp.artistcontrol.in/penalty-shoot-out-de-evoplay-un-juego-de-casino-innovador-para-jugadores-espanoles/

En cambio, la ganancia máxima en Joker’s Jewels suele estar limitada a un multiplicador específico de la apuesta, que varía según la versión del juego y el casino, pero que generalmente se sitúa en un rango de 1,000x a 5,000x. Si bien esta cantidad sigue siendo atractiva, palidece en comparación con el potencial explosivo de Sweet Bonanza. ¿Se puede jugar Sweet Bonanza 1000 gratis? Sí, muchos casinos ofrecen la versión demo sin necesidad de registrarse ni depositar dinero. La slot gratis Sweet Bonanza tiene ya media década en el mercado, y, aun así, es difícil de superar por lanzamientos más modernos. No es de extrañar cuando tenemos en cuenta el gran trabajo de diseño audiovisual que hay detrás y, más importante aún, el diseño de mecánicas y jugabilidad. La demo Sweet Bonanza no es solo un aperitivo visual: ofrece una visión completa del flujo del juego, sus riesgos y su potencial, permitiendo que el jugador decida con conocimiento si vale la pena apostar dinero real en esta tragamonedas.

buy generic tadalafil online cheap – fast ciltad cialis high blood pressure

The Real Person!

The Real Person!

Furnob’s COVID-19 Updates & Shipment Delays Learn More Download Mostbet App, Play, And Win Big! Read More » Content Обман Уже На Этапе Регистрации Как Делать Ставки? Melbet, Букмекерская Контора – Ооо Букмекер Паб, Белогорск Линия В Прематче Melbetru: Букмекерская Контора Мелбет Отстойная Контора! Какие Бонусы Дает Мелбет Сегодня? Официальный Сайт Мелбет Где Взять Фрибет В Мелбет? Бонусы И Актуальные Акции Бк “мелбет” Мобильные Ставки Нарушения Со Стороны Игроков ❓ Как Зарегистрироваться В В завершение хочется сказать, что Aviator — это не просто игра. Это целый мир, который ждет своих героев. Где бы вы ни находились, всегда можно скачать aviator и отправиться в невероятное путешествие. Обратите внимание, что игры онлайн-казино от Мелбет пока недоступны на melbet.ru для российских игроков. ПРАВОВАЯ ИНФОРМАЦИЯ Бонус новым игрокам Скачать aviator — это погрузиться в увлекательный мир авиации, полный азарта и приключений. Aviator game скачать — начните свою авиационную эпопею уже сейчас!

https://beonlegal.com/2025/07/13/%d1%81%d1%82%d1%80%d0%b0%d1%82%d0%b5%d0%b3%d0%b8%d0%b8-%d0%b8-%d1%81%d0%be%d0%b2%d0%b5%d1%82%d1%8b-%d0%b8%d0%b3%d1%80%d0%b0-aviator-%d0%bd%d0%b0-%d0%b4%d0%b5%d0%bd%d1%8c%d0%b3%d0%b8-%d0%b2-%d0%be/

Эти особенности выделяют Pin Up Aviator среди других игровых автоматов и делают его привлекательным выбором для игроков, ищущих новые впечатления.Правила и Механика игры Авиатор Как пополнить Авиатор в Казахстане Игровой предсказатель коэффициента Авиатор прост в настройке и использовании. Просто создайте учетную запись пользователя и войдите в систему. Помните об этом и играйте честно! Предиктор Авиатор — это программное обеспечение, предназначенное для предсказания результатов игры в Aviator Spribe. Его могут использовать игроки, которые хотят увеличить свои шансы на победу в этой игре. Для начала вам нужно выполнить 50 полетов с коэффициентами от 1 до 100, чтобы научиться зарабатывать как можно больше. predictor Тем не менее, важно заметить, что использование предиктора может нарушать правила игры в некоторых онлайн-казино, поэтому перед использованием стоит убедиться в законности такого использования.

cialis 100mg from china – cialis com coupons cialis best price

The Real Person!

The Real Person!

} } CUSCEN Türkçe dil seçeneğiyle sunulan bu versiyon, hem yeni başlayanlara hem para deneyimli oyunculara hitap eder. Slot Sugar Rush oyna, Türkiye’deki oyunculara farklı RTP seçenekleri ve yüksek kazanç potansiyeli sunar. Mobil uyumluluğu neticesinde oyuna her a good erişebilir, TRY ile bahis yaparak şansınızı deneyebilirsiniz. Sugar Dash, üçlü eşleştirme oyunları arasında en popüleri Candy Crush’ın oynanış açısından basitleştirilmiş sürümü diyebilirim. Sugar Rush, son yılların en çok ilgi çeken oyunlarından biridir. Çocuklar ve gençler arasında büyük bir popülarite kazanmıştır. Peki, bu oyunu özel kılan nedir? Slot, canlı bir ızgarada yer alan şekerler ve sakızlı ayılar gibi ikramlar etrafında şekillenen parlak ve renkli bir temaya sahiptir. Oyunun görselleri eğlencelidir ve kazanan bir kombinasyon elde ettiğinizde semboller zıplar ve patlar. Neşeli müzik, her galibiyetten sonra çalan çanları içerir ve eğlenceli atmosfere katkıda bulunur. Arka plan, puding tarlaları, dondurma tepeleri ve lolipoplarla tatlı temalı bir manzara sergiler ve oyuncular için genel olarak neşeli ve ilgi çekici bir deneyim yaratır. Pragmatic Play’nin Sugar Rush’si, şeker temalı tasarımı ve iyi uygulanmış özellikleriyle sağlam bir slot oyun deneyimi sunuyor.

https://felipeclavijo.com.br/bigger-bass-bonanza-incelemesi-turkiyedeki-online-casino-oyunculari-icin/

‘Sugar Rush’ 3. sezon: Çıkış tarihi Polygun Arena: Online Shooter As Kermit the Frog and the Hulk discovered: it’s not easy being green. Now another verdant character is gleefully brought to the screen by lyricist-producer Stephen Schwartz, screenwriters Winnie Holzman and Dana Fox, and director Jon M Chu in an adaptation of Schwartz’s Broadway musical, the first of two parts. Tümünü Görüntüle Daha Fazla Bilgi Daha Fazla Bilgi Müşteri Hizmetleri YAZ KAMPANYASI BAŞLADI Kabul ederseniz, size gösterdiğimiz tanıtımları kişiselleştirmek için Amazon hizmetlerinden edindiğimiz kişisel bilgilerinizi kullanabiliriz. Ayrıntılı bilgi için lütfen İlgi Alanına Dayalı Tanıtımlar Bildirimini inceleyiniz. Daha Fazla Bilgi Kabul ederseniz, size gösterdiğimiz tanıtımları kişiselleştirmek için Amazon hizmetlerinden edindiğimiz kişisel bilgilerinizi kullanabiliriz. Ayrıntılı bilgi için lütfen İlgi Alanına Dayalı Tanıtımlar Bildirimini inceleyiniz.

The Real Person!

The Real Person!

Non è questo il momento opportuno per ricordare i pro e i contro del compromesso; diciamo che lo considero – almeno, questo è l’auspicio – come una tappa verso una ragionevole gestione delle risorse alieutiche nel Mediterraneo, combinata con un doveroso sostegno al precario livello di occupazione del settore ittico, coinvolgente migliaia di famiglie dislocate sulle coste del Mare nostrum. Augusta, Georgia. Questa città di 192mila abitanti, la seconda dello Stato dopo la capitale Atlanta, ha dato i natali al famosissimo wrestler Hulk Hogan. Ma in tutto il mondo è Senza ricetta prezzo, acquisto su internet e acquisto on line italia, sicuro tranne generico acquisto sicuro. Comprar generico online anche online consegna rapida, generico e sicuro e generico doc nonostante acquisto generico in farmacia

https://prueba.restaurantesecuador.top/2025/07/12/7slots-sweet-bonanza-besonderheiten-und-aktionen/

Un altro motivo per giocare a Mission Uncrossable in modalità demo è quello di mettere in pratica la propria strategia. La slot gratuita consente di verificare se l’algoritmo proposto è adatto alle proprie esigenze o di sviluppare una propria metodologia di scommessa. Mission Uncrossable non perde tempo con regole complicate. Vi getta nel bel mezzo del gioco: solo voi, un campo pieno di pericoli e il semplice obiettivo di riuscire ad attraversarlo. Il gioco Chicken Road the Road ispirerà i principianti e gli amanti esperti del brivido con vincite veloci. Il compito principale del giocatore è far passare il pollo attraverso le superfici di cottura. Per ogni passaggio, l’utente riceverà un moltiplicatore che comporrà la vincita. Chicken Road può essere avviato in molti casinò online gratuitamente e con soldi veri.

order zantac 150mg online cheap – buy ranitidine pill order ranitidine pill

The Real Person!

The Real Person!

INCIDÈNCIA TÈCNICA El 4 de agostode 2003partedel GrupodeTrabajooomiena procesarlas preguntasy paralelamentetrabajaren la diseño interior y cubierta: rag reservados todos los derechos. de acuerdo a lo dispuesto en el art. 270 del Código Penal, podrán ser castigados con penas de multa y privación de libertad quienes sin la preceptiva autorización reproduzcan, plagien, distribuyan o comuniquen públicamente, en todo o en parte, una obra literaria, artística o científica, fijada en cualquier tipo de soporte. 18. A Landscape Management Plan shall be made available for DINAMA’s approval before Create professional content with Canva, including presentations, catalogs, and more. • Fórmula especial. No sería necesaria durante la lactancia materna. Se empleará fórmula extensamente hidrolizada (tolerada por más del 90% de los lactantes con APLV) o fórmula de soja (alto potencial antigénico, se puede emplear para tratar APLV, pero no antes de los 6 meses, ni cuando exista enteropatía o malabsorción). No se pueden emplear como tratamiento las fórmulas parcialmente hidrolizadas, ni la leche de otros rumiantes, como oveja o cabra. En pacientes con altos niveles de sensibilización o, si hay antecedente de reacción anafiláctica, puede ser recomendable la administración de fórmula muy altamente hidrolizada (semi-elemental) o incluso elemental (aminoácidos).

https://teenpattistarapk.com/la-propuesta-ludica-que-suma-tension-al-casino-movil-balloon-de-smartsoft/

Uptodown es una app store multiplataforma especializada en Android. Nuestro objetivo es proporcionar acceso libre y gratuito a un gran catálogo de aplicaciones sin restricciones, ofreciendo una plataforma de distribución legal accesible desde cualquier navegador, así como a través de su app oficial. Puedes construir estructuras en cualquier lugar accesible del mapa. ✪ Dos campañas completas con misiones PvE (puedes jugarlas sin conexión) Perfectos para entrenar la mente y disfrutar de mecánicas satisfactorias, los juegos de suelen contar con cientos de niveles y diseños para todos los gustos. Si buscas títulos que estimulen tu intelecto, visita también la sección de . La versión Android de TowerRush está disponible para descarga directa en nuestra página oficial. Se adapta a una gran variedad de dispositivos, con controles responsivos y gráficos fluidos. La compatibilidad ha sido probada en múltiples versiones de Android, desde 7.0 en adelante. Puedes tower rush instalar fácilmente en segundos y comenzar a jugar sin registros complejos. Las notificaciones inteligentes te mantienen informado sobre actualizaciones y torneos activos.

how to buy viagra online in canada – https://strongvpls.com/# order viagra now

The Real Person!

The Real Person!

Baixar e instalar o APK do Big Bass Splash em seu dispositivo Android pode ser seguro e simples se você seguir estas etapas: Ao consultar esta tabela, você pode escolher o melhor site para baixar o APK do Big Bass Splash com base em suas prioridades de experiência do usuário, velocidade de download e confiabilidade do site. O Big Bass Splash é uma slot com cinco tambores e três linhas, com 10 linhas de pagamento. O giro grátis é o principal recurso bônus neste jogo. No Big Bass Splash, o recurso é acionado pelos ‘’Scatters’’, que neste jogo, são representados pelo peixe fisgado, e liberados nas seguintes condições: O retorno para o jogador do Big Bass Splash é de 96,71%, acima da nossa média de aproximadamente 96%. Seguindo um padrão visto em outros jogos do mesmo formato, o Big Bass Splash apresenta 10 linhas de pagamento, em uma placa de 5×3. O pouso, então, é acionado por pelo menos três símbolos em bobinas adjacentes, e como dito, o que já é familiar para a maioria dos jogadores.

https://wp1-c12349-4.btsndrc.ac/balloon-game-review-winning-big-with-smartsoft-in-india/

A partir do momento em que você começa a lançar seu anzol no Big Splash, você tem a oportunidade de pescar grandes ganhos através das variadas funções especiais de como jogar Big Bass Splash. Confira-as abaixo. O Big Bass Splash é uma slot com cinco tambores e três linhas, com 10 linhas de pagamento. Programa fidelidade Prepare sua vara, vista o colete e venha fisgar grandes vitórias em Big Bass Splash, o slot eletrizante da Pragmatic Play com a Reel Kingdom. Com gráficos renovados, trilha imersiva e recursos inéditos, esse título leva a já consagrada série Big Bass a um novo patamar — e tudo isso está disponível na 4win, a casa de apostas que mais paga no Brasil! Vulkan Vegas Casino é uma plataforma conhecida em várias partes do mundo, inclusive em Portugal. Nossa empresa foi lançada em 2019 e temos um site focado em casino, com vários recursos disponíveis para que os jogadores possam aproveitar.

Thanks for sharing. It’s outstrip quality. click

This is the compassionate of literature I truly appreciate. prednisone and high blood pressure

What a data of un-ambiguity and preserveness of precious familiarity regarding unpredicted

feelings. https://tinyurl.com/28wjzmw4 gamefly

Good blog you possess here.. It’s severely to find elevated quality belles-lettres like yours these days. I honestly respect individuals like you! Withstand guardianship!! https://ursxdol.com/furosemide-diuretic/

Thanks on putting this up. It’s evidently done. https://prohnrg.com/product/loratadine-10-mg-tablets/

The Real Person!

The Real Person!

In most cases, you’ll need to buy chips to play Teen Patti. These chips represent the currency used in the game. The app is pretty intuitive, and it works fine in 3G and 4G connections. Players can choose the games they like and play without any wait time to join a table. Players can also play with an existing Teen Patti login account. One downside of this card game app is the amount of ads that keep popping up. Sign Up Bonus ₹10 – Teen Patti Master App Details Sign Up Bonus ₹150 Min. Withdrawal ₹100 – Free-to-play online casino platform The right to erasure – You have the right to request that we erase your personal data, under certain conditions. Overall, Teen Patti Real – 3 Patti Online is a great app for those looking for a fun and easy-to-play multiplayer card game. Its smooth gameplay, stunning graphics, and engaging animation, and easy-to-navigate interface are all charming aspects of the game that make it enticing to play. Do note that the ads that pop up frequently.

https://egyptdestinations.net/tower-x-game-by-smartsoft-a-review-for-indian-players/

The frequency of such X’s is ~ 40%. This is neither much nor little. If you feel that you are definitely lucky, bet on x2 or x3. However, pay attention not only to your inner feelings, but also to the X-line – there has not been a high multiplier for a long time, bet on this tactic. Today, online casino registration takes only 5 seconds and can be done through an account in a social network such as VKontakte. This is convenient because the player can quickly replenish his account with the desired amount. Find Space XY available to play for real money at the following online casinos: Sign in to add your own tags to this product. WE MAKE NO GUARANTY OF CONFIDENTIALITY OR PRIVACY OF ANY COMMUNICATION OR INFORMATION TRANSMITTED ON THE SITE OR ANY WEB SITE LINKED TO THE SITE. WE WILL NOT BE LIABLE FOR THE PRIVACY OF THE INFORMATION, EMAIL ADDRESSES, REGISTRATION AND IDENTIFICATION INFORMATION, DISK SPACE, COMMUNICATIONS, CONFIDENTIAL OR TRADE-SECRET INFORMATION, OR ANY OTHER CONTENT TRANSMITTED OVER NETWORKS ACCESSED BY THE SITE, OR OTHERWISE CONNECTED WITH YOUR USE OF THE SITE.

Greetings! Very serviceable suggestion within this article! It’s the crumb changes which wish obtain the largest changes. Thanks a lot for sharing! cenforce femme

The Real Person!

The Real Person!

Come in altre slot che pagano i cluster di simboli, Sugar Rush 1000 utilizza un meccanismo detto “Tumble” all’avverarsi di una vincita: in altre parole, i simboli costituenti tali cluster vincenti vengono rimossi dalla griglia di gioco e sostituiti da altri che cadono dall’alto. Questo processo si ripete fino a quando non si formano più nuove vincite. \nNaturalmente! Il tuo denaro è assolutamente al sicuro con noi! Lavoriamo con SafeCharge, una delle aziende leader nella tecnologia dei pagamenti online, certificata dal 2007 secondo lo standard di sicurezza dei dati di livello 1 del settore delle carte di pagamento.\n\n\n Il sistema controlla quale lato ha una migliore combinazione di carte e quel giocatore diventa il vincitore, c’è stato un picco definitivo nelle entrate lorde del gioco. Dove posso giocare sugar rush ovviamente, aspetto un po ‘ e non posso ancora andarmene e devo rientrare nel server per risolvere il problema.

https://harripertyo1974.bearsfanteamshop.com/per-maggiori-informazioni

Sugar Rush è disponibile anche su dispositivi mobili, grazie all app con giochi casinò, offrendo la stessa esperienza coinvolgente anche su smartphone e tablet. Grazie alla sua grafica di alta qualità e alle animazioni fluide, il gioco si adatta perfettamente ai piccoli schermi e consente così di divertirsi comodamente sfruttando una semplice connessione a internet. Insomma, vi basterà aprire l’app di gioco sul device e potrete gustare tutte le delizie di Sugar Rush ovunque vi troviate. Pubblicato il 30 giugno 2023 @lightningcloud: no, NON sbagli. ^_^Quando Felix insiste per seguire Calhoun dentro Sugar Rush ci sono anche le scritte “LEEROY JENKINS” e “SHENG LONG WAS HERE”. Sugar Rush è una slot coloratissima, che catapulta il giocatore in una dimensione piena zeppa di caramelle e orsetti gommosi. Il gioco si caratterizza non solo per le meccaniche curiose, ma anche per una grafica accattivante e divertente.

The Real Person!

The Real Person!

精采內容: Όπως κάθε φρουτάκι, έτσι και το Sugar Rush έχει δυνατά και αδύναμα σημεία. Στα βασικά πλεονεκτήματα περιλαμβάνονται: Όπως κάθε φρουτάκι, έτσι και το Sugar Rush έχει δυνατά και αδύναμα σημεία. Στα βασικά πλεονεκτήματα περιλαμβάνονται: Παραθέτουμε ενδεικτικά τις πληρωμές για κάποια σύνολα συμβόλων στο Sugar Rush 1000, ώστε να έχετε εικόνα της αξίας των νικών σας. Πρέπει να έχετε υπόψη πως κάθε νίκη από 5 έως 15 σύμβολα πληρώνει ξεχωριστό ποσό. Τόσο στο βασικό παιχνίδι όσο και στη λειτουργία Free Spins του κουλοχέρη Sugar Rush, το μέγιστο κέρδος είναι 5.000x το συνολικό ποντάρισμα του παίκτη.

https://code.datasciencedojo.com/bqwmnzyyhzvy2

Instagram: @amatu_mascotaL-V 8am – 6pmS 8am – 12pm Το Sugar Rush 1000 έχει πολύ καλό RTP ίσο με 96,53%. Αυτό είναι άνετα κοντά στον μέσο όρο και εγκρίνεται από τον οδηγό μας για στρατηγικές κουλοχέρηδων. Ο κουλοχέρης έχει μεταβλητότητα 5 5 και έχει ένα εντυπωσιακό μέγιστο κέρδος ίσο με 25.000x το ποντάρισμά σας. Το παίξιμο της δωρεάν έκδοσης του Sugar Rush 1000 προσφέρει πολλαπλά οφέλη στους Έλληνες παίκτες: Για να αξιοποιήσετε στο έπακρο την εμπειρία του demo του Sugar Rush 1000, δοκιμάστε τις ακόλουθες στρατηγικές:

The thoroughness in this piece is noteworthy. https://ondactone.com/product/domperidone/

Бонусы бывают пустышками, а бывают такими, от которых игра начинает гореть по-настоящему. Именно такие предложения я нашёл, когда решил Vodka Casino скачать приложение. Сразу после установки получил промокод, активировал его и начал игру. Никаких подвисаний, слоты грузятся на лету, а кэшбэк начисляется даже на неудачные сессии. Зеркало всегда подхватывается автоматически, поэтому никаких проблем с доступом. Удобно, что можно играть где угодно — в транспорте, на обеде, дома перед сном. Платформа реально затягивает. И главное — ты не просто тратишь деньги, ты получаешь эмоции, шанс на выигрыш и постоянную поддержку со стороны сервиса.

The Real Person!

The Real Person!

Currently, there are three good free spins promotions available for Sweet Bonanza. The offer at Casino Days is a no deposit offer, while the two others require you to make a deposit. Smart Offers for First-TimersSome no deposit bonuses are better suited for beginners. Look for ones with simple terms, low wagering, and games you actually enjoy. Many great starter bonuses offer free spins on trending slots or small amounts of bonus cash for trying out popular tables like blackjack. These are more than freebies — they’re a low-risk way to learn, try different games, and maybe score a win. When you sign up at Monopoly Casino, the first thing you should do is deposit and wager at least £10 on slots – then you’ll get 30 free spins on the Monopoly Paradise Mansion slot game. This online casino is unique because there are so many Monopoly-themed games, but if you’re not a fan, don’t worry – you can choose from tons of other slots like 88 Fortunes, Rainbow Riches, and Raging Rhino. There are even classic casino games and live dealer table games.

https://community.networkofcare.org/blogs/trownawarmi1986/archive/2025/08/01/skycrown-casino-online.aspx

Another sweet pleasure developed by Pragmatic Play manufacturers. But this is not everything. This is an updated version of Sweet Boanza, with addition of Christmas magic. This wonderful launch started appearing in the lobbies of numerous gambling sites on November 11th, 2019. The screen shows some great snowdrifts and snowmen in cylinder hats and striped scarves. The fruits are covered with snow and are on the bottom of the screen. With a great melody in the background this updated version of Sweet Bonanza, this brings the Christmas time anytime you want it in front of your screen, mobile smart-phone, tablet or other devices. Another sweet pleasure developed by Pragmatic Play manufacturers. But this is not everything. This is an updated version of Sweet Boanza, with addition of Christmas magic. This wonderful launch started appearing in the lobbies of numerous gambling sites on November 11th, 2019. The screen shows some great snowdrifts and snowmen in cylinder hats and striped scarves. The fruits are covered with snow and are on the bottom of the screen. With a great melody in the background this updated version of Sweet Bonanza, this brings the Christmas time anytime you want it in front of your screen, mobile smart-phone, tablet or other devices.

This is the make of post I turn up helpful.

https://proisotrepl.com/product/colchicine/

It’s hard to find well-informed people on this topic, but you seem like you know what you’re talking about!

Thanks

The Real Person!

The Real Person!

If you find 4, there are 20 lines that run across the 5 reels. Creating a player account with Greenplay Casino is easy, its time to get spinning. There are plenty of features, including wild symbols, free spins, and a multiplier during the bonus round. What I (and many others) love about Big Bass Bonanza is its high RTP of 96.71%, which is above the market average. This means you get a solid return if you take on the risk. While the gameplay is simple, triggering the bonus round still gives a thrill. Big Bass Bonanza – Keeping it Reel Big Bass Bonanza 1000 offers 10 fixed pay lines When you play the Big Bass Bonanza slot demo or real money version, you’ll enjoy great bonus features. These features include Multiplier Wilds and a Free Spins Bonus Round. You’ll fill the Wild Meter in the bonus round to win extra free spins and multipliers worth up to 10x.

https://old.tenisperu.com.pe/tenis_campo/win-aviator-the-smart-way-ghanas-winning-formula/

CBC Kids uses cookies in order to function and give you a great experience. Your parent or guardian can disable the cookies by clicking here if they wish. Sign up to get custom embedding links and start making money! Looking for a particular game? Contact us and our team will help you! The technology under your game can make it or break, so you don’t want to take any chances on this department. We use the latest techniques to ensure that your game has the best quality and performance possible. We adapt to your needs so you won’t be limited when creating your latest project. – Screaming voice will make the chicken perform some ninja jump and turn the chicken into a super ninja chicken 😀 hi tristan jayden woods from grand avenue the school you visited yesterday so i got the high score on your exploding chickens game and my score didn’t come up so i don’t know about that ps by the way my score was 200 000

The Real Person!

The Real Person!

Last time, we looked at the Huff N’ Puff series and how they evolved the game with each release to make it fresh and up the stakes. Today, we’re going to look at it from a different perspective by looking at three key releases in the massive and venerable Buffalo line of slots. The Buffalo slot machine is a high volatility slot. That means players can expect relatively long dry spells before hitting a big win. It’s also quite rare to trigger the Buffalo slot bonus feature for a chance at the progressive jackpot. While many players have done it and there’s definitely a chance of you doing the same, it’s pretty much a once-in-a-lifetime occurrence. Here’s more on slot volatility. In order to play Games (other than Play-for-Free Games) on OLG.ca, a Player is required to have a positive notional balance of funds in their Standard Player Account. Notwithstanding the foregoing, a Player may purchase tickets for Draw-Based Lottery Games Played Online through their Player Account, using Direct Pay on OLG.ca (subject to system availability). Direct Pay is a feature available only to Players with a Player Account. OLG will not extend credit to Players.

https://www.min-jet.com/chicken-road-game-review-a-casual-spin-for-indian-players/

There is no doubt that this Megaways version will catch the eye of players and they will want to give it a spin. After all, the Buffalo King slot has been one of the gaming community’s favorites for quite some time now. If you’re looking for a Buffalo slot game that’s upping the ante, check out 5 Wild Buffalo from Relax Gaming and 4ThePlayer. Thanks to features like its Boosting Fortunes, you can really amp up the size of your prizes. Plus, there’s a Fortune Wheel that gives you a shot at even bigger rewards. The Buffalo Thunder feature lets you stack buffaloes that can turn into massive symbols with ever-increasing multipliers. The Free Spins are also packed with wild symbols that boost your winnings even more. So take a chance and let the Wild Buffalo guide you to your fortune.

The Real Person!

The Real Person!

Los CFD son instrumentos complejos y tienen un alto riesgo de perder dinero rápidamente debido al apalancamiento. El 61% de las cuentas de inversionistas minoristas pierden dinero cuando intercambian CFD con este proveedor. Debe considerar si comprende cómo funcionan los CFD y si puede permitirse asumir el alto riesgo de perder su dinero. JoVE Science Education Recibe una alerta de existencias By publishing your document, the content will be optimally indexed by Google via AI and sorted into the right category for over 500 million ePaper readers on YUMPU. El sistema de enfriamiento líquido extremo con gran radiador de 360 mm y 3 ventiladores RGB garantiza que tu sistema se mantenga fresco y funcionando a pleno rendimiento, incluso durante largas sesiones de juego en configuraciones gráficas ultra. La tarjeta gráfica NVIDIA RTX 4070 Super de 12 GB G-DDR6X con ray tracing y DLSS te brinda gráficos de última generación, permitiéndote disfrutar de una calidad visual impresionante y alcanzar los FPS más altos en cualquier escenario.

https://yardimcilazim.com/sugar-rush-de-pragmatic-play-un-analisis-detallado-para-jugadores-en-espana/

Un nuevo adaptador USB de la compañía Cyber Gadget permitirá la conexión de los mandos DualShock al WiiMote de Nintendo. Sobre este asunto, otra pregunta que nos debemos formular es qué clase de democracia había en esos años en Occidente que permitió la llegada del nazismo al poder. Dando como respuesta, que si la clase política que gobernaba en esos años en Europa hubiera actuado sobre las causas que llevaron a Hitler al poder y haberlo hecho de manera diferente a cómo se hizo se podrían haber evitado los abominables crímenes que se perpetraron incluida la Segunda Guerra Mundial. The tower contains three apartments, one in each story. In the central one, which is used as a muniment room, there is preserved an invaluable curiosity, an original copy of the Magna Charta of King Henry III. It appears that a copy of this Great Charter was sent to the sheriffs of all the counties in England. The illustrious Ela, Countess of Salisbury, was at that time sheriff of Wiltshire (at least so tradition confidently avers), and this was the copy transmitted to her, and carefully preserved ever since her days in the abbey which she founded about four years after the date of this Great Charter.

The Real Person!

The Real Person!

Pre-order pre-save Gold Rush Kid Wyrażam zgodę na przetwarzanie moich danych osobowych dla potrzeb wykonania Usług (zgodnie z Ustawą z dnia 29.08.1997 r. o Ochronie danych osobowych; t.j.Dz. U. z 2002r. Nr 101, poz. 926 ze zm.). W celu zapisania się do naszego biuletynu informacyjnego rozsyłanego e-mailem. Sizzling Hot Deluxe jest to robot od momentu Novomatic, jaki to przenosi internautów do odwiedzenia otoczenia imponujących owocowych slotów. Uciecha przekazuje pięć bębnów oraz 5 miarki wypłat, przy zachowaniu prostotę oraz elegancję tradycyjnych jednorękich bandytów. Charakteryzuje się ona wielkim RTP na poziomie 100,66%, jak powoduje go atrakcyjnym w celu zawodników poszukujących w podobny sposób gry, jak i rzeczywistych możliwości pod wygraną. Niejednokrotnie przedkładane są również bezpłatne gry hazardowe do odwiedzenia pobrania w aparat telefoniczny w ciągu darmo, które to czynią, hdy dojście do odwiedzenia ukochanej uciechy wydaje się nadal szybszy i łatwiejszy.

https://www.vegapottery.com/2025/08/04/gdzie-i-jak-sledzic-najswiezsze-wygrane-na-vulkan-vegas/

Superbetting. com truly does not accept bets on sports, will not engage in gambling and related routines. More reviews concerning Mostbet casino you can read through popular Casino Metropol resources. The bookmaker offers politics, Television shows, business, music, and special markets. Today we let you discover Mostbet gambling site with our Mostbet review. Mostbet is a European bookmaker owned by Realm Entertainment Constrained. Realm Entertainment Ltd. is a organization based in Malta. Konfiguracja Androida: Uruchom narzędzie do obsługi komórek lub skorzystaj z wersji strony internetowej za pośrednictwem przeglądarki; przejdź do sekcji aplikacji; kliknij 1xBet Android; przejdź do ustawień swojego telefonu komórkowego; idź prosto do bezpieczeństwa segmentu; zezwolić na instalację z 1 3 imprezy; przejdź do menu głównego z pobranymi plikami i kliknij raport apk 1xBet; kliknij na niego i rozpocznie się metoda instalacji;Konfiguracja iOS: przejdź do oficjalnej strony 1xBet; znajdź ikonę z «pakietami komórkowymi»; po kliknięciu możesz zostać przekierowany do sklepu z aplikacjami, gdzie jednym kliknięciem możesz pobrać aplikację 1xBet na iOS.

888starz фриспины https://1stones.ru/wp-content/pgs/888starz-official-site-aviator.html

I am in truth thrilled to glitter at this blog posts which consists of tons of worthwhile facts, thanks object of providing such data. http://pingfarm.com/index.php?action=ping&urls=https://wakelet.com/wake/Ygm_w25-9BwVAfPHOoN7B

The Real Person!

The Real Person!

888starz зеркало https://gazeta-curier.ru/cor/pgs/obzor_mobilnogo_prilozgheniya_23.html

The Real Person!

The Real Person!

BrunoCasino voordelen https://forum.onetime.nl/topic/23837-brunocasinoone/

скачать 888starz на телефон бесплатно https://operativa.ru/dosug/stavki-na-kibersport-v-888starz.html

Proof blog you be undergoing here.. It’s intricate to assign elevated status article like yours these days. I honestly respect individuals like you! Withstand care!! http://ledyardmachine.com/forum/User-Toynck

The Real Person!

The Real Person!

इसके परिणामस्वरूप गेम की डिमांड बढ़ गई, और नए खिलाड़ियों को आकर्षित करने के लिए इसका मोबाइल वर्जन भी लॉन्च किया गया। अब ये मोबाइल वर्जन आसानी से पूरे PC और मोबाइल डिवाइसों में संतुलित ग्राफिक्स और प्रसिद्ध नोटेशन की स्पीड के साथ पाए जा रहे हैं। संक्षेप में, एविएटर प्रदर्शन संस्करण खेल का अभ्यास मोड है। आप किसी भी वास्तविक पैसे को जोखिम में डाले बिना सभी मुख्य खेल की अवधारणाओं और सुविधाओं से गुजर सकते हैं। यह इनके लिए एक शानदार मौका है:

https://www.kocyigitmakina.com/2025/08/08/%e0%a4%b8%e0%a5%8d%e0%a4%aa%e0%a5%8d%e0%a4%b0%e0%a4%be%e0%a4%87%e0%a4%ac-%e0%a4%95%e0%a4%be-%e0%a4%85%e0%a4%b5%e0%a4%bf%e0%a4%8f%e0%a4%9f%e0%a4%b0-%e0%a4%91%e0%a4%a8%e0%a4%b2%e0%a4%be%e0%a4%87/

अच्छी तरह से निर्मित दुकान, न केवल बिक्री बल्कि वे आपका निर्माण भी कर रहे हैं। यहां तक कि वे सेमिनार भी आयोजित करते हैं. आपको उचित मूल्य पर सामग्री मिलती है इस फॉर्म को पूरा करके, आप हमारे ईमेल प्राप्त करने के लिए साइन अप कर रहे हैं और किसी भी समय सदस्यता छोड़ सकते हैं। इस फॉर्म को पूरा करके, आप हमारे ईमेल प्राप्त करने के लिए साइन अप कर रहे हैं और किसी भी समय सदस्यता छोड़ सकते हैं।

The Real Person!

The Real Person!

Plus, we’ll add a free sweet treat to your Greggs App wallet every year on your birthday so you can celebrate with whatever your heart (or sweet tooth) desires. Only deposit products are FDIC insured. Cardiac Services – Uniphar Medtech Barista Bar App Cloud Nine Niacinamide Glow Blush Use code: TREAT10 and enjoy 10% OFF on all orders Sugar rush video slot machine the Nudge Wild symbol on the bonus reel moves any wilds in the main game up or down to fill a reel and complete a win, on this game – its generally 5x that as they are harder to get. The philosophy behind Thrills has always been to cater the needs of its customers, you will still need to know which games you should focus on when making money from the game. Sadly, its even got a resort-sized complex more or less ready to inhabit.

https://estampadoskyp.cl/2025/08/18/free-mines-game-play-without-any-deposit-in-indias-online-casinos/

Yes, the CopyTrader feature is available in the demo, and functions the same way as it does in real mode. We’re here for you 7 days a week, through the app or via email. Reach out to global buyers and participate in international trade fairs The practice that includes Predicting and betting on an object’s colour is known as Colour Trading. The practice is quite popular in India. There is still Confusion Regarding the Legality of this Procedure among the Common Indian People. The Procedure Capitalizes on Colour Trading’s Visual and Psychological aspects, which makes Complex Market data simpler. Sam Azzarello: Bruce, you mentioned a few factors, and there’s more than a few that are adding to the uncertainty and impacting the outlook. Let’s go deeper on tariffs. You and the team have written a lot about trade. Can you expand on how that could flow through to global growth and inflation, impact the US domestic outlook?

brand forxiga 10mg – click forxiga 10mg without prescription

The Real Person!

The Real Person!

Connect with us The animation of the wildlife symbols is breathtakingly realistic. The animals come to life in the reels with eye-catching colour and range from cute to intimidating. The moose seems gentle and friendly while the wolf stares down the players with a fierce look. Godzilla Vs King Kong Fax: 086 606 4979 Fishin’ Frenzy Megaways Take it to the badlands on the go as Buffalo King Megaways is fully compatible on all mobile devices. Sign up to MrQ today and play over 900 real money mobile slots and casino games. So, once you have set your budget and deposit limit, you will be ready to play. Here is our quick step-by-step guide on how you play one of our many slot games here at Amazon Slots: A: Buffalo King Megaways offers the potential to win up to 5,000x your stake, making it a highly rewarding slot if luck is on your side.

https://www.imalatdunyasi.com/casino-game-review-longest-multiplier-chain-ever-recorded-in-football-x-vs-mine-island-slot-achievements/