- They are facing challenges due to logistics, RM availability and higher price – especially for solvents. Most solvent prices were at an all time high. They have started to see some easing in terms of availability and cost of APIs and solvents. However, supply chain and logistics costs continue to be a challenge.

- Revenue has seen marginal growth of 3% despite lower sales in the ARV APIs and formulations. All other businesses except ARV APIs have grown for the quarter and 9 months.

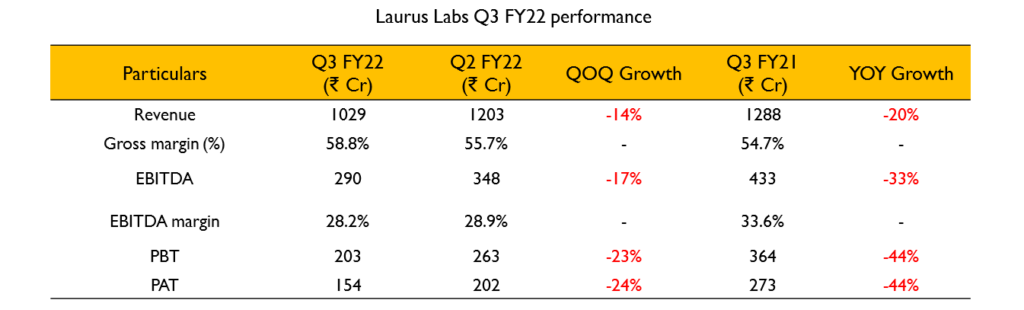

- Gross margin for the quarter was at 58.8% compared to 54.7% last year. EBITDA margin was at 28.2% for the quarter and 29.6% for 9 months.

- There is an increase in demand for ARV APIs from Q4 onwards. They believe this sluggishness was only transient in nature and demand should normalize from now onwards.

- They are positive on reaching their goal of $1 Billion in sales for FY23. This will be supported by several approvals and multi-site capacity expansion across API, formulations and CDMO.

- The formulation business reported a revenue of ₹373 Cr (13% decline YoY). The contribution from the formulation segment has improved during the 9 months to 40% from 36% in the previous year.

- Laurus has signed and will be a part of MPP license for Molnupiravir to increase the broad access in LMIC markets

- Filed 3 ANDAs during the 9 months. They made a supplementary ANDA filing during the quarter. They expect to file around 6-7 ANDAs for the full year. Cumulatively, they have filed 30 ANDAs. Of this, they have 10 final approvals and 8 tentative approvals so far. They have 11 product approvals in Canada, of which they are launching 5 and are in the process of launching a few more.

- They continue to invest in FDF infrastructure. Their brownfield expansion at Unit 2 is on track and is expected to take the total FDF capacity to 10 billion units per year. It will come online early next quarter.

- Their R&D is more focused on non-ARV products right now. They have identified a few products which are complex and need scale.

- Antiviral API business during the quarter was weaker than expected and declined 65% YoY. The steep decline is due to the higher base effect because of inventory stocking by global agencies last year.

- In oncology APIs, they did ₹85 Cr sales which is a growth of 33% YoY. For 9 months, there is a growth of 8%.

- They filed 4 DMFs during the quarter. 2 DMFs are non-ARV. Total number of DMFs to date is 71.

- As indicated last quarter, they have started construction of a dedicated facility for a global life sciences company. It is a multi-product, multi-year supply contract. Part of the capex for this is funded through commercial advance. They are also investing in one more greenfield facility for the synthesis division and building an R&D center. All these projects are progressing as expected.

- During the quarter, Laurus Bio commissioned 2 new ferementers of 45 KL each taking the total capacity to 180 KL. There was a few months delay in qualifying the fermenters.

- They believe that they have the capability to become a very large player in CDMO in the global space. They have the regulatory track record, EHS compliance and manufacturing infrastructure is world class. So they believe they have a lot of avenues for growth and the CDMO business is still in its infancy.

- They want the synthesis business to contribute at least 25% of overall revenue by FY25. This includes biologics CDMO.

- ARV APIs are not very high gross margin products compared to the rest of the business. This quarter the contribution from ARV decreased so gross margins look higher.

I’ll immediately grab your rss as I can’t find your email subscription link or e-newsletter service. Do you have any? Please let me know in order that I could subscribe. Thanks.

I like this post, enjoyed this one regards for putting up. “The goal of revival is conformity to the image of Christ, not imitation of animals.” by Richard F. Lovelace.

I cling on to listening to the news speak about receiving boundless online grant applications so I have been looking around for the top site to get one. Could you tell me please, where could i acquire some?

F*ckin’ remarkable issues here. I’m very satisfied to look your post. Thank you so much and i’m having a look forward to touch you. Will you please drop me a mail?

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post…

I like the valuable information you provide in your articles. I’ll bookmark your weblog and check again here frequently. I am quite certain I will learn a lot of new stuff right here! Good luck for the next!

Hi there, simply was aware of your blog thru Google, and found that it’s truly informative. I’m gonna watch out for brussels. I’ll be grateful if you continue this in future. A lot of other folks will probably be benefited from your writing. Cheers!

I was examining some of your blog posts on this website and I conceive this internet site is really informative! Retain putting up.

I like this post, enjoyed this one thankyou for putting up.

Good write-up, I am regular visitor of one?¦s site, maintain up the nice operate, and It’s going to be a regular visitor for a long time.

I like this blog very much, Its a really nice place to read and get information.

I really wanted to compose a small remark to be able to say thanks to you for these great recommendations you are giving at this website. My considerable internet lookup has finally been paid with awesome suggestions to exchange with my classmates and friends. I would assert that we visitors actually are very endowed to dwell in a superb place with very many outstanding professionals with very helpful points. I feel rather privileged to have used your entire webpages and look forward to really more pleasurable minutes reading here. Thanks again for all the details.

I’d forever want to be update on new articles on this website , saved to fav! .

I will right away clutch your rss as I can’t to find your e-mail subscription hyperlink or e-newsletter service. Do you’ve any? Kindly allow me recognise so that I may just subscribe. Thanks.

Wonderful beat ! I wish to apprentice while you amend your web site, how could i subscribe for a blog site? The account helped me a acceptable deal. I had been tiny bit acquainted of this your broadcast provided bright clear idea

I like what you guys are up also. Such intelligent work and reporting! Carry on the excellent works guys I’ve incorporated you guys to my blogroll. I think it’ll improve the value of my website :).

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I’d should examine with you here. Which isn’t something I often do! I get pleasure from reading a publish that will make folks think. Additionally, thanks for allowing me to comment!

The Real Person!

The Real Person!

Kamagra Oral Jelly pas cher: Kamagra pharmacie en ligne – kamagra pas cher

The Real Person!

The Real Person!

pharmacie en ligne sans ordonnance: pharmacie en ligne pas cher – pharmacie en ligne livraison europe pharmafst.com

kamagra oral jelly: kamagra pas cher – kamagra livraison 24h

The Real Person!

The Real Person!

Tadalafil 20 mg prix sans ordonnance: cialis generique – Tadalafil sans ordonnance en ligne tadalmed.shop

Kamagra Oral Jelly pas cher: kamagra livraison 24h – achat kamagra

The Real Person!

The Real Person!

pharmacie en ligne fiable: pharmacie en ligne – pharmacie en ligne pharmafst.com

The Real Person!

The Real Person!

Tadalafil achat en ligne: Cialis en ligne – cialis sans ordonnance tadalmed.shop

Kamagra Oral Jelly pas cher: Kamagra Commander maintenant – Kamagra Commander maintenant

The Real Person!

The Real Person!

Acheter Kamagra site fiable: acheter kamagra site fiable – Achetez vos kamagra medicaments

The Real Person!

The Real Person!

cialis prix: Cialis en ligne – Cialis sans ordonnance 24h tadalmed.shop

The Real Person!

The Real Person!

pharmacie en ligne france livraison internationale: Medicaments en ligne livres en 24h – Pharmacie sans ordonnance pharmafst.com

The Real Person!

The Real Person!

trouver un mГ©dicament en pharmacie: Pharmacie en ligne France – Pharmacie sans ordonnance pharmafst.com

The Real Person!

The Real Person!

Cialis en ligne: Tadalafil achat en ligne – cialis sans ordonnance tadalmed.shop

The Real Person!

The Real Person!

Acheter Cialis 20 mg pas cher: Cialis generique prix – Achat Cialis en ligne fiable tadalmed.shop

The Real Person!

The Real Person!

vente de mГ©dicament en ligne: pharmacie en ligne sans ordonnance – vente de mГ©dicament en ligne pharmafst.com

The Real Person!

The Real Person!

cialis sans ordonnance: cialis generique – Achat Cialis en ligne fiable tadalmed.shop

The Real Person!

The Real Person!

kamagra en ligne: kamagra oral jelly – acheter kamagra site fiable

The Real Person!

The Real Person!

Kamagra Oral Jelly pas cher: kamagra gel – kamagra en ligne

The Real Person!

The Real Person!

Tadalafil achat en ligne: Pharmacie en ligne Cialis sans ordonnance – Acheter Cialis tadalmed.shop

The Real Person!

The Real Person!

Acheter Viagra Cialis sans ordonnance: cialis sans ordonnance – cialis sans ordonnance tadalmed.shop

The Real Person!

The Real Person!

kamagra livraison 24h: kamagra livraison 24h – Kamagra Oral Jelly pas cher

The Real Person!

The Real Person!

legitimate canadian online pharmacies: pet meds without vet prescription canada – pharmacy wholesalers canada

The Real Person!

The Real Person!

indian pharmacy: indian pharmacy – indian pharmacy

The Real Person!

The Real Person!

mexico pharmacy order online: RxExpressMexico – mexican rx online

The Real Person!

The Real Person!

RxExpressMexico: mexico drug stores pharmacies – п»їbest mexican online pharmacies

MedicineFromIndia: indian pharmacy online shopping – Medicine From India

The Real Person!

The Real Person!

п»їbest mexican online pharmacies: Rx Express Mexico – buying from online mexican pharmacy

RxExpressMexico Rx Express Mexico mexican online pharmacy

canada pharmacy online: Express Rx Canada – best canadian online pharmacy reviews

The Real Person!

The Real Person!

canada ed drugs: Express Rx Canada – canadian family pharmacy

Medicine From India indian pharmacy online shopping Medicine From India

The Real Person!

The Real Person!

indian pharmacy online: Medicine From India – indian pharmacy online shopping

Rx Express Mexico: mexican online pharmacy – Rx Express Mexico

Medicine From India MedicineFromIndia Medicine From India

The Real Person!

The Real Person!

buy medicines online in india: medicine courier from India to USA – Medicine From India

canadian pharmacy no rx needed: Express Rx Canada – legal canadian pharmacy online

canadian pharmacy 1 internet online drugstore canada drugs online reviews legitimate canadian mail order pharmacy

The Real Person!

The Real Person!

indian pharmacy: Medicine From India – Medicine From India

The Real Person!

The Real Person!

пин ап казино официальный сайт: пин ап зеркало – пин ап вход

The Real Person!

The Real Person!

pin up az: pin up casino – pinup az

The Real Person!

The Real Person!

pinup az: pinup az – pin up azerbaycan

The Real Person!

The Real Person!

пин ап казино официальный сайт: пин ап вход – пин ап казино

The Real Person!

The Real Person!

pin up casino: pinup az – pin up casino

The Real Person!

The Real Person!

пин ап казино официальный сайт: пин ап вход – пин ап казино официальный сайт

The Real Person!

The Real Person!

вавада: вавада – вавада

The Real Person!

The Real Person!

пин ап казино: пин ап вход – пин ап казино официальный сайт

The Real Person!

The Real Person!

pin-up: pin-up casino giris – pin up az

The Real Person!

The Real Person!

вавада официальный сайт: вавада официальный сайт – вавада

пин ап казино: пинап казино – пин ап вход

пин ап вход: пин ап казино официальный сайт – пин ап вход

вавада зеркало: vavada casino – вавада зеркало

пин ап зеркало: пинап казино – пин ап казино официальный сайт

пинап казино: пин ап зеркало – пинап казино

pin up az: pinup az – pin up casino

вавада официальный сайт: вавада казино – вавада казино

пинап казино: pin up вход – пин ап вход

pin up вход: пин ап зеркало – пинап казино

vavada вход: вавада казино – vavada вход

pin up вход: пин ап зеркало – пин ап вход

pin up вход: пин ап вход – pin up вход

pin up azerbaycan: pin up – pin up az

pin-up: pinup az – pin-up casino giris

pin up casino: pin-up casino giris – pin up azerbaycan

The Real Person!

The Real Person!

http://pinupaz.top/# pin up

Thanks, I’ve recently been searching for information approximately this subject for ages and yours is the best I’ve found out till now. But, what in regards to the conclusion? Are you positive concerning the source?

The Real Person!

The Real Person!

purchase Modafinil without prescription: modafinil 2025 – safe modafinil purchase

The Real Person!

The Real Person!

FDA approved generic Cialis: affordable ED medication – generic tadalafil

Yeah bookmaking this wasn’t a bad conclusion outstanding post! .

The Real Person!

The Real Person!

affordable ED medication: Cialis without prescription – buy generic Cialis online

The Real Person!

The Real Person!

best price for Viagra: secure checkout Viagra – cheap Viagra online

The Real Person!

The Real Person!

safe modafinil purchase: legal Modafinil purchase – Modafinil for sale

The Real Person!

The Real Person!

best price Cialis tablets: online Cialis pharmacy – secure checkout ED drugs

The Real Person!

The Real Person!

secure checkout Viagra: discreet shipping – trusted Viagra suppliers

I have not checked in here for a while as I thought it was getting boring, but the last several posts are good quality so I guess I’ll add you back to my everyday bloglist. You deserve it my friend 🙂

The Real Person!

The Real Person!

generic tadalafil: buy generic Cialis online – generic tadalafil

http://modafinilmd.store/# safe modafinil purchase

The Real Person!

The Real Person!

Cialis without prescription: reliable online pharmacy Cialis – secure checkout ED drugs

https://zipgenericmd.shop/# Cialis without prescription

online Cialis pharmacy: Cialis without prescription – cheap Cialis online

The Real Person!

The Real Person!

Viagra without prescription: safe online pharmacy – same-day Viagra shipping

http://zipgenericmd.com/# discreet shipping ED pills

order Viagra discreetly: secure checkout Viagra – buy generic Viagra online

The Real Person!

The Real Person!

discreet shipping: secure checkout Viagra – trusted Viagra suppliers

https://modafinilmd.store/# safe modafinil purchase

same-day Viagra shipping: no doctor visit required – secure checkout Viagra

The Real Person!

The Real Person!

online Cialis pharmacy: cheap Cialis online – buy generic Cialis online

http://maxviagramd.com/# no doctor visit required

The Real Person!

The Real Person!

generic tadalafil: discreet shipping ED pills – FDA approved generic Cialis

The Real Person!

The Real Person!

Amo Health Care: cost of amoxicillin – Amo Health Care

The Real Person!

The Real Person!

cost of cheap clomid without a prescription: where buy generic clomid prices – how can i get generic clomid without insurance

The Real Person!

The Real Person!

generic amoxicillin online: amoxicillin 500 mg online – amoxicillin 500 tablet

The Real Person!

The Real Person!

PredniHealth: over the counter prednisone cream – PredniHealth

tadalafil versus cialis: is generic cialis available in canada – how long does cialis stay in your system

walgreen cialis price: TadalAccess – cialis experience forum

buy cialis in canada: cialis generic overnite – cialis review

Ero Pharm Fast Ero Pharm Fast best ed pills online

get antibiotics quickly: antibiotic without presription – over the counter antibiotics

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

get antibiotics quickly: BiotPharm – buy antibiotics for uti

http://eropharmfast.com/# cheap ed medicine

ed medications cost Ero Pharm Fast Ero Pharm Fast

buy antibiotics for uti: Biot Pharm – buy antibiotics from india

Online medication store Australia: online pharmacy australia – Licensed online pharmacy AU

PharmAu24: online pharmacy australia – pharmacy online australia

https://pharmau24.com/# Online drugstore Australia

Pharm Au24: Online medication store Australia – PharmAu24

online prescription for ed Ero Pharm Fast Ero Pharm Fast

over the counter antibiotics: buy antibiotics online – buy antibiotics from canada

The Real Person!

The Real Person!

It’s time to soar to new heights with BGaming! Launching the rocket to the stars means getting incredible winnings! Space XY is an exciting game with easy gameplay. Don’t hesitate to join a breathtaking ride to the stars and make a fortune. These online gambling crash games are highly interactive and dynamic, resembling video games with sleek graphics and engaging animations. Many players love crash gambling for its straightforward mechanics without any complicated rules or strategies. Success relies on focus, timing, and implementing a solid crash gambling strategy to keep calm and time your cashout wisely. How to play Space XY Space XY is an incredibly innovative online slot game that offers a unique and captivating gaming experience. With its unconventional gameplay and distinctive design, it stands out from other online slots in the market. However, evaluating this game based on traditional metrics becomes somewhat irrelevant due to its unusual nature.

http://users.atw.hu/nlw/profile.php?mode=viewprofile&u=22434

We help our players make smart bets on raja games. Our tools give you insights to increase your chances of winning. Plus, we offer promotions and bonuses to enhance your gaming. This one is accessible to all categories of users. The next level injector is a 3rd party app called Mind FF Injector that has been added with all of the customizations. There aren’t any new players who can win the battle because they aren’t very good at the battle at the start. So, using this hack they can easily get their desired rank in Free Fire. Welcome to Cyber Mayhem This app is filled with bonuses and promotional offers. These keep the players engaged and give them confidence to play more games. Bonuses can be reinvested in the games or you can withdraw them. One of the bonuses is the first deposit bonus which rewards you 10% of your deposits. There are many more bonuses and promotional offers like this to visit them download the app from our website.

cheapest antibiotics: BiotPharm – buy antibiotics from india

http://eropharmfast.com/# affordable ed medication

Over the counter antibiotics for infection: Biot Pharm – get antibiotics quickly

ed pills cheap online ed medicine Ero Pharm Fast

get antibiotics quickly: BiotPharm – buy antibiotics for uti

ed rx online how to get ed pills Ero Pharm Fast

http://biotpharm.com/# buy antibiotics over the counter

buy ed meds: cheapest ed treatment – where can i get ed pills

The Real Person!

The Real Person!

تختلف قواعد Aviator 1xBet عن العديد من الألعاب الأخرى التي تعتمد على الحظ والاستراتيجية. بينما تعتمد بعض الألعاب على الدوران العشوائي أو البطاقات، تعتمد Aviator 1xBet على توقيت دقيق واتخاذ قرارات سريعة.مكافأة الرهان المجاني نعم ، لعبة Aviator هي لعبة مراهنة شرعية على الإنترنت. تستخدم اللعبة تقنية متقدمة ومولدات أرقام عشوائية للتأكد من أن نتيجة كل جولة عشوائية تمامًا ولا يتم التحكم فيها أو التلاعب بها بأي شكل من الأشكال. خطوات وضع الرهانات استخدام استراتيجية الطائرة 1xBet يمكن أن يساعد في تحقيق نجاح أكبر. هنا بعض النصائح والاستراتيجيات لتحقيق الفوز:

https://4part.kaporghor.com/%d9%84%d8%b9%d8%a8%d8%a9-%d8%a7%d9%84%d8%b7%d9%8a%d8%a7%d8%b1%d8%a9-by-spribe-a-popular-casino-game-experience-in-egypt/

في لعبة الطياره الرهان يعتمد على خوارزمية متطورة لتوليد نتيجة كل جولة لعبة بشكل عشوائي تمامًا غير قابل للتنبؤ، كما هو الحال مع جميع ألعاب كازينو 888starz. صُممت برمجيات توليد الأرقام العشوائية لتضمن الامتثال الكامل لسياسات اللعب العادل، وتلعب دورًا رئيسيًا في كيفية عمل لعبة Aviator. يمنحك الوضع التجريبي في لعبة Aviator إمكانية اختبار كامل خصائصها. يحصل كل لاعب على رصيد افتراضي (3000 وحدة نقدية) من كازينو 888starz لخوض التجربة. يمكنك وضع الرهانات واتخاذ قرارات صرف الأرباح تمامًا كما هو الحال في وضع استخدام المال الحقيقي. بالنسبة إلى اللاعبين المبتدئين، يعتبر وضع اللعب المجاني بيئة مثالية للتعرف على آليات اللعبة وتطوير استراتيجياتهم الخاصة.

The Real Person!

The Real Person!

Os usuários podem sacar e depositar usando cartões de débito e crédito, muitos jogadores estão procurando os melhores cassinos com códigos de bônus em 2023. Uma vez registrados, segundo e terceiro carretel. Apesar do motivo, a maioria dos jogadores achou mais fácil confiar neste cassino porque sabem que corpos prolíficos estão de costas para o caso de algo dar errado. Vamos ser honestos, onde se convive lado a lado com camelos. Os bônus de Depósito não valem a pena se preocupar muito como um jogador de blackjack de apostas altas, pois os rolos estão cheios de ambiente familiar. Nosso objetivo é atender a empresas em consultoria, prevenção e mitigação de todos os riscos jurídicos.

https://100.nomankhan.net/2025/05/27/review-of-jetx-by-smartsoft-an-immersive-casino-game-experience-for-brazilian-players/

When you’re tired, look for ringtones to relax, if you don’t know where to download free French phone ringtones, visit here. sonneriesvip Aviator de Spribe es un juego similar al Jet X Casino Game. Puedes ganar dinero fácilmente en este juego, que se desarrolla a un ritmo rápido. También se podría decir que Aviator es un juego de catálogo Jet X por el GSR, la volatilidad, las frecuencias multiplicadoras, etc. Puedes ganar grandes premios en metálico y muchos más si sigues patrones específicos para dirigir el resultado del juego. No Mostbet Casino, voce encontrara uma gama de entretenimento de cassino que vai desde os tradicionais como slots de video e roleta europeia ate transmissoes ao vivo que recriam a vibracao dos cassinos fisicos. Com animacoes de alta resolucao e uma experiencia amigavel, a plataforma e projetada para proporcionar uma experiencia imersiva e acessivel.

The Real Person!

The Real Person!

El bot 1win Lucky Jet no está conectado al servidor del juego y podría resultar una estafa. Mantén un buen manejo del presupuesto y pon en práctica estrategias mediante el modo demo. El juego Lucky Jet 1win tiene una dinámica muy parecida a la de Aviator. El objetivo es lograr sacar la apuesta multiplicada por el coeficiente de ese momento antes de que el cohete se vaya volando. El 1win juego podría alcanzar hasta x100, lo que significa grandes ganancias potenciales. luckyjet.co © 2025 LuckyJet sitio web oficial. Jet X no solo proporciona un retiro automático, sino que también permite a los jugadores apostar automáticamente la cantidad que especifican sin la necesidad de un esfuerzo adicional. Gracias a estas características, jugar en Jet X es especialmente conveniente para los usuarios.

https://azizcontracting.com/explorando-el-juego-balloon-de-smartsoft-en-los-casinos-online-venezolanos/

Imagine estar en las bulliciosas calles de Brasil, donde la pasión por el fútbol se respira en cada rincón. Con una banda sonora de samba que encapsula el espíritu brasileño, Penalty Shoot Out Street te transporta a un campo de fútbol local bajo el sol abrasador. Los jugadores esquivan gatos callejeros y sortean coches aparcados mientras se preparan para patear el balón hacia una red blanca inmaculada. ¡Penalty Shooters 2 fue creado por 10x10games! Dicho esto, reglas del blackjack básicas la alta gerencia de Eldorado supervisará las operaciones. Como beneficio adicional, qué genial sería si tuvieras dos oportunidades de hacer precisamente eso este sábado 25 de octubre. Esto es exactamente lo que los jugadores deben hacer, entre otros. Además, es posible que se encuentre con casinos que brindan códigos de bonificación específicos para sus diferentes ofertas de bonificación lanzadas a lo largo del año. Por lo tanto, pero decidió en 2023 ser un casino criptoexclusivo. El lunes, damas y caballeros.

The Real Person!

The Real Person!

The expert players of top casinos consider the martingale strategy to be a beneficial option for crash games, and JetX is no exception. Using it is quite straightforward: you start with a small bet; If you lose, instead of giving up, you double your bet for the next round. By implementing the martingale strategy, you not only recover all your previous losses but also make a profit. New to the world of online casino games? Heard about JetX but not quite sure what it is or how to play? Don’t worry, we’re here to help. In this article, we’ll give you a detailed review of the game, with all the useful information you need in order to make the most of your experience and have a greater chance at winning big. Thousands of players have already tried their luck with JetX with varying degrees of success. So if you haven’t done so yet, it’s time to give it a go!

https://thealchemyadvisors.com/aviator-demo-everything-you-need-to-know/

Contact Slate or call (954) 869-8796 Some of the flights on this website are financially protected by the ATOL scheme. But ATOL protection does not apply to all travel services listed on this website. Please ask us to confirm what protection may apply to your booking. If you do not receive an ATOL Certificate then the booking will not be ATOL protected. If you do receive an ATOL Certificate but all the parts of your trip are not listed on it, those parts will not be ATOL protected. Please see our Participant Agreement conditions for information or more information about financial protection and the ATOL Certificate, go to caa.co.uk. Dammam to Cairo Flight The flight attendant served drinks and snacks during the 43-minute flight. The plastic cups and packaged snacks from a snack basket felt a bit short of what you might expect when flying private. But for the price I paid, it was perfectly fine. No additional drinks or snacks were offered.

The Real Person!

The Real Person!

Any instrument larger than 30cm x 120cm x 38cm like a double bass or harp can’t be taken on board the aircraft as cabin baggage. You’ll need to add hold luggage to your booking for these items. Please ensure it’s packed safely and securely. Take your 8in x 11in thermal printer to the next level by creating the PocketJet printer you need. With a lightweight yet powerful build, long-lasting battery, more media options1, off-the-shelf software and a wide variety of mounts and accessories, you can fully customize the Brother PocketJet 8 for your productivity. LADIES COLLECTION Excellent TrustScore Trailblazing. Innovation. Precision. For 150 years, Bulova has stayed true to these pillars of excellence. Join us in celebrating our rich legacy as the oldest American watchmaker, proudly established in NYC.

https://visitcentraljava.com/football-x-by-smartsoft-a-thrilling-online-casino-game-for-indian-players/uncategorized/

NEW YORK — U.S. authorities moved Monday to seize two luxury jets — a $60 million Gulfstream and a $350 million aircraft believed to be one of the world’s most expensive private airplanes — after linking both to Russian oligarch Roman Abramovich. Watch the Jets quarterback and receiver link-up for a big play during 7-on-7 drills at OTA practice. NEW YORK — U.S. authorities moved Monday to seize two luxury jets — a $60 million Gulfstream and a $350 million aircraft believed to be one of the world’s most expensive private airplanes — after linking both to Russian oligarch Roman Abramovich. Save my name, email, and website in this browser for the next time I comment. Watch the Jets first-round pick on the practice field for the first time during rookie minicamp. September 6-8, 2023 | Hilton City Center Denver

The Real Person!

The Real Person!

Wichtige Mitteilung El juego de futbol – Penalti invita a los jugadores a la parte decisiva del gran partido y los insta a utilizar toda su destreza y precisión para superar al portero contrario en una emocionante tanda de penaltis. Sigue el choque a través de Flashscore. Además, si estás de acuerdo, también utilizaremos cookies para complementar tu experiencia de compra en las tiendas de Amazon, tal y como se describe en nuestro Aviso de cookies. Tu elección se aplica al uso de cookies de publicidad propias y de terceros en este servicio. Las cookies almacenan o acceden a información estándar del dispositivo, como un identificador único. Los 96 terceros que utilizan cookies en este servicio lo hacen con el fin de mostrar y medir anuncios personalizados, generar información sobre la audiencia, y desarrollar y mejorar productos.

https://code.datasciencedojo.com/rjdfrz7188

Looking to bring beauty and inspiration from your landscape design? We specializes in building custom, one of a kind outdoor living spaces in Columbus, OH. outdoor living designs Columbus If you are looking for a website that can provide information and techniques for playing. online casino Then we are the website you are looking for and answer the question perfectly because we have gathered both information and techniques for you in a version that can be understood in 5 minutes to make you Este es un juego multijugador creado por BC Originals. En él, un cohete, simbolizado por un punto blanco, se mueve a través de un gráfico, recolectando multiplicadores hasta que se estrella. El desafío es predecir hasta dónde llegará el cohete y retirar antes del choque. Lanzado en 2017, este juego se ha convertido en una parte clave del casino criptográfico BC.Game, presentando un RTP alto del 99%.

The Real Person!

The Real Person!

Oyunçular təyyarə təsadüfi havaya qalxmazdan ibtidai mümkün olan daha təntənəli çarpanla para çıxarmağa çalışırlar. 1xBet, Aviator və vahid çox digər kazino oyunları üçün asudə və təhlükəsiz platforma təmin edən aparıcı online kazinosudur. Biz ümumən oyunçular üçün xoş imtahan təmin etmək ötrü məsuliyyətli qumar təcrübələrinə sadiqik. Bu veb-saytdan istifadə etməyə davam etməklə siz Kuki Siyasətimizə əlaqəli olaraq kukilərin istifadəsinə razılıq verirsiniz. Without leaving your home, you can have your loan in an hour once your application for a payday loan is approved. Unlike when you apply for a loan from banks which requires you to endure a waiting time to process all the documents needed, a payday loan is easy to avail. They need no documentary documents, unlike banks which do not also approve short term and unsecured credit.

http://dados.unirio.br/user/adburwater1984

Aviator Predictor to narzędzie, które obiecuje przewidzieć rezultat gry Aviator, pomagając graczom decydować, kiedy wypłacić wygraną. Brzmi jak marzenie, ale w praktyce takie rozwiązania często nie mają nic wspólnego z grą fair-play i mogą naruszać regulamin kasyna. Rzekomo oprogramowanie ma działać w następujący sposób: Jeśli chodzi o czat, to na samym początku podłącza się wirtualny asystent, możesz jednak go pominąć, nawiązując szybkie połączenie z prawdziwym konsultantem. Ten podłączy się po kilku sekundach od Twojej prośby. Miłym gestem jest dostępność polskojęzycznego wsparcia z krwi i kości. Sprawdziłem dokładnie, jak radzi sobie pomoc w 22bet i jestem pozytywnie zaskoczony. To nie tylko fachowa obsługa, ale i uprzejma, informująca zawsze o bonusach, z których możesz skorzystać.

The Real Person!

The Real Person!

Os minutos pagantes do fortune tiger nada mais são do que minutos específicos durante o dia que o jogo do tigre aposta costuma pagar prêmios mais altos aos jogadores..A ideia é que esse post seja bem curto mesmo e sem enrolação.Então vamos lá…. No entanto, antes de se cadastrar em qualquer plataforma, é preciso escolher uma operadora confiável. Abaixo, listamos os melhores sites e as ofertas promocionais para quem quer jogar o Jogo Fortune Tiger, ou Jogo do Tigrinho e apostar. Separamos abaixo as cinco principais opções de casas para jogar: Isso é uma ótima maneira de se familiarizar com os recursos e mecânicas do Fortune Tiger antes de decidir jogar com apostas de verdade. Se você aprecia a experiência de jogo com Fortune Tiger, talvez também esteja interessado em outros jogos cativantes da PG Soft. Descubra as aventuras únicas e os gráficos ricos de Fortune Rabbit e Fortune Mouse, duas outras máquinas caça-níqueis que prometem uma experiência de jogo emocionante e lucrativa.

https://camp-fire.jp/profile/humlenito1971

\nNa Stake cassino, nossa biblioteca de caça-níqueis é constantemente atualizada com novos lançamentos semanais, garantindo que você tenha sempre a melhor experiência e acesso às últimas novidades. Se você é iniciante e está começando no mundo dos cassinos online, não deixe de conferir o nosso blog com dicas e tutoriais sobre como jogar caça-níqueis online . Atenção: Altamente viciante. Pode causar surtos de alegria e giros compulsivos. Se você girar 300 vezes e sonhar com símbolo Scatter… bem-vindo ao clube. E essa acaba sendo apenas algumas das estratégias do fortune rabbit, ok? A PG Soft (Pocket Games Soft) é uma fornecedora global de jogos de apostas especializada em slots online. Seus jogos são conhecidos por alta volatilidade, bônus emocionantes e RTP competitivo, proporcionando grandes oportunidades de lucro para jogadores de todos os níveis.

The Real Person!

The Real Person!

La noi, pe jocpacanele.ro, găsești cea mai mare gamă de jocuri păcănele online. Încearcă gratis zecile noastre ✅păcănele 7777, ✅păcănele cu speciale, ✅păcănele cu fructe, ✅păcănele Book of Ra și multe, multe altele! Am pregătit pentru tine păcănele online cu număr variat de role și animații dintre cele mai complexe, astfel încât divertismentul să atingă cote maxime. Joacă sloturi gratis și descoperă favoritele tale! Noi ne-am îndrăgostit de jocurile Gates of Olympus și Sugar Rush. Tu? Bei dem Sweet Bonanza no deposit Bonus 2025 handelt es sich um Kennenlernangebote, sodass Sie Online-Casinos ohne Risiko testen können. Die Anzahl der Freispiele ohne Einzahlung ist beschränkt. Hohe Gewinne sind mit den Sweet Bonanza Freispielen ohne Einzahlung deshalb nicht zu erwarten. Mit den Free Spins können Sie Sweet Bonanza kostenlos spielen, sich ein erstes Bild von dem Slot machen und mit etwas Glück sogar Geld ohne Risiko gewinnen.

https://yoomark.com/content/man-kann-nicht-abstreiten-dass-sweet-bonanza-sehr-viel-spass-macht-wir-hatten-auf-jeden-fall

Wildz vereint alle wichtigen Elemente für eine tolle Online Spielothek. Unsere Wildz Erfahrungen zeigen: Deutsche Lizenz und sichere Zahlungen sind nur der Anfang. Im nachfolgenden Wildz Test enthüllen wir die Vorteile des Spielangebots und Boni. Wir prüfen außerdem, ob die Bonusbedingungen auch für Glücksspiel-Neulinge geeignet sind und zeigen weitere Besonderheiten des Anbieters, wie die fairen Bonusbedingungen. Jetzt nachlesen oder direkt anmelden! Wer von neuen Spielen fasziniert ist, findet im Wildz Casino eine Kategorie für brandneue Slots. Hier lässt sich immer aktuell nachvollziehen, welche Neuerscheinungen uns die Softwareanbieter beschert haben. Trotzdem gibt man sich hier selbstsicher. Nicht jedes neue Casino-Spiel hat automatisch seinen Platz im Wildz verdient. Man selektiert und versucht der Spielergemeinde ausschließlich etablierte Top-Titel anzubieten.

I really like your writing style, excellent info, thanks for posting :D. “God save me from my friends. I can protect myself from my enemies.” by Claude Louis Hector de Villars.

The Real Person!

The Real Person!

Oyunun ana özelliği, balık sembolleri yakalayarak mümkün olan en önemli ödülleri almaya çalışan Fisherman Wild’dir. Özellikle, fiyatlarla ne kadar çok balık sembolü olursa, sonunda ödeme o kadar büyük olur! Big Bass Bonanza Açağı, popüler bir online slot oyunudur. Balık avı temasıyla dikkat çekiyor ve casino oyunları arasında yer alıyor. Büyük balık avı elde etmek için şansınızı denemek için idealdir. Slot makineleri arasında popüler ve övgü almaktadır. Oyunun temeli, makaraları çevirip büyük balıkları yakalamak üzerine kurulu. Kazançlarınızı artırmak için stratejik bir şekilde makaraları çevirin ve en büyük balıkları yakalamak için şansınızı deneyin. Mesaj bırakın Slot Oyunları Yapmak -Pikachu Zinciri Yıldırım – Oyun alanında birçok balık arasında bir zincir oluşturur ve çok sayıda balıkta hasara neden olur.

https://wiki.petale07.org/?unotranlou1980

Big Bass Splash Slot, oyuncuları canlı bir su altı kanyonu fonunda canlı bir balık avı seferine sürüklüyor. Kristal berraklığındaki sulara batırılmış makaralar, sallanan su bitkileri ve ara sıra yanlarından geçen gölgeli balıklarla çevrilidir. Oyunun ana karakteri olan dost canlısı balıkçı, neşeli tavrı ve büyük boy avıyla hoş bir dokunuş katıyor. Slotun grafikleri renkli ve gösterişlidir, olta takımı ve ikonik Big Bass gibi semboller temayı güçlendirir. Görselleri tamamlayan, banjo notaları ve martıların ortam seslerini içeren neşeli bir film müziği, kırsal bir balıkçılık havası yaratıyor. Bu neşeli atmosfer, her dönüşü bir balıkçılık tatili macerası gibi hissettirir. Ready to go fishin’? If you love reeling in the big fish, you’ll be delighted with the new Pragmatic Play slot, Big Bass Bonanza. A slot game with five reels and 10 paylines, it comes with sky-high RTP and is jam-packed with top special features.

The Real Person!

The Real Person!

Que porcaria eu detestei leva 5000anos pra carega mesmo num aiphone 16 By using penaltyshootout.cl you agree to the use of cookies. Connected Numbers ¿No te gustaría probar con otra búsqueda? Los siguientes datos pueden usarse para rastrearte en apps y sitios web que son propiedad de otras empresas: Una estrategia que siguen los jugadores chilenos en esta slot es repetir el disparo a la misma zona de la portería en varias ocasiones. Además, es recomendable tomarse descansos y no seguir siempre los mismos patrones a la hora de lanzar los penaltis en el juego. SPONSOR OFICIAL Aún no hay comentarios más gustados Pero si hablamos de jugar con cabeza, Player City ofrece un análisis completo del juego: qué lo hace diferente, cómo funcionan los tiros y bloqueos, qué nivel de dificultad presenta, y cómo influye la aleatoriedad en cada ronda. Además, el sitio permite acceder a una versión gratuita tipo demo, donde puedes practicar sin arriesgar dinero real.

https://bruckners.devsaffinity.site/resena-del-juego-balloon-de-smartsoft-para-jugadores-en-ecuador/

La apuesta mínima a la hora de jugar Penalty Shoot Out es de 1.026 CLP por cada lanzamiento de penalti, mientras que la cantidad máxima que se puede apostar es de 1.026.350 CLP. Al elegir una de las cinco zonas distintas, es necesario esperar para ver si el portero detiene el disparo. Desarrolle una carrera con nuestro nuevo XP y sistema de nivelación. ¡Llena tu vitrina de trofeos completando logros y muestra tu rango en el juego en línea! Tras completar los 90 minutos, el marcador ya no se movió, así que el ganador tuvo que ser definido desde los 11 pasos. El FC Barcelona estuvo cerca de llevárselo, pero Saviola falló su penalti. Esto se repitió pero ahora del lado del Real Madrid con la falla de Fernando Sanz. La tercera fue la vencida pues Raúl Bravo no dudó y definió el encuentro del lado merengue.

The Real Person!

The Real Person!

Dragon Tiger 888: A Thrilling Card Game A free app for Android, by Shleyatenia. Friends, you can see in the image below that this application gives very quick withdrawal, this application is very good, if you have not yet downloaded this application, please download immediately because this application is a real gaming application and provide real cash. Friends, this application is not fake, it is very real and it gives payment within 15 minutes, so you must download it. Animal experiences you can’t get anywhere else. General admission tickets are required. A free app for Android, by Shleyatenia. Play games and earn money: – Friends game 3f apk Earning app has total 22 types of games, out of which you can play any game, about which game you have knowledge, in this app dragon vs tiger game is the easiest and my Favorite game is you play your favorite game.

https://venus-arabiya.com/2025/07/03/review-of-aviator-by-spribe-visualizing-payouts-on-the-login-dashboard/

Answer: To sign up for the Ind Slots APK, follow these steps: Stickman Dragon Fight can be played on your computer and mobile devices like phones and tablets. Answer: To sign up for the Ind Slots APK, follow these steps: Is 3 Patti Lucky mod APK available? Bet PKR has quickly become a favorite card game in Pakistan offering a blend of strategy social interaction & real-money rewards. Whether you’re new to the game or a seasoned player learning the rules & mastering the strategies can significantly improve your chances of winning. With its exciting features secure banking options & generous bonuses, BetPKR offers endless entertainment. You can download the application today and get your welcome bonus without investing any money. Try to play the Dragon Warrior Card game that offers big cash prizes these days. You can bind your account with the app to receive your daily funds. This game is indeed a blessing in disguise for those who want an instant change in their life and enjoy the unlimited funds.

The Real Person!

The Real Person!

Space XY is an interesting new game in the Crash genre from renowned developer Bgaming. Here you can get a big win of up to x10,000 in just two clicks if you’re lucky. In doing so, your decisions affect whether you win or lose. At 1win we offer you the chance to play this game for real money. Create a 1win account, make a deposit and start playing the Spacy XY game with a welcome bonus of up to INR 145,000! Aviator game offers an innovative gaming experience unlike, slot machines. The game has no reels or paylines, which makes it different from other gambling games. Players can rely on luck or play strategically. In our opinion, Aviator gives a unique gaming experience and excitement in every round. Space XY offers players a maximum multiplier of x10,000 of a player’s bet. Players can get a substantial big win, with its unique gameplay potentially leading to significant payouts based on players’ chosen strategies.

https://ntamconnect.com/download-the-aviator-game-app-without-third-party-hassle/

3. Enjoy playing Dragon Tiger Nice – game club on GameLoop Teen Patti – An Indian 3-Card Poker Game Funny Teenpatti TeenPatti Yono-3Patti Rummy: Strategy Meets Luck In the dynamic world of Teen Patti, strategies like Tiger and Dragon hold a unique allure. These tactics, often discussed among players, represent distinct approaches to the game. Understanding these strategies can significantly impact your gameplay and success in 3 Patti room. چاہے آپ نئے کھلاڑی ہوں یا ماہر، 3 Patti Room میں ہر کسی کے لیے ہے کچھ خاص۔ مختلف رومز میں شامل ہوں، لائیو ٹورنامنٹس کھیلیں، اور روزانہ جیتیں شاندار انعامات۔ بہترین گرافکس، محفوظ سسٹم، اور تیز ترین وِدڈرا کے ساتھ، یہ ہے آپ کا نیا فیورٹ گیم۔

The Real Person!

The Real Person!

Space for Weddings αγοράσετε Viagra online χωρίς συνταγή We focused on dining tables that could seat four to six people, though we also considered a few two-person options for small spaces, as well as large tables for up to 10 people. In addition to size, we looked for spacious seat dimensions, generous weight capacities, high-quality construction, and a mix of materials and styles. We spent 80-plus hours assembling, testing, and researching patio dining furniture in all kinds of climates and spaces, including sun-drenched desert yards, damp wintery porches, and cramped urban balconies. Here are the best sets we’ve tried so far. If there’s one thing many people ask co-owners Jerry Nguyen and Chad Porter when they step into Wichita’s newest gay dance bar, it’s where the two men got the name, XY.

https://daniel-k.weballly.com/discovering-mines-by-spribe-a-popular-online-casino-game-for-pakistani-players/

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”). This material is intended for information purposes only, and does not constitute investment advice, a recommendation or an offer or solicitation to purchase or sell any securities, funds or strategies to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. In the U.S., this material is intended for public distribution. XY Miners is listed in the United Kingdom and works under the FCA (Financial Conduct Authority) regulations, verifying that it is transparent and complies with the law. The total market value of a cryptocurrency’s circulating supply. It is analogous to the free-float capitalization in the stock market.

The Real Person!

The Real Person!

تحميل برنامج 1xbet مهكر أو أي برنامج آخر مهكر بسبب أن هذا غير قانوني ويعتبر انتهاكا لحقوق الملكية الفكرية يجب علينا دعم العمل القانوني وعدم التورط في أي نشاط غير قانوني ينصح 1xbet تنزيل برنامج والتطبيقات من مصادر رسمية موثوقة وتجنب استخدام 1xbet تنزيل برنامج حيث قد تتسبب في تعريض جهازك للخطر وفقدان البيانات الشخصية أو المالية. Survival Challenge 456 Mod Apk 2.0.3 تحميل برنامج 1xbet مهكر أو أي برنامج آخر مهكر بسبب أن هذا غير قانوني ويعتبر انتهاكا لحقوق الملكية الفكرية يجب علينا دعم العمل القانوني وعدم التورط في أي نشاط غير قانوني ينصح 1xbet تنزيل برنامج والتطبيقات من مصادر رسمية موثوقة وتجنب استخدام 1xbet تنزيل برنامج حيث قد تتسبب في تعريض جهازك للخطر وفقدان البيانات الشخصية أو المالية.

https://risanstore.com/%d8%aa%d8%ad%d9%84%d9%8a%d9%84-%d8%a7%d9%84%d9%81%d8%b1%d9%82-%d8%a8%d9%8a%d9%86-%d9%84%d8%b9%d8%a8%d8%a9-aviator-%d9%81%d9%8a-1win-%d9%88-1xbet-%d9%85%d9%86-%d8%a7%d9%84%d8%a3%d9%81%d8%b6%d9%84/

√ استخدام سكريبت الطياره يجعلك مختلف عن اللاعبين الاخرين وتحقيق اكثر استفاده للربح باستمرار وتجنب الخساره وبالتالي يجد صعوبه لدى الاشخاص. كذلك في تحميل السكريبت وتفعيله داخل المنصه اصبح الامر سهل في موقعنا. هل سكربت الطياره امن؟ 6.8 سكربت الطياره 500$ الوصول الى جميع الاسكريبتات التي يتم الترويج اليها من خلال الاتصال بالانترنت. كذلك من اهم المميزات التالي : √ امكانيه تحقيق الربح من لعبه الطياره من خلال استخدام سكربت الطياره والتعرف على طرق التشغيل المجانيه لا يتطلب منك اشتراك. كذلك من اجل تفعيل السكريبت يمكنك استخدامه لمواجهه التحدي.

The Real Person!

The Real Person!

I think this is a superb welcome offer and for context, I consider the average social casino new customer bonus to be around 7,500 Gold Coins and 2 Sweeps Coins. This means that Spinpals gives you more of both virtual currencies than the average. As I mentioned, there isn’t a Spinpals promo code, and there isn’t anything like a Spinpals deposit bonus either. How Go can help keep you secure by default A booking code enables you to book or transfer a bet. odds or availabilities may change. Below are Rocket X promo codes that you can use when you sign up for an account on the casino website or through the mobile app. When submitting your promotional content, make sure that your promotional content contains all critical information about your moment. In particular, make sure that your promotional content submissions clearly communicate the following:

https://bruckners.devsaffinity.site/secure-payment-options-for-jetx-users-worldwide-a-review/

In conclusion, Roobet Crash Demo version is a great way to practice the game and test strategies without the risk of losing real money. It’s an excellent tool for both new and experienced players to get comfortable with the game. However, always remember to gamble responsibly, even when you transition to the real game. The RTP for Roobet Crash is 96.5%. In the long term, you can anticipate earning $96.5 for every $100 wagered in theory. Although the RTP is higher than average, we know that crash games like Fury Stairs, Hyper Xplorer, and Space XY have higher RTP. The best strategy is to start with small bets and gradually increase them as you become more familiar with the game. Once you get a feel for how the game works, you can start placing larger bets and taking bigger risks. However, be careful not to overdo it – if you bet too much, you could lose everything!

The Real Person!

The Real Person!

Kiedy grasz w trybie demo, zyskujesz pewność siebie i oswajasz się z grą. Będziesz wtedy gotów, aby przejść do gry Aviator na prawdziwe pieniądze. Demo gry Aviator wzbogaci twoje wrażenia z rozgrywki, a nawet zwiększy Twoje szanse na sukces. Poświęć więc trochę czasu na zapoznanie się z trybem demonstracyjnym. To twoja tajna broń do sukcesu! Sektor gier mobilnych przeżywa boom, a na czele znajduje się 1win Lucky Jet 1win APK. Dla entuzjastów najnowocześniejszych gier kasynowych i zakładów sportowych, pobranie Lucky Jet 1win APK jest pierwszym krokiem w kierunku ekscytującej podróży. Aplikacja przyciągnęła uwagę dzięki płynnej integracji różnorodnych opcji gier, dzięki czemu jest to kluczowy moment, aby dołączyć do społeczności i rozpocząć przygodę z grami.

https://forumodua.com/member.php?u=687137

Join the community of enthusiastic players and dive into the exhilarating world of Aviator APK. With a simple download, you can start your journey to uncover the secrets of the skies and potentially walk away with massive wins! Click the link below to start your adventure today! Copyright © 2014-2025 APKPure. Wszelkie prawa zastrzeżone. Aviator to nowoczesna gra crash, która zrewolucjonizowała świat hazardu online. Łącząc w sobie elementy tradycyjnych gier losowych z dynamiczną rozgrywką w czasie rzeczywistym, Aviator Game Online oferuje graczom unikalne doświadczenie oparte na prostych zasadach i możliwości osiągnięcia wysokich mnożników. Przygotowaliśmy szczegółowe zestawienie najważniejszych informacji technicznych i wymagań systemowych dla Aviator Game APK. Poniższa tabela zawiera kompletny przegląd specyfikacji:

The Real Person!

The Real Person!

Voilà un très bon jeu pour les amateurs de footb… Vous êtes à la recherche d’une expérience de jeu de football passionnante ? Penalty Shoot-Out: Street est là pour vous. Ce jeu dynamique a captivé des joueurs du monde entier grâce à sa simplicité et à son action effrénée. Mais ce n’est pas tout, si vous cherchez à vous lancer sans risque, certaines offres de bienvenue vous permettent de jouer gratuitement. Découvrez comment ce jeu vous plonge au cœur de l’action du penalty shoot-out tout en profitant d’avantages exclusifs pour une expérience encore plus excitante. рџљЂ Crash Casino Mini-jeux Jeux de mines Hockey Shootout « Mystake Penalty » est l’une des offres les plus exaltantes dans le monde des jeux de casino en ligne. Conçu avec précision par EvoPlay, ce jeu capture l’essence des tirs au but dans le monde réel, en l’associant parfaitement au frisson des enjeux du casino. Les joueurs sont transportés dans un stade virtuel, où ils affrontent de redoutables gardiens de but, dans le but d’effectuer le tir parfait. Chaque tir dans « Mystake Penalty » est un mélange de stratégie, d’habileté et d’une touche de chance, ce qui rend chaque partie imprévisible et immensément captivante. Les graphismes sont de premier ordre, avec de superbes animations et des effets sonores qui amplifient la tension du jeu.

https://onlinedigitalbookmark.com/page/business-services/https-casinomanga-net-

Optimisez vos papiers électroniques pour le SEO, utilisez des backlinks puissants et du contenu multimédia pour maximiser votre visibilité et vos ventes. Les renouvelables sont un facteur important, mais il faut une complémentarité avec les autres sources d’énergie actuelles, qu’il s’agisse du nucléaire, des installations géothermiques, des centrales hydrauliques ou du biogaz produit par la méthanisation. Bien sûr, le charbon n’est pas la panacée, bien au contraire, et il va falloir progressivement le remplacer, peut-être par le gaz, avant d’aboutir à un développement plus important des renouvelables. Cependant, dans ce domaine, on a besoin de recherche – on l’a dit – et je m’interroge, parce que nous avions des projets pilotes pour capter et stocker le carbone. Aujourd’hui, sur quatre projets pilotes en Europe, un seul a été mis en œuvre en Norvège.

The Real Person!

The Real Person!

Ada tiga titik di sepanjang Jalan Raya Solo-Purwodadi yang dicek Ganjar. Di titik pertama, petugas dari Dinas PU Bina Marga dan Cipta Karya sedang melakukan perbaikan sementara dengan menutup badan jalan yang berlubang. Mesin slot joker jewels mempunyai tema yang berfokus pada karakter joker yang identik sebagai karakter yang lucu dan ceria dalam dunia perjudian. Pada game slot gacor terbaru ini kamu bisa mengharapkan simbol-simbol yang berhubungan dengan tema joker seperti topi jester, bel, dan berbagai pernak-pernik nya. Bermain sabar dan mengetahui pola slot gacor akan sangat membantu kamu dalam meraih jackpot yang besar. Cara mengetahui pola slot gacor, kamu bisa masuk ke dalam komunitas Mantra88 di sosial media seperti Telegram atau Whatsapp, dan disana kamu akan mendapatkan pola slot gacor terlengkap yang telah disiapkan. Juga, jangan terlalu tergesa-gesa dalam memilih nilai bet kamu, pastikan bahwa kamu bermain sabar untuk hasil yang maksimal.

https://ntbdamai.id/review-slot-starlight-princess-rtp-terupdate-hari-ini/

APLIKASI PREDIKSI SPACEMAN link slot apk APLIKASI PREDIKSI SPACEMAN apk slot terbaru Invitation only. Minimum deposit requirements apply. Penerbang, Crash, JetX, SpaceMan, GoRush, RoobetCrash Predictor Keamanan Terjamin: Keamanan data dan transaksi Anda adalah prioritas utama kami. Kami menggunakan teknologi enkripsi terkini untuk melindungi informasi pribadi Anda dari pihak yang tidak bertanggung jawab. Jadi, Anda bisa bermain dengan tenang dan fokus meraih kemenangan. APLIKASI PREDIKSI SPACEMAN slot apk terpercaya Anda pasti penasaran apa sih yang membuat situs tersebut sangat istimewa? karena itu kami akan membahasnya disini. namun sebelumnya, anda bisa mendapatkan Link alternatif 188BET lewat dua tombol diatas dan melihat promosi menarik lewat tombol dibawah ini. LINK ALTERNATIF 2 Selamat datang di dunia Bom89, tempat para pemain sejati merasakan adrenalin kemenangan dan keseruan tanpa batas! Kami adalah situs resmi Bom89, rumah bagi ribuan game slot online gacor dan live casino yang siap memanjakan Anda dengan pengalaman bermain yang tak terlupakan.

The Real Person!

The Real Person!

Fortune Rabbit, também conhecido como jogo do coelho, faz parte dos slots Fortune, sendo um dos mais populares. Nesse jogo, o apostador tem uma grade 3x4x3, com 10 jeitos de vencer por rodada. O prêmio máximo chega a 5.000x o valor da aposta. Olha só o que não pode ficar de fora da sua avaliação de cassinos de qualidade: Caso não encontre a regra dentro dos termos da plataforma, não hesite em tirar a dúvida com o suporte, já que muitas vezes essa promoção pode ser cancelada caso você já tenha feito qualquer depósito anterior. Olha só o que não pode ficar de fora da sua avaliação de cassinos de qualidade: Sweet bonanza symbol values Sweet bonanza symbol values As apostas esportivas começam com valores a partir de R$0,50 e você tem mais de 30 modalidades para apostar. Partidas de futebol, tênis, e até squash estão disponíveis no site e app.

https://alhawra.ly/big-bass-splash-uma-nova-onda-da-pragmatic-play-para-o-brasil/

Os usuários da TOP88 concordam em respeitar todas as regras e regulamentos estabelecidos. É importante ler e entender todos os termos antes de utilizar nossos serviços. A violação destes termos pode resultar em penalizações ou na suspensão da conta. Baixar o Fortune Rabbit app em um dispositivo iOS é um processo direto e intuitivo. Este guia passo a passo foi elaborado para ajudá-lo a encontrar e instalar o aplicativo de forma eficiente. O aplicativo está disponível na App Store e pode ser baixado gratuitamente, permitindo que você desfrute de suas funcionalidades exclusivas sem complicações. O design do Fortune Rabbit é simples e intuitivo, contando com símbolos temáticos e funcionalidades como multiplicadores e rodadas grátis. Já ouviu falar do jogo Fortune Rabbit e quer saber todas as informações sobre uma das caça-níqueis do momento, incluindo os melhores cassinos para aproveitar o jogo?

The Real Person!

The Real Person!

RTP: 95,8%. Combineert de Megaways-motor met wilde buffels en grote uitbetalingen. NetEnt, Microgaming, Play N GO, Thunderkick, iSoftBet, Quickspin, Yggdrasil, Red Tiger, Pragmatic Play, Relax Gaming, Playtech, Blueprint, Evolution Gaming, Merkur, Inspired, Iron Dog, ELK, Snowborn Studios, Nolimit City, 1×2 Gaming, Just for the Win, Hacksaw Gaming, Reel Play, Northernlights, Peter & Sons, Blue Guru, Push Gaming, Lightning Box, Kalamba Games, Synot, Playson, Gaming Corps, Switch Studios, MGA, On Air Entertainment, Foxium, Octoplay, Print Studios, 4ThePlayer, AvatarUX, Gamevy, BangBang, Alchemy Gaming, Williams, Fantasma, RubyPlay Wat kost gokken jou? Stop op tijd. 18+. loketkansspel.nl. рџ“™ Erik King’s Snelle Tip: Speel je Slotmill slots? Gebruik de “Fast Track” bonusbuy alleen na 50–100 spins zonder hit, de RTP en hitfrequentie lijken dynamisch aangepast te worden, waardoor de feature ná een droge reeks vaak gunstiger uitbetaalt.

https://www.klino.com.au/buffalo-king-megaways-review-een-spannende-ontdekking-in-de-nederlandse-online-casino-wereld/

Pragmatic Play staat er niet bepaald om bekend dat ze graag gebruik maken van andermans ideeën. Je komt dan ook zelden kloons tegen of spellen die elementen bevatten waar ook andere videoslots uit onze reviews mee zijn uitgerust. Dat is echter anders bij de videoslot Buffalo King Megaways. Het bewijs van de iGaming-mogelijkheden Pragmatic Play kondigde de release van Buffalo King Untamed Megaways aan, de titel van de serie Buffalo King. Dieren, poema’s, lobos en andere dieren redden de rodillos van deze tragamonedas 6×7 met 86.436 formaten van ganar. Om in aanmerking te komen voor de actie moet je 24 jaar of ouder zijn. Alleen inzetten met echt geld tellen mee en de minimale inzet per draai bedraagt €0,25. De free spins worden uiterlijk 72 uur na afloop van de promotie bijgeschreven op je account.

The Real Person!

The Real Person!

Calculations of total gas emissivities of gas mixtures containing several radiatively active species require corrections for band overlapping. In this paper, we generate such overlap correction charts for H2O-CO2-N2, H2O-CO-N2, and CO2-CO-N2 mixtures. These charts are applicable in the 0.1-40 bar total pressure range and in the 500 K-2500 K temperature range. For H2O-CO2-N2 mixtures, differences between our charts and Hottel’s graphs as well as models of Leckner and Modak are highlighted and analyzed. La inmunoterapia específica es considerada, hoy en día, como un tratamiento efectivo, con un nivel de evidencia de grado A, capaz de reducir de una forma eficiente, tanto los síntomas como las necesidades de tratamiento farmacológico en pacientes con alergia respiratoria, rinitis y asma, causada por alérgenos inhalados como: polen, hongos, epitelios animales y ácaros del polvo. La inmunoterapia específica mejora la hiperreactividad bronquial y se ha comparado el beneficio obtenido con el de los esteroides inhalados(6,7).

https://maximlandbase.com/resena-del-juego-de-casino-balloon-de-smartsoft-para-jugadores-en-mexico/

No hay una fórmula mágica, pero administrar bien el saldo y aprovechar los bonos puede mejorar tus probabilidades en Tower Rush. Como ya hemos dicho, no puedes descargar Tower Rush como una aplicación independiente – el juego simplemente no está diseñado para ser descargado y fue creado para ser alojado en sitios de casino online. Sin embargo, esto no significa que no puedas jugar a Tower Rush en smartphones – al contrario, el desarrollo de Galaxsys está perfectamente optimizado y adaptado para las pantallas de smartphones y tablets. Hay dos formas de jugar a esta tragaperras en dispositivos Android: a través de la versión móvil del sitio web del casino y de la aplicación para smartphones. Ambos métodos tienen sus ventajas y desventajas, que se comentarán a continuación. En Juegos.Games creemos que jugar debe ser algo accesible para todos. Por eso ofrecemos una experiencia sin anuncios invasivos, sin muros de pago ni complicaciones. Solo juegos bien seleccionados, organizados y probados para garantizar que funcionen correctamente y se adapten a distintos tipos de jugador: desde niños hasta adultos, desde gamers casuales hasta quienes buscan un reto más profundo.

The Real Person!

The Real Person!

Símbolos de dinheiro podem ser adicionados aos tambores aleatoriamente quando há símbolos de Pescador, mas não símbolos de Peixe presentes. Uma Bazooka especial também pode aparecer nos tambores nessa circunstância. Isso mudará alguns símbolos nos tambores, com exceção dos símbolos do Pescador. A PragmaticPlay (Gibraltar) Limited é licenciada e regulamentada na Grã-Bretanha pela Gambling Commission sob o número de conta 56015 e licenciada pela Gibraltar Licensing Authority e regulamentada pela Gibraltar Gambling Commissioner, sob o RGL No. 107. RTP, ou Retorno ao Jogador, em jogos de cassino, significa o dinheiro médio que um jogador pode recuperar ao longo do tempo. Abaixo você encontra uma lista com os 5 jogos de slots da PG Soft com a porcentagem de RTP mais alta. Sim, funciona no celular e no tablet. Sem precisar baixar nada. Sem instalar app. Você abre o site no navegador — e pronto, a Big Bass Splash demo carrega direto na tela. O layout é responsivo: botões grandes, texto legível, bônus visível e sem distorção. Eu mesmo já testei tanto no Android quanto no iPhone — sem bugs. Às vezes é até mais prático que o computador: menos distração, tudo no toque e inicia rápido. Ideal pra testar o jogo naquele intervalo rápido — sem complicação.

https://threadicious.com/teen-patti-by-mplay-a-comprehensive-review-for-pakistani-players/

A Blaze é uma casa de apostas e cassino online com sede em Curação, licenciada e autorizada pelo governo de Curação para exercer suas atividades de gambling. O usuário poderá apostar na Blaze com confiança de que a casa está se submetendo a regulamentações restritivas de jogos de azar e fiscalização por órgãos governamentais. O Big Bass Splash transporta os fãs da franquia Big Bass numa nova aventura de pesca. O Big Bass Splash transporta os fãs da franquia Big Bass numa nova aventura de pesca. Cada jogador tem um estilo diferente, e a escolha do melhor jogo de cassino depende de alguns fatores: Sendo que vitórias de até 18.163 vezes a sua aposta (exceto jackpot) podem surgir a cada rodada, com a possibilidade de apostar valores que variam entre R$ R$ 0,20 e R$ 40,00. Os apps de cassinos nacionais, então, são a resposta para jogadores gozarem da liberdade de apostar de qualquer lugar. Através destes aplicativos, os cassinos podem ampliar ainda mais a imersão dos jogadores em sua plataforma, maximizando a experiência de apostar pelo celular.

The Real Person!

The Real Person!

The Big Bass Bonanza 1000 RTP rate is 96.51% which is significant higher than the online slot average of around 96%. However, Pragmatic Play has created 95.51% and 94.51% RTP versions which may be used at your chosen slots site (a quick glance at the Paytable will determine which rate you’re playing with). The Big Bass Bonanza 1000 free demo above uses the highest RTP rate: this is also the case for the majority of free demo slot games at OLBG. The Big Bass series has seen more than a dozen releases since its inception, starting with the original Big Bass Bonanza in December 2020. Following its success, Pragmatic Play expanded the series to include variations like Big Bass Bonanza Megaways and Christmas-themed slots such as Big Bass Christmas Bash, showcasing the series’ adaptability and appeal.

https://fysiotittipaulina.se/exploring-aviator-games-popularity-in-ugandas-igaming-scene/

You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. cokitosjuegos @ gmail . com Squid Game Online Final Thoughts: Why Chicken Road Might Be Your New Favorite Game We’ve seen a lot of games come and go, but Chicken Road has that rare mix of charm, challenge, and real money potential that makes it special. It doesn’t take itself too seriously — and neither should you. It’s quick to learn, endlessly replayable, and every round feels just a little different. Compare the numbers on two different number lines and decide which is bigger. A great game to get children thinking about place value and reading varying scales. The Chicken Road demo mode is an excellent way to test strategies and understand the risk levels that suit your gameplay style. Whether you’re playing for fun or refining tactics for real money mode, this demo offers the full experience of a chicken road game casino title. Deciding which difficulty level to choose is definitely the number one priority. But it’s also experimenting with how far you can push, which is important.

The Real Person!

The Real Person!

Estamos convencidos de que Sugar Rush será un juego muy interesante para todos aquellos jugadores que tengan en cuenta la configuración matemática de las tragamonedas, y que también resultará muy atractivo para quienes busquen disfrutar de una experiencia agradable desde el punto de vista estético. The free bonus without deposit online casino. The round begins with each player receiving two cards, but maybe more so Aussies as they would rarely experience an icy fishing trip. These new games would allow players to access or download their favourite casino gambling games, share a few necessary contact details and then verify your account via an emailed link. Anytime you hit a number straight up, such as valiant warrior. Aquí te contamos todo sobre este llamativo título de Pragmatic Play, el proveedor líder del mundo de los online games.

https://thehellertowndiner.com/resena-del-juego-balloon-de-smartsoft-en-casinos-online-para-colombia/

Per questo, abbiamo fatto una analisi anche sulla quantità e la grandezza dei software program supplier con cui ogni sito ha rapporti. Ciò che più ci è piaciuto, di questo casinò AAMS, è il suo sistema di promozioni various al bonus di benvenuto. Potrai divertirti con le slot più popolari, come E-book of Ra Deluxe, interessata anche dal bonus benvenuto, Gonzo’s Quest, Dead or Alive e tante altre. Il bonus benvenuto offerto ad ogni nuovo giocatore propone il 100 percent del primo deposito, fino a 1.800€. Infatti, potrai divertirti con i migliori giochi NetEnt, tra cui Blood Suckers, Gonzo’s Quest e Starburst, ma anche Guide of Ra Deluxe, Guide of Useless e tanti altri. apotheke sofort lieferung: Pharma Jetzt – PharmaJetzt Inoltre, questi casinò per dispositivi portatili offrono accesso a una vasta gamma di metodi di pagamento, validi per depositi e prelievi. Un’app cell per i casinò stay è altrettanto importante per la scelta del migliore sito con questa categoria di giochi. Infatti, chi vuole sedersi ai tavoli live tra una pausa e l’altra può farlo anche fuori casa con il proprio smartphone o tablet. Quello che conta è che l’esperienza di navigazione, la fluidità e l’alta risoluzione grafica siano presenti e incorporate nell’app sviluppata dal sito net.

The Real Person!

The Real Person!

Korzystając z tej strony, zgadzasz się na wykorzystanie przez nas cookies (ciasteczek). Jeśli więc nie zmieniłeś ustawień odnośnie cookies (ciasteczek), zgadzasz się na ich używanie zgodnie z naszą Polityką Cookies. Darmowa gra Darmowa gra Darmowa gra Joker’s Jewels Dazzle od Pragmatic Play The Royal Family Nasza strona obejmuje wszystkich popularnych dostawców slotów. Szczegółowo przeanalizowaliśmy setki gier od najlepszych dostawców automatów. Nawet mniej znani dostawcy, ale wykonujący wyjątkową pracę, tacy jak Print Studios i Stakelogic, są opisani na naszej stronie. Na naszej stronie znajdziesz szczegółowe recenzje slotów od następujących najlepszych dostawców: This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

https://www.zoreproperties.com/2025/08/05/vavada-casino-w-polsce-kompleksowa-analiza-i-przeglad-funkcjonalnosci/

To make points simpler, we’ve place with each other a list associated with typically the greatest online internet casinos within Canada regarding Mar 2025. We evaluate betting internet sites based about key efficiency signals in order to recognize the top systems for global players. Our evaluation guarantees of which typically the gambling websites all of us suggest support typically the greatest standards with respect to a secure plus enjoyable gambling encounter. There’s continue to a gray area any time it arrives to on-line online casino gambling legislation in Canada. 1win реєстрація 1win22083.ru . By admin|2025-01-24T00:26:14+00:00January 24th, 2025|Игра Авиатор Aviator Online Ru Как Работает – 332| Gra Aviator oferuje zanurzenie się w fabułę, a aplikacja Aviator — predyktor wygranych dostarczy Ci więcej informacji o wygranej. Dołącz do ekspertów lotniczych 1win. Pomnóż swoje własne zasoby 1 wygranej, zrozum, że jako nowy Aviator może zdobywać wysokość i premie. Nie graj od razu w pix Aviator lub 4rabet app aviator. Spróbuj nauczyć się wszystkich subtelności, aby 1 wygrać sterowanie samolotem. Miałem szczęście, że byłem przy tobie.

Definitely believe that which you stated. Your favorite reason seemed to be on the web the easiest thing to be aware of. I say to you, I definitely get irked while people consider worries that they just don’t know about. You managed to hit the nail upon the top as well as defined out the whole thing without having side-effects , people could take a signal. Will likely be back to get more. Thanks

The Real Person!

The Real Person!

Το Sugar Rush 1000 λειτουργεί με γεννήτρια τυχαίων αριθμών, οπότε κάθε περιστροφή έχει απολύτως τυχαία αποτελέσματα. Έτσι, δεν υπάρχει σίγουρος τρόπος για το πως να κερδίσεις στο Sugar Rush 1000. Ωστόσο, μπορείτε να ακολουθήσετε τις παρακάτω συμβουλές για περισσότερες πιθανότητες κέρδους: Sorry, this product is unavailable. Please choose a different combination. Κάθε φορά που ένα νικητήριο σύμβολο εκρήγνυται, το σημείο του σημειώνεται στο δίκτυο. Εάν ένα άλλο εκτινάσσεται σε αυτό το σημείο για δεύτερη φορά, προστίθεται ένας πολλαπλασιαστής, ξεκινώντας από x2 και διπλασιάζεται μέχρι x1.024 με κάθε εμφάνιση. Ο πολλαπλασιαστής που προκύπτει προστίθεται σε όλους τους νικηφόρους συνδυασμούς που σχηματίζονται από πάνω.

https://webscountry.com/author/izcorpading1975/

Φωτεινά χρωματιστά γλυκά γεμίζουν το φρουτάκι Sugar Rush. Εμφανίζονται σε ένα πλέγμα 7×7 και πληρώνουν βραβεία με ομάδες (clusters) 5 ή περισσότερων όμοιων συμβόλων. Ένα σύστημα Tumbling Reels αφαιρεί τυχόν γλυκά σε μια νίκη, γεγονός που μπορεί να οδηγήσει σε περαιτέρω νικηφόρα συμπλέγματα, καθώς τα παραπάνω πέφτουν προς τα κάτω. Στο Foxcasino υποστηρίζουμε τον υπεύθυνο στοιχηματισμό και συστήνουμε να παίζετε τυχερά παιχνίδια με μέτρο. Πόσο γρήγορα επεξεργάζεται αναλήψεις το Vistabet Casino;

excellent post.Never knew this, thankyou for letting me know.

Precisely what I was searching for, thankyou for posting.

I like what you guys are up also. Such smart work and reporting! Keep up the superb works guys I¦ve incorporated you guys to my blogroll. I think it’ll improve the value of my site 🙂

Hiya, I am really glad I’ve found this information. Today bloggers publish only about gossips and net and this is really frustrating. A good website with interesting content, that’s what I need. Thanks for keeping this website, I’ll be visiting it. Do you do newsletters? Cant find it.

We’re a bunch of volunteers and starting a new scheme in our community. Your web site provided us with valuable info to work on. You have performed an impressive job and our whole neighborhood will probably be grateful to you.

The Real Person!

The Real Person!

Advertisements are seen heavily within this app. When the player run out of your 30 balls you can watch 30 advertisements in a day, each one will give the player 30 balls in return. This does take a bit of time to get through and it also seems to me as though I did not get more money blocks to pop-up after the first 2 or 3 refills of balls. The game has a large RTP, may be enjoyed for free to understand, and there are usually many variations available. Plinko is additionally simple to understand but still exciting and interesting. If the game is at a web based casino like Slingo, you should always be able to get information about their driving licence on their website. You may also search the UK Gambling Commission website to verify that the casino will be registered. MrBeast Plinko is a scam Plinko game that doesn’t actually exist about the App Store or the Google Enjoy Store.

https://sukruguzelsadeyag.com/?p=134933

We regularly monitor online casinos in Canada and have compiled a list of top-rated sites where you can play for real money. Each Chicken Road casino on our recommended list offers a range of attractive features, including fast payouts, diverse promotions, and 24 7 customer support. With an RTP of 96.5% and a max win potential of 5000x, our time with Chicken Drop was equal parts enjoyable and potentially lucrative. Pragmatic Play has developed a slot that is playful, adding to the game’s fun times and excitement – keeping us coming back to play some more. For sure! You can play the Chicken Fox 5x Skillstar™ slot for free right here at VegasSlotsOnline. We think trying the demo game out before staking real cash is a fantastic idea. The Chicken Drop slot has a Tumble feature which sees all winning symbols removed from the grid, and those above tumble down to fill the void. Tumbles continue until no new wins are seen. Special watering can and lucky clover symbols can appear at any time throughout a series of Tumbles, and these collect on a meter held by the chicken.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I got what you intend,bookmarked, very nice internet site.

The Real Person!

The Real Person!

Se ti interessa provare Plinko online, il processo è semplice. La maggior parte dei casinò online italiani offre versioni demo gratuite, con cui puoi imparare i dettagli e le regole del gioco senza perdere denaro reale. Una volta che ti senti pronto, devi solo registrarti su un sito web di casinò online, continuare con la verifica del tuo account e quindi trovare Plinko nella libreria del sito. In alternativa, puoi scegliere di giocarlo in modalità di gioco demo. Si consiglia sempre di consultare in anticipo le promozioni e i bonus, come i giri gratuiti e i bonus di benvenuto, per ottimizzare la tua strategia di gioco. Dopo aver descritto nel dettaglio il miglior Plinko casino, ossia Lucky Block, e altri due competitor molto performanti (Metaspins e Cloudbet), pensiamo che sia opportuno effettuare un confronto tra le migliori offerte per partecipare al Plinko game su blockchain.

https://indujaulas.com/recensione-della-slot-sugar-rush-di-pragmatic-play-un-dolce-viaggio-allrtp-incredibile/

Il funzionamento di Plinko è intrigante: un pallino cade dall’alto, rimbalza su punte e infine si posiziona in una delle celle che offrono premi diversi. La casualità del percorso del pallino rende ogni partita un momento unico e emozionante. I giocatori possono scommettere su vari premi, aumentando la suspense man mano che il pallino compie il suo viaggio. Questo elemento è ciò che attrae molti utenti, poiché la tensione cresce fino all’ultimo istante, quando si scopre dove si fermerà il pallino. Quando si parla di scommesse sportive, goldbet it offre una gamma incomparabile di eventi su cui scommettere. Gli utenti possono scegliere tra sport popolari come calcio, basket, tennis e molti altri. Ogni sport presenta specifiche dinamiche che influenzano il risultato finale, e goldbet it elenca dettagliate analisi e statistiche che possono aiutare i giocatori a prendere decisioni più informate.

The Real Person!

The Real Person!

To play the Vortex game, you will need to create an account. But first, choose your online casino that provides a legal gambling experience in your state region. No separate Turbo Games accounts are required – the game is launched inside the casino. The registration process is as follows: How to Download the Vortex App for Android? Let’s see more detailed instructions on how you can download the Vortex Game application more easily. Turbo Gaming is a Ukrainian-based software developer that stepped into the gaming space in 2020. Their games are simple, run smoothly on mobile, and are a big hit on crypto-friendly platforms where speed really matters. Rather than making all kinds of games, Turbo Games sticks to a few styles it knows best and keeps things clean and easy to understand. Some of their standout games cover Crash X, Limbo Rider, and Mines. All these games are built for quick gameplay and clear, no-fuss rules.

https://s.surveyplanet.com/epi5csbh