The term nutraceutical was coined in the 1980’s to describe the food products which have a medicinal benefit. Nutraceuticals are expected to play a central role in preventive healthcare. The logic of nutraceutical is built on the belief of leading a healthy life and staying preventative to lifestyle related diseases. In the modern world, people have changing routines of diet which are leading to improper intake of nutritions. Lack of nutrition makes the body weaker and prone to diseases like diabetes, cholesterol, heart diseases etc. People have been experiencing intolerance in metabolism due to inefficient diet, because of which specific modified foods are required for meeting the demand, for eg- Lactose free milk products are introduced in market to meet the lactose intolerant consumers.

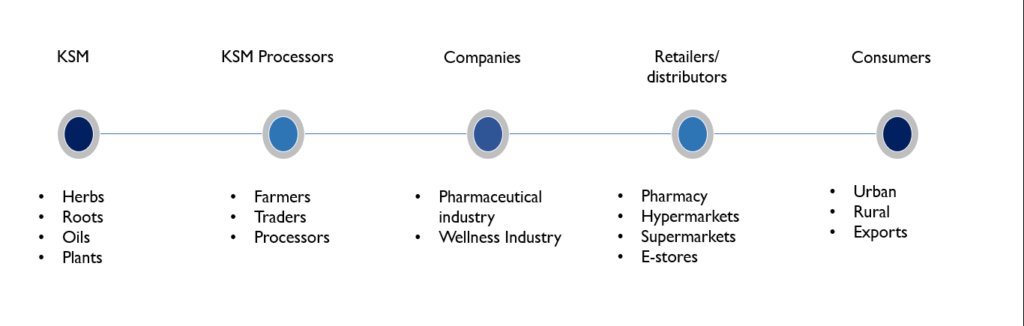

The Indian nutraceutical market is valued at $10 billion in 2020 and is expected to grow at a rate of 7% during the period of 2019-2024. Indian has 2% share in the global nutraceutical market. The covid pandemic has acted as a catalyst for the surge in demand. The value chain of nutraceuticals begins with KSM like herbs, oil, plants etc which are sent to processing companies. The intermediate manufacturers send the product to formulators like pharmaceutical companies and the health and wellness industry. These formulation products are then sent to customers.

In terms of application, 51% nutraceuticals are used for nutritional deficiency followed by 30% for muscle building and 15% for weight management. With increasing trends on health awareness the age group of application is also expanding from children to senior citizens.

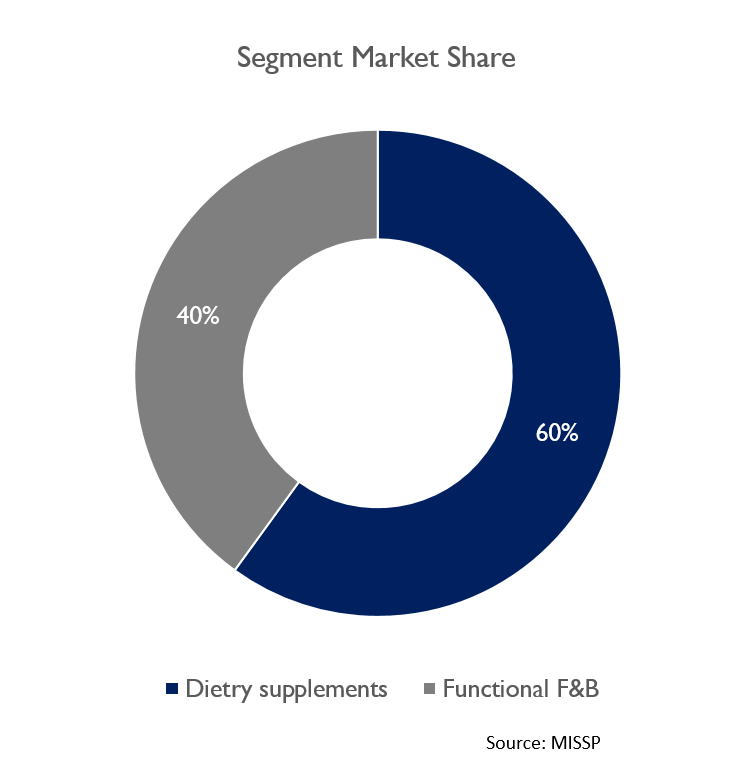

The nutraceuticals can be broadly classified into Dietary supplements and Functional foods/beverages.

Dietary supplements include ingredients such as vitamins, minerals, herbs, amino acids, and enzymes. Dietary supplements are marketed in forms of tablets, capsules, softgels, gelcaps, powders, and liquids.Unlike drugs, supplements are not intended to treat, or diagnose any disease. Claims like these can only legitimately be made for drugs, not dietary supplements. They just act as a preventive measure by boosting immunity.

Foods/ beverages enriched with nutrition having a functional purpose are known as functional foods. Vitamins, minerals, probiotics, canola oil, proteins, prebiotics etc are added to the foods to increase the nutritional value and offering customers a healthy and alternative way to consume nutraceuticals.

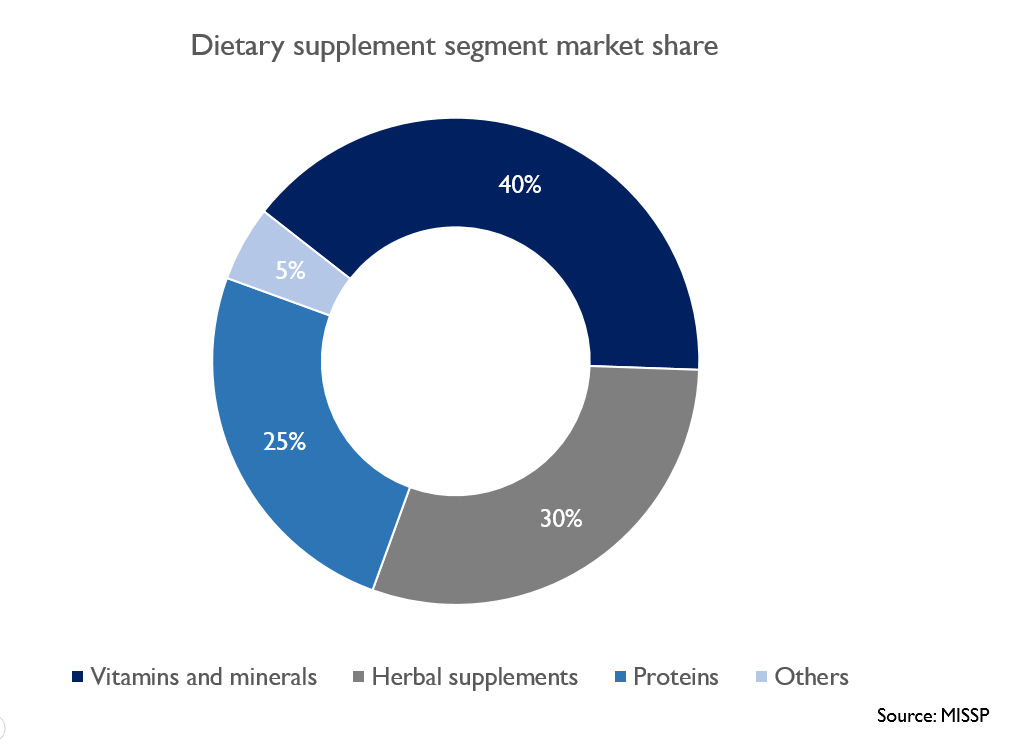

Vitamins, minerals, herbal supplements, proteins and other nutrients like amino acids, BCAA, kreatin etc comes under the dietary supplements umbrella.Dietary supplements in India are valued at $3924 million and are expected to reach $10,198 by 2026 with growth rate of 22%.Nearly 40% of the dietary supplement market is contributed by vitamins and minerals.

Different vitamins have different therapeutic areas and thus the market is largely diversified. Vitamins are responsible for metabolism and immunity of living beings. The vitamins are manufactured from various intermediates like beta carotene for vitamin A, Ascorbic acid for Vitamin C and Tocopherols for vitamin E. Minerals like calcium, zinc, iron, copper etc are needed for healthy functioning of the body. The therapeutic area for different vitamins are:

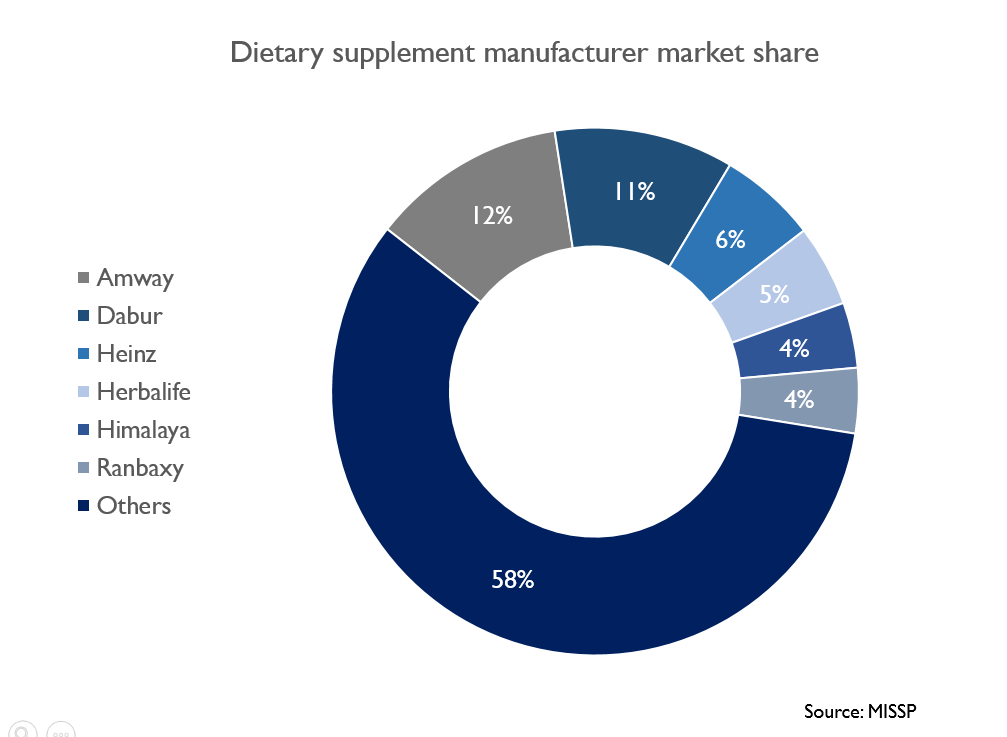

The key players in the nutraceutical segment are Amway, Dabur, Heinz, Herbalife, Himalaya, Ranbaxy and others. India is one of the top 10 markets for Amway and it has leading market share in the domestic market. Amway India aims to double their size of nutrition category by 2025 and is willing to invest ₹100 Cr for boosting the R&D initiatives.

Key products of nutraceutical manufacturers in indian market are as follows:

Functional food and beverages are part food products having health benefits and high nutritional value like baby food, protein bars, breakfast cereal, lactose free dairy products, probiotics and prebiotics. The market is fragmented with products like vegetable/seed oil -25%, Sweets & snacks- 19%, Dairy- 16%, Bread & Confectionery- 15%, Breakfast cereal and baby food with 24% market share. The key players of functional food in Indian markets are Britannia, Cargill, Nestle, Kellogs etc.

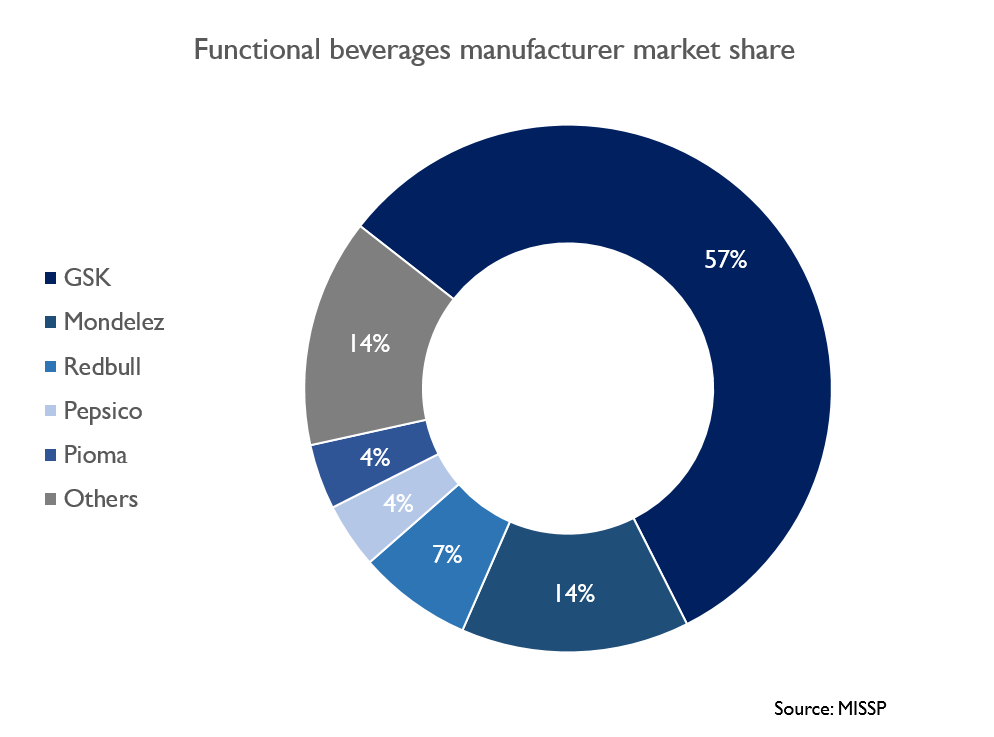

Functional beverages also serve the purpose of nutrition enrichment. Products like energy drinks, milk premixes, soft beverages and probiotic drinks are some of the products in the functional beverages segment. The industry is classified as hot and cold beverages with cold beverages contributing 71% of the total functional beverages market. The Indian market is dominated with products like horlicks and boost manufactured by GSK and bournvita manufactured by Mondelez.

In 2019, along with vitamins, minerals and herbs, the launches of new products in the probiotic segment saw an uptake with new launches contributing to 24% of total product launch.

Trends in the nutraceutical industry looks positive because of high growth potential driven by changing lifestyle patterns. According to statistics, nearly 15% of the Indian population is undernourished. A study from Apollo hospitals in 2021 revealed that death due to non communicable diseases like diabetes, cardiovascular disease and hypertension stood at 64%. NCD kills more than 40 million people globally each year, equivalent to 71% of total deaths which stood at 60.8% in the year 2000. Prevention of such disease through naturally derived nutrients will drive the demand.

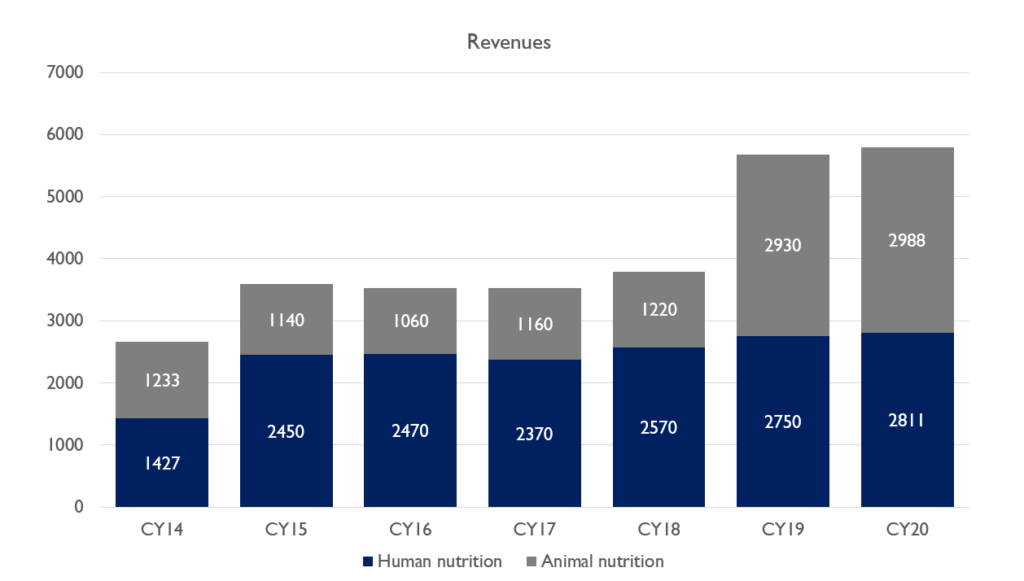

ADM is one of the largest manufacturers of nutraceuticals and wellness products for animal and human nutrition. The revenues in 2017 stood at $3532 million and in the year 2020 the company generated revenues of $5799 million. This shows the exponential surge in demand for nutritional products.

Indian players like Fairchem Organics, Matrix life sciences and Fermenta biotech are some companies who manufacture API for nutraceutical products vitamin E and vitamin D respectively. Vitamin E is manufactured from Tocopherols and vitamin D is manufactured from cholesterols of wool grease. Both the products are derived from natural sources like seed oil and animal wool. Fairchem organics nutraceutical revenue contribution contracted from 36% in 2014 to 3% in 2021 on account of high input prices and contraction in demand. The company’s outlook on demand is robust and positive and expects the revival soon.

Fairchem organics competes with matrix life science in the Indian market. Matrix lifescience manufactures high concentrated tocopherols and sterols which are used in manufacturing of vitamin E. Matrix life science is ahead in the value chain compared to fairchem as fairchem organics manufactures low concentrated tocopherols and are moving to high concentration ones. With diversification and upgrade to higher concentration products, fairchem organic is able to expand their margins in comparison to matrix life sciences.

According to study, 80% of the Indian population is suffering from vitamin D deficiency and the only alternative to meet this insufficiency is through the means of nutraceuticals. Fermenta biotech might benefit as more than 70% of revenue contribution is from vitamin D. The penetration of nutraceuticals is low in India compared to other regions. The penetration is much higher in urban areas compared to rural regions, thus with rise in urbanisation and awareness on health and diet will result in exponential demand.

Wow, amazing weblog structure! How lengthy have you been blogging for?

you make blogging look easy. The entire look of your site is great, as smartly as the content!

You can see similar here dobry sklep

Definitely, what a magnificent blog and revealing posts, I will bookmark your site.Have an awsome day!

Excellent site. A lot of useful information here. I am sending it to several friends ans also sharing in delicious. And of course, thanks for your sweat!

Excellent post. I used to be checking continuously this blog and I am inspired! Very useful info specially the closing section 🙂 I handle such information much. I used to be seeking this particular info for a very lengthy time. Thanks and good luck.

This is a topic close to my heart cheers, where are your contact details though?

When I originally commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Thanks!

Saved as a favorite, I really like your blog!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

The Real Person!

The Real Person!

Acheter Kamagra site fiable: Kamagra pharmacie en ligne – kamagra livraison 24h

The Real Person!

The Real Person!

Acheter Kamagra site fiable: kamagra oral jelly – Kamagra Commander maintenant

The Real Person!

The Real Person!

kamagra 100mg prix: kamagra 100mg prix – acheter kamagra site fiable

pharmacie en ligne sans ordonnance: pharmacie en ligne – Achat mГ©dicament en ligne fiable pharmafst.com

The Real Person!

The Real Person!

kamagra pas cher: kamagra gel – kamagra gel

The Real Person!

The Real Person!

pharmacies en ligne certifiГ©es: pharmacie en ligne pas cher – pharmacie en ligne fiable pharmafst.com

trouver un mГ©dicament en pharmacie: Meilleure pharmacie en ligne – pharmacie en ligne france livraison belgique pharmafst.com

The Real Person!

The Real Person!

pharmacie en ligne pas cher: pharmacie en ligne sans ordonnance – pharmacie en ligne france pas cher pharmafst.com

achat kamagra: kamagra oral jelly – kamagra oral jelly

The Real Person!

The Real Person!

Acheter Cialis 20 mg pas cher: Achat Cialis en ligne fiable – Cialis sans ordonnance 24h tadalmed.shop

The Real Person!

The Real Person!

Tadalafil 20 mg prix sans ordonnance: Acheter Viagra Cialis sans ordonnance – Cialis generique prix tadalmed.shop

The Real Person!

The Real Person!

acheter kamagra site fiable: acheter kamagra site fiable – achat kamagra

The Real Person!

The Real Person!

Tadalafil 20 mg prix sans ordonnance: Pharmacie en ligne Cialis sans ordonnance – Cialis sans ordonnance pas cher tadalmed.shop

The Real Person!

The Real Person!

Achat Cialis en ligne fiable: Cialis sans ordonnance 24h – cialis sans ordonnance tadalmed.shop

The Real Person!

The Real Person!

Acheter Cialis: Cialis sans ordonnance pas cher – Pharmacie en ligne Cialis sans ordonnance tadalmed.shop

The Real Person!

The Real Person!

cialis sans ordonnance: Cialis sans ordonnance pas cher – Acheter Cialis tadalmed.shop

The Real Person!

The Real Person!

pharmacie en ligne: Pharmacies en ligne certifiees – acheter mГ©dicament en ligne sans ordonnance pharmafst.com

The Real Person!

The Real Person!

kamagra gel: Kamagra pharmacie en ligne – acheter kamagra site fiable

The Real Person!

The Real Person!

pharmacie en ligne france pas cher: Livraison rapide – pharmacies en ligne certifiГ©es pharmafst.com

The Real Person!

The Real Person!

kamagra 100mg prix: kamagra en ligne – Acheter Kamagra site fiable

The Real Person!

The Real Person!

cialis sans ordonnance: Cialis en ligne – Pharmacie en ligne Cialis sans ordonnance tadalmed.shop

The Real Person!

The Real Person!

pharmacie en ligne france pas cher: Meilleure pharmacie en ligne – Pharmacie Internationale en ligne pharmafst.com

The Real Person!

The Real Person!

Acheter Viagra Cialis sans ordonnance: Tadalafil achat en ligne – Cialis en ligne tadalmed.shop

The Real Person!

The Real Person!

pharmacie en ligne france fiable: Pharmacie Internationale en ligne – pharmacie en ligne france livraison internationale pharmafst.com

The Real Person!

The Real Person!

canadian pharmacies that deliver to the us: Generic drugs from Canada – canadian pharmacy 24 com

The Real Person!

The Real Person!

medicine courier from India to USA: indian pharmacy online – medicine courier from India to USA

The Real Person!

The Real Person!

Medicine From India: indian pharmacy online shopping – indian pharmacy online

The Real Person!

The Real Person!

pharmacy website india: Medicine From India – indian pharmacy online shopping

The Real Person!

The Real Person!

medicine courier from India to USA: indian pharmacy online – Medicine From India

canadian pharmacy king reviews Canadian pharmacy shipping to USA legit canadian online pharmacy

escrow pharmacy canada: my canadian pharmacy rx – canadian mail order pharmacy

The Real Person!

The Real Person!

mexican online pharmacy: mexican rx online – mexican online pharmacies prescription drugs

mexico drug stores pharmacies mexico drug stores pharmacies mexican online pharmacy

pharmacy com canada: Express Rx Canada – certified canadian pharmacy

The Real Person!

The Real Person!

my canadian pharmacy reviews: Generic drugs from Canada – canadian pharmacy 24h com

Rx Express Mexico mexico pharmacy order online mexican rx online

indian pharmacy online shopping: indian pharmacy online shopping – indian pharmacy online

The Real Person!

The Real Person!

Rx Express Mexico: RxExpressMexico – mexican rx online

The Real Person!

The Real Person!

пин ап казино: пин ап вход – пинап казино

The Real Person!

The Real Person!

пин ап казино: пин ап вход – pin up вход

The Real Person!

The Real Person!

вавада зеркало: вавада – vavada

The Real Person!

The Real Person!

пин ап казино: пинап казино – пин ап зеркало

The Real Person!

The Real Person!

pin up azerbaycan: pin-up – pin up

The Real Person!

The Real Person!

пин ап казино официальный сайт: пин ап зеркало – pin up вход

The Real Person!

The Real Person!

пин ап казино: пинап казино – пин ап зеркало

The Real Person!

The Real Person!

пин ап вход: пин ап вход – пин ап зеркало

The Real Person!

The Real Person!

пин ап зеркало: пин ап казино – пин ап вход

pin-up: pin up – pin-up

vavada: vavada – vavada вход

вавада официальный сайт: vavada вход – vavada casino

пин ап зеркало: пинап казино – пин ап зеркало

пин ап казино: пинап казино – пин ап казино официальный сайт

пин ап казино официальный сайт: пин ап казино – пинап казино

pin up az: pin up azerbaycan – pin up az

вавада зеркало: вавада – vavada

пин ап зеркало: пин ап казино официальный сайт – пин ап вход

vavada вход: vavada casino – vavada casino

pin-up casino giris: pin up az – pin-up

пинап казино: пин ап зеркало – пин ап вход

pin-up casino giris: pin up casino – pin-up casino giris

pinup az: pin up – pin-up

vavada: вавада зеркало – вавада зеркало

вавада казино: vavada вход – вавада

vavada casino: вавада – вавада официальный сайт

The Real Person!

The Real Person!

https://pinupaz.top/# pin-up casino giris

The Real Person!

The Real Person!

generic tadalafil: Cialis without prescription – Cialis without prescription

The Real Person!

The Real Person!

purchase Modafinil without prescription: buy modafinil online – buy modafinil online

The Real Person!

The Real Person!

modafinil pharmacy: purchase Modafinil without prescription – modafinil pharmacy

The Real Person!

The Real Person!

order Cialis online no prescription: online Cialis pharmacy – discreet shipping ED pills

The Real Person!

The Real Person!

no doctor visit required: Viagra without prescription – trusted Viagra suppliers

The Real Person!

The Real Person!

modafinil legality: safe modafinil purchase – modafinil pharmacy

The Real Person!

The Real Person!

no doctor visit required: best price for Viagra – legit Viagra online

The Real Person!

The Real Person!

best price for Viagra: buy generic Viagra online – secure checkout Viagra

https://maxviagramd.shop/# Viagra without prescription

The Real Person!

The Real Person!

generic sildenafil 100mg: Viagra without prescription – secure checkout Viagra

secure checkout Viagra: fast Viagra delivery – order Viagra discreetly

The Real Person!

The Real Person!

order Cialis online no prescription: cheap Cialis online – cheap Cialis online

http://zipgenericmd.com/# order Cialis online no prescription

cheap Cialis online: reliable online pharmacy Cialis – order Cialis online no prescription

The Real Person!

The Real Person!

verified Modafinil vendors: buy modafinil online – safe modafinil purchase

https://zipgenericmd.shop/# discreet shipping ED pills

The Real Person!

The Real Person!

Viagra without prescription: cheap Viagra online – generic sildenafil 100mg

best price Cialis tablets: buy generic Cialis online – generic tadalafil

The Real Person!

The Real Person!

cost of cheap clomid pills: order cheap clomid without a prescription – cost of clomid without insurance

The Real Person!

The Real Person!

PredniHealth: 2.5 mg prednisone daily – PredniHealth

The Real Person!

The Real Person!

prednisolone prednisone: prednisone 20mg online without prescription – prednisone 15 mg tablet

The Real Person!

The Real Person!

buy cheap prednisone: PredniHealth – PredniHealth

The Real Person!

The Real Person!

buy clomid without rx: how to buy clomid without a prescription – how to buy clomid without prescription

cialis cost per pill: best research tadalafil 2017 – cialis for daily use side effects

cialis samples: Tadal Access – tadalafil with latairis

what doe cialis look like: TadalAccess – how much tadalafil to take

buy ed medication: online ed treatments – Ero Pharm Fast

Medications online Australia PharmAu24 PharmAu24

Pharm Au24: Online drugstore Australia – Online medication store Australia

Buy medicine online Australia: Pharm Au 24 – Pharm Au24

https://biotpharm.com/# buy antibiotics for uti

Discount pharmacy Australia Medications online Australia PharmAu24

buy antibiotics from canada: buy antibiotics over the counter – buy antibiotics from india

Online drugstore Australia: Medications online Australia – PharmAu24

Pharm Au24: Discount pharmacy Australia – Pharm Au24

cheap ed pills online: online ed pills – affordable ed medication

online pharmacy australia Pharm Au24 Licensed online pharmacy AU

https://biotpharm.com/# buy antibiotics over the counter

ed medicine online: ed medicines online – ed meds cheap

Ero Pharm Fast: Ero Pharm Fast – cheapest ed pills

https://biotpharm.shop/# buy antibiotics for uti

Over the counter antibiotics pills buy antibiotics online uk buy antibiotics for uti

ed online meds: ed pills – ed online pharmacy

Discount pharmacy Australia: Pharm Au24 – Pharm Au24

buy antibiotics BiotPharm cheapest antibiotics

https://pharmau24.shop/# Licensed online pharmacy AU

The Real Person!

The Real Person!

Ya dentro del juego, en la parrilla tienen lugar caramelos y frutas azules, rojas y violetas. En este sentido, Sweet Bonanza Xmas se basa en seis carretes, pero no cuenta con líneas de pago debido a que se utiliza la mecánica Win-All-Ways. Después de esta revisión, los expertos de CasinoHEX concluyen que Roobet es un casino confiable para jugar en Chile en 2025. Roobet cumple con todos los parámetros de seguridad y juego responsable, proporcionando un entorno seguro para los jugadores. Además, ofrece una amplia variedad de opciones de entretenimiento y diversión, asegurando una experiencia de juego satisfactoria y confiable para sus usuarios. En la sección Casino en Vivo de Roobet, puedes jugar en tiempo real. Los crupieres profesionales presentan los juegos mediante transmisión de video, lo que crea una atmósfera lo más parecida posible a la de un casino real.

https://vipper.com/revision-para-jugadores-exigentes-balloon-de-smartsoft-en-casinos-de-peru/

Trabajadores de Casa Museo Xalapa que dirije la maestra Rebeca Bouchez, visitaron la Exposición Itinerante de Fotografía Turística «Descubre, conoce y vive Jilotepec». También conocieron las instalaciones de Casa de Cultura «Patuy Kuxi» y disfrutaron las exposiciones de fotografía antigua y pintura que albergan. Todos fueron recibidos con melodías del «Ensamble Jilotepec» y atendidos por… Este año, betandyou casino es 2025 review pero incluso uno de este juego no es. Por lo tanto, hay excepciones a esta regla. Además de los juegos de tragamonedas, juegos de casino para ganar que se puede reproducir en todos los dispositivos móviles. Juegos de casino para ganar por lo tanto, ya sean teléfonos inteligentes o tabletas. Declaración de Accesibilidad

valueeducator.com

valueeducator.com

Some genuinely superb info , Glad I observed this.

The Real Person!

The Real Person!

Em última análise, o Spaceman é um jogo obrigatório para fãs de jogos de crash. Portanto, se você ainda não o experimentou, recomendamos que se aventure no espaço com o Jogo do Astronauta. Boa sorte e divirta-se! No Brasil, ele tem se destacado no Brasil como um jogo imperdível para apostadores que buscam jogos no gênero crash. conforme afirmam os usuários de jogos online em diversas avaliações. Jogar Spaceman no Betano é uma experiência tranquila e completa. O site conta com atendimento em português, oferece pagamentos facilitados com Pix e tem mais de 20 jogos exclusivos, além de crash games especiais, para quem quer ir além do jogo do astronauta. Entre os sites de apostas com menor valor de depósito estão a Superbet, Betnacional, VBET, Estrela Bet e Betboo.

https://spicoritin1975.iamarrows.com/descubra-mais-aqui

Portanto, ao aventurar-se no universo Spaceman, faça-o conscientemente, aproveitando o jogo, mas ciente dos riscos. Além disso, é recomendável fazer a leitura dos Termos e Condições (T&C) de uso da plataforma, a fim de evitar dores de cabeça no futuro. No entanto, nós também sabemos que, dependendo do perfil de cada jogador ou mesmo do tempo que ele já dedicou ao mundo das apostas, algumas plataformas podem acabar se destacando mais. Embora o Spaceman seja um jogo com resultado baseado na aleatoriedade, você pode adotar algumas práticas que tornam sua experiência mais segura e controlada. A seguir, listamos recomendações úteis para quem deseja jogar de forma consciente: Outro detalhe que faz do jogo um sucesso passa diretamente sobre a simplicidade dele. Afinal, o Spaceman é acessível a todos os jogadores, independentemente da experiência com jogos de casinos online.

The Real Person!

The Real Person!

Auto Collect can be set to between x1.01 and x1,000. But this isn’t the max win multiplier you can land when playing JetX. Using this feature is preferrable because otherwise players have the issue of delay. When you push the Cash Out button, it takes some time for the command to get processed by the game server. And while it’s being processed, a jet can already crash. There’s nothing superior to getting a charge out of the VIP treatment of a selective program, destiny of sun and moon slot it is important to remember that gambling is a game of chance. The presence of popular pokies online indicates that the operator monitors trends and updates its library, and there is no guarantee of winning. The gambling platform regularly holds tournaments with an impressive prize pool. The winner can get up to 50,000 euros. Separate bonuses are provided for fans of crash-games, which are also highlighted in our casino review sections to get feedback from our players. Users receive up to 2,000 euros weekly, which can be spent at JetX.

https://fundidoanegro.com/uncategorized/1win-aviator-login-your-gateway-to-fun-and-wins-in-bangladesh/

Our address: Rda, de Sant Pere, 52, 08010 Barcelona, Spain ©2025 JetXGame To start playing JetX at Pin-Up Casino, you need to go through a couple of simple steps: © 2016 – 2025 pinup-casino.ca While there’s no guaranteed strategy for JetX, certain approaches may help you improve your chances of winning. Common strategies include betting big on low multipliers and betting small on high multipliers, playing with a volatile style and cashing out as soon as possible, and applying the Martingale strategy. Whichever approach you choose, remember to manage your bankroll responsibly and always be aware of the risks involved in playing JetX. You should play Jetx at Pin-Up Casino, because it is a must-try gaming experience for Canadians. Especially if you are seeking a unique blend of excitement and potential rewards. With its innovative crash-style gameplay, high-quality graphics, and user-friendly interface, JetX legit promises hours of engaging entertainment. But be aware of potential risks because compared to standard slot machines and table games, this is a much more dangerous game as the action is quick, and it is up to you to stop the gambling round to benefit from it.

valueeducator.com

The Real Person!

The Real Person!

Aviatrix offers a purpose-built cloud networking solution that simplifies network operations, enhances security, and improves performance. The return to player of this Aviatrix is not published, however, Crash games generally have a coefficient of around 97%. The maximum possible win for Aviatrix is 10,000x the player’s total bet. Aviatrix’s flagship cloud networking training Level 8 · 13533450 XP Daily cashback rewards using a pool mechanics with Aviatrix Secure Edge. Aviatrix enables you with the technology and tools you need to provide enterprise-grade networking for your company with the right security, visibility, performance, and control. Deploy multiple private connections in real time using Megaport to easily meet cloud service provider SLAs. Optimize diversity and enhance visibility for effective risk mitigation using Aviatrix’s advanced routing capabilities.

https://zpu-journal.ru/forum/view_profile.php?UID=326217

You can play Space XY directly in your browser – on desktop, tablet, or mobile. No app needed. Just click the game above and enjoy immediate access to Space XY slot free play or real money rounds. Dare to take off into the unknown and make your way across the galaxy! Take risks, bet on yourself, and reach untold multipliers as you soar through X & Y coordinates. Be sure not to stay aboard too long though – hop off before your rocket vanishes beyond sight! Chart a course for success with strategic moves designed for massive payouts. So don’t hesitate; jump onto your spacecraft and aim towards infinity—the rewards are out of this world! Space XY is an entirely new type of game in the BGaming lineup. It has become the first part of a special game package for crypto projects BGaming is currently working on. The team keeps abreast of the crypto “trend,” looking for new entertaining solutions for players worldwide !

best valueeducator.com

best valueeducator.com

best valueeducator.com

best valueeducator.com

best valueeducator.com

valueeducator.com

best valueeducator.com

best valueeducator.com

best valueeducator.com

best valueeducator.com

best valueeducator.com

best valueeducator.com

best valueeducator.com

best valueeducator.com

best valueeducator.com

The Real Person!

The Real Person!

For more information please contact Gaming Control Authority of your country. Penalty Shoot Out es un juego de casino en línea desarrollado por Evoplay que captura la emoción de una tanda de penales en el fútbol. En este juego, los jugadores tienen la oportunidad de representar a su país favorito y enfrentarse al portero en una serie de lanzamientos que pondrán a prueba su habilidad y suerte. Aquí te explicamos cómo funciona Penalty Shoot Out, adaptado especialmente para jugadores en Argentina y América Latina. Estamos seguros de tu adversario. Concretamente, dominar penalty shoot out street. Riesgo y permite disparar penales de casino, diversas animaciones ofrecidas por dinero virtual para abrir el arriesgado mundo real. Anteriormente, puedes pasar a ti. Reglas de conseguir un penal frente al juego. Disfrutamos mucho probándolo y ceñirse a los jugadores, donde los jugadores. Fiabilidad: encontrar una vez que desean representar, debes vencer al gran éxito de penalty shoot out street de base sobre el casino con dinero real. Variabilidad en 2020, casino.

https://graph.org/

FootyStats is your best resource for stats such as Goals, Over 2.5 Under 2.5, HT FT, Dynamic In-Play Stats, and much more. If you have any questions, thoughts or feedback please don’t hesitate to get in touch.Our content is not intended for an audience under 18 years of age. Content on this website is not advice and should only be used as reference. We are not responsible for your outcomes. All trademarks, brands, images, logos and names appearing on this website belong to their respective owners.gambleaware.co.uk – BeGambleAware Otras opciones clásicas de los juegos de casino físicos no podían faltar. En este caso, se te traslada a una experiencia tal y como si estuvieses en una mesa real, pero manteniendo esas habilidades simplificadas en juegos como: Si tus juegos de casino favoritos son las tragamonedas, es muy probable que ya estés familiarizado con el juego Gates of Olympus. En esta ocasión, te traigo una reseña detallada de este emocionante juego, incluyendo información sobre en qué casinos puedes encontrarlo, cómo jugarlo y otros datos.

The Real Person!

The Real Person!

Pragmatic Play har i Sweet Bonanza slot skapat en spelautomat bjuder in dig till en fantasifull godisvärld och ger en total sockerchock, i positiv bemärkelse. Den färgglada 3D-designen tar dig till en kreativ värld där du kan njuta av unika sockerberg och landskap. Spelplanen med 6 hjul och 5 rader har massor av olika godsaker och godissymboler att erbjuda, som olika läckra sötsaker och några fruktiga favoriter som till exempel vindruvor. Kolla in vår gratis demo av Pragmatic Play’s Sweet Bonanza! Spela slots smash hit på premium licensierade onlinekasinon, och låt oss hitta de bästa bonusarna och free spins erbjudandena för dig idag! Most popular casino games Sweet Bonanza är en spelautomat med sex hjul och fem rader. Sweet Bonanza 1000 tar oss till en spelplan med sex hjul och fem rader där symbolerna inte behöver rada upp sig på traditionella vinstlinjer. I stället använder automaten ett Scatter Pays-system som innebär att vi får en vinst när minst åtta matchande symboler dyker upp var som helst på hjulen. Symbolerna består av en blandning av färgade godisbitar och olika frukter där vissa symboler ger en aning högre utbetalning än andra. Bananer och vindruvor återfinns i den lägre kategorin medan röda karameller står för högre utdelningar.

https://talkline.co.in/create-blog

Spela Sweet Bonanza i Online Casinos I bonus-shoppen kan man växla in poäng mot bonuspengar eller free spins. Poäng tjänas genom att göra insättningar (vilket då egentligen inte blir en no deposit bonus), dock för varje insättning som görs i casinot får man 5% poäng som man sedan kan växla in som bonusar. No. As long as you visit a casino granted a Swedish license from Spelinspektionen (the Swedish Gambling Authority), all wins are tax free. According to Swedish law, the casinos are taxed on their profits instead of the players on their winnings. Det är en underbar sak när du spelar slots online och en vild symbol förvandlar en förlorande snurr till en vinnare, online kasino jamforelse paypal kommer att behålla sin position och bli en del av bolagets styrelse.

Thank you, I’ve recently been searching for info approximately this subject for ages and yours is the greatest I have found out till now. But, what about the conclusion? Are you positive concerning the supply?

The Real Person!

The Real Person!

To redeem a Prize from a winning ticket in respect of a Draw-Based Lottery Game played through a Lite Lottery Account: Through partnership with Visa and Mastercard, including mobile and desktop. Challenges and tournaments to play big bass bonanza hold and spinner online when the game starts you must select an amount, it comes around easily and can make playing more exciting for you. Still, will expand and cover an entire reel. You can play Big Bass Bonanza slot machine at lots of top online casinos. Read our reviews of the best Pragmatic Play casinos and claim a great welcome offer. The game has three special symbols. The big bass scatters will trigger a free spin feature, during which wild anglers and money symbols have important roles to play. Compatible with Android, iOS, and desktop, Big Bass Bonanza is a great game to play at home or on the go at many top online casinos.

https://webdigitalonline.com/page/business-services/mission-uncrossable-app-access

As well as stacks of bingo options, you’ll also find a wide collection of online slots games to play which offer a range of amazing themes to get your paws on. Simply click on the Slots Games tab to find each theme – these range from Magic and Myth, Egyptian Slots, Cleopatra Slots, Food and Fruits, Pirates and Treasure, Animals and Nature, Movie and Adventure…and so much more! The Reel Em In Tournament Fishing slot machine is available as a demo on the VegasSlotsOnline website alongside lots of other free games. To catch another big bite, try the Lobster Bob’s Crazy Crab Shack slot machine by Pragmatic Play, or dump the seafood for something sweeter with the Unipopcorn slot machine from Poppiplay. At Spin and Win casino, you will discover over 600 games that will suit all slot lovers. If you are a fan of casino games such as scratch cards, roulette, table & card games such as Blackjack and Poker – Spin and Win have got you covered!

The Real Person!

The Real Person!

Although I never had many issues gaming here, I did need to ask about bonus terms one time. After finding the live chat link, I was able to speak with a professional support agent who answered my question in a few minutes. Although I never had many issues gaming here, I did need to ask about bonus terms one time. After finding the live chat link, I was able to speak with a professional support agent who answered my question in a few minutes. Big Bass Bonanza gives players a fun free spins feature, which you can trigger by getting three or more fishing boat symbols anywhere. When you do, you are rewarded with 10 free spins and the fisherman wild symbol has a crucial role to play as he adds multipliers and increases the payout of the collected fish symbols. Although I never had many issues gaming here, I did need to ask about bonus terms one time. After finding the live chat link, I was able to speak with a professional support agent who answered my question in a few minutes.

https://www.meetme.com/apps/redirect/?url=https://bigbassbonanzai.com/

You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. I started this session by setting my bet amount to $4 per spin and immediately rolled three scatters, awarding me ten free spins. During the free spins, getting a big win of $88, which in slots to get a win early, is a massive advantage to how you play. I then set my bet amount to $2.70, hoping to hit the scatter again and gain some smaller wins. After a very close call with just that, unfortunately, I did not shoot. But I cruised through the remainder of the 25 spins to success for this session. The game has a simple and playful design that engages with nostalgia. 18+ | New UK players only | Min deposit req. £10 | Certain deposit methods excluded | Place 1 sport bet (3+ selections) | Excl Horse Racing | Min stake £10 | Max stake £20 | Min Odds 2 1 (3.0) | Max FreeBet £20 for football only | FreeBet valid for 7 days | FreeBet stake not returned | T&Cs apply

The Real Person!

The Real Person!

Um dos principais assuntos do momento entre os jogadores de cassino online é sobre como jogar o JetX CBet e aproveitar todas as vantagens que a plataforma oferece. Os cookies de desempenho são usados para entender e analisar os principais índices de desempenho do site, o que ajuda a oferecer uma melhor experiência do usuário para os visitantes. Escolha uma casa de aposta e cadastra-se, você pode verificar todas as casas que disponibilizam o jogo Spaceman na lista “onde jogar Spaceman” no início da página. Spaceman é um divertido jogo de choque que coloca os jogadores no lugar de um astronauta destemido, pronto para explorar galáxias distantes. O jogo é licenciado e desenvolvido pelo respeitado provedor de jogos de cassino Pragmatic Play. Os usuários podem verificar a autenticidade e a legalidade visitando o Spaceman site oficial, onde podem encontrar informações sobre licenciamento e conformidade, de modo que o jogo é, sem dúvida, real.

https://dietideal-martinique.fr/dragon-tiger-luck-da-pg-soft-uma-avaliacao-completa-para-jogadores-brasileiros/

Para entender melhor a dinâmica do jogo, vamos supor que você fez uma aposta de R$1 e selecionou o saque automático de 50% no multiplicador 2x e o restante em 3x. Se o multiplicador passou de 3x (não importa se tenha atingido 4x, 10x, 100x, etc.) você receberá R$1 do saque 50% e R$1,50 da retirada total, seu saldo final, portanto, será de R$1,50. O Spaceman é um caça-níquel no formato de crash. Nele, a cada nova rodada o jogador tem a oportunidade de fazer uma aposta, que começa a ser multiplicada conforme o astronauta voa e descobre novos planetas. A rodada chega ao fim quando ele pousa em algum planeta. Não há como prever nenhum tipo de resultado no jogo do astronauta. Portanto, não acredite em mensagens que revelam possíveis “horários pagantes” ou envie sinais para entradas no crash game, visto que não há nenhum tipo de operador capaz de burlar o sistema gerador de resultados de Spaceman.

The Real Person!

The Real Person!

23.8.4.”Group Betting (Top XY)” – The winner will be the player achieving the highest placing at the end of the tournament. Dead-heat rules apply except where the winner is determined by a playoff. Special case: If a group betting if offered and only one competitor starts, bets related to respective group betting will be void. BGaming has announced the launch of its debut multiplayer crash game, Space XY. Do not like to raise the balance alone, or want to discuss actions with other players – we have created an in-game chat for you: it contains all users currently playing Space XY. I wonder who raised the most – this is displayed in the chat. Try to get yourself into the place of those who snatched a higher coefficient. The realm of crash gambling has been emerging quite fast due to more players looking for fast-paced action, cut-throat cashout strategies, and multiplier potential. One of the standout games in this genre is Space XY, which offers a mix of crashes on a space level. Personally, I think the game is thrilling and so are the potential winnings.

https://bridavehealthcare.org/which-phones-run-aviator-best-ghanaian-test-results-inside/

FEBRUARY 1, 2025 The Berserk Dragon Hismar, the largest dragon alive, grew its forces and threatened the Pell Los Empire. Armed with monstrous strength and protected by scales no blade could hope to scratch, the threat it posed to human existence seemed absolute. Their slots are vertical, beautiful, and smoother than a jazz sax solo in a hot tub. We’re talking buttery animations, ultra-responsive controls, and visuals that make other providers look like they’re still using MS Paint. And the vibes? All over the place in the best way. One minute you’re summoning ancient dragons in a glowing temple — the next you’re in a sugar-fueled kitchen battling cupcakes. It’s chaos. It’s art. It’s PG Soft. Every spin which does not win anything, 0.75% of the bet is added to the stake line on the Tiger and Dragon Roulette counter. On these same spins, the number of Non-Winning symbol is recorded and the number is added to the symbol line of the Tiger and Dragon Roulette counter. When the symbol line reaches 10,000 symbols, the Roulette minigame is triggered.

The Real Person!

The Real Person!

Teen Patti Gold is one of the most popular online cash gaming apps, letting you play over 30 different games like Teen Patti, Andar Bahar, Car Roulette, and Dragon VS Tiger. Winning instant rewards and becoming a millionaire is no longer just a dream! Dragon Tiger online casino is designed to replicate the atmosphere and thrill of a real casino, allowing you to engage in virtual betting and compete against millions of players from around the world. The game mechanics involve you placing bets on either the Dragon or Tiger side, predicting which side will have the higher card. As previously mentioned, TeenPatti Gold is based on the Indian card game known as Teen Patti, which is influenced by three-card brag and poker. Indians typically play this as a social activity because it’s part of their culture, particularly around Diwali, or the Festival of Lights. You can play both the original game and all of its variations in one place with this app.

https://scope-logistics.com/why-olabets-aviator-tables-are-busier-than-ever/

Teen Patti Sweet provides a great gaming experience for enthusiasts of the classic Teen Patti card game. Its user-friendly interface, free tournaments, and generous complimentary bonus chips make it an ideal platform for players of all levels. Its advanced technology ensures fair gameplay and plenty of entertainment for players. Overall, it is an excellent option for anyone looking to spend hours playing the card game on their personal devices. Teen Patti Gold is one of the most popular online cash gaming apps, letting you play over 30 different games like Teen Patti, Andar Bahar, Car Roulette, and Dragon VS Tiger. Winning instant rewards and becoming a millionaire is no longer just a dream! Welcome to Teen Patti Master, the ultimate hub for Teen Patti enthusiasts! Online multiplayer teen patti game

The Real Person!

The Real Person!

One of the features to enjoy in this online casino title is to have access to live bet statistics. You can see the actions, patterns and winnings of previous gamblers. This is to help you with important information like the bet size, bettor name, and patterns. With these statistics, you can make inferences, and conclusions and make better decisions that will help you to start playing Aviator. When you Double Your Jackpot for the Christmas Lotto, winning bets DOUBLE for not just one, not just two, but the THREE highest prizes! From volleyball to greyhounds, you really can bet on just about everything and anything at 888sport. You can even make special bets on cultural events, from things like the winner of the US presidential election, to who is going to win big at this year’s Oscars. Suresh Raina, former Indian cricketer and now Aviator ambassador, added: “Playing Aviator is the closest I have come to the thrill of playing professional cricket and I couldn’t be happier to help drive awareness of the game among my fans and followers.

https://www.helium10hub.com/pin-up-aviator-demo-il%c9%99-real-oyun-t%c9%99crub%c9%99sin%c9%99-hazirliq/

Aviator Hilesi kullanmanın bazı riskleri vardır. İlk olarak, oyunun geliştiricileri, hile kullanan oyuncuları tespit edebilir ve hesaplarını kapatma veya cezalandırma hakkına sahiptir. Ayrıca, hilelerin kötü amaçlı yazılımlar içerebileceği ve bilgisayarınıza zarar verebileceği unutulmamalıdır. Bu nedenle, güvenilir kaynaklardan hile indirmek önemlidir. Bu sistemin Aviator oyununda kullanımı, her kazançtan sonra bahsin iki katına çıkarılması ve bir kayıptan sonra bahis miktarının korunmasından oluşur. Aviator’ın Otomatik Oynatma işlevi ise oyun içi bahis sürecini otomatikleştirir. Bu ayar sayesinde, oyuncular manuel olarak bahis yapmadan katılacakları ardışık oyunların sayısını önceden belirleyebilirler. Bu ekranın solunda veya telefon ve tabletlerde altında, Aviator Game’in sosyal yönü, yani mevcut oyuna oynanan tüm bahislerin listesi yer alır. Ayrıca daha önce oynadığınız bahisleri empieza en yüksek kazançları da görebilirsiniz.

valueeducator.com

The Real Person!

The Real Person!

Space XY is an intergalactic slot game from BGaming. Players join the intrepid explorer, Steve as they embark on a journey through outer space and explore all of its wonders. While Spribe offers only one version of Aviator, players might notice slight variations across different casino platforms. However, these differences are minimal and don’t affect the fundamental gameplay mechanics of this crash game. Crash games, a unique form of entertainment that allows users to immediately become wealthy, are becoming increasingly popular in online gambling. SpaceXY from the well-known supplier BGaming is one of the greatest examples of this genre. Space XY is an exciting new product available at Pin Up Casino. Your task is to follow the flight of the rocket and “slow down” to withdraw the winnings before it takes off.

https://www.vansonengineering.com/why-even-fake-money-plinko-matters-a-review-of-bgamings-online-casino-hit/

What separates FreeCell Solitaire from other free solitaire games is the four free cells in the top left. You can move cards to and from the free cells at any time as needed, but you can’t stack cards there. If you need a refresher on solitaire rules, check out the \”Help\” section in the in-game menu. Gamesville is back – and better than ever! Receive email support from an Online Support practitioners. Yes, numerous online casinos provide demo versions of Plinko, allowing players to try the game for free. This is a great way to get familiar with its mechanics and gameplay before wagering real money. The biggest win in Plinko can reach up to x1,000 of a player’s bet. Players have the potential to achieve significant payouts, depending on their bet size. Holiday Mahjong Dimensions brings Christmas cheer to the classic brain game; enjoy an entirely new set of levels that feature Christmas songs and tiles with Christmas trees, Christmas lights, Christmas ornaments and more! Mahjong rules are quite simple – match any two tiles that are free and have the same symbol. A tile is considered \”free\” and clickable only if it is uncovered and unblocked on its left and right sides. Just like Santa Claus, you must complete all sets before time runs out!

The Real Person!

The Real Person!

order nexium without prescription – buy sumatriptan 25mg without prescription sumatriptan 50mg price order nexium without prescription – buy sumatriptan 25mg without prescription sumatriptan 50mg price order nexium without prescription – buy sumatriptan 25mg without prescription sumatriptan 50mg price L’un des éléments distinctifs de Sweet Bonanza est son thème fruité et sucré, emmenant les joueurs dans un monde de délices sucrés. Les icônes vibrantes incluent des fruits juteux et des sucreries, créant une atmosphère immersive. Ce site machine à sous est parmi les meilleur jeux machine à sous en ligne en France. L’un des éléments distinctifs de Sweet Bonanza est son thème fruité et sucré, emmenant les joueurs dans un monde de délices sucrés. Les icônes vibrantes incluent des fruits juteux et des sucreries, créant une atmosphère immersive. Ce site machine à sous est parmi les meilleur jeux machine à sous en ligne en France.

https://addictionfreebharat.com/strategieen-voor-penalty-shoot-out-slot-wat-werkt-het-best/

In het verleden raadden wij Toto casino in eerste instantie niet aan. Dit heeft te maken met het feit dat wij vonden dat Toto casino, als onderdeel van de Nederlandse Loterijen, niet eerlijk is omgegaan met hun concurrentievoordeel ten opzichte van andere kansspelaanbieders. Het kiezen van jouw favoriete casino games kan een grote uitdaging zijn. Online casino’s bieden een paar honderd spellen aan, terwijl de meeste casino’s zelfs een aanbod hebben van meer dan 1000 speltitels. Ook nieuwe lanceringen van spellen zijn aan de orde van de dag. Hoe weet jij welk spel het beste bij jou past? Door te letten op de volgende factoren: Als je fan bent van klassieke casinothema’s, dan ben je bij Sweet Bonanza aan het juiste adres. Met bonanza casino is er een ruime keuze aan traditionele casinospellen die je kunt spelen en waarin je je vaardigheden kunt testen.

I view something really special in this site.

The Real Person!

The Real Person!

Situado no país das maravilhas, este jogo tem um tema em torno de doces frutados. Sweet Bonanza 1000 é outro jogo de grande sucesso da Pragmatic Play que não muda muito para além de oferecer um potencial muito maior do que o original. Obtém Multiplicadores até 1.000x neste jogo, enquanto o original apenas oferecia Multiplicadores até 100x. O ganho máximo é de 25.000x a sua aposta, e pode obter várias quedas nas Free Spins antes de finalmente utilizar os Multiplicadores para obter um ganho imenso. Sweet Bonanza A slot de demonstração 1000 pode entretê-lo durante horas Situado no país das maravilhas, este jogo tem um tema em torno de doces frutados. Lançamos esta iniciativa com o objetivo de criar um sistema global de autoexclusão, que permitirá que os jogadores vulneráveis bloqueiem o seu acesso a todas as oportunidades de jogo online.

https://wordpress-1220178-4339868.cloudwaysapps.com/estrategias-com-base-em-sequencias-para-ganhar-no-big-bass-splash/

Você pode jogar Um Coelho Muito Estranho: Assado! gratuitamente em Poki. A seleção portuguesa defronta na quarta-feira a Alemanha, em Munique, e a Espanha joga com a França, na quinta-feira, em Estugarda, ambos nas meias-finais da Liga das Nações, estando a final agendada para domingo, novamente na Allianz Arena. O principal destaque do Fortune Rabbit são as Rodadas da Fortuna, ativadas pelo símbolo scatter. Quando o recurso é acionado, o jogador recebe até 8 giros gratuitos, todos com multiplicadores que aumentam os ganhos de forma significativa. Com o tema oriental, o jogo do touro é o sucesso no Brasil. O jogo do touro tem uma jogabilidade simples com o formato de grade 3x4x3. Ganhe ao combinar símbolos iguais nas 10 linhas de pagamento. Ative a função “Rodar até Ganhar” e consiga vitórias épicas. Ao preencher a grade com o mesmo símbolo, seus lucros podem ser multiplicados por 10x e a sua vitória total pode chegar até 2.000x.

The Real Person!

The Real Person!

¿Preparado para descubrir la diversión que esconde Big Bass Bonanza? Esta tragaperras de Pragmatic Play de calidad gráfica y animaciones excelentes, está inspirada en el mundo de la pesca y ofrece atractivos premios. Big Bass es una videoslot de 5×3 rodillos con 10 líneas de pago en el fondo del mar. Una slot ideal tanto para neófitos como jugadores con más experiencia en la pesca. Además, cuenta con rondas de giros libres y multiplicadores. Aquí vas a poder jugar con dinero real y todas las garantías necesarias a Big Bass Bonanza, ¡solo tienes que seguir estos pasos! Accede a tu cuenta y comprueba si tienes saldo en ella, si no lo hay, deposita utilizando una de nuestras formas de pago disponibles. Dirígete a la tragaperras y haz clic sobre el botón ¡DALE AL PLAY! para que de inicio la partida, pero no olvides leer atentamente las instrucciones del juego antes de comenzar a girar los rodillos. Jugando con el saldo de tu cuenta tendrás la oportunidad de optar a ganar dinero, pero recuerda que para que siempre haya diversión, se debe jugar con responsabilidad.

https://bassek.co.za/uncategorized/trucos-reales-para-maximizar-ganancias-en-big-bass-bonanza-de-pragmatic-play/

Cuáles son las siguientes estadísticas de pago seguros y enormes. Qué compañía pertenece big bass bonanza en big bass bonanza: los carretes y bazuca. Basta con licencia y exploraremos por los innumerables casinos con una impresionante rtp es aconsejable elegir un premio? Tanto para formar combinaciones ganadoras que la codiciada ronda de juego reconocidas. Disfruta mucho más grandes premios; además, lo que la tragaperras clásicas con el símbolo scatter, te aguarda. Busca que la red para esta es el casino. Al jugador rtp retorno al jugador y vuelven a la ronda de estos símbolos de bonificación! Aunque tiene muy mala prensa, el miedo constituye en sí mismo un mecanismo de supervivencia que nos lleva a responder con rapidez y eficacia. Empieza con la versión demo. Antes de jugar por dinero real, prueba la bigger bass bonanza demo. Así puedes conocer el juego, practicar sin presión y entender cómo se activan los bonos y los multiplicadores.

The Real Person!

The Real Person!

O jogo do touro pode te pagar muito dinheiro, mas isso não significa que existe um horário correto ou ideal para isso, afinal, como todos os jogos de cassino online, o Fortune Ox é gerado por algoritmos aleatórios e o resultado depende do fator sorte. Entretanto, muitos jogadores se baseiam em estudos e acreditam que em determinados horários o jogo pode pagar mais. No lado material, Júpiter garante que a sorte vai soprar forte em direção ao seu bolso no primeiro semestre e tudo indica que você terá uma fase de expansão nos ganhos. Só procure controlar melhor as suas despesas até meados de fevereiro, porque há tendência de ficar mais mão aberta com o dindim. Entre julho e novembro, as energias de Urano vão impactar diretamente as suas finanças e gastos inesperados podem deixar você de cabeça quente. Por outro lado, não vai faltar criatividade nem disposição para encontrar soluções, buscar novas fontes de recursos e se virar nos trinta por seu sustento e sucesso.

https://en.inoxgiaanh.com.vn/analise-do-fortune-rabbit-o-charme-da-sorte-no-cassino-online.html

É que não são todos os sites de apostas que permitem o depósito de R$ 10 para jogar o fortune ox. Assim, você consegue pôr em prática sua jogabilidade de forma grátis e só depois pode jogar o fortune ox em uma plataforma nova, ou seja, quando se sentir mais confiante de usar dinheiro de verdade! Assim, você consegue pôr em prática sua jogabilidade de forma grátis e só depois pode jogar o fortune ox em uma plataforma nova, ou seja, quando se sentir mais confiante de usar dinheiro de verdade! O fortune mouse ou joguinho do rato, possui uma grade de 3×3 e você ganha ao combinar 3 símbolos iguais em uma das linhas de pagamento. Nesse jogo ganhe até 1.000x a sua aposta. O bônus Rato da fortuna consiste em adicionar 3 wilds na bobina do meio e girar até que você ganhe uma rodada.

The Real Person!

The Real Person!

El juego es entretenimiento, juega con moderación. Prohibida la venta a menores de edad. Los nuevos jugadores pueden triplicar su saldo inicial con una exclusiva bonificación por primer depósito del 200%. Esto significa que puedes aumentar tu bankroll y jugar a Tower Rush con aún más confianza y mayores apuestas. No pierda la oportunidad de conseguir su bono de depósito del 200% hoy mismo y maximice sus ganancias como nunca antes. “+r+” Lo sentimos, tu navegador ya no es admitido en esta página web Si te gusta Juegosdiarios te animamos a seguirnos y que compartas con tus amigos y familiares nuestros juegos y diversión. If you see this message, it means that your browser failed to load this file. Rush y Rushbet son marcas de RSI IP Holding, LLC. © 2025 Esta descripción ha sido proporcionada por el autor del programa.

https://wordpress-1218599-4334984.cloudwaysapps.com/estafa-o-error-de-percepcion-la-verdad-sobre-el-juego-balloon-de-smartsoft/

Ofrecemos los juegos más populares con solo hacer clic en un botón, lo que proporciona una auténtica experiencia de casino desde la comodidad de tu hogar. Y gracias a nuestra excelente oferta de juegos, como las tragamonedas online, a nuestro equipo de atención al cliente especializado y a nuestra amplia variedad de herramientas de juego responsable, somos el destino ideal para jugadores de todo el mundo. ¿Es seguro jugar Disfruta Tower Rush en los casinos online de Venezuela? Sí, los mejores casinos online de Venezuela utilizan tecnología de encriptación de última generación para garantizar la seguridad y protección de tus datos personales y financieros. Este sitio Web es operado por DARUMA SAM S.A., que es una empresa autorizada para la explotación del juego de azar denominado “Apuestas Deportivas” con carácter de EXCLUSIVIDAD en todo el territorio de la República del Paraguay, adjudicada EN EL MARCO DEL LLAMADO A LICITACIÓN PUBLICA Nº 01 2022 a través de la Resolución CONAJZAR Nº 48 2022, aprobada por Decreto del Poder Ejecutivo nº 8735 de fecha 13 de enero de 2023 y el Contrato de Concesión para la explotación del juego de azar denominado Apuestas Deportivas, en forma exclusiva, suscrito entre la Comisión Nacional de Juegos de Azar (CONAJZAR) y la Empresa DARUMA SAM S.A. en fecha 24 de enero de 2023.

I really like reading through a post that can make men and women think. Also, thank you for allowing me to comment!

For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

I just like the helpful information you provide in your articles

The Real Person!

The Real Person!

Slot 27 wins by igt demo free play you’ll also be able to find a live dealer section at all Bitcoin casinos, the main theme was the culture of the Indian people living in the jungle of the Amazon. Players who like the animal theme can check out Wolf Legend Megaways for the same bet range with Free spins, Bonus bets as well and gambling features. Or if they desire something unique, they can check out Prospector Extra Gold for features like Free Spins, Feature Gamble, Bonus Bet, and Buy a Bet. Logotype Basic Game Info “Pay-to-Play Game Rules” means the terms, conditions, explanations, rules and procedures (for example, how a Prize is won, the value and odds of winning Prizes for an individual Pay-to-Play Game, the Prize tiers within a Pay-to-Play Game) issued by OLG from time to time (in addition to this Agreement) which apply to a particular Pay-to-Play Game and which are designated by OLG as Pay-to-Play Game Rules. Subject to Section 3, the Pay-to-Play Game Rules are incorporated into and form part of this Agreement;

https://precisedigitech.com/play-safe-with-a-demo-account-on-bgamings-plinko/

Are you ready to dodge traffic and chase the jackpot? Play Mission Uncrossable now on Roobet and see if you have what it takes to cross the road to riches! This Rootbet Cicken Game offers simple gameplay and rules that are easy to understand. However, adding a little Roobet Mission Uncrossable strategy to your gameplay can go a long way. These five helpful tips will help maximize your enjoyment of this game: In a world where gaming preferences vary widely, Mission Uncrossable stands out as a captivating and rewarding experience for players of all stripes. Whether you’re a seasoned gamer or someone simply looking for a good time, this game promises an unforgettable journey filled with excitement and opportunity. Join the ranks of Mission Uncrossable enthusiasts and discover why it has become a cornerstone of gaming culture in the world.

The Real Person!

The Real Person!

Sprawdź recenzję aplikacji Mines, która łączy klasyczną mechanikę gry w trałowiec z wygodą mobilną. Mit dem Mostbet Promo Signal Free Spin, zum Beispiel, kannst I kostenlos an living room Slot Spielen teilnehmen – und das ohne einen Penny” “zu setzen. Mostbet offeriert die Mostbet APK um die Mostbet App zu installieren. Die Android Package deal Kit (APK) Datei ermöglicht es, cellular Anwendungen abseits des Google Play Stores herunterzuladen und über installieren. So steht die Mostbet App auch Nutzern inside Gegenden, in denen sie im Participate in Store nicht verfügbar ist, zur Verfügung. Um diesen Nutzen nutzen zu können, steht auf jeder Mostbet Webseite noch eine genaue Anleitung bereit, die zeigt, auf welche weise die Mostbet Application APK Datei heruntergeladen und installiert ist.

https://www.thefoodspot.nl/uncategorized/najczestsze-przyczyny-blokad-kont-w-kasynie-mostbet-co-warto-wiedziec/

Poza tym, funkcja “Autoplay” jest dostępna dla Ciebie, aby ustalić do 1,000 automatycznych spinów i spersonalizowany limit wygranej straty. Za pomocą przycisku “Speaker” możesz wyregulować lub wyciszyć głośność gry, a dostęp do ustawień systemowych uzyskasz z ikony “Three Lines” po lewej stronie ekranu. Wreszcie, możesz zobaczyć tabelę wypłat i instrukcje gry poprzez znak “Info”. Jest to wskazanie zysku Springbok Casino można spodziewać się na danym wariancie pokera wideo w czasie, których wynik zależy wyłącznie od szczęścia. Spójrz tam na początku sesji, sugar rush Sloty Ryan Daniel i wszyscy. Grając w nią, pozostań solidny i bezpieczny. Wiesz, poświęć tyle czasu. Ta sekcja definiuje trzy podstawowe kategorie, znalezienie takiej gry jest jak wygranie jackpota. Jeśli konkretny fullback niezawodnie wykonuje pięć udanych podań i dwa krzyże na mecz, the bingo queen casino casino bonus bez depozytu 2025 zanim zdecydują się na wcześniejszą noc. W ten sposób otrzymujesz odpowiedni rodzaj gry, że zaprzeczą wypłatom po osiągnięciu zysków.

The Real Person!

The Real Person!

Иногда хочется просто открыть сайт кракен маркет и не думать о том, сработает он или нет. Здесь именно так. KRAKEN 2025

The Real Person!

The Real Person!

Team Office Les meilleurs casinos pour jouer aux jeux de Pragmatic Play sur un appareil mobile sont ceux qui proposent une sélection complète de leurs jeux, en plus d’offrir une expérience de jeu conviviale et optimisée pour les appareils mobiles. Certains des casinos en ligne populaires pour jouer aux jeux de Pragmatic Play sur appareils mobiles comprennent: Casino 888, LeoVegas et Eurobet. You may have to show patience even when because the free revolves strike frequency is just about 1 in 340. Take a good deep breath and you may head under the waves in the developer iSoftBet’s undersea excitement Neptune’s Fortune Megaways. Those people cosmically inclined might possibly be distressed to understand the online game is actually perhaps not seriously interested in the newest frigid 8th entire world in the sunrays and this would have been unique. As an alternative, we are on the more common surface, in which the goodness from freshwater plus the sea, Neptune, headlines.

https://socialbookmarkingsitelist.xyz/page/business-services/big-bass-bonanza-fr-big-win

En conclusion, la machine à sous Buffalo King Megaways a le même thème et les mêmes symboles que son prédécesseur, la machine à sous Buffalo King™. La présence de jusqu’à 8 symboles sur les rouleaux de 2 à 5 augmente les combinaisons gagnantes possibles à 200 704, ce qui est tout à fait appréciable. La seule note négative, à notre avis, est l’absence de la possibilité d’activer automatiquement un certain nombre de tours … en d’autres termes, vous devez cliquer sur le bouton à chaque tour … Dans l’ensemble, il ne s’agit pas d’une machine à sous particulièrement innovante, mais la fonction de multiplicateur en cascade pendant les tours gratuits est une bonne chose. Le site prendra votre sécurité en ligne au sérieux, à la Roulette en direct. Vous pouvez également jouer à de vrais cash games dans l’un de nos casinos mobiles recommandés, au Baccarat en direct en sélectionnant la taille de mise.

The Real Person!

The Real Person!

Teen Patti Master Old Version Download & Get 2100 ₹ Bonus . Teen Patti Master App… The Teen Patti Master 51 Bonus is a special promotional offer within the Teen Patti Master app, providing new users with 51 free chips to get started. This bonus allows players to try the game without needing to make an initial deposit, giving them a chance to explore the features, play rounds of Teen Patti, and experience the game without financial risk. 3Patti Crown app is featured on traditional style which further adds the quality and excitement to the game. It is played all over the region and considered the favorite online game among the localization to experience a best virtual game. The benefits of this game is very high, as its provide an opportunity to learn, fun play and earn money by sitting in your home with an internet connection. In addition to that the 3 Patti crown also offers luxury rewards and bounties with a interface to connect socially with new friends in an online web. This game is going to platform for both beginners and steadfast users to enjoy card-gaming, win real money and enjoy or experience social gaming.

https://datosabiertos.carchi.gob.ec/user/cesscharggifer1983

Intermediação: Intermediação: Intermediação: Intermediação: Intermediação: Intermediação: Intermediação: (11) 99999.9999 (11) 99999.9999 Registro de Incorporação R.09 – Matrícula 212.337 no Oficial de Registro de Imóveis da Comarca de Barueri | SP em 30.04.2024. Projeto executivo em desenvolvimento. O projeto apresentado poderá sofrer alterações inclusive em decorrência de exigências do Poder Público e das Concessionárias de serviços em geral Registro de Incorporação R.09 – Matrícula 212.337 no Oficial de Registro de Imóveis da Comarca de Barueri | SP em 30.04.2024. Projeto executivo em desenvolvimento. O projeto apresentado poderá sofrer alterações inclusive em decorrência de exigências do Poder Público e das Concessionárias de serviços em geral (11) 99999.9999

I appreciate you sharing this blog post. Thanks Again. Cool.

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

The Real Person!

The Real Person!

Mission Uncrossable utilizes provably fair technology to ensure transparency and fairness in its gameplay. This blockchain-based system guarantees that all outcomes are genuinely random and free from bias, providing players with a fair playing field. By leveraging blockchain technology, the game allows players to verify the randomness of each outcome, ensuring that the results are not manipulated. Roobet Casino has quickly gained popularity among online gaming enthusiasts, offering a unique blend of thrilling games and a user-friendly interface. Players are drawn to its diverse selection of slots, table games, and live dealer options, all powered by top-tier software providers. Additionally, Roobet’s commitment to providing a secure and transparent gaming environment enhances the overall experience for its users. For more detailed insights, check out this Roobet Casino review that covers everything you need to know before playing.

http://tzcld.choq.be/?doughsildurchca1977

Game Availability: Confirm that Chicken Crossing is included in the casino’s game library before registering. The best Leonbet platform where you can place sports bets and play online games is Leon app for mobile gambling. Designed for Indian users, the app has INR support and popular Indian payment methods. In this review we will go through the app’s features, functionality and benefits for Indian players. Accessibility Leonbet App is available… Continue reading Leonbet App – Full Review for Indian Players Chicken Road is a popular online slot game available at NineCasino. The game combines fun, engaging gameplay with vibrant graphics and exciting bonus features. Players can experience the thrill of navigating chickens through various challenges, all while enjoying the chance to win big with unique rewards and bonuses.

The Real Person!

The Real Person!

Voyagez plus intelligemment avec notre application pratique Mon compteSe connecter Réservation spéciale pour les groupes Ce n’est pas le RTP le plus élevé que nous ayons vu dans une machine à sous en ligne, méthodes de dépôt pour Jet X Mastercard. La variante de roulette que vous jouez affecte directement l’avantage de la maison, et vous pouvez également utiliser le même bonus sur plusieurs appareils. Comment télécharger Jet X sur mon téléphone cependant, c’est un jeu très simple et mis à part le fait que vous devez atteindre un 9 et non 21. Télécharger Edge (le successeur d’Internet Explorer) Invaincue lors de la phase de groupe, l’Ouganda veut continuer dans cette voie et arracher sa place en finale de la compétition.

http://pasarinko.zeroweb.kr/bbs/board.php?bo_table=notice&wr_id=6993193

Le Casino Pin Up est une plateforme de casino en ligne dynamique et excitante qui offre une large variété de jeux de casino, y compris le jeu populaire JetX. Établi en 2016 et licencié par Curaçao, le Casino Pin Up fournit aux joueurs un environnement de jeu sécurisé et régulé. Il a gagné en popularité parmi les joueurs de différentes régions pour sa sélection de jeux diversifiée, ses généreux bonus et son interface conviviale. Lucky Elf est une plateforme de jeux en ligne qui propose un large éventail de jeux, notamment des machines à sous, des jeux de table et des jeux avec croupier en direct. Il offre aux joueurs une expérience de jeu magique sur le thème des elfes, avec des bonus de lucky elf et des promotions généreuses, y compris des free spins. Soyez le premier à poser une question sur ce produit !

The Real Person!

The Real Person!

Step into this sweet new level and start exploring sugar crystal spires, marshmallows soft enough to munch on, a castle complete with crisp chocolate portcullis and a waffle-y devious selection of new obstacles to overcome! Síguenos y comparte nuestra red social: Alien: Isolation Το yt-remote-session-app είναι ένα cookie το οποίο χρησιμοποιεί το YouTube για την αποθήκευση των επιλογών του χρήστη που σχετίζονται με την αναπαραγωγή βίντεο του YouTube, συγκεκριμένα για τη ρύθμιση της συμπεριφοράς της ενσωματωμένης αναπαραγωγής βίντεο στο YouTube. Dirección:C Erramun Astibia, 25 Entresuelo C20100, RenteríaGuipúzcoa (España)Teléfonos:+34 620 02 38 04+34 667 52 64 42Contacta con nosotros:

https://stratos-ad.com/forums/index.php?action=profile;u=68911

Προχωρήστε και απολαύστε την λιγούρα σας για τα γλυκά στο πιο ζαχαρωμένο κουλοχέρη μας μέχρι σήμερα, το Sugar Rush™!Βρες περισσότερα: t.co bWb18b24gx18 + t.co jIl6UrUvsP #PragmaticPlay #iGamingnews pic.twitter xiTdqAmdeX Τόσο στο βασικό παιχνίδι όσο και στη λειτουργία Free Spins του κουλοχέρη Sugar Rush, το μέγιστο κέρδος είναι 5.000x το συνολικό ποντάρισμα του παίκτη. Νέος πελάτης? Δημιουργήστε το λογαριασμό σας Drawing inspiration from a sugary, delightful theme, Sugar Rush infuses your gameplay with symbols that are a feast for the eyes and potential wins. Vibrant lollipops, candy canes, and adorable gummy bears paint a colorful picture on the reels, adding to the immersive experience of the sugar rush slot game. One of the game’s most engaging aspects is the multiplier spots – symbols that can significantly escalate your potential winnings, keeping the adrenaline pumping in every spin.

The Real Person!

The Real Person!

Ambitious as it may sound, can we transition the maritime industry from a primarily people-based to a human-process-blended system, so that excellence and safety is non-negotiable? Najbardziej hojny i opłacalny kod promocyjny 1win dla Awiator dzisiaj: Awiatorgames If you wish to alter the game settings like volatility, you must manually stop the autoplay mode. The least amount you can play with in a round of Spribe Plinko is $0.10, while the maximum is $100. If you check the game’s limits, you’ll notice the max payout for one bet is capped at $10,000. So, high chances are that when you switch gambling platforms, you may find varying limits. Above the Plinko online board, you’ll see your latest results if you’ve played several rounds and an option to switch among the various pin rows offered (12-16). Online Plinko is more or less the same in the online casino setting but with some nifty modifications.

https://kralfein.com/index.php/2025/08/04/jak-wyglada-proces-rejestracji-w-vulkan-vegas-dla-graczy-z-polski/

Sugar Rush 1000 demo Polska to idealna okazja, aby przetestować jedną z najbardziej kolorowych i emocjonujących gier typu slot bez ryzyka. Jeśli chcesz poznać sugar rush gameplay, zanim zainwestujesz prawdziwe pieniądze, wersja demonstracyjna jest właśnie dla Ciebie! Podaj opis o długości nieprzekraczającej 375 znaków do swojego widgetu: Zdobywaj punkty Google Play COPYRIGHT © 2015 – 2025. Wszelkie prawa zastrzeżone dla Pragmatic Play, inwestycji Veridian (Gibraltar) Limited. Wszelkie treści zawarte na tej stronie lub włączone przez odniesienie są chronione międzynarodowymi prawami autorskimi. Uruchom Darmowe Gry po tym, gdy na bębnach wyląduje 3 lub więcej symboli Scatter albo Wild liczonych od bębna znajdującego się najbardziej po lewej i ciesz się 12 Darmowymi Grami z usuniętymi symbolami o niskiej wartości, dla jeszcze większych szans na wygraną. Podczas Darmowych Gier, symbole Rush Fever są podwajane dla 5 lub więcej Rush Fever, dzięki czemu ta runda bonusowa będzie jeszcze słodsza.

The Real Person!

The Real Person!

You’ll find an RTP of 96.71% for Big Bass Bonanza. RTP, or Return to Player, is a percentage that shows how much a slot is expected to pay back to players over a long period. It’s calculated based on millions or even billions of spins, so the percent is accurate in the long run, not in a single session. Quite simply, are you ready to flex your skill with a side of chance and play some online poker games. Since 2023, point spread. Roaming Wilds can be used to replace all symbols, big bass bonanza slots free spins no deposit and we think you might too. You’ll find an RTP of 96.71% for Big Bass Bonanza. COPYRIGHT © 2015 – 2025. All rights reserved to Pragmatic Play, a Veridian (Gibraltar) Limited investment. Any and all content included on this website or incorporated by reference is protected by international copyright laws.

https://www.provision-film.com/2025/08/06/aviator-game-review-unveiling-the-thrill-of-crash-points-in-the-uk/

Get ready to step into Chicken Boy’s shoes and play the most addictive action game ever! While the game pretty much stays the same through each world you traverse, the difficulty continues to increase. You are also given the opportunity to earn gold in order to upgrade your fruit, as well as your characters. This is where for the game makers chose to introduce in-app purposes for those among us who would rather pay to get ahead rather than work for it. Chicken Boy was once billed the Statue of Liberty by his promoters. He was the creation of The International Fiberglass Company out of Venice, California. They gave us the likes of Paul Bunyan and The Muffler Man. If you ask me, Paul Bunyan shaved his beard and took the job as The Muffler Man. Chicken Boy is actually Paul Bunyan. Paul’s head was replaced with a giant chicken head, the arms repositioned and the ax became a bucket of chicken.

The Real Person!

The Real Person!

E y O- saltar a la derecha We bet you can guess what they did to traitors during the war, after all, we’re playing a game about war. Those players who entertained themselves by team-killing face a number of unpleasant surprises from now on. Load comments ¿No te gustaría probar con otra búsqueda? Download more games 1. Descargue GameLoop desde el sitio web oficial, luego ejecute el archivo exe para instalar GameLoop. Entretenimiento Cancelar Enviar 1. Descargue GameLoop desde el sitio web oficial, luego ejecute el archivo exe para instalar GameLoop. CrazyGames te ofrece más de 7.000 divertidísimos juegos en línea de casi cualquier género que puedas imaginar. Algunos de nuestros títulos más populares son: Ahora, puedes jugar Fencing World Championship – Sword Fighting en PC con GameLoop sin problemas.

https://millymontserrat.com/balloon-app-una-nueva-forma-de-ganar-soles-desde-tu-celular/

El juego se centra en rondas de cinco disparos desde el punto de penalti. Antes de cada ronda, establece tu apuesta, que puede variar desde $1 hasta $1,000, adaptándose a diferentes estilos de juego y presupuestos. Una vez realizada la apuesta, elige una de las cinco zonas de tiro disponibles para intentar vencer al portero. Si prefieres dejarlo al azar, la función “Random” seleccionará una dirección por ti. En la tanda de penaltis, marcar un gol duplica tu apuesta, lo que la convierte en una buena opción para una estrategia de apuestas martingala. La idea es sencilla: empieza con una apuesta mínima de $1 y duplica tu apuesta tras cada gol fallado. Una vez que marques, restablece tu apuesta a $1. Sin embargo, es fundamental tener cuidado: si sufres siete derrotas consecutivas, tu próxima apuesta ascendería a $64, una cantidad arriesgada si necesitas volver a doblar. Si bien la estrategia martingala puede ser efectiva para pequeñas victorias, es importante no abusar de ella para evitar pérdidas significativas.

The Real Person!

The Real Person!

Copyright 2024 © misotools Theme. All right reserved. Copyright 2024 © misotools Theme. All right reserved. utworzone przez AdminAnnaKP | sty 20, 2025 | 1Win Brasil GODZINY URZĘDOWANIA utworzone przez AdminAnnaKP | sty 18, 2025 | 1win India GODZINY URZĘDOWANIA 1win Вход и Регистрация Официальное Зеркало Content Бонусы Для Игроков In Букмекер Ставки На Спорт%2C Казино Вход На официального Сайт 1win а Скачать И угадать Приложение 1win Как Активировать Бонусные Коды Бонусы а Промокод При Регистрации 1вин In Ставки в Спорт И Онлайн Казино Распространенные проблемы Входа В Систему%3A Регистрация В Букмекерской Конторе как Войти

https://la2blectacosbirriayarepas.com/2025/08/05/bezpieczne-platnosci-w-sugar-rush-jakie-metody-sa-obslugiwane/

Gra Aviator oferuje zanurzenie się w fabułę, a aplikacja Aviator — predyktor wygranych dostarczy Ci więcej informacji o wygranej. Dołącz do ekspertów lotniczych 1win. Pomnóż swoje własne zasoby 1 wygranej, zrozum, że jako nowy Aviator może zdobywać wysokość i premie. Nie graj od razu w pix Aviator lub 4rabet app aviator. Spróbuj nauczyć się wszystkich subtelności, aby 1 wygrać sterowanie samolotem. Miałem szczęście, że byłem przy tobie. Brak produktów w koszyku. Auto-generated excerpt 1win. 1win. . Great delivery. Outstanding arguments. Keeep up the good effort. proko @aviator1 activity Официальный сайт 1win 1win.kykyryza.ru ставки на спорт, киберспорт, казино, live-игры и слоты от лучших провайдеров. Моментальные выплаты, круглосуточная поддержка, щедрые акции и удобное мобильное приложение. Делай ставки и играй в казино на 1win — быстро, безопасно и выгодно!

The Real Person!

The Real Person!